Few words outside of politics polarize more than cryptocurrency.

Crypto is among the most urgent of current tech topics, driven by billions of cryptocurrency trades weekly — bitcoin and so many others — and a cultural stigma perhaps unseen in finance since the days of the Wall Street wolves of the 1980s. Almost since its creation, crypto has been characterized by sudden wealth creation, surprise hacks, big scams, bold promises and shattered dreams.

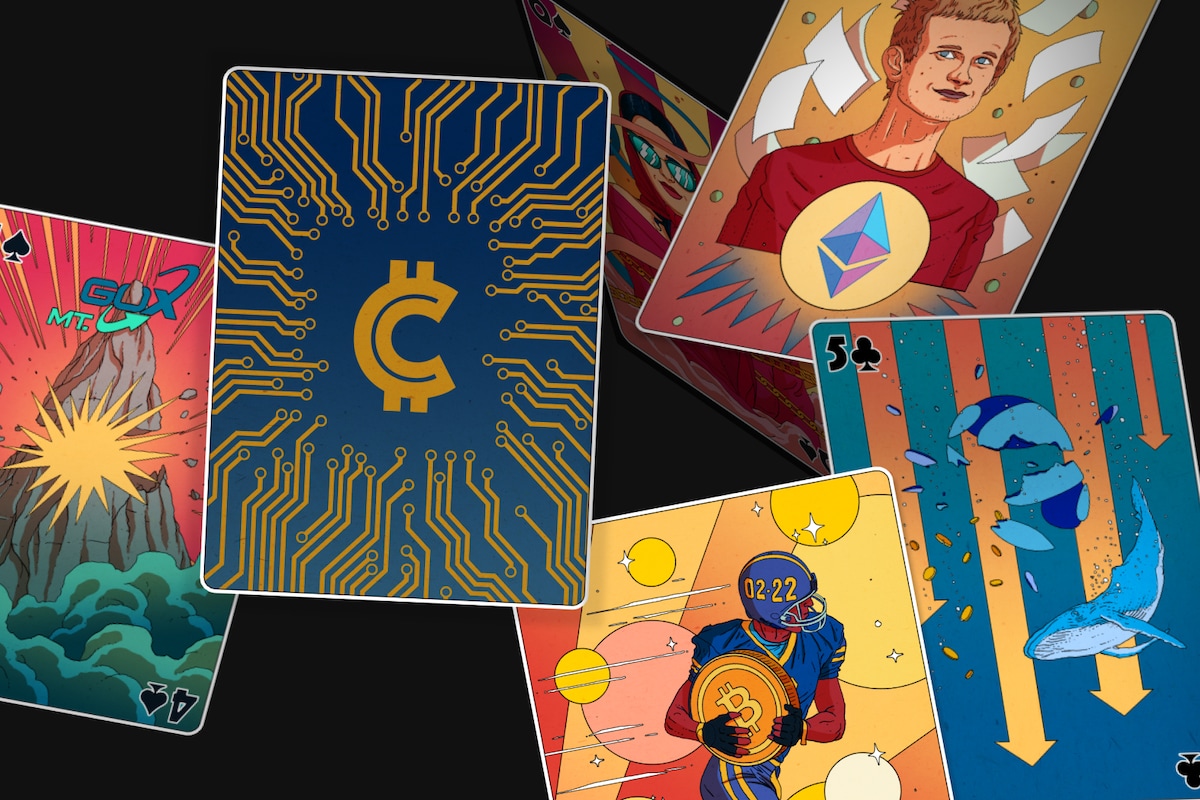

And the craziest part is no one can say what this blackjack table will turn up next. Welcome to crypto’s house of cards.

A mysterious figure named Satoshi Nakamoto sends 10 “bitcoins” to the cryptographer Hal Finney, and a world is unleashed.

Nakamoto — who had previously written a white paper explaining the underlying complex technology — believes the computer-based asset he’s created is far preferable to the traditional banking system, which is under massive strain from the financial crisis just several months earlier. With its unique code and easy transferability, bitcoin will work well across borders and around bureaucracy, Nakamoto argues. And the many digital “books” that his code would create (a.k.a., the blockchain) would ensure the coins couldn’t be faked or hacked. Nakamoto would mine — generate with computer code — some one million bitcoins then disappear from public view the next year. His identity remains unknown.

Bitcoin starts being used — for shadiness. An untraceable “dark net” called Silk Road launches. And for the next few years of its existence, the platform accepts only bitcoin for its black market items.

