Global Cryptocurrency Payment Apps Market

Dublin, Dec. 29, 2022 (GLOBE NEWSWIRE) — The “Cryptocurrency Payment Apps Market Size, Share & Trend Analysis Report by Cryptocurrency Type, by Payment Type, by Operating System, by End User, by Region, and Segment Forecasts, 2022-2030” report has been added to ResearchAndMarkets.com’s offering.

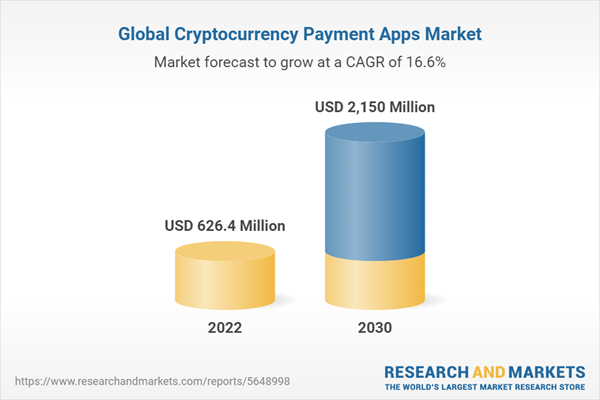

The global cryptocurrency payment apps market size is expected to reach USD 2.15 billion by 2030, growing at a CAGR of 16.6% from 2022 to 2030, according to this study conducted.

Companies Mentioned

Coinbase

BitPay

Coinomi

Paytomat

Apirone OU

SecuX Technology Inc.

Circle Internet Financial Limited

Binance

CoinJar UK Limited

Cryptopay Ltd.

The growing adoption of blockchain technology is anticipated to drive the growth of the market. The increased emphasis cryptocurrency payment app providers are putting on offering enhanced payment solutions also bodes well for the growth of the market.

Services that merge bitcoin with conventional bank-based payments are expanding and providing crypto users flexibility. For instance, in June 2022, the cryptocurrency exchange Coincoinx introduced a service named Coinpago that would let customers pay in Venezuela without having to exchange their cryptocurrency for fiat. Coinpago is expected to enable customers to make purchases at any merchant or store in the nation.

The growing acceptance of cryptocurrency as an alternative to fiat currencies is anticipated to propel the market’s expansion during the forecast period. For instance, in August 2022, Gucci with the integration of BitPay, becomes the first prominent brand to accept payments via ApeCoin. With this, customers across the U.S. will be able to buy products from its stores through ApeCoin via BitPay’s payment infrastructure.

Over the course of the projection period, the COVID-19 outbreak is anticipated to significantly contribute to the growth of the market for crypto payment apps. The rising emphasis on digitalization and the growing popularity of contactless payments since the outbreak is anticipated to provide new opportunities for the growth of the market. In addition, the rising demand for faster checkouts and flexibility to choose from multiple payment methods at physical payment terminals is expected to accentuate the market’s growth.

Report Attribute

Details

No. of Pages

160

Forecast Period

2022 – 2030

Estimated Market Value (USD) in 2022

$626.4 Million

Forecasted Market Value (USD) by 2030

$2150 Million

Compound Annual Growth Rate

16.6%

Regions Covered

Global

Cryptocurrency Payment Apps Market Report Highlights

The Bitcoin segment is expected to dominate the market during the forecast period owing to the growing popularity of bitcoin as a medium of exchange for products and services.

The online payment segment is expected to witness the fastest growth during the forecast period. The strong and continual growth of the online platforms which accepts cryptocurrency as a payment option is contributing to the growth.

The android segment dominated the market in 2021. The dominance is attributable to the proliferation of android smartphones owing to the affordability factor as they are comparably cheaper than iOS-based smartphones.

The businesses segment is expected to dominate the market during the forecast period owing to the increased adoption of cryptocurrency payment apps among businesses.

The North America region is expected to dominate the market during the forecast period due to the presence of several prominent players in the region.

