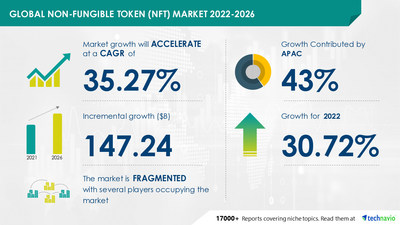

NEW YORK, Nov. 9, 2022 /PRNewswire/ — The non-fungible token (NFT) market size is expected to grow by USD 147.24 billion and accelerate at a CAGR of 35.27% between 2021 and 2026. The report provides a comprehensive analysis of the current market scenario, YOY growth rates, revenue-generating segments, regional growth opportunities, product launches, and vendor landscape among others. Asynchronous Art Inc., Binance Services Holdings Ltd., Dapper Labs Inc., Decentraland Foundation, and Enjin Pte. Ltd. are identified as some of the key vendors in the market. Download Free PDF Sample Report

Non-Fungible Token (NFT) Market 2022-2026: Scope

Technavio presents a detailed picture of the market by way of study, synthesis, and summation of data from multiple sources. Our non-fungible token (NFT) market report covers the following areas:

Non-Fungible Token (NFT) Market Size

Non-Fungible Token (NFT) Market Trends

Non-Fungible Token (NFT) Market Industry Analysis

Non-Fungible Token (NFT) Market 2022-2026: Vendor Analysis

We provide a detailed analysis of around 25 vendors operating in the non-fungible token (NFT) market. Backed with competitive intelligence and benchmarking, our research report on the non-fungible token (NFT) market is designed to provide entry support, customer profile, and M&As as well as go-to-market strategy support. Technavio identifies the following as the key vendors in the market:

Binance Services Holdings Ltd.: The company offers a wide range of non-fungible tokens such as Alien Worlds Binance Mission, Bored Pixel EN, Freaky Mandrill Ape, Legendary X Squid GAME, and The Virgin Mary. Edition 17.

Dapper Labs Inc.: The company offers non-fungible tokens namely NBA Top Shot.

Decentraland Foundation: The company offers a wide range of non-fungible tokens such as AustinDCL Security Helmet, Blockchain Camouflage Guardian, Stick Woman, and Energy.

FTX Trading Ltd.: The company offers nonfungible tokens for Animals Retro Art, FTX Special, Landscapes, Contemporary Art, and FTX Swag.

Funko Inc.: The company offers non-fungible tokens such as Scooby doo X Funko, Transformers X Funko, Nickelodeon Cartoons X Funko, and Retro Comics X Funko.

Asynchronous Art Inc.

Enjin Pte. Ltd.

Foundation Labs Inc.

Gala Games

Gemini Trust Co. LLC

Gain access to more vendor profiles available with Technavio. Buy Now!

Technavio’s library includes over 17,000+ reports covering more than 2,000 emerging technologies. Subscribe to our “Basic Plan” at just USD 5,000 and get lifetime access to our Technavio Insights

Non-Fungible Token (NFT) Market 2022-2026: Segmentation

The global non-fungible token (NFT) Market is segmented as below:

Application

Collectibles accounted for the highest market share in 2021. NFT collectibles are limited edition or rare NFT tokens which are minted on the blockchain. Collectibles are unique, and one collectible cannot be exchanged or traded with another collectible. The growth of the collectible segment is majorly driven by the growing demand for digital assets across the world. Additionally, the emergence of tokenization in the digital asset industry will further propel the segment’s growth.

Geography

APAC will dominate the market growth, occupying 43% of the global market share. The NFT market in APAC is expected to grow due to the growing demand for digital assets in countries like Singapore, China, South Korea, the Philippines, and Japan. Korean retail channels are expanding their footprint into the flourishing NFT business by selling art and fashion items. The NFT market in countries such as Japan is also gaining traction. Sports enterprises are showing more interest in selling NFT videos of sports events. These factors positively impacted the regional market. Identify potential segments and regions to invest in over the forecast period. Download Free Sample Report

Non-Fungible Token (NFT) Market 2022-2026: Key Highlights

CAGR of the market during the forecast period 2022-2026

Detailed information on factors that will assist non-fungible token (NFT) market growth during the next five years