As more are moved, and mined, the coin’s value begins to fluctuate, suggesting an asset that itself can be traded. Starting out at 30 cents, bitcoin’s value hits $1 early in 2011, rises to above $30 by June and then crashes to $2 by the fall. It was the first bitcoin-price roller-coaster. It wouldn’t be the last.

Bitcoin reaches parity with the dollar for the first time

Litecoin, one of the first alternatives to bitcoin, is created

Electrum, one of the first and most popular bitcoin wallets, is launched

The first halving — a measure to limit the supply of bitcoins — takes place

Treasury issues guidance saying that “virtual currency” is not legal tender

A Russian Canadian teenager, Vitalik Buterin, writes a white paper titled “A Next Generation Smart Contract & Decentralized Application Platform” and it kick-starts a revolution. Building on Nakamoto’s work, the paper lays out the underpinning of a new kind of blockchain, or digital ledger, that will allow for all sorts of new trades such as NFTs — and further facilitate a libertarian monetary system beyond the reach of government.

Buterin and his partners will create the ethereum blockchain, which will also spin off a crypto token called ETH that competes with bitcoin, as well as jump-start a market that will one day be worth hundreds of billions of dollars.

Meanwhile, bitcoin trading is picking up, and Bloomberg gives it a ticker symbol. Regulators start to notice, as the New York State Department of Financial Services issues a report warning of potential criminal activity.

Chinese bitcoin-mining company Canaan Creative is founded, paving the way for large-scale mining

U.S. Senate holds first-ever hearings on bitcoin

Bitcoin investor GameKyuubi launches a phrase for the ages when in a colorful post he says he is "HODLING” his crypto

After attracting scores of customers, a shiny new cryptocurrency platform, Mt. Gox, abruptly pauses users’ ability to withdraw money so it can “obtain a clear technical view of the currency processes.” Untold millions are suddenly unavailable from the platform, which had been whimsically named for the “Magic: The Gathering” card game. The company declares bankruptcy, among the first such events in crypto. It won’t be the last.

A Bloomberg columnist also calls bitcoin one of the worst investments of 2014 — after Forbes had called it the best investment of 2013.

IRS states that crypto is to be taxed as property

Rep. Steve Stockman (R-Tex.) introduces the Virtual Currency Tax Reform Act, but it fails to pass.

Kevin McCoy and Anil Dash mint the first NFT

The name Ruja Ignatova might not mean much even to most crypto-traders. But anyone who’s ever been hit by a scam feels, indirectly, the handiwork of the so-called “Cryptoqueen.” The Bulgarian German legal PhD starts selling onecoin, a currency she says will one day replace bitcoin, giving grand presentations around the world. There’s only one problem — it’s a total sham. As much as $4 billion of consumers’ money goes missing.

Ignatova goes on the lam in 2017 and eventually is placed on the FBI’s Ten Most Wanted List. She hasn’t been seen in years. But every crypto scam owes a spiritual debt to the person who first realized that an obscure technology, a cult of personality and reflexive greed can separate people from their life savings.

Former Obama White House tech adviser Brian Forde is hired to run MIT’s Digital Currency Initiative

Greece defaults on a debt of 1.6 billion euros to the International Monetary Fund

Commodity Futures Trading Commission says virtual currencies are commodities covered by the Commodity Exchange Act

The U.K. holds its Brexit referendum

Donald Trump becomes the 45th president of the United States

Seeing bitcoin and other cryptocurrencies starting to attract everyday investors, Changpeng Zhao, a China-born, Canada-raised financial tech executive, launches Binance, an online exchange that allows people to buy and sell crypto. The company will eventually become the biggest exchange in the world.

Meanwhile, new coins are being introduced nearly every day — some 800 by mid-2017. Innovations like tether — a coin whose value is designed to move in tandem with the U.S. dollar — emerge to facilitate trading. Venture capital money is pouring in. Noisy mining operations running crypto’s complex calculations sprout up around the world. Overnight, crypto millionaires known as “whales” proliferate. This is looking less like a cutting-edge way to conduct transactions — that’s too time-consuming — and more like an old-fashioned investment frenzy. And Binance is at the center of it.

Bitcoin starts the year at $900

Bitcoin tops $19,000

The froth of 2017 is followed by the frost of 2018. Right before Christmas 2017, bitcoin is worth nearly $20,000, and many other coins are riding high. The same time a year later, it has fallen to barely $3,000, and many coins have gone away, along with their investors.

The reasons for the crash are many: Global hacks, regulation in Asia, bans on certain coin ads by Facebook and Google. It seems like crypto will never be the same again. A House Financial Services subcommittee conducts a hearing on the risks of crypto. But with the crash, they don’t feel a need to step in.

