Aaryamann Shrivastava

FXStreet

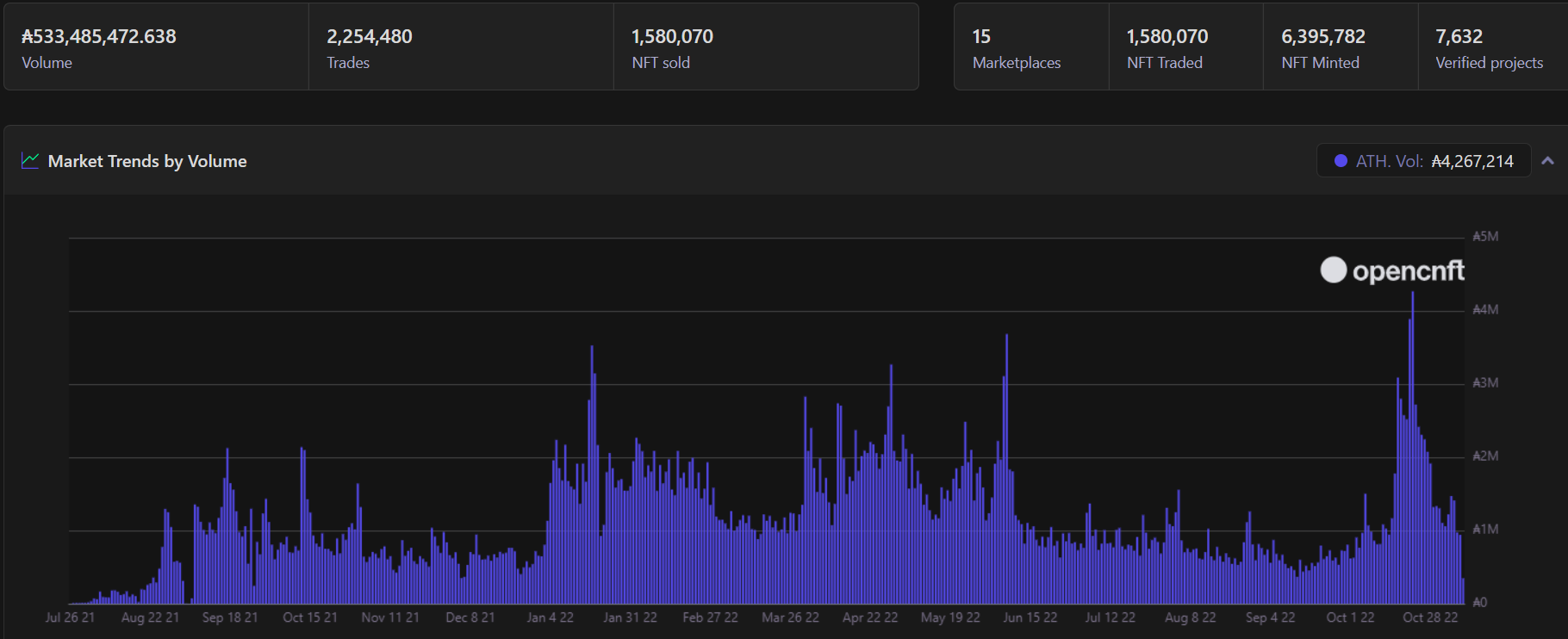

Cardano price does not seem to be reflecting the strides the altcoin has made in the Non-Fungible To.ken (NFT) space. Whilst still not yet significant, Cardano-based NFT volume continues to grow gradually. This is an achievement in itself, given the current condition of the NFT market in general, in which every chain and collection is suffering.

Cardano-based NFTs came to life back in July 2021, and since then, the blockchain has seen multiple ups and downs. Along with the chain, the NFTs volumes also fluctuated, peaking last month at $4.2 million in a single day.

Following the same this month, the total number of NFTs minted on the chain crossed the 6 million mark, touching 6.4 million.

However, the volume of NFTs traded this week has been some of the lowest of 2022. This is in line with the rest of the NFT market as well, where sales have been a major concern. The month of October was already quite disappointing, amassing only $491.2 million in NFT sales.

A little less than September’s $526.7 million, the declining sales have made it difficult for volume to cross the $500 million. Even so, the total sales in November are expected to cross $500 million.

Cardano NFT sales

Whether or not that happens will depend on which direction the market moves in. At least in the case of the crypto market, up seems a little difficult.

The altcoin registered a 10.07% decline in the last two days as prices reached $0.384. The last major rise noted by ADA was in mid-October for nine days when the price rose by 23.53%. At the time, Cardano was close to closing above the six-month-long support of $0.409 but failed to do so.

Fluctuating around the same level, ADA is expected to decline further before testing the line as resistance again. The current critical support is at $0.33, which is where Cardano could be if broader market cues don’t improve.

ADAUSD 1-day chart

Cardano price has room to rise, however, according to the Relative Strength Index (RSI), since the altcoin is nowhere near being overbought. Thus if an increase in buying pressure is observed over the next few days, ADA’s price could shoot up and flip $0.409 into support.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Ripple (XRP) price action is hanging against the ropes with Bitcoin price action and other major cryptocurrencies as the US midterms take center stage.

US regulator Securities and Exchange Commission (SEC) won its lawsuit against LBRY Inc after a New Hampshire judge announced that LBRY is an unregistered security, landing a milestone win for the regulator.

Bitcoin action slips over 4% intraday and 7% with the weekend sell-off included. The uncertainty on the outcome of the US midterms weighs on investor sentiment and faces even more pressure in the aftermath of Musk tweeting to vote Republican as Tesla shares tank.

Binance Coin price has not behaved very differently from the rest of the crypto market, declining by 3% in the span of 24 hours. The exchange coin is reacting to the broader market cues following Binance’s move to liquidate its FTT holdings.

BTC shows a consolidative structure despite the Fed’s hawkish tone on November 2. Regardless of the macroeconomic impact of this development, BTC continues to hover in a tight range. Investors need to be careful as this rangebound movement could result in an explosive move. Since the technical and on-chain metrics point to different outlooks, the direction of this breakout is yet to be determined.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and omissions may occur. Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, clients or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.