Estimation of the non-fungible token (NFT) market size and its contribution to the parent market

Predictions on upcoming trends and changes in consumer behavior

The growth of the non-fungible token (NFT) market

Analysis of the market’s competitive landscape and detailed information on vendors

Comprehensive details of factors that will challenge the growth of non-fungible token (NFT) market vendors

Related Reports:

The metaverse in FMCG market share is expected to increase to USD 2.11 billion from 2021 to 2026 at an accelerating CAGR of 21.8%. The growing number of FMCG brands entering the metaverse platform is notably driving the metaverse in FMCG market growth, although factors such as privacy and security concerns over metaverse may impede the market growth.

The cryptocurrency mining hardware market report is a comprehensive research document that provides in-depth qualitative and quantitative intelligence. Technavio’s analysts estimate the market share growth of USD 12053.16 million from 2022 to 2027, at a CAGR of 11.35%. The profitability of cryptocurrency mining ventures is notably driving the cryptocurrency mining hardware market growth, although factors such as growing demand for the volatility in the value of cryptocurrency may impede the market growth.

NON-FUNGIBLE TOKEN (NFT) Market Scope

Report Coverage

Details

Page number

120

Base year

2021

Forecast period

2022-2026

Growth momentum & CAGR

Accelerate at a CAGR of 35.27%

Market growth 2022-2026

USD 147.24 billion

Market structure

Fragmented

YoY growth (%)

30.72

Regional analysis

APAC, South America, Middle East and Africa, North America, and Europe

Performing market contribution

APAC at 43%

Key consumer countries

United Arab Emirates, Singapore, China, The Philippines, and Venezuela

Competitive landscape

Leading companies, competitive strategies, consumer engagement scope

Companies profiled

Asynchronous Art Inc., Binance Services Holdings Ltd., Dapper Labs Inc., Decentraland Foundation, Enjin Pte. Ltd., Foundation Labs Inc., FTX Trading Ltd., Funko Inc., Gala Games, Gemini Trust Co. LLC, Mintable.app, Mobox Digital Co. Ltd., Onchain Labs Inc., OpenSea, Rarible Inc., Sorare SAS, SuperRare Labs Inc., Theta Labs Inc., Yellowheart LLC, and Yuga Labs LLC

Market Dynamics

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and future consumer dynamics, and market condition analysis for the forecast period.

Customization purview

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized.

Table Of Contents:

1. Executive Summary

1.1 Market Overview

Exhibit 01: Executive Summary – Chart on Market Overview

Exhibit 02: Executive Summary – Data Table on Market Overview

Exhibit 03: Executive Summary – Chart on Global Market Characteristics

Exhibit 04: Executive Summary – Chart on Market by Geography

Exhibit 05: Executive Summary – Chart on Market Segmentation by Application

Exhibit 06: Executive Summary – Chart on Incremental Growth

Exhibit 07: Executive Summary – Data Table on Incremental Growth

Exhibit 08: Executive Summary – Chart on Vendor Market Positioning

2. Market Landscape

2.1 Market ecosystem

Exhibit 09: Parent market

Exhibit 10: Market characteristics

3. Market Sizing

3.1 Market definition

Exhibit 11: Offerings of vendors included in the market definition

3.2 Market segment analysis

Exhibit 12: Market segments

3.3 Market size 2021

3.4 Market outlook: Forecast for 2021 – 2026

Exhibit 13: Chart on Global – Market size and forecast 2021-2026 ($ billion)

Exhibit 14: Data Table on Global – Market size and forecast 2021-2026 ($ billion)

Exhibit 15: Chart on Global Market: Year-over-year growth 2021-2026 (%)

Exhibit 16: Data Table on Global Market: Year-over-year growth 2021-2026 (%)

4. Five Forces Analysis

4.1 Five Forces Summary

Exhibit 17: Five forces analysis – Comparison between 2021 and 2026

4.2 Bargaining power of buyers

Exhibit 18: Bargaining power of buyers – Impact of key factors in 2021 and 2026

4.3 Bargaining power of suppliers

Exhibit 19: Bargaining power of suppliers – Impact of key factors in 2021 and 2026

