Subscribe for full access to The Hollywood Reporter

Subscribe for full access to The Hollywood Reporter

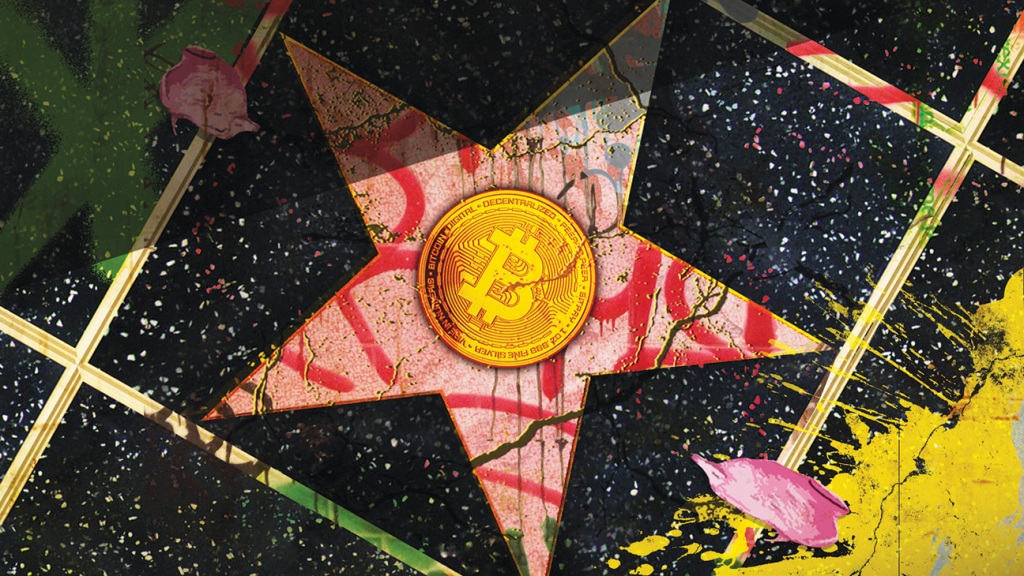

As FTX implodes, leaving investors searching for ways to recover their losses, star promoters like Larry David and Tom Brady are being dragged into litigation over their role in endorsing the crypto exchanges.

By Winston Cho

To the uninitiated, the world of cryptocurrency exists on the outskirts of traditional finance. But every once in a while, more people catch a glimpse. This year’s coveted commercial breaks during the Super Bowl fit the bill, as several now-infamous ads featured stars hawking crypto. Larry David appeared in a spot for FTX, as did Matt Damon and LeBron James in Crypto.com clips.

By showing up in the most premium real estate in all of TV, and partnering with some of Hollywood’s most trusted brand ambassadors, the crypto firms bought themselves an air of credibility on the path toward legitimacy. Or, at least it appeared they were on their way there, until FTX — one of the world’s top digital currency-exchange platforms that also issues its own token called FTT — collapsed when customers made a run on the exchange amid a months-long crypto sell-off. On Dec. 12, FTX founder Sam Bankman-Fried was charged and arrested for violations of securities laws, a month after he was sued in a proposed class action alongside stars who promoted the company.

blogherads

.defineSlot( ‘medrec’, ‘gpt-article-mid-article-uid0’ )

.setTargeting( ‘pos’, [“mid-article1″,”mid-articleX”,”mid”,”mid-article”] )

.setSubAdUnitPath(“ros/mid-article”)

.addSize([[300,250],[2,2],[300,251],[620,350],[2,4],[4,2]])

;

});

FTX account holders, in addition to those who bought now-worthless crypto from other issuers that filed for bankruptcy, are likely to recoup pennies on the dollar on their investments. FTX’s new chief executive John J. Ray III told a House committee Dec. 13, “We’re not going to be able to recover all the losses here.” They sit in line behind a host of creditors with higher priority. Now, new scrutiny is on the A-listers to whom FTX turned to launder its reputation. While they might not have knowingly committed fraud, they could be on the hook for promoting unregistered securities. “The people who have the most liability happen to be billionaires,” says Adam Moskowitz, who is representing FTX and Voyager customers in proposed class actions against the crypto exchange firms.

Bankman-Fried leveraged the world of entertainment and celebrity to grow his businesses, lure in new crypto buyers and establish FTX as an island of legitimacy in a sea of scams. His aggressive marketing strategy featured partnerships with NBA teams, patches on Major League Baseball umpire uniforms and splashy TV ads of stars touting the exchange as a safe place to invest money.

blogherads

.defineSlot( ‘medrec’, ‘gpt-dsk-tab-mid-article2-uid1’ )

.setTargeting( ‘pos’, [“mid”,”mid-article2″,”mid-articleX”] )

.setSubAdUnitPath(“ros/mid-article2”)

.addSize([[300,250],[300,251],[620,350],[2,4],[4,2]])

;

});

“People generally hesitate when it comes to the unknown,” said former FTX U.S. executive Sina Nader, who led partnerships for the exchange, when speaking with The Hollywood Reporter for a story just over a year ago. “Working with trusted people and institutions, people will look and say, oh, if Stephen Curry, or Tom Brady, or Gisele, or Trevor Lawrence, or the entire MLB are comfortable with crypto and FTX, then maybe I can get comfortable with it too.”

In a lawsuit filed Nov. 15, FTX account holders sued Bankman-Fried and stars who endorsed the platform, including David, and others like Tom Brady and Stephen Curry. They allege the company was a “Ponzi scheme” that used funds obtained through new investments to pay off old investments and maintain the appearance of liquidity. The suit claims that FTX’s interest-bearing accounts were securities, which would obligate promoters to disclose compensation from the company.

