Bitcoin BTC and cryptocurrencies have been rocked by a huge $2 trillion crash this year—though it could reveal the future “Amazons and eBays.”

Subscribe now to Forbes’ CryptoAsset & Blockchain Advisor and successfully navigate the volatile bitcoin and crypto market

The bitcoin price dropped under the closely-watched $20,000 per bitcoin level this week before rebounding slightly, however, some fear it has further to fall.

Now, after Tesla billionaire Elon Musk revealed a surprise crypto bet, a Chinese Communist Party (CCP) newspaper has warned investors should be prepared for the bitcoin price to hit zero.

Want to stay ahead of the market and understand the latest crypto news? Sign up now for the free CryptoCodex—A daily newsletter for traders, investors and the crypto-curious

