The global crypto market cap is $ with a 24-hour volume of $. The price of Bitcoin is $21,094.68 and BTC market dominance is %. The price of Ethereum is $1,555.74 and ETH market dominance is %. The best performing cryptoasset sector is Adult, which gained 24%.

The Right Place to Buy, Exchange and Borrow against Your Crypto.

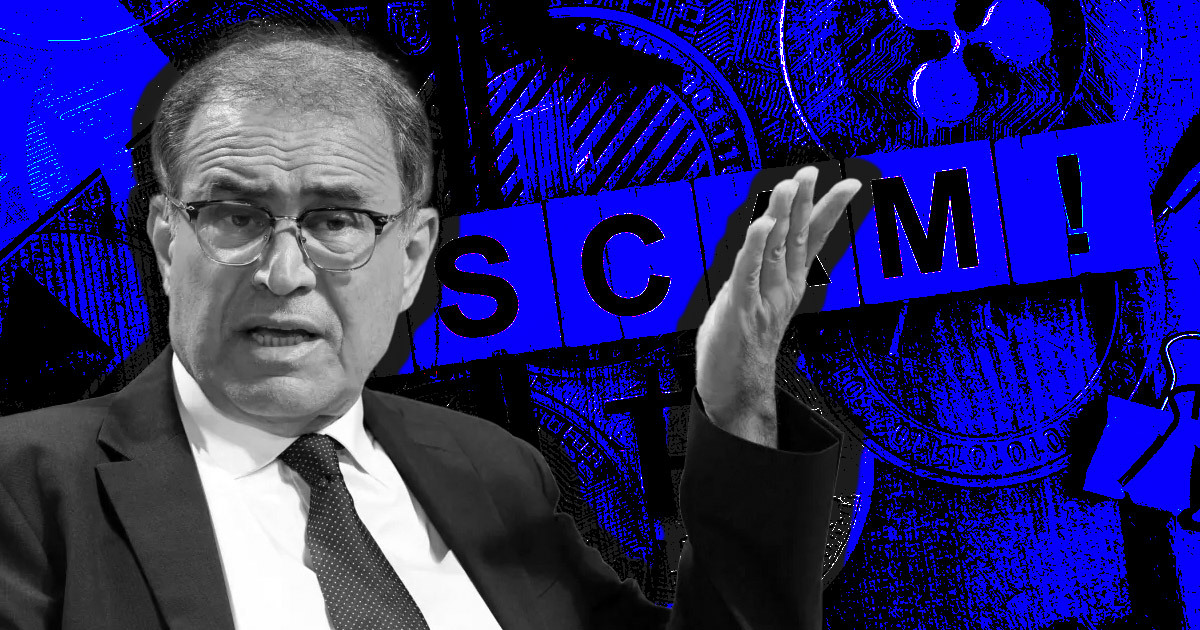

Speaking from Davos, Nouriel Roubini renewed his attack on cryptocurrency and considering the events of 2022, even crypto advocates are starting to agree with him.

Cover art/illustration via CryptoSlate

Nouriel Roubini renewed his objections to crypto, warning people to stay away as 99% of it is a scam.

“FTX, SBF are not an exception; they are a rule. Nearly 99% of crypto is a scam, criminal activity, bubble, Ponzi scheme. It’s going bust.”

Roubini has a long history of voicing negative opinions about digital assets. For example, as reported by CryptoSlate over two years ago, the American Economist blasted Bitcoin’s value proposition, saying it had no place in investment portfolios due to its lack of intrinsic value, the prevalence of market manipulation, and extreme price volatility.

Riding on the recent FTX turmoil, Roubini took the opportunity to restate his negativity towards the cryptocurrency sector. But does he have a point?

Speaking to Yahoo Finance from Davos, Roubini explained that millions of disadvantaged individuals, including “young people, people who have lower incomes, or minorities,” were suckered into buying Bitcoin at the top.

“Most of them got FOMO in 2021 when it skyrocketed to 20, to 30, to 50, to 69 [thousand dollars], and 99% of them bought well above the current market value. So they lost their shirts.”

Continuing, he said, “that’s just Bitcoin alone,” and that altcoins had fared much worse during the bear cycle, with some losing “95%” in value. Further, of the “20,000 ICOs,” “officially, 80% were a scam, and another 17% have gone to zero,” and the people behind them belong in jail.

