Five Democrats wrote the SEC, CFTC, CFPB, OCC, FDIC, Fed and Treasury to see how policies keep employees who jump to crypto lobbying roles from exerting undue influence.

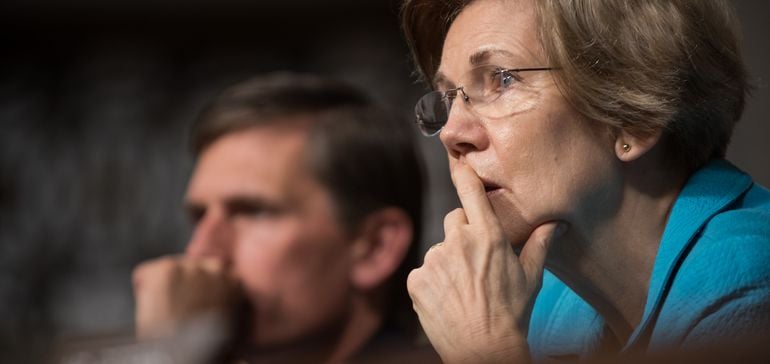

Sen. Elizabeth Warren, D-MA, and four other Democratic lawmakers asked seven federal agencies Monday what safeguards are in place to prevent staff from jumping to crypto lobbying positions.

“We are concerned that the crypto revolving door risks corrupting the policymaking process and undermining the public’s trust in our financial regulators,” Warren wrote in a letter also signed by Sen. Sheldon Whitehouse, D-RI; and Reps. Rashida Tlaib, D-MI; Alexandria Ocasio-Cortez, D-NY; and Jesús “Chuy” Garcia, D-IL.

More than 200 government officials have moved between regulatory posts and crypto firms, the lawmakers wrote, citing figures from the Tech Transparency Project. That includes 31 from the Treasury Department; 28 from the Securities and Exchange Commission (SEC); 15 from the Commodity Futures Trading Commission (CFTC); six from the Federal Reserve; five from the Office of the Comptroller of the Currency (OCC); three from the Consumer Financial Protection Bureau (CFPB); and two from the Federal Deposit Insurance Corp. (FDIC), the lawmakers said.

“Just as powerful Wall Street interests have long exercised their influence over financial regulation by hiring former officials with knowledge of government’s inner workings, crypto firms appear to be pursuing the same strategy,” the lawmakers wrote.

In two of the best-known examples, former Acting Comptroller of the Currency Brian Brooks became CEO of crypto exchange Binance.US months after leaving the OCC. He resigned after three months with the company but moved to another crypto firm, Bitfury, where he remains CEO.

Kathy Kraninger, the CFPB’s former acting director, became vice president of regulatory affairs at crypto startup Solidus Labs. Among her duties: Building out the company’s regulatory team.

In their letter, the lawmakers assert that crypto firms more than quadrupled their lobbying spend over the past three years.

“Americans should be confident that regulators are working on behalf of the public, rather than auditioning for a high-paid lobbying job upon leaving government service,” the lawmakers wrote.

Warren and the others Monday asked officials at the SEC, CFTC, OCC, CFPB, FDIC, Fed and Treasury Department what policies the agencies have in place to prevent former employees-turned-lobbyists from exerting influence. They also asked how long individuals must wait after leaving government work before taking roles in a space they oversaw.

The CFPB, FDIC and Fed acknowledged they received the letter, according to Law360. The SEC declined to comment. The CFTC and OCC didn’t respond to requests for comment.

“Treasury employees who are seeking outside employment are subject to recusal obligations that limit the types of work they can do in their current role and must disqualify themselves from participating in any particular matter in which a prospective employer has a financial interest,” spokesperson Kristin Lynch told the publication. “This requirement applies even to the early stages of a matter, such as making a recommendation or participating in an investigation.”

The lawmakers are also asking the agencies what rules they have in place to ensure transparency and avoid the appearance of conflicts of interest. Warren and the others said they’d like responses by Nov. 7. The Fed and FDIC, in their acknowledgments to Law360, promised to respond to the letter.

Get the free daily newsletter read by industry experts

Topics include: Commercial banking, payments, technology, risk, regulations, policy

De-scheduling the drug may take away the fear of prosecution, but some analysts argue the compliance burden may actually increase.

The BaaS space is expected to reach $74.55 billion by 2030, and has emerged as an enticing revenue stream for community banks. Meanwhile, the OCC has hinted more regulation is forthcoming.

Keep up with the story. Subscribe to the Banking Dive free daily newsletter

Topics include: Commercial banking, payments, technology, risk, regulations, policy

Keep up with the story. Subscribe to the Banking Dive free daily newsletter

Topics include: Commercial banking, payments, technology, risk, regulations, policy

Subscribe to Banking Dive for top news, trends & analysis

Topics include: Commercial banking, payments, technology, risk, regulations, policy

Get the free daily newsletter read by industry experts

Topics include: Commercial banking, payments, technology, risk, regulations, policy

De-scheduling the drug may take away the fear of prosecution, but some analysts argue the compliance burden may actually increase.

The BaaS space is expected to reach $74.55 billion by 2030, and has emerged as an enticing revenue stream for community banks. Meanwhile, the OCC has hinted more regulation is forthcoming.

The free newsletter covering the top industry headlines

Topics include: Commercial banking, payments, technology, risk, regulations, policy

Author

Administraroot