Bitcoin is on a wild ride.

The world’s largest cryptocurrency soared to $68,990 last November. Now, it’s at around $19,000 — a staggering 72% pullback from the peak.

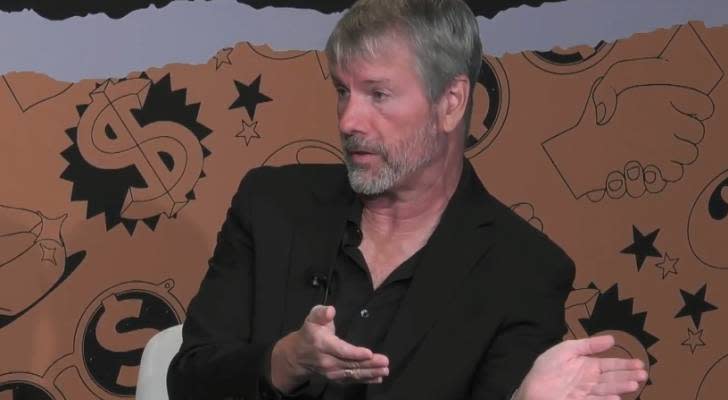

But MicroStrategy CEO Michael Saylor remains bullish. In fact, he not only sees a revival for the cryptocurrency but expects plenty of upside above its previous high.

Don’t miss

Mitt Romney says a billionaire tax will trigger demand for these two physical assets

You could be the landlord of Walmart, Whole Foods and Kroger

High prices, rising rates, a volatile stock market — why you need a financial advisor

BofA says S&P 500 is the ‘worst thing to hold’ right now — 4 top sectors it prefers

“I think that the next logical stop for bitcoin is to replace gold as a non-sovereign store of value asset and gold is a $10 trillion asset right now. Bitcoin is digital gold, it’s 100x better than gold,” he says at MarketWatch’s Money Festival on Wednesday.

“You can’t inflate it. The half-life of money in bitcoin is forever. You can move it on billions of computers at the speed of light. So if bitcoin goes to the value of gold it’s going to $500,000 a coin, and I think that happens this decade.”

Considering where bitcoin is trading right now, $500,000 implies a potential upside of over 2,500%.

Saylor is putting his money where his mouth is. He tells MarketWatch that he personally owns 17,732 bitcoins that he’s had for “about two years” and bought “around the $9,500 range.”

His company MicroStrategy has bought about 130,000 bitcoins for a total price of approximately $3.98 billion.

Still, the path probably won’t be a straight line.

“I think this is the decade where bitcoin institutionalizes from 2020 to 2030,” he says, adding that “it’ll be a wild ride.”

If you share Saylor’s view, here are a few ways to gain exposure to this cryptocurrency.

More: Compare the best investment apps

The first option is the most straightforward: If you want to buy bitcoin, just buy bitcoin.

These days, many platforms allow individual investors to buy and sell crypto. Just be aware that some exchanges charge up to 4% commission fees for each transaction. So look for apps that charge low or even no commissions.

While bitcoin commands a five-figure price tag today, there’s no need to buy a whole coin. Most exchanges allow you to start with as much money as you are willing to spend.

Exchange-traded funds have risen in popularity in recent years. They trade on stock exchanges, so buying and selling them is very convenient. And now, investors can use them to get a piece of the bitcoin action, too.

For instance, ProShares Bitcoin Strategy ETF (BITO) started trading on NYSE Arca in October 2021, marking the first U.S. bitcoin-linked ETF on the market. The fund holds bitcoin futures contracts that trade on the Chicago Mercantile Exchange and has an expense ratio of 0.95%.

Investors can also consider the Valkyrie Bitcoin Strategy ETF (BTF), which made its debut a few days after BITO. This Nasdaq-listed ETF invests in bitcoin futures contracts and charges an expense ratio of 0.95%.

When companies tie some of their growth to the crypto market, their shares can often move in tandem with the coins.

First, we have bitcoin miners. The computing power doesn’t come cheap and energy costs can be substantial. But if the price of bitcoin goes up, miners such as Riot Blockchain (RIOT) and Hut 8 Mining (HUT) will likely receive growing attention from investors.

Then there are intermediaries like Coinbase Global (COIN) and PayPal (PYPL). When more people buy, sell, and use crypto, these platforms stand to benefit.