When pressed on the value of blockchain and Distributed Ledger Technology (DLT) over cryptocurrency, Roubini said he remained skeptical because it is overhyped technology that cannot deliver on its promise of trustlessness without some centralized and accredited input.

Giving the example of using DLT to verify organic tomatoes, Roubini said that the process still needs people to verify the farms are using organic cultivation methods and further verification that the products in the store are the same as what was verified on the farm.

“After you’ve tested it and you’ve made sure the tomatoes are organic, you can put it on a centralized database that is as good and cheaper than DLT. So the idea that DLT can create trust is impossible because, in reality, you always need some credible institution that validates transactions.”

The accuracy of Roubini’s percentage data is questionable, as is his lax use of the term “ICOs,” which faded away in 2019 due to the term’s association with rug pulls.

However, considering the events of 2022, even the most diehard crypto supporters would concede he has a point.

The most upvoted comment in a cryptocurrency Reddit post discussing the interview agreed with Roubini’s general premise on the prevalence of scams.

“Basically yes. With 100-1000 tokens released every day and rugged a few minutes – hours after it could be more than 90%.”

Most other comments echoed that view, with one saying a 99% scam rate is a conservative estimate.

Samuel is a strong believer in individual autonomy and personal freedom. He is a relative newcomer to the world of cryptocurrency, having first bought Bitcoin in early 2017, but keen to make up for the lost time.

Breaking through resistance: Understand the factors driving Bitcoin’s surge past $21,000 in our latest market report.

Directly from this Widget: the top CEXs + DEXs aggregated through Orion. No account, global access.

Disclaimer: Our writers’ opinions are solely their own and do not reflect the opinion of CryptoSlate. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Buying and trading cryptocurrencies should be considered a high-risk activity. Please do your own due diligence before taking any action related to content within this article. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies.

Bitcoin is a decentralized digital currency, without a central bank or single administrator, that can be sent electronically from user to user on the peer-to-peer bitcoin network without intermediaries.

Nouriel Roubini is a professor of economics at New York University’s Stern School of Business.

FTX is a defunct cryptocurrency exchange, currently in bankruptcy proceedings, that was founded by Sam Bankman-Fried and Zixiao “Gary” Wang in May 2019.

CoinGecko tied the floor price rise to reports of Trump’s planned return to social media platforms Twitter and Facebook.

Ripple CEO Brad Garlinghouse expects a judgment in the first half of 2023.

Speaking from Davos, Nouriel Roubini renewed his attack on cryptocurrency and considering the events of 2022, even crypto advocates are starting to agree with him.

The stablecoin, AUDN, will focus on reducing settlement time, bringing down cost of international transfers, and carbon credits.

The crypto asset’s value has rallied over the past several days.

Alameda Research’s liquidator positions have been liquidated twice in less than four days due to forcibly closing leveraged positions.

Along with draining all crypto and NFTs, the attackers gained control of NFT God’s social media accounts and his Substack blog.

Ethereum’s Shanghai upgrade in March will enable withdrawals from the beacon chain by granting ETH validators the ability to unstake.

The fake Pi token reached a trading volume of $46.8 million on Huobi, becoming the most traded token on the exchange over the past 24 hours.

A look at how the crypto market impacted 17 of crypto’s wealthiest founders and investors since March, as per Forbes estimates.

The floor price for the former president’s NFT collection is around 0.16 ETH.

Midas will rebalance its users’ accounts by deducting 55% from it and their rewards earned. The move would allow users to withdraw 45% of their assets.

Breaking through resistance: Understand the factors driving Bitcoin’s surge past $21,000 in our latest market report.

Got a story tip? Email [email protected]

Disclaimer: By using this website, you agree to our Terms and Conditions and Privacy Policy. CryptoSlate has no affiliation or relationship with any coin, business, project or event unless explicitly stated otherwise. CryptoSlate is only an informational website that provides news about coins, blockchain companies, blockchain products and blockchain events. None of the information you read on CryptoSlate should be taken as investment advice. Buying and trading cryptocurrencies should be considered a high-risk activity. Please do your own diligence before making any investment decisions. CryptoSlate is not accountable, directly or indirectly, for any damage or loss incurred, alleged or otherwise, in connection to the use or reliance of any content you read on the site.

© 2023 CryptoSlate. All rights reserved. Terms | Privacy

Please add “[email protected]“ to your email whitelist.

Stay connected via