The weather may be getting chillier here in New York City, but it’s been icy cold in the crypto venture space for months.

Whether you’ve been reading or scrolling through Twitter lately, you’ve likely noticed a slowdown in funding for crypto startups. But just how much of a drop-off is actually hitting the industry?

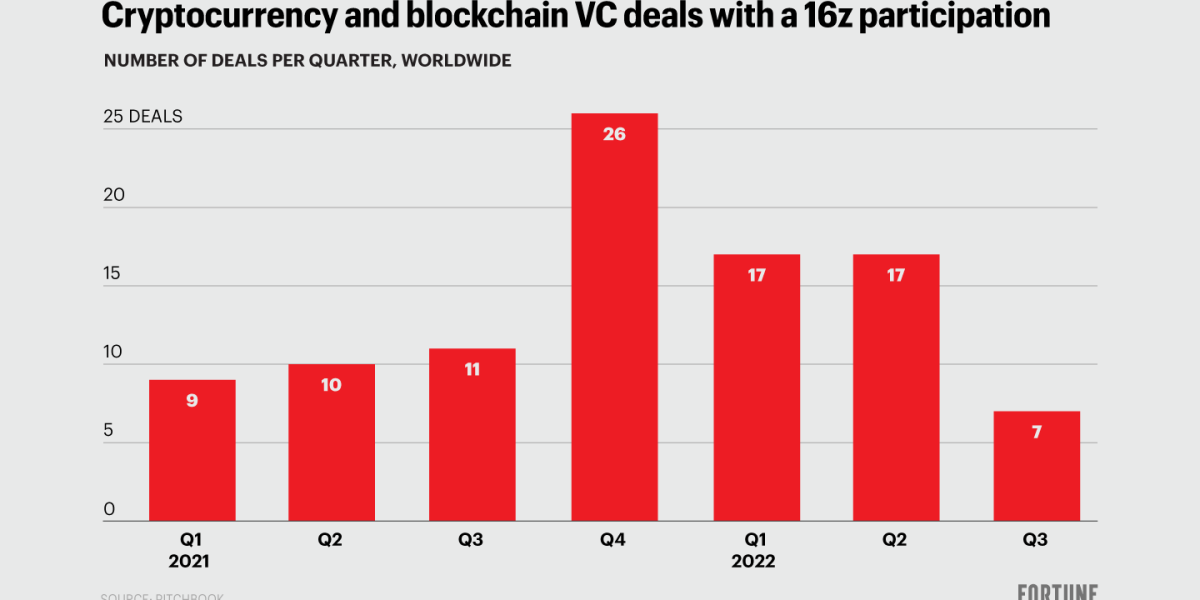

If you look at mega crypto investor Andreessen Horowitz’s activities, the slump looks pretty dramatic.

Though the firm has continued doing deals, a16z crypto, which manages $7.6 billion in funds and raised a whopping $4.5 billion fund in May, participated in only seven crypto and blockchain VC deals in the third quarter of 2022, a huge drop from its peak of 26 deals in the fourth quarter of 2021, according to PitchBook data, and nearly 60% lower than the second quarter this year. The value of the firm’s investments, meanwhile, dropped from nearly $2.4 billion in the first quarter of this year to around $600 million last quarter, per PitchBook data. Of note, the value of a16z’s crypto deals in the third quarter of 2022 is still higher than the year-ago quarter. (A spokesperson for a16z said the firm couldn’t confirm these stats given there are deals yet to be publicly disclosed.)

Certainly it’s not just crypto—venture investing is down en masse over the past few months, as Jessica pointed out yesterday (though seed funding has proved more resilient, in crypto, too).

A16z declined to chat with me. But ex-a16z partner Katie Haun reportedly hasn’t been in a rush to deploy her new $1.5 billion fund for Haun Ventures, either. Per a recent story in The Information, Haun told the outlet that her firm still has “the vast overwhelming majority of our capital,” and that “we’ve been taking it very slow.”

