Lee Reiners, the executive director of the Global Financial Markets Center at Duke Law School, has a firm line on digital financial services. The former regulator is of the general opinion that the crypto boom of recent memory had more to do with loose Federal Reserve monetary policy than the inherent long-term investment potential of such assets as Dogecoin DOGE or CryptoDickButt #666. In fact, he thinks that crypto should be banned.

He may well be right, I couldn’t say, and anything I do say about cryptocurrencies is for entertainment purposes only. And even if it wasn’t, you’d have to be insane to take investment advice from me and not only about crypto. But what exactly is “crypto” anyway?

John Paul Koning posted on Twitter that we should be a little wary of using it as a catch-all term. As he pointed out, given the spectrum of instruments across the sector (eg, bitcoin, stablecoins, NFTs, DeFi, L2s and so on), the word “crypto” has become less meaningful to the point at which it may in fact subvert the general discussion and undermine understanding of the topic.

I think this is a good point. While JP and I may be few against many, I do think it would be helpful to at least distinguish cryptocurrency from tokenized assets of one form or another, whether they are traded in a centralized or decentralized market.

(As one commenter I saw on Twitter put it — at least I think it was on Twitter, but am subject to internesia — you wouldn’t lump together astrology and astronomy and call them “astro”.)

Hence I will undertake to try not use the word “crypto” for these new kinds of digital assets in the future. Instead I will refer more specifically on the one hand to cryptocurrency (or “unstablecoins”) and on the other hand to digital assets of some form that are bearer instruments exchanged without clearing and settlement as “stablecoins” when backed by reserves of fiat currency and something else yet to be determined (we’ll come back to this later) when I mean tokens that are backed by real-world assets.

I will, however, continue to use the word in another context. I am not a lawyer (or IANAL, as the kids say), but my good friend Charles Kerrigan is. And rather a good one at that. He is a partner at the international law firm CMS and wrote a fine article on the word recently. In this, he said that “crypto isn’t a what, it’s a how – a way of doing things.” That is a really good take so from now on, I am only going to use the dread word “crypto” when I mean a way to exchange both fungible and non-fungible tokens directly and in a decentralized manner.

But back to what to call these tokens that are some sort of digital asset that is kind of new and kind of different and of which stablecoins are a specific subset. How should we be thinking about these? People have grown so accustomed to using the centralized services of Web2 to (as Richard Bartle so memorably said) “buy things that don’t exist from people who don’t own them” that the idea of actually owning things — these new kinds of digital objects you can sell, trade, or take elsewhere — appears novel. Heading into the metaverse this will change, because the metaverse is a virtual world in which this kind of property will be integral to the economy, but right now we don’t quite know how to categorize or classify such objects..

We know that the simplistic token maximalist position that if the token is in your wallet then it is yours simply cannot be right. The advocates of these strong digital property rights see computer code as the equivalent of the courts, contracts and correction facilities in the real world. Hence the mantra “code is law” and the idea that the metaverse turns “digital serfs into homesteaders.”

