Bitcoin BTC and cryptocurrencies have been hard hit this year by a brutal crash that’s sent the price of major cryptocurrencies into a tailspin.

Subscribe now to Forbes’ CryptoAsset & Blockchain Advisor and successfully navigate the volatile bitcoin and crypto market

The bitcoin price has crashed under the closely-watched $20,000 per bitcoin level, down more than 70% from its all-time high set late last year. Ethereum and other top ten cryptocurrencies BNB BNB , XRP XRP , solana, cardano, and dogecoin have also seen similar declines—with some predicting more pain could be on the way.

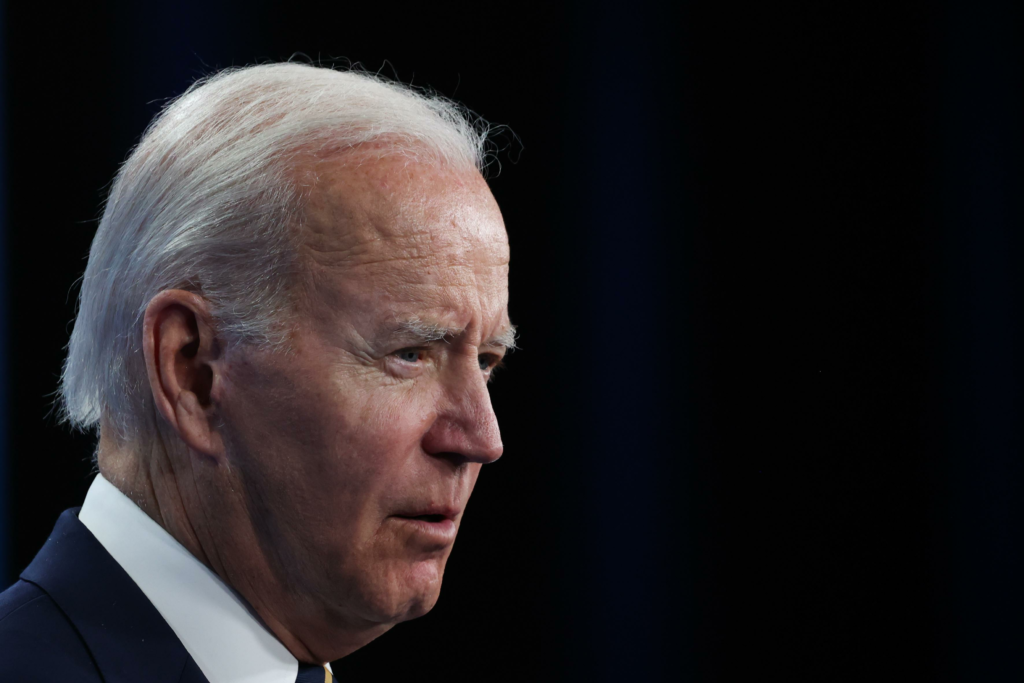

Now, after Wall Street giant Deutsche Bank issued a surprise bitcoin price prediction this week, reports have emerged the Biden administration could pass crypto legislation governing so-called stablecoins such as the recently collapsed terraUSD and its support coin luna as soon as this year.

Want to stay ahead of the market and understand the latest crypto news? Sign up now for the free CryptoCodex—A daily newsletter for traders, investors and the crypto-curious

U.S. president Joe Biden could sign stablecoin legislation into law later this year, according to … [+]

This week, the President’s Working Group on Financial Markets, a group that includes several financial regulators, met to discuss stablecoin legislation, with an anonymous official telling Coindesk the legislative package could become law by the end of the year. The source said it would define stablecoins for the purposes of U.S. regulation and address how they’re used.

The stablecoin market has ballooned in recent years with the largest stablecoin tether now boasting a market capitalization of almost $70 billion. Stablecoins— cryptocurrencies that are price pegged to traditional currencies such as the U.S. dollar—are used to facilitate payments and ease people’s entry to certain cryptocurrency exchanges that don’t support direct deposits.

This year, the collapse of the so-called algorithmic stablecoin terraUSD that used a cryptocurrency called luna to maintain its U.S. dollar peg sent shockwaves through the crypto market and galvanized regulators to better police the technology and protect users.

Sign up now for CryptoCodex—A free, daily newsletter for the crypto-curious

The bitcoin price has crashed to under $20,000 per bitcoin in recent weeks, sparking a broader … [+]

TerraUSD and luna’s collapse shook the confidence of many crypto investors that have been further rocked by many crypto lending companies suspending withdrawals in recent weeks in the face of spiraling bitcoin, ethereum and crypto prices.

In Europe, lawmakers this week secured an agreement on tough new rules designed to ensure stablecoins maintain ample reserves to meet redemption requests in the event of mass withdrawals.

E.U. lawmaker Stefan Berger said the rules would “put order in the Wild West of crypto assets,” adding the rules “will provide legal certainty for crypto-asset issuers, guarantee equal rights for service providers and ensure high standards for consumers and investors.”

Author

Administraroot