Key Topics Covered:

Chapter 1 Methodology and Scope

Chapter 2 Executive Summary

Chapter 3 Cryptocurrency Payment Apps Industry Outlook

3.1 Market Segmentation and Scope

3.2 Market Size and Growth Prospects

3.3 Cryptocurrency Payment Apps Market – Value Chain Analysis

3.4 Cryptocurrency Payment Apps Market – Market Dynamics

3.4.1 Market driver analysis

3.4.1.1 Increasing number of cryptocurrency holders

3.4.1.2 Rising acceptance of digital currencies

3.4.2 Market challenge analysis

3.4.2.1 Security issues associated with Cryptocurrency Payment Apps

3.5 Penetration and Growth Prospect Mapping

3.6 Cryptocurrency Payment Apps Market – Porter’s Five Forces Analysis

3.7 Cryptocurrency Payment Apps Market – PESTEL Analysis

Chapter 4 Investment Landscape Analysis

4.1 Investor Strategies

4.2 Investor Vision & Goal Analysis

4.3 Funding Raised in Cryptocurrency

4.4 Investments Made in Cryptocurrency Payment Apps

Chapter 5 Cryptocurrency Payment Apps Cryptocurrency Type Outlook

5.1 Cryptocurrency Payment Apps Market Share By Cryptocurrecny Type, 2021

5.2 Bitcoin

5.2.1 Bitcoin cryptocurrency payment apps market, 2017 – 2030

5.3 Ethereum

5.3.1 Ethereum cryptocurrency payment apps market, 2017 – 2030

5.4 Litecoin

5.4.1 Litecoin cryptocurrency payment apps market, 2017 – 2030

5.5 DAI

5.5.1 DAI cryptocurrency payment apps market, 2017 – 2030

5.6 Ripple

5.6.1 Ripple cryptocurrency payment apps market, 2017 – 2030

5.7 Others

5.7.1 Other cryptocurrency payment apps market, 2017 – 2030

Chapter 6 Cryptocurrency Payment Apps Payment Type Outlook

6.1 Cryptocurrency Payment Apps Market Share By Payment Type, 2021

6.2 In-Store Payment

6.2.1 In-store cryprtocurrency payment apps market, 2017 – 2030

6.3 Online Payment

6.3.1 Online cryprtocurrency payment apps, 2017 – 2030

Chapter 7 Cryptocurrency Payment Apps Operating System Outlook

7.1 Cryptocurrency Payment Apps Market Share By Operating System, 2021

7.2 Android

7.2.1 Android cryptocurrency payment apps market, 2017 – 2030

7.3 iOS

7.3.1 iOS cryptocurrency payment apps market, 2017 – 2030

7.4 Others

7.4.1 Others cryptocurrency payment apps market, 2017 – 2030

Chapter 8 Cryptocurrency Payment Apps End User Outlook

8.1 Cryptocurrency Payment Apps Market Share By End User, 2021

8.2 Individuals

8.2.1 Cryptocurrency payment apps market for individuals, 2017 – 2030

8.3 Businesses

8.3.1 Cryptocurrency payment apps market for businesses, 2017 – 2030

Chapter 9 Cryptocurrency Payment Apps Regional Outlook

Chapter 10 Competitive Analysis

10.1 Recent Developments & Impact Analysis, By Key Market Participants

10.2 Company Categorization

10.3 Vendor Landscape

10.3.1 Key company market share analysis, 2021

10.4 Company Analysis Tools

10.4.1 Company market position analysis

10.4.2 Competitive dashboard analysis

Chapter 11 Competitive Landscape

For more information about this report visit https://www.researchandmarkets.com/r/ux7b7q

Attachment

Global Cryptocurrency Payment Apps Market

And what it means for your ability to build wealth.

My children have inherited $5 million of stock from their father (whose estate has not yet been dispersed after 11 months) leaving them with a 30% or so loss of value over which they have had no control. Is there … Continue reading → The post Ask an Advisor: My Kids Inherited $5 Million. How Should They Handle It? appeared first on SmartAsset Blog.