4.4 Threat of new entrants

Exhibit 20: Threat of new entrants – Impact of key factors in 2021 and 2026

4.5 Threat of substitutes

Exhibit 21: Threat of substitutes – Impact of key factors in 2021 and 2026

4.6 Threat of rivalry

Exhibit 22: Threat of rivalry – Impact of key factors in 2021 and 2026

4.7 Market condition

Exhibit 23: Chart on Market condition – Five forces 2021 and 2026

5 Market Segmentation by Application

5.1 Market segments

Exhibit 24: Chart on Application – Market share 2021-2026 (%)

Exhibit 25: Data Table on Application – Market share 2021-2026 (%)

5.2 Comparison by Application

Exhibit 26: Chart on Comparison by Application

Exhibit 27: Data Table on Comparison by Application

5.3 Collectibles – Market size and forecast 2021-2026

Exhibit 28: Chart on Collectibles – Market size and forecast 2021-2026 ($ billion)

Exhibit 29: Data Table on Collectibles – Market size and forecast 2021-2026 ($ billion)

Exhibit 30: Chart on Collectibles – Year-over-year growth 2021-2026 (%)

Exhibit 31: Data Table on Collectibles – Year-over-year growth 2021-2026 (%)

5.4 Sports – Market size and forecast 2021-2026

Exhibit 32: Chart on Sports – Market size and forecast 2021-2026 ($ billion)

Exhibit 33: Data Table on Sports – Market size and forecast 2021-2026 ($ billion)

Exhibit 34: Chart on Sports – Year-over-year growth 2021-2026 (%)

Exhibit 35: Data Table on Sports – Year-over-year growth 2021-2026 (%)

5.5 Arts – Market size and forecast 2021-2026

Exhibit 36: Chart on Arts – Market size and forecast 2021-2026 ($ billion)

Exhibit 37: Data Table on Arts – Market size and forecast 2021-2026 ($ billion)

Exhibit 38: Chart on Arts – Year-over-year growth 2021-2026 (%)

Exhibit 39: Data Table on Arts – Year-over-year growth 2021-2026 (%)

5.6 Others – Market size and forecast 2021-2026

Exhibit 40: Chart on Others – Market size and forecast 2021-2026 ($ billion)

Exhibit 41: Data Table on Others – Market size and forecast 2021-2026 ($ billion)

Exhibit 42: Chart on Others – Year-over-year growth 2021-2026 (%)

Exhibit 43: Data Table on Others – Year-over-year growth 2021-2026 (%)

5.7 Market opportunity by Application

Exhibit 44: Market opportunity by Application ($ billion)

6. Customer landscape

6.1 Customer landscape overview

Technavio’s customer landscape matrix comparing Drivers or price sensitivity, Adoption lifecycle, importance in customer price basket, Adoption rate and Key purchase criteria

Exhibit 45: Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

7. Geographic Landscape

7.1 Geographic segmentation

Exhibit 46: Chart on Market share by geography 2021-2026 (%)

Exhibit 47: Data Table on Market share by geography 2021-2026 (%)

7.2 Geographic comparison

Exhibit 48: Chart on Geographic comparison

Exhibit 49: Data Table on Geographic comparison

7.3 APAC – Market size and forecast 2021-2026

Exhibit 50: Chart on APAC – Market size and forecast 2021-2026 ($ billion)

Exhibit 51: Data Table on APAC – Market size and forecast 2021-2026 ($ billion)

Exhibit 52: Chart on APAC – Year-over-year growth 2021-2026 (%)

Exhibit 53: Data Table on APAC – Year-over-year growth 2021-2026 (%)

7.4 South America – Market size and forecast 2021-2026

Exhibit 54: Chart on South America – Market size and forecast 2021-2026 ($ billion)

Exhibit 55: Data Table on South America – Market size and forecast 2021-2026 ($ billion)

Exhibit 56: Chart on South America – Year-over-year growth 2021-2026 (%)

Exhibit 57: Data Table on South America – Year-over-year growth 2021-2026 (%)

7.5 Middle East and Africa – Market size and forecast 2021-2026

Exhibit 58: Chart on Middle East and Africa – Market size and forecast 2021-2026 ($ billion)

