Let’s see what happens.

In Jamie Dimon’s annual letter to JP Morgan Chase shareholders, he said explicitly that “DeFi and blockchain are real”, which caused some comment in crypto circles given his previous statement that “I don’t care about bitcoin. I have no interest in it.” But I think it is possible to believe that tokenization will be huge and that Defi protocols will have a serious role to play in the next generation of financial services, while simultaneously being skeptical that cryptocurrencies will have a major role.

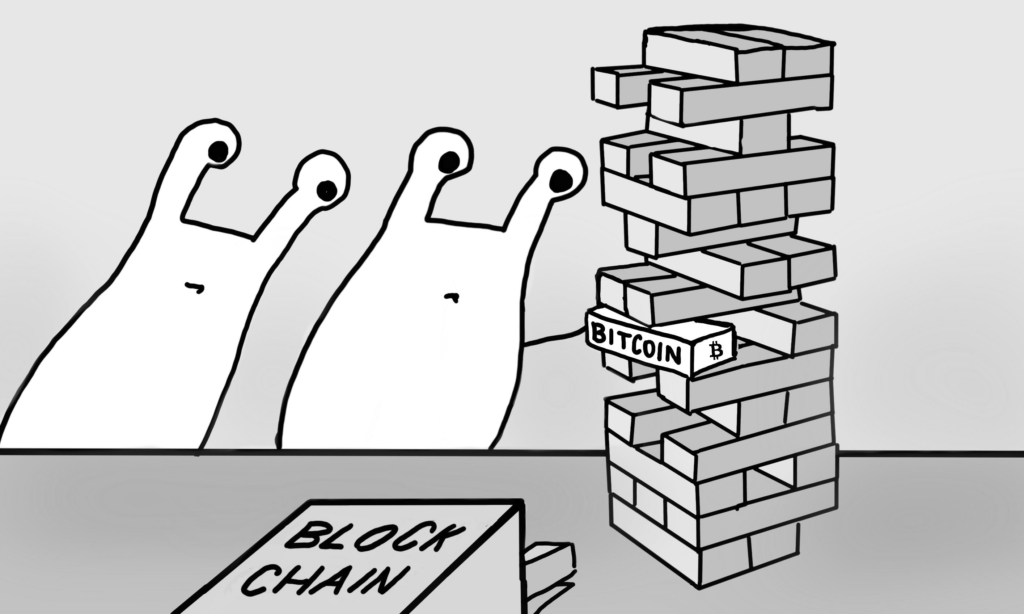

DeFi without Bitcoin? Opinion is certainly divided, but when it comes to the entertaining ongoing spat between Marc Andreessen and Jack Dorsey, I’m on the Andreessen side of the fence. It is not at all clear to me that Bitcoin BTC is the universal and utopian money of the future, whereas I think that the experimentation going on the DeFi world will in time open up new ways of doing business in the finance sector.

I do not see this as a controversial positions. In fact, I think this has long been the view of serious players in the financial services mainstream. Irfan Ahmad (VP at State Street, the world’s largest custodian bank), recently said that cryptocurrencies have not just entered another winter, but a “polar vortex”, which seems a reasonable view given the collapse of the Celsius decentralized finance (DeFi) protocol and the news that Three Arrows Capital has filed for bankruptcy and so on. However, beneath the ice, his and other investment banks are working on using shared ledge technologies to build new trillion-dollar markets that do not involve speculative cryptocurrencies. But instead use digital representations (i.e., tokens) linked to real-world, hard assets.

There is no paradox at all: whether cryptocurrencies survive the coming storm of regulation, central bank digital currencies, instant payments and digital identity, institutional markets will ultimately use the new infrastructure to trade bonds, gold and carbon in digital form. It won’t only be commodities that are tokenized and traded without clearing and settlement. Banks will tokenize all forms of collateral, such as; title to property, using the technology. As the Bank for International Settlements (BIS) set out in their current Bulletin (no. 57, 14th June 2022), “DeFi lending must engage in large-scale tokenization of real-world assets unless it wants to remain a self-referential system fueled by speculation.”

Speaking at Consensus 2022 last month, Tyrone Lobban (Head of Onyx Digital Assets at JPMorgan) described in detail the bank’s institutional-grade, DeFi plans and highlighted how much value in tokenized assets is waiting in the wings. He said that tokenized assets ranging from US Treasuries to money market fun shares could be all be used collateral in DeFi pools, bring trillions of dollars of assets into DeFi, “so that we can use these new mechanisms for trading, borrowing [and] lending, but with the scale of institutional assets.”