At a House subcommittee hearing Rep. Brad Sherman (D-Calif.) says “cryptocurrencies are a crock”

The SEC seeks to classify most digital currency as securities, which are subject to stricter laws

Bitcoin sinks to barely $3,000

Sam Bankman-Fried and Gary Wang found FTX

A pandemic strikes, the world shuts down, and people are suddenly stuck at home with nothing to do. But they have an infusion of cash — buoyed by stimulus checks and all the income they’re not spending elsewhere. Crypto starts looking pretty good again. Forget transactional uses — this is about making a fast investment buck.

An exchange founded the previous year, FTX, starts to gain traction. New cryptobanks like Celsius take off, offering seemingly magical 25 percent returns for depositors who leave their money with it. Bitcoin goes from $6,000 to $60,000, creating more whales. The rush also seeps into weirder provinces. The value of dogecoin, a dog-based coin launched as a satiric commentary on the crypto enterprise, skyrockets thanks to Elon Musk, then crashes. “Rug-pulls”— scams where newly launched coins are hyped by founders who quickly sell them and disappear — multiply. So do crypto-friendly ransomware attacks.

Congress begins to pay more attention — the Senate puts a crypto provision in an infrastructure bill in 2021. Some state regulators also raise concerns, ordering some crypto businesses to stop doing business in their states. FTX founder Sam Bankman-Fried also takes note and becomes a major political donor.

The SEC files a lawsuit against crypto company Ripple, setting up an important legal showdown

Mike Winkelmann, aka “Beeple,” sells a piece of NFT art for $69 million

The American oil delivery system known as the Colonial Pipeline experiences a ransomware attack enabled by crypto

U.S. Treasury requires any crypto transfer worth $10,000 or more to be reported to the IRS

El Salvador passes a law declaring bitcoin as legal tender

The People’s Bank of China bans all cryptocurrency transactions

The Justice Department announces the launch of the National Cryptocurrency Enforcement Team (NCET)

Bitcoin soars above $60,000 for the first time

A set of Super Bowl commercials storms the airwaves, and crypto’s cultural moment is here. Pew Research several months earlier had reported that 16 percent of Americans have traded or transacted in cryptocurrency, and the industry wants to grow it further. Bitcoin is now frequently above $40,000. Cryptocompanies are rolling in digital dough — enough to pay Matt Damon, LeBron James, Larry David and others to tout their products. Two NBA arenas are renamed for crypto exchanges.

A growing group of critics — mainly tech figures and academics, but also a handful of lawmakers — raise alarms. But the tech is going mainstream, with legacy entities like Fidelity encouraging more crypto investment. Barely three years removed from the end of the crypto winter, a crypto summer arrives.

Russia invades Ukraine, which quickly begins soliciting donations in crypto

New York couple Heather Morgan and Ilya Lichtenstein are arrested for allegedly scheming to launder billions in crypto

The blockchain associated with videogame Axie Infinity is hacked, leading to the theft of more than $600 million in cryptocurrency

Over a few weeks beginning in May, crypto collapses. It starts with terra — a hot stablecoin and a companion token — falling apart. Whales and institutions sell it frantically, wiping out the wealth of hundreds of thousands of investors.

The erosion of something so hot has a negative effect throughout the industry. Crypto-banks Celsius and BlockFi, hedge fund Three Arrows Capital and broker Voyager face liquidity and other issues, with investors in many cases unable to get their money back. Celsius, Three Arrows and Voyager file for bankruptcy. FTX and Sam Bankman-Fried step in to provide a credit facility to BlockFi, for instance, but the long-term solvency of many of these entities is questionable. Trading platform Coinbase lays off 18 percent of its staff. Bitcoin hovers in the low 20s for much of the summer, less than half its value from the comparatively go-go days of March.

But there is some good news — in September, ethereum is able to move its platform to a faster, cheaper and more environmentally friendly operating mechanism, in a shift known as “The Merge.” And crypto’s fortunes seem — once again — momentarily poised for a rebound.

Bitcoin drops below $19,000, its lowest price since 2020

Ethereum switches to a new transaction system, hoping to reduce crypto’s environmental toll. Bitcoin again dips below $19,000, wiping out the summer’s gains.

Illustrations by Olivier Bonhomme for The Washington Post. Editing by Karly Domb Sadof and Mark Seibel. Additional editing by Monique Woo, Virginia Singarayar and Jamie Zega.

Data used in this story to find the number of cryptocurrency fraud complaints came from the Federal Trade Commission, and the data used to track large investments came from YipitData.

Author

Administraroot