Other celebrities named in the complaint include Gisele Bündchen, Shaquille O’Neal and Naomi Osaka. They all appeared in ads for FTX. The suit claims Osaka was paid an equity stake in the company and undisclosed amounts of crypto. So were FTX ambassadors Brady, Bündchen and MLB All-Star Shohei Ohtani — all of whom neglected to disclose payments from the company, the suit says. Similar accusations were lodged in a lawsuit filed Dec. 8 against stars including Jimmy Fallon, Gwyneth Paltrow and Justin Bieber, who promoted Bored Ape Yacht Club nonfungible tokens.

blogherads

.defineSlot( ‘medrec’, ‘gpt-thr-article-mid-articleX-uid2’ )

.setTargeting( ‘pos’, [“btf”,”mid-articleX”,”mid”] )

.setSubAdUnitPath(“ros/mid-articleX”)

.addSize([[300,250],[300,251],[620,350]])

.setLazyLoadMultiplier(2)

;

});

It’s a lucrative game. Shark Tank star Kevin O’Leary, also a paid ambassador to FTX, testified before the Senate Banking Committee on Dec. 14, telling them FTX paid him an astonishing $18 million to promote the exchange, including $3 million to cover taxes, $1 million in FTX equity (now “most likely worthless,” he said), and $10 million in crypto tokens held in FTX wallets (“I have written them off to zero,” he told the committee).

A-list promoters of crypto and other digital assets already have run into legal trouble — a key consideration in civil suits alleging fraud. On Oct. 3, the Securities and Exchange Commission charged Kim Kardashian for endorsing on Instagram EthereumMax without disclosing a $250,000 payment she received for the promotion. She settled the case for $1.3 million. Floyd Mayweather Jr. and DJ Khaled have resolved similar suits filed by the SEC over failing to disclose payments they received for promoting investments in an initial coin offering.

“The federal securities laws are clear that any celebrity or other individual who promotes a crypto asset security must disclose the nature, source, and amount of compensation they received in exchange for the promotion,” said Gurbir S. Grewal, director of the SEC’s Division of Enforcement, in a statement over Kardashian’s settlement.

But there’s a ruling challenging the notion that stars can be held liable for their alleged complicity in peddling crypto. On Dec. 7, a federal judge dismissed a lawsuit against endorsers of EthereumMax accusing them of fraudulently misleading their millions of followers into buying EMAX tokens, only to sell their own stakes once its value was inflated. While the case raises “legitimate concerns” over the ability of celebrities to persuade undiscerning followers to buy “snake oil with unprecedented ease and reach,” U.S. District Judge Michael Fitzgerald found that there’s an expectation for “investors to act reasonably before basing their bets on the zeitgeist of the moment.”

blogherads

.defineSlot( ‘medrec’, ‘gpt-thr-article-mid-articleX-uid3’ )

.setTargeting( ‘pos’, [“btf”,”mid-articleX”,”mid”] )

.setSubAdUnitPath(“ros/mid-articleX”)

.addSize([[300,250],[300,251],[620,350]])

.setLazyLoadMultiplier(2)

;

});

“This is a volatile area, and people need to do their own research,” says Daniel Dubin, an attorney at Alston & Bird, who is skeptical that stars face much legal exposure. “[This ruling] sets the right tone for this type of litigation. You don’t want to excuse someone for investing in something they should’ve known to be a bad investment.”

The FTX litigation takes a different approach. Moskowitz, the lawyer repping FTX account holders, seeks a court order in a separate class action filed in Florida state court that FTX offered unregistered securities in the form of interest-bearing accounts. A judge will consider the issue through the Howey Test, a standard that emerged in a 1946 Supreme Court case for determining whether a transaction qualifies as an investment contract.

Max Dilendorf, an attorney specializing in crypto, stresses that FTX’s interest-bearing accounts are securities because they require investment of money into a common enterprise where there’s an expectation of profits from the efforts of third parties. “If I’m buying something like a digital token or an NFT, I’m buying an investment contract,” Dilendorf says. “The only reason I’m buying is because I expect a profit.”

Dilendorf stresses the SEC’s stance that most crypto are securities and subject to disclosure and registration requirements, backed up in suits filed by the agency in which courts applied the Howey test. In 2020, a New York federal judge ruled in favor of the SEC in its suit against Kik and found that the company illegally sold unregistered securities through an initial coin offering. The order was followed by an identical ruling in another suit against Telegram, which was forced to surrender $1.2 billion in ill-gotten gains and pay a fine of $18.5 million.

blogherads

.defineSlot( ‘medrec’, ‘gpt-thr-article-mid-articleX-uid4’ )

.setTargeting( ‘pos’, [“btf”,”mid-articleX”,”mid”] )

.setSubAdUnitPath(“ros/mid-articleX”)

.addSize([[300,250],[300,251],[620,350]])

.setLazyLoadMultiplier(2)

;

});

Even if they didn’t knowingly participate in the alleged scheme, celebrity promoters may be on the hook for damages if it’s found that the exchange sold unregistered securities. The so-called “blue sky” law — enacted by various states to protect consumers from securities fraud — that the suit is claiming a violation of is the vehicle that allowed courts to claw back money from investors who profited off of Bernie Madoff’s Ponzi scheme even though they weren’t aware of the fraud. While O’Neal may be trying to distance himself from FTX by saying Dec. 15 that he was “just a paid spokesperson,” that question will be decided by the courts in pending litigation.

A version of this story first appeared in the Dec. 16 issue of The Hollywood Reporter magazine. Click here to subscribe.

Sign up for THR news straight to your inbox every day

Unique expertise on how the law impacts Hollywood pros, projects and processes

Subscribe for full access to The Hollywood Reporter

Send us a tip using our anonymous form.