Finally, there are companies that simply hold a lot of crypto on their balance sheets.

Saylor’s company serves as a prime example. MicroStrategy is an enterprise software technologist with a market cap of $2.2 billion. Yet its stash of around 130,000 bitcoins is worth approximately $2.47 billion.

Sign up for our MoneyWise investing newsletter to receive a steady flow of actionable ideas from Wall Street’s top firms.

Warren Buffett likes these 2 investment opportunities outside of the stock market

A Wells Fargo study shows that nearly half of Americans are leaning on their credit card rewards to help offset some of the costs of everyday purchases

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

You have just a few weeks to pounce on Treasury I bonds' sky-high interest rate. Also called Series I savings bonds, their interest rate is 9.62%.

Intel reports quarterly results on Oct. 27. Its last big layoff round, comprising 12,000 job cuts, was announced in tandem with first-quarter earnings in 2016.

After the annus horribilis of 2022, with the final quarter now in play, investors will be hoping a late-year rally will materialize. According to Carson Group's chief market strategist Ryan Detrick, that’s not such a far-fetched idea. "While October has a reputation for crashes, it is really a bear market killer,” Detrick recently wrote. “Of the past 17 bear (or near bear markets), stocks bottomed in October six times. Could it happen again? With sentiment this pessimistic and extremely positive

The stock market had a mixed performance on Tuesday, trading higher for parts of the day but finishing with new closing lows for the year for the S&P 500 (SNPINDEX: ^GSPC) and Nasdaq Composite (NASDAQINDEX: ^IXIC). The Dow Jones Industrial Average (DJINDICES: ^DJI) managed to hold onto some modest gains, but they were quite a bit smaller than they'd been earlier in the afternoon. High-growth tech stocks once again found themselves in the crosshairs of bearish investors on Tuesday, extending losses from earlier in the year amid ongoing concerns about inflation.

Nio (NYSE: NIO) is working to expand beyond China, but right now investors are trading the company knowing its main market is still China. Last week, Nio outlined its strategy to continue its push into the European market.

Tired of hearing about inflation? Well, tough luck. That is once again this week’s hot topic. On the agenda, the wholesale and consumer inflation reports – out Wednesday and Thursday, respectively. Considering the market’s latest pullback, Wall Street is evidently on edge following a good-is-bad jobs report, with little expectation the Fed will be relaxing its monetary policy anytime soon. Q3 earnings are also about to kick off and financial statements will offer a clue on inflation and rising c

It's common for companies to up their dividend payouts when business is fruitful, allowing investors to build up a cash pile quickly.

Shares of Credit Suisse are tumbling after reports surfaced that the Justice Department is investigating its role in asset hiding.

It's looking like a rough day for stocks. Our call of the day is a look at the future and a billion-dollar industry and some stocks to play it, from Citigroup.

Shares of electric-vehicle giant Tesla have gone through a brutal stretch lately. Bulls might be getting some relief soon.

One of the 800-pound gorillas in the auto industry will compete head-to-head with the company in an important segment.

Nikola (NKLA) closed the most recent trading day at $2.99, moving -0.33% from the previous trading session.

Layoffs may be on the way at Intel, Oregon’s largest employer. The moves would come as the semiconductor industry is pushing the state for more incentives. Bloomberg, citing unnamed sources, reported late Tuesday that Intel is planning significant workforce reductions that could affect the sales and marketing division.

XPeng Inc. Sponsored ADR (XPEV) closed at $9.41 in the latest trading session, marking a -1.36% move from the prior day.

If you're searching for a low-risk, high-yield dividend stock, this wireless leader could be worth considering.

Warnings about monetary overkill by central banks are growing louder. This time the insurgency is coming from within America's New Keynesian elite.

A Cowen analyst says chip stocks are near all-time low valuations after their big drops this year. Several offer solid buying opportunities.

U.S. national debt is above $31 trillion for the first time as the Federal Reserve is in retreat from buying it and foreign investors' interest is waning.

The Automotive-Domestic Industry is in the top 36% of over 250 Zacks Industries and two stocks investors may consider buying out of the group are General Motors (GM) and Ford Motor Company (F).

The Nasdaq and S&P 500 sank to new bear market lows Tuesday as chip stocks and Tesla slumped. Big inflation reports are ahead.

Author

Administraroot