Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services.

Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services.

Motley Fool Issues Rare “All In” Buy Alert

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

For serious crypto investors, risk management is a primary concern. Once you’ve amassed a certain level of crypto wealth, you don’t want to lose it to hackers, scammers, or cybercriminals. As a result, one popular risk- management technique is cold storage, which is a way of storing your cryptocurrency offline and away from bad actors on the internet.

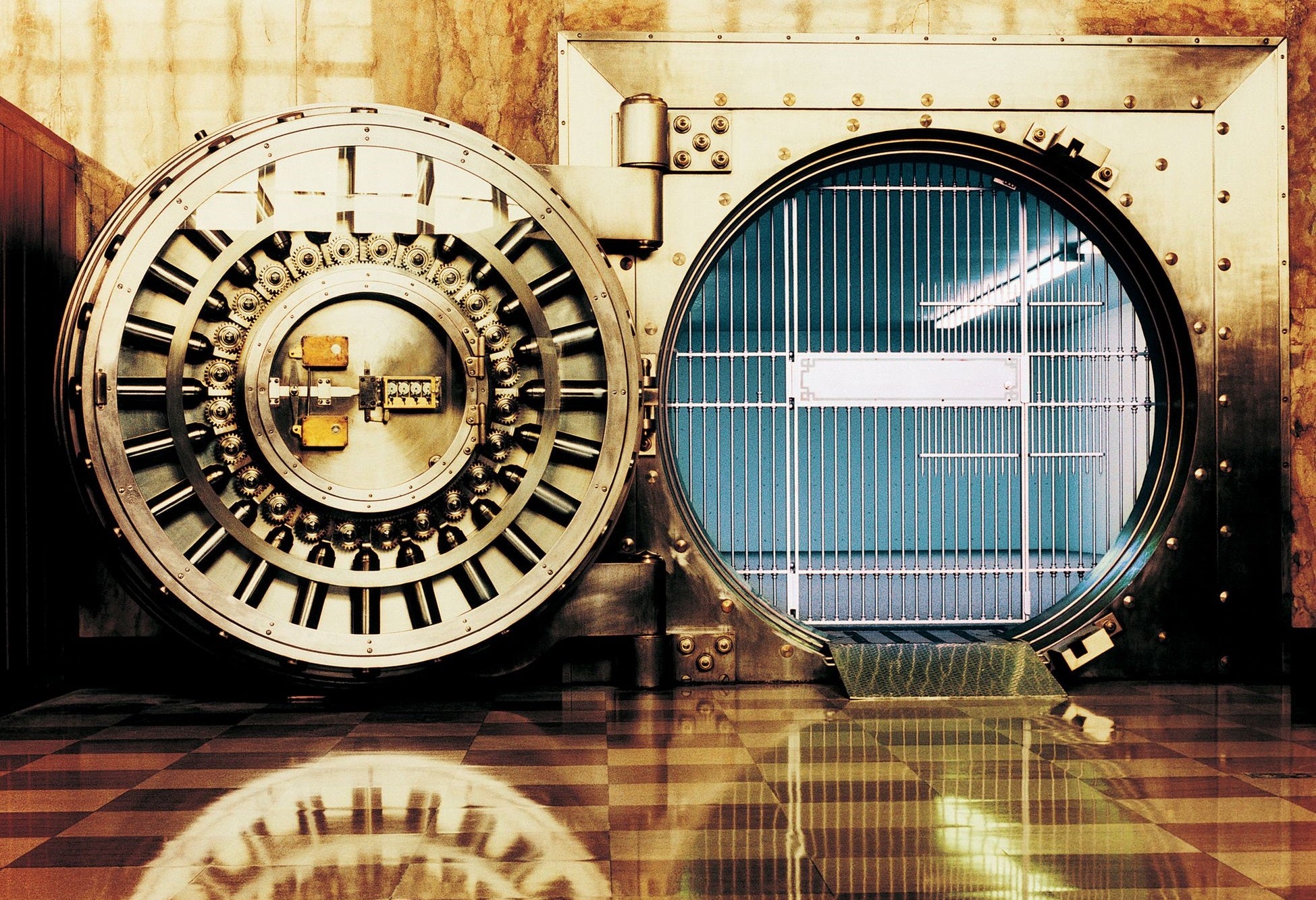

Cold storage in crypto can take various forms. For billionaire investors, cold storage can involve armed guards, hardened underground bunkers, and giant bank vaults. For retail investors, cold storage typically involves a physical device resembling a USB stick that you can buy online for less than $150. For both billionaire investors and retail investors, there are three primary reasons to consider cold storage for crypto.