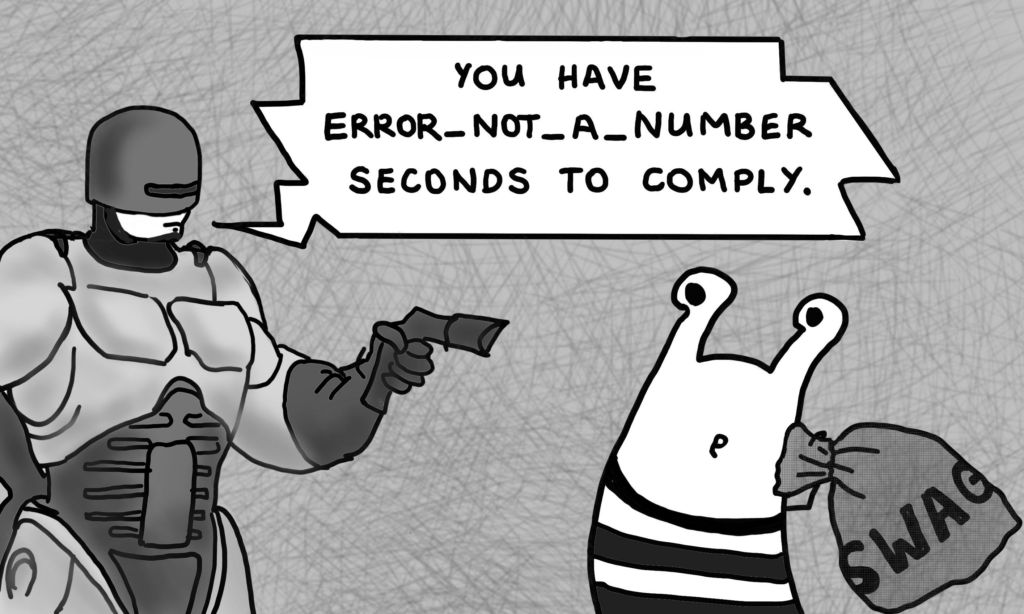

Codes is the law.

This is an appealing perspective, given a legal framework rooted in another age, but it is the right one? The issues here have been brought into sharp relief by the collision between NFTs and intellectual property law. Copyright and trademark laws were not written with NFTs in mind, which means that it will be up to the courts to adjudicate disputes in the current legal framework until revised statutes are enacted.

That sounds reasonable, I think, but what might these revised statutes look like? Informed industry observers focus on the property law treatment of such assets and in common law jurisdictions there seems does indeed seem to be trend toward engaging with “downstream” conceptual and doctrinal questions in the law of property.

The Law Society of England & Wales, to focus on a key example, has a consultation concerning such matters underway right now. They note that while the law (by which they mean, of course, the law of England and Wales, not the concept of law in general) has to some extent been able to accommodate these new digital assets as objects of property rights, certain aspects of the law now need reform to ensure that digital assets benefit from what the Society terms “consistent legal recognition and protection.”

One thing I learned from reading the consultation, while IANAL, is that there are currently two different kinds of property. The first is “things in possession”, which means broadly speaking assets that are tangible, moveable and visible such as a bicycle or a gold bar. The second is “things in action”, which means property that can only be claimed or enforced through legal action or proceedings, such as debt or shares in a company.

The Law Society rather interestingly proposes to add a third category to allow for what they call new, emergent, and idiosyncratic objects of property rights. I might be tempted to label this category “things in wallets” but they have chosen the more generic “data objects” (rather than, for example, “tokens”.)

The reason that I like the wallet label is that it has connotations of personal control. Indeed, the lawyers say the in the case of these digital objects the factual concept of control (as opposed to the concept of possession) best describes “the relationship between data objects and persons”, which I think is their way of saying “not your keys, not your coins.” I agree with this general point: the owner of the token for a seat at the ball game is the person who controls the private key of the wallet that the token is in.

When it comes to the assets themselves, they say that the law should “recognize and give effect” to the freedom of commercial parties to devise bespoke contractual arrangements. This includes systems in which the holder of a given token is regarded as having legal title to whatever it is that is somehow linked to the token (eg, the seat at the ball game.)

However, being lawyers, that is the beginning rather than the end of the story. They go on to say that holding a token should not necessarily be regarded as a “definitive record of (superior) legal title” to the token. Or, in other words, code is not law and that just because you have the keys that does not make them your coins. And while that may sound like turkeys voting against Thanksgiving, they have a point.

(I once, many years ago, gave a talk about the use of digital signatures in commercial transactions. One of the advantages, I said, was non-repudiation. A lawyer in the audience was quick to tell me that in his opinion good counsel can repudiate anything.)

In parallel to the legal consultation, the British government has just published its new Bill on financial markets. This includes reference to regulating both cryptocurrencies and web3 (including stablecoins) in an attempt to guide their transition into the mainstream. The Bill refers to what it calls “digital settlement assets that can be used for the settlement of payment obligations; can be transferred, stored or traded electronically, and use technology supporting the recording or storage of data (which may include distributed ledger technology).”

I think they mean tokens.

(Maybe it makes sense to integrate “data objects” and “digital settlement assets” into the single overarching category of “digital assets” but I am genuinely interested what different perspectives there might be about this labelling. Labels are important.)

I’m not enough of an expert on the Law of England & Wales, the regulation of financial markets or decentralized finance protocols to propose a definitive set of definitions at this point, but I think I can say that:

John Paul is right: Let us stop talking about “crypto” and talk about cryptocurrencies, tokens and DeFi;

Good, now we have a platform to build on!