My question is, if valuations have come down a lot, and these firms have tons of cash to deploy, why not take the opportunity to snap up lots of deals at lower prices? I recently asked Grace Isford, a principal at VC firm Lux Capital who focuses on fintech and Web3 investments, and she suggested that for crypto VCs in general, “it’s hard to know how active they’ve been recently because a lot of their investments could have also been made in stealth,” she posited. Isford did note that she’s heard some crypto funds are focusing more on liquid positions at the moment (meaning actual tokens versus equity investments) given compressed market prices. “There may be some good hedge fund opportunities,” she suggested, though Lux Capital doesn’t participate in such hedge fund strategies. Meanwhile a recent TechCrunch article suggested VCs are waiting for even lower valuations.

To be sure, many of these firms may have long deployment schedules, so they might not be in a rush to spend their money right now. And lots of crypto companies raised ample funds in 2021 or early 2022, and are likely not keen on raising a downround and taking a valuation cut (nor are their investors). “A lot of companies don’t need the capital right now,” Isford noted. She’s been less involved in Web3 over recent months, too, Isford told me.

We’ll have to see if the chill in the crypto venture space, alongside the broader drawdown in VC funding, will last in the coming quarters—and whether heavy hitters like a16z will remain content with their slower pace. My bet is things probably won’t get much more frothy anytime soon—but, these firms can’t wait forever to start spending their LPs’ money.

Call out: Are you a founder or investor in the crypto/Web3 space? I’d love to hear about what you’re seeing and hearing (and doing!). Send me a line: anne.sraders@fortune.com or DM @AnneSraders on Twitter.

Have a good weekend.

Anne Sraders

Twitter: @AnneSraders

Email: anne.sraders@fortune.com

Submit a deal for the Term Sheet newsletter here.

Jackson Fordyce curated the deals section of today’s newsletter.

VENTURE DEALS

– Banyan, a New York-based network for SKU data, raised $43 million in Series A funding co-led by Fin Capital and M13.

– Hoxton Farms, a London, U.K.-based company growing animal fat without animals, raised $22 million in Series A funding. Collaborative Fund and Fine Structure Ventures co-led the round and were joined by investors including Systemiq Capital, AgFunder, MCJ Collective, Founders Fund, BACKED VC, Presight Capital, CPT Capital, and Sustainable Food Ventures.

– Tellius, a Reston, Va.-based decision intelligence platform, raised $16 million in Series B funding. Baird Capital led the round and was joined by investors including Sands Capital Ventures, Grotech Ventures, and Veraz Investments.

– Chip City Cookies, a New York-based cookie brand, raised $10 million in funding from Enlightened Hospitality Investments and Union Square Hospitality Group.

– Bookkeep, a New York-based accounting automation platform, raised $6.6 million in seed+ funding. Fin Capital led the round and was joined by investors including TTV Capital, Argonautic Ventures, Lerer Hippeau, Haymaker Ventures, and others.

– Lithos, a Seattle-based agricultural carbon removal company, raised $6.29 million in seed funding. Union Square Ventures and Greylock led the round and were joined by investors including Bain Capital Ventures, Carbon Removal Partners, Carbon Drawdown Initiative, Fall Line Capital, and Cavallo Ventures.

– StoryFit, an Austin-based machine learning and audience insights provider for the entertainment industry, raised $5.5 million in Series A funding. Refinery Ventures led the round and was joined by investors including Techstars, Elkstone Partners, Collective Capital Ventures, Alumni Ventures, and others.

– Cofertility, a Los Angeles-based egg donation, freezing, and donor matching company, raised $5 million in seed funding. Initialized Capital and Offline Ventures co-led the round and were joined by investors including Coalition Partners, Muse Capital, Arkitekt Ventures, and other angels.