Exhibit 59: Data Table on Middle East and Africa – Market size and forecast 2021-2026 ($ billion)

Exhibit 60: Chart on Middle East and Africa – Year-over-year growth 2021-2026 (%)

Exhibit 61: Data Table on Middle East and Africa – Year-over-year growth 2021-2026 (%)

7.6 North America – Market size and forecast 2021-2026

Exhibit 62: Chart on North America – Market size and forecast 2021-2026 ($ billion)

Exhibit 63: Data Table on North America – Market size and forecast 2021-2026 ($ billion)

Exhibit 64: Chart on North America – Year-over-year growth 2021-2026 (%)

Exhibit 65: Data Table on North America – Year-over-year growth 2021-2026 (%)

7.7 Europe – Market size and forecast 2021-2026

Exhibit 66: Chart on Europe – Market size and forecast 2021-2026 ($ billion)

Exhibit 67: Data Table on Europe – Market size and forecast 2021-2026 ($ billion)

Exhibit 68: Chart on Europe – Year-over-year growth 2021-2026 (%)

Exhibit 69: Data Table on Europe – Year-over-year growth 2021-2026 (%)

7.8 Singapore – Market size and forecast 2021-2026

Exhibit 70: Chart on Singapore – Market size and forecast 2021-2026 ($ billion)

Exhibit 71: Data Table on Singapore – Market size and forecast 2021-2026 ($ billion)

Exhibit 72: Chart on Singapore – Year-over-year growth 2021-2026 (%)

Exhibit 73: Data Table on Singapore – Year-over-year growth 2021-2026 (%)

7.9 China – Market size and forecast 2021-2026

Exhibit 74: Chart on China – Market size and forecast 2021-2026 ($ billion)

Exhibit 75: Data Table on China – Market size and forecast 2021-2026 ($ billion)

Exhibit 76: Chart on China – Year-over-year growth 2021-2026 (%)

Exhibit 77: Data Table on China – Year-over-year growth 2021-2026 (%)

7.10 Venezuela – Market size and forecast 2021-2026

Exhibit 78: Chart on Venezuela – Market size and forecast 2021-2026 ($ billion)

Exhibit 79: Data Table on Venezuela – Market size and forecast 2021-2026 ($ billion)

Exhibit 80: Chart on Venezuela – Year-over-year growth 2021-2026 (%)

Exhibit 81: Data Table on Venezuela – Year-over-year growth 2021-2026 (%)

7.11 The Philippines – Market size and forecast 2021-2026

Exhibit 82: Chart on The Philippines – Market size and forecast 2021-2026 ($ billion)

Exhibit 83: Data Table on The Philippines – Market size and forecast 2021-2026 ($ billion)

Exhibit 84: Chart on The Philippines – Year-over-year growth 2021-2026 (%)

Exhibit 85: Data Table on The Philippines – Year-over-year growth 2021-2026 (%)

7.12 United Arab Emirates – Market size and forecast 2021-2026

Exhibit 86: Chart on United Arab Emirates – Market size and forecast 2021-2026 ($ billion)

Exhibit 87: Data Table on United Arab Emirates – Market size and forecast 2021-2026 ($ billion)

Exhibit 88: Chart on United Arab Emirates – Year-over-year growth 2021-2026 (%)

Exhibit 89: Data Table on United Arab Emirates – Year-over-year growth 2021-2026 (%)

7.13 Market opportunity by geography

Exhibit 90: Market opportunity by geography ($ billion)

8. Drivers, Challenges, and Trends

8.1 Market drivers

8.1.1 Increasing demand for digital artworks

8.1.2 Growing investment in digital assets

8.1.3 Security and ownership of digital assets

8.2 Market challenges

8.2.1 Uncertainty of the NON-FUNGIBLE TOKEN (NFT) market

8.2.2 Threat from cyberattacks

8.2.3 Legal and regulatory challenges associated with the NON-FUNGIBLE TOKEN (NFT) market

8.3 Impact of drivers and challenges

Exhibit 91: Impact of drivers and challenges in 2021 and 2026

8.4 Market trends

8.4.1 Growing number of big brands entering the market

8.4.2 Emergence of fractionalized NON-FUNGIBLE TOKEN (NFT)s

8.4.3 Growing application of AI in the market

9. Vendor Landscape

9.1 Overview

9.2 Vendor landscape

Exhibit 92: Overview on Criticality of inputs and Factors of differentiation

The potential for the disruption of the market landscape was moderate in 2020, and its threat is expected to remain unchanged by 2025.

