BizNews

The world is changing fast and to keep up you need local knowledge with global context.

BizNews

The world is changing fast and to keep up you need local knowledge with global context.

*This content is brought to you by Jaltech

The irony within the cryptocurrency market is that although the financial infrastructure being built on top of blockchains is largely decentralised and transparent, the de facto gatekeepers to this ecosystem, cryptocurrency exchanges, are centralised and opaque. Coupled with scant regulatory oversight, this corner of the industry has come to resemble the worst of traditional finance – reminding us why the financial services industry is so heavily regulated in the first place.

An organisation or network is decentralised when no single authority can unilaterally make decisions on behalf of other stakeholders. As an example, the JSE is not a decentralised exchange as its board has the power to halt trading. Decentralisation requires participants with a direct interest to reach a consensus on decisions that will affect the collective.

For information about Jaltech’s Off-exchange Cryptocurrency safety deposit box, click here.

Why is this important? A number of cryptocurrency exchanges have recently had to freeze customer withdrawals after the revealing of the use of customer assets in “off-exchange” lending arrangements and other risky strategies.

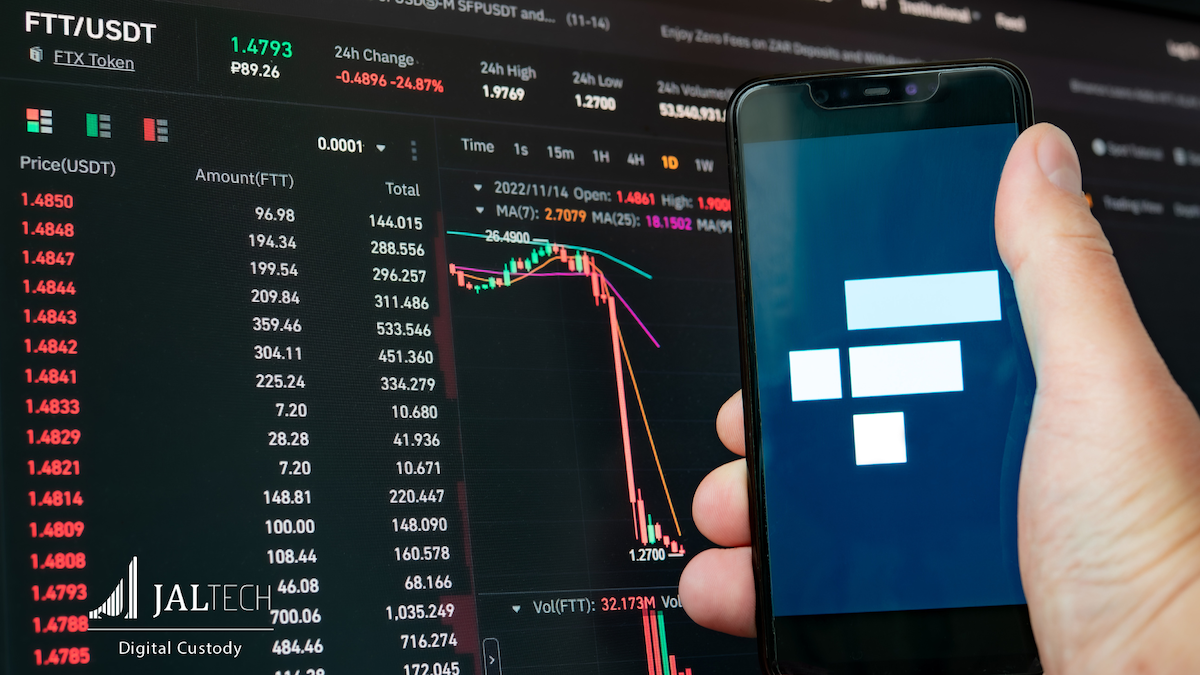

The most recent and egregious example of this is cryptocurrency exchange FTX: The world’s second-largest cryptocurrency exchange imploded this month following the announcement that it had a roughly USD 6 billion hole in its balance sheet, allegedly due to the use of customer funds to make risky investments.

Some of the largest global industry players such as Gemini and GOPAX have had to freeze customers’ withdrawals as hundreds of millions of dollars in assets – expected to be liquid and available to meet liabilities – are now locked up in FTX’s bankruptcy proceedings. FTX and these exchanges are by no means alone, the list of exchanges which have historically frozen customers’ funds is long, here are just a few – CoinFLEX, Crypto.com, Celsius, Babel Finance, Finblox, and Voyager Digital.

When times are good and customer deposits are strong, exchanges can conceal their financial woes. Only when mass redemptions begin do we see cracks materialize. The Warren Buffett quote, “only when the tide goes out will you discover who’s been swimming naked” sums up the scenario for cryptocurrency exchanges right now.

For information about Jaltech’s Off-exchange Cryptocurrency safety deposit box, click here.

The cryptocurrency market’s core has been shaken by the FTX earthquake, however, the aftershocks are likely to bring a wave of destruction that may ultimately see millions of cryptocurrency exchanges’ customers losing billions. As an example, FTX has yet to release its full list of creditors — with the top 50 having a combined claim of over R50 billion. These will be the entities to watch out for and I for one would be surprised if contagion has not reached South Africa cryptocurrency exchanges.

Cryptocurrency investors who hold cryptocurrency on exchanges still have time to act and reduce risk. They can do so by self-custody through a hardware or paper wallet, or even more securely through a third-party custody provider (such as Jaltech’s custody solution in partnership with Fireblocks). The downside of doing so is miniscule in relation to losing your entire investment.

Jonty Sacks & Jason Welz – Jaltech Fund Managers

Jaltech offers private individuals, institutions, and corporates a seamless, cost-effective, and a safer alternative storage option to holding cryptocurrencies themselves or on a cryptocurrency exchange.

For information about Jaltech’s Off-exchange Cryptocurrency safety deposit box, click here.

Read also:

Listen to the story of Cyril Ramaphosa’s rise to presidential power, narrated by our very own Alec Hogg.

Narration by Alec Hogg

BizNews

© 2022 BizNews, Inc. | The Rational PerspectiveTerms & ConditionsComments Policy

Author

Administraroot