Yahoo Finance’s Pras Subramanian joins the Live show to discuss reports that Elon Musk has addressed Tesla staff in a memo thanking them for a strong fourth quarter and assuring them to not be bothered by stock price uncertainty.

In this article, we will take a look at the 11 best buy-the-dip stocks to buy now. If you want to see more stocks in this selection, go to the 5 Best Buy-the-Dip Stocks To Buy Now. The leading US market indices are on their way to recording the first annual loss since 2018 and the […]

Money can't buy you happiness, but what about working with a financial advisor?

Based on the agreement Elon Musk signed to help fund his Twitter purchase, he has experienced his first margin call because of Tesla's stock-price declines.

Yahoo Finance Live anchors discuss the decline in stock for Cal-Maine Foods despite topping revenue expectations.

Yahoo Finance Live anchors discuss AMC Entertainment stock falling to a 52-week low amid debt reduction plans.

The Federal Reserve gave the stock market a shock recently as the central bank raised interest rates once again, taking its benchmark rate to its highest level in 15 years. The Fed also suggested that it would keep raising rates in 2023 to bring down inflation. The Fed's hawkish stance sent equities tumbling, as it was expected that the central bank would dial down rate increases in 2023 thanks to signs of cooling inflation.

Any time an industry is in turmoil, a company within it can see notable volatility in its stock price, with some movements making less sense than others. On Wednesday, one of the more up-and-down titles in the sector, Carvana (NYSE: CVNA), saw a counterintuitive rise. The company's share price ended the day 3% higher, despite yet another negative analyst note on its prospects.

The Dow Jones rallied Thursday after first-time jobless claims. Tesla stock raced higher on a reiterated overweight rating.

U.S. stock index futures bounce back on Thursday after the Nasdaq nearly hit a 30-month low a day earlier as the market looked set to erase some of its recent losses on the second-to-last trading day of the year.

All three of these high-yield dividend stocks have a long history of annual payout raises and an ability to raise their distributions without breaking their balance sheets. Shares of AbbVie (NYSE: ABBV) have risen more than 50% from a low point in October. Right now, AbbVie's dividend doesn't offer much more than a savings account.

The stock market seems bound and determined to leave investors with bad memories of 2022, with major market benchmarks once again failing to deliver even a tiny bounce as the end of the year approaches. Losses for the Dow Jones Industrial Average (DJINDICES: ^DJI), Nasdaq Composite (NASDAQINDEX: ^IXIC), and S&P 500 (SNPINDEX: ^GSPC) all topped 1% as investors continue worrying about whether the macroeconomic picture in 2023 will remain just as cloudy as it is today. For investors looking for more immediate recognition of their achievements, though, TG Therapeutics (NASDAQ: TGTX) saw its stock move higher after getting good news from the U.S. Food and Drug Administration.

In this article, we will take a look at the 12 best 52-week high stocks to buy now. If you want to see more stocks in this selection, go to the 5 Best 52-Week High Stocks To Buy Now. The equity markets have been taking a beating this year as the Dow Jones Industrial Average […]

ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) Q3 2022 Earnings Call Transcript November 16, 2022 ZIM Integrated Shipping Services Ltd. beats earnings expectations. Reported EPS is $9.66, expectations were $9.54. Operator: Ladies and gentlemen, thank you for standing by. I am Irene, your chorus call operator. Welcome and thank you for joining the ZIM Integrated Shipping […]

Investors continue to be optimistic about OPKO Health (OPK) owing to its potential in RAYALDEE.

GE will ultimately break into three separate, independent, publicly traded companies. Next week Healthcare will be the first to be spun off.

Upbeat air-travel demand bodes well for American Airlines (AAL).

Sam Bankman-Fried is expected to enter a plea deal next week to fraud charges connected to the collapse of cryptocurrency FTX Reuters reported.