Over the past six months, the perceived risk of storing crypto on cryptocurrency exchanges has increased significantly. After all, there have been a number of high-profile bankruptcies and insolvencies in the crypto world during the current “crypto winter.” At the same time, there is persistent speculation about the potential bankruptcy risk of popular cryptocurrency exchanges. In cases such as Voyager or Celsius, investors lost access to their crypto holdings for an unspecified period of time as soon as financial distress was announced. At a certain point, people started questioning whether these crypto holdings might be permanently frozen or used to pay off creditors later. All of this has made some crypto investors nervous.

Image source: Getty Images.

Not surprisingly, people are exploring alternatives to storing their crypto on an exchange, and cold storage offers a relatively affordable solution. Even before the onset of the crypto winter, some investors had a simple rule of-thumb for how much of their crypto to hold on-exchange and how much to hold off-exchange. For example, they might decide to hold 20% of their crypto on a cryptocurrency exchange, and the remainder in cold storage.

Another reason to consider cold storage in crypto is the ever-present risk posed by cybercriminals and hackers. To paraphrase infamous bank-robber Willie Sutton: Hackers rob cryptocurrency exchanges because that’s where the crypto is. Throughout the history of crypto, there have been some legendary exploits involving major crypto exchanges. Perhaps the best-known example is Mt. Gox, where hackers broke into the exchange, pulled out $350 million in Bitcoin over an extended period of time, and vanished into thin air. In fact, there’s an entire Wikipedia page dedicated to major crypto heists all over the world.

The final reason to consider cold storage is to protect your crypto during periods of very high volatility or extreme market uncertainty. For example, when Ethereum flips the switch on the Merge, people are not 100% certain about what’s going to happen next. As a result, some major cryptocurrency exchanges have said that they will pause withdrawals and deposits of Ethereum on the day of the Merge, and potentially even longer. Coinbase Global has also warned users to be aware of scams related to the Merge, due to all the confusion about the “old” Ethereum and the “new” Ethereum. And Robinhood has already alerted crypto investors that, out of an abundance of caution, it will pause withdrawals of several other cryptos in addition to Ethereum. If you are concerned about what might happen to your crypto, one option would be moving it to cold storage.

As they say in the crypto world, “Not your keys, not your crypto.” The keys refer to the cryptographic keys that protect your crypto. When you hold your money on a cryptocurrency exchange, the exchange holds your keys for you in a custodial role. But when you use cold storage, you’re in charge of your keys. Hackers can’t get access to these keys because the keys are offline.

However, there is one downside risk here. Since only you own the keys, if you ever lose them, there will be nobody who can give them back to you. The annals of crypto are filled with examples of people who have lost hundreds of thousands of dollars in Bitcoin simply because they lost their keys. That’s one reason people store their crypto on exchanges — it keeps them from ever experiencing this unfortunate scenario. And major cryptocurrency exchanges can offer a form of cold storage themselves to help customers protect against the risks outlined above.

At the end of the day, some form of cold storage makes sense if you have a lot of crypto at risk. It really depends on your risk tolerance and how much crypto you need to access daily. If you are planning to HODL (crypto lingo for “hold”) for the long haul, then cold storage could be one way to protect your Bitcoin during what could end up being a very long crypto winter.

Dominic Basulto has positions in Bitcoin and Ethereum. The Motley Fool has positions in and recommends Bitcoin, Coinbase Global, Inc., and Ethereum. The Motley Fool has a disclosure policy.

*Average returns of all recommendations since inception. Cost basis and return based on previous market day close.

Market-beating stocks from our award-winning analyst team.

Calculated by average return of all stock recommendations since inception of the Stock Advisor service in February of 2002. Returns as of 09/07/2022.

Discounted offers are only available to new members. Stock Advisor list price is $199 per year.

Calculated by Time-Weighted Return since 2002. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns.

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services.

Making the world smarter, happier, and richer.

Market data powered by Xignite.