9.3 Landscape disruption

Exhibit 93: Overview on factors of disruption

9.4 Industry risks

Exhibit 94: Impact of key risks on business

10. Vendor Analysis

10.1 Vendors covered

Exhibit 95: Vendors covered

10.2 Market positioning of vendors

Exhibit 96: Matrix on vendor position and classification

10.3 Binance Services Holdings Ltd.

Exhibit 97: Binance Services Holdings Ltd. – Overview

Exhibit 98: Binance Services Holdings Ltd. – Product / Service

Exhibit 99: Binance Services Holdings Ltd. – Key offerings

10.4 Dapper Labs Inc.

Exhibit 100: Dapper Labs Inc. – Overview

Exhibit 101: Dapper Labs Inc. – Product / Service

Exhibit 102: Dapper Labs Inc. – Key offerings

10.5 Decentraland Foundation

Exhibit 103: Decentraland Foundation – Overview

Exhibit 104: Decentraland Foundation – Product / Service

Exhibit 105: Decentraland Foundation – Key offerings

10.6 FTX Trading Ltd.

Exhibit 106: FTX Trading Ltd. – Overview

Exhibit 107: FTX Trading Ltd. – Product / Service

Exhibit 108: FTX Trading Ltd. – Key offerings

10.7 Funko Inc.

Exhibit 109: Funko Inc. – Overview

Exhibit 110: Funko Inc. – Product / Service

Exhibit 111: Funko Inc. – Key news

Exhibit 112: Funko Inc. – Key offerings

10.8 Gemini Trust Co. LLC

Exhibit 113: Gemini Trust Co. LLC – Overview

Exhibit 114: Gemini Trust Co. LLC – Product / Service

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focus on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

View original content to download multimedia:https://www.prnewswire.com/news-releases/non-fungible-token-nft-market-to-record-usd-147-24-bn-asynchronous-art-inc-binance-services-holdings-ltd-dapper-labs-inc-to-emerge-as-key-vendors—technavio-301671319.html

SOURCE Technavio

The travel industry was hit harder than most others during the pandemic and it appears that the recovery has legs.

The 13% reduction in the staff at Meta Platforms was not a surprise as tech giants have forecasted lower revenue growth as advertising dollars shrink. The CEO of Meta Platforms , Mark Zuckerberg, made the decision to lay off 11,000 of the company's 87,000 employees, but is offering over three months of severance pay and six months of health insurance coverage for those affected. "I know this is tough for everyone, and I'm especially sorry to those impacted," Zuckerberg added.

After placing restrictions on foreign participation in supplying "critical minerals" used in batteries and high-tech devices, the government of Canada has ordered three Chinese companies to divest …

Shell has been handed £90m of taxpayer cash under the Government’s scheme to help families with surging energy bills.

Republicans doing worse than expected in the midterms could be causing a sell-off in oil and gas stocks today, but oil prices were down as well.

Eli Lilly & Co must pay Teva Pharmaceuticals International GmbH $176.5 million after a trial to determine whether its migraine drug Emgality infringed three Teva patents, a Boston federal court jury decided on Wednesday. The jury agreed with Teva that Lilly's Emgality violated its rights in the patents, which relate to its own migraine drug Ajovy. The jury also found that Lilly infringed the patents willfully and rejected its argument that the patents were invalid.

A problem with a vendor in the supply chain of Wichita-based Spirit AeroSystems Inc. slowed delivery activity for the Boeing Co. last month. Boeing this week reported 35 aircraft deliveries for October, down from 51 deliveries in September as handovers of its 737 MAX jet fell from 36 to 22 sequentially. The slip comes as Boeing works to stabilize production of its best-selling MAX at 31 aircraft per month, with commercial airplanes unit CEO Stan Deal attributing the decline at the company’s investor day last week to a problem with its fuselage supplier.