– Bumpa, a Lagos, Nigeria-based retail automation platform, raised $4 million in seed funding. Base10 Partners led the round and was joined by investors including Plug & Play Ventures, SHL Capital, Magic Fund, Jedar Capital, DFS Labs, FirstCheck Africa Angel Program, E62 Ventures, Club14, and Fast Forward Ventures.

– HiPeople, a Berlin, Germany-based HR tech startup, raised $2.7 million in funding. Moonfire, Cherry Ventures, Capnamic, and Mediahuis Ventures invested in the round.

– LuckyTruck, a remote-based trucking insurance provider, raised $2.4 million in seed extension funding. Candid Insurance Investors led the round and was joined by investors including Markd’s Parker Beauchamp, Draper University Ventures, and SiriusPoint.

– Netmaker, an Asheville, N.C.-based cloud networking startup, raised $2.3 million in funding co-led by Lytical Ventures, Uncorrelated VC, and SaxeCap.

– Super Advisor, a Toronto, Canada-based digital platform developer for financial advisors, raised CAD $2 million ($1.45 million) led by Rhino Ventures.

PRIVATE EQUITY

– KKR acquired a minority stake in SkinSpirit, a Palo Alto, Calif.-based skin and body care company. Financial terms were not disclosed.

– Marcone, a Genstar Capital portfolio company, acquired Great Plains/Pool & Spa Products, a Houston and Kansas City-based pool and spa equipment and parts distributor. Financial terms were not disclosed.

– Outdoor Living Supply, a Trilantic North America portfolio company, acquired Bedrock Landscape Supply, a Las Vegas-based natural stone, pavers, bulk materials, and landscape supplies provider. Financial terms were not disclosed.

– Strata Information Group, a portfolio company of Fort Point Capital, acquired akaCRM, a San Diego-based advisory, implementation, and managed support services for Salesforce and Conga in the higher education, K-12, and non-profit end markets. Financial terms were not disclosed.

IPOS

– Best in Parking, an Austrian garage and car parking site operator, is considering an initial public offering valued at more than €1 billion ($979 million), according to Bloomberg.

– Prime Medicine, Cambridge, Mass.-based gene editing therapies developer, plans to raise $175.1 million in an offering of 10.3 million shares priced at $17.

FUNDS + FUNDS OF FUNDS

– Bregal Sagemount, a Dallas, New York, and Palo Alto-based private equity firm, raised $2.5 billion for a fund focused on growth businesses with high recurring revenues.

– Operator Collective, a San Francisco-based venture fund, raised $92 million for a fund focused on investing in early stage enterprise and B2B tech companies.

PEOPLE

– a16z crypto, the Menlo Park, Calif.-based crypto investment arm of a16z, hired Collin McCune as head of government affairs. Formerly, he was with the House Financial Services Committee.

– AE Industrial Partners, a Boca Raton, Fla.-based private equity firm, hired Stephanie Sanford as a senior vice president. Formerly, she was with ICBC Aviation Leasing.

– Guidepost Growth Equity, a Boston-based growth equity firm, hired Nate Machado as operating partner and Taylor Doherty and Reginald Seawright as vice presidents. The firm also promoted Steve Brown to vice president. Formerly, Machado was with Abry Partners, Doherty was with Highfive Brands, and Seawright was with McKinsey & Company.

This is the web version of Term Sheet, a daily newsletter on the biggest deals and dealmakers. Sign up to get it delivered free to your inbox.

© 2022 Fortune Media IP Limited. All Rights Reserved. Use of this site constitutes acceptance of our Terms of Use and Privacy Policy | CA Notice at Collection and Privacy Notice | Do Not Sell My Personal Information | Ad Choices

FORTUNE is a trademark of Fortune Media IP Limited, registered in the U.S. and other countries. FORTUNE may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.

S&P Index data is the property of Chicago Mercantile Exchange Inc. and its licensors. All rights reserved. Terms & Conditions. Powered and implemented by Interactive Data Managed Solutions.

Author

Administraroot