This will be a whole new financial services sector, and it will be an important one. Since, as The Economist pointed out, tokens can be digital representations of nearly anything, “they could be efficient solutions to all sorts of financial problems.” Apart from anything else, tokens mean a lower cost trading environment, which is why the big players want to use them as soon as the regulatory environment is stable.

As Tom Zschach, Chief Innovation Officer at SWIFT, said it: “Financial institutions today don’t typically engage with permissionless digital assets, because of their unregulated status and anonymity… But many financial institutions, central banks, market infrastructures, and others including SWIFT are experimenting with digital assets – particularly CBDCs and tokenized assets.”

Why? Well, SWIFT say that it is to uncover new opportunities to increase efficiency, reduce costs, encourage financial inclusion and continue to bring more value to their communities. This not a unique perspective. It is why the forward-thinking financial institutions are looking at: Not because of ideology, but because of money.

One thing that the advent of institutional DeFi will require is digital identity infrastructure because of the need for KYC etc. in legitimate markets. This has already started to happen here and there (eg, in Aave AAVE Arc) but we need a scale identity infrastructure if we are going to connect DeFi with the “real world”, so to speak.

I had the good fortune to have Tyrone on my panel on digital identity at Money20/20 in Amsterdam last month. He’s thoughtful guy and I take his views very seriously. His view is that the way forward here is to use digital identity building blocks such as W3C verifiable credentials (VCs). I have to say that I agree completely with his view VCs are the key to scale solutions and that “since verifiable credentials are not held on-chain, you don’t have the same overhead involved with writing this kind of information to blockchain, paying for gas fees, etc.”

Indeed. And they have another important benefit: Privacy.

Transparency is one of the key reasons that we should all want to see a renewed and reinvented financial sector. Look at some of the recent problems in the world of finance, such as the collapse of Wirecard. Corporate accounts included assets that simply did not exist. Since auditors and the regulators and the board were unable to prevent criminality on a grand scale here, it is reasonable to ask whether technology might be able to do better job. Well, I think the answer is yes, and I think tokenization is part of consistent vision of just how it might do so: if I claim to own one-thousandth of the Mona Lisa it is easy for you to check on the digital asset platform to see that the token representing one-thousandth of the Mona Lisa is in my wallet. You don’t have to rely on auditors or other middlemen.

As is evident from the current crypto cryogenic polar winter vortex or whatever it is called now, DeFi has some significant advantages. Arthur Hayes notes accurately that DeFi protocols control some colossal loan books with the lending standards, counterparty addresses and liquidation levels completely transparent. Observers can evaluate the health of these books continuously. Depositors can process all relevant information about the health of the various protocols before they commit their funds. And when the value of collateral falls, it is automatically liquidated so that there are no bad debts.

Transparency, however, does not mean that everything should be visible to everyone all of the time. The Wharton School published a paper last year on “DeFi Beyond The Hype” which noted that there may well be some tension between the increased auditability and transparency of shared ledger records and the privacy of stakeholders. It’s one thing for me to be able to examine you loan book on a shared ledger somewhere to determine that you are solvent, quite another for me to know who your counterparties are.

Business can’t work like that. Secrecy is vital to commerce. Not only is it important for businesses to protect the privacy of their customers and suppliers, they do not want to reveal their strategies to competitors. Anonymity does not work for markets, but complete transparency does not work for participants. What is needed is not the anonymity of the permission less blockchain but privacy in a well-regulated environment, and this where verifiable credentials deliver. In the right trust framework it is easy to present credential that says that I am a US citizen, over 18 and have a brokerage account (for example) without telling the world who I am.

(Should I get up to no good, however, the providers of these important attentions will of course hand over my real identity to the force of law and order.)

Thus we come to a nexus of DeFi, verifiable credentials and privacy-enhancing governance structures that is the potential site of a sort of Big Bang in the world of finance: The creation of a new financial services universe.

This is why, when it comes down to it, I agree with Richard Turrin who wrote that there is an immediate need to “fix the rampant corruption, fix the DeFi protocols that encourage leverage, fix the scams, and fix the culture of greed.” and Lisa Wade who says “Once it becomes regulated, it will be essential portfolio management knowledge to bring in these new asset classes into the portfolio.”

They are surely right to say that DeFi will change financial services for the better.

Author

Administraroot