(Bloomberg) — A year ago, one of China’s most famous internet celebrities sold about $1 billion of products — from shampoo to scarves — in a 14-hour livestream as part of Singles’ Day, the country’s annual e-commerce extravaganza.Most Read from BloombergSam Bankman-Fried’s $16 Billion Fortune Is Eviscerated in DaysMeta to Cut 11,000 Jobs; Zuckerberg Says ‘I Got This Wrong’Hochul Wins NY Governor Race as GOP’s Zeldin Refuses to ConcedeBinance Backs Out of FTX Rescue, Citing Finances, Investiga

Crypto exchange Binance said it would walk away from an initial offer to acquire its competitor FTX after a review of the company’s finances.

These top-notch income stocks, which range in yield from 1.8% to 7.6%, are as rock solid as they come.

(Bloomberg) — China is increasing Covid restrictions in southern manufacturing powerhouse Guangzhou, suspending schools and widening lockdowns after days of more incremental moves failed to arrest a swelling outbreak. Most Read from BloombergSam Bankman-Fried’s $16 Billion Fortune Is Eviscerated in DaysMeta to Cut 11,000 Jobs; Zuckerberg Says ‘I Got This Wrong’Hochul Wins NY Governor Race as GOP’s Zeldin Refuses to ConcedeBinance Backs Out of FTX Rescue, Citing Finances, InvestigationsRussia Or

Most people don't pay attention to diesel fuel prices, but they're up way more than the cost of gasoline and driving the cost of many other things higher.

While the number of stocks on "sale" seems to be growing exponentially in 2022, the three businesses we'll look at today have dipped to valuations that buy-and-hold investors should consider. First, with Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) and Adobe (NASDAQ: ADBE), we have two of the biggest names in technology, trading with price-to-free-cash-flow ratios they haven't seen since 2013. Meanwhile, SoFi Technologies (NASDAQ: SOFI) now trades at around $5 per share, despite having over $3 worth of tangible book value per share on its balance sheet, and rapidly growing revenue.

Apple Inc and Amazon.com Inc were accused in an antitrust lawsuit on Wednesday of conspiring to drive up iPhone and iPad prices by removing nearly all other resellers of new Apple products from Amazon's website. The proposed class action in Seattle federal court objected to an agreement that took effect in January 2019, under which Apple gave Amazon discounts of up to 10% on its products, in exchange for Amazon letting just seven of 600 resellers stay on its platform. This transformed Amazon into the dominant reseller of new iPhones and iPads on its website, according to the complaint, after it had previously carried a limited number of Apple products as well as knockoffs.

Peabody's 3rd-quarter earnings report shows incredible strength

Eunice Shin, Prophet Global Leader for Tech, Media & Entertainment Practice, and Direct-to-Consumer Practice, joins Yahoo Finance Live to discuss Disney earnings, advertising demand, and headwinds for streaming companies.

(Bloomberg) — Meta Platforms Inc. Chief Executive Officer Mark Zuckerberg said the company will cut more than 11,000 jobs, calling himself responsible for the first major round of layoffs in the social media giant’s history.Most Read from BloombergSam Bankman-Fried’s $16 Billion Fortune Is Eviscerated in DaysMeta to Cut 11,000 Jobs; Zuckerberg Says ‘I Got This Wrong’Hochul Wins NY Governor Race as GOP’s Zeldin Refuses to ConcedeBinance Backs Out of FTX Rescue, Citing Finances, InvestigationsRus

Walt Disney Co. has a profit problem, and that's helped send shares of the media giant to their worst daily performance in more than two decades.

RBC Capital Market Media Analyst Kutgun Maral joins Yahoo Finance Live to discuss Disney earnings, macroeconomic headwinds, the Disney+ ad-supported tier, Netflix looking into sports streaming, and margins in the parks business.

RingCentral Inc. is set to report its latest earnings and revenue figures after the close of trading Wednesday. Let's check out the charts and indicators. In this daily bar chart of RNG, below, we can see that prices suffered a long and hard decline the past 12 months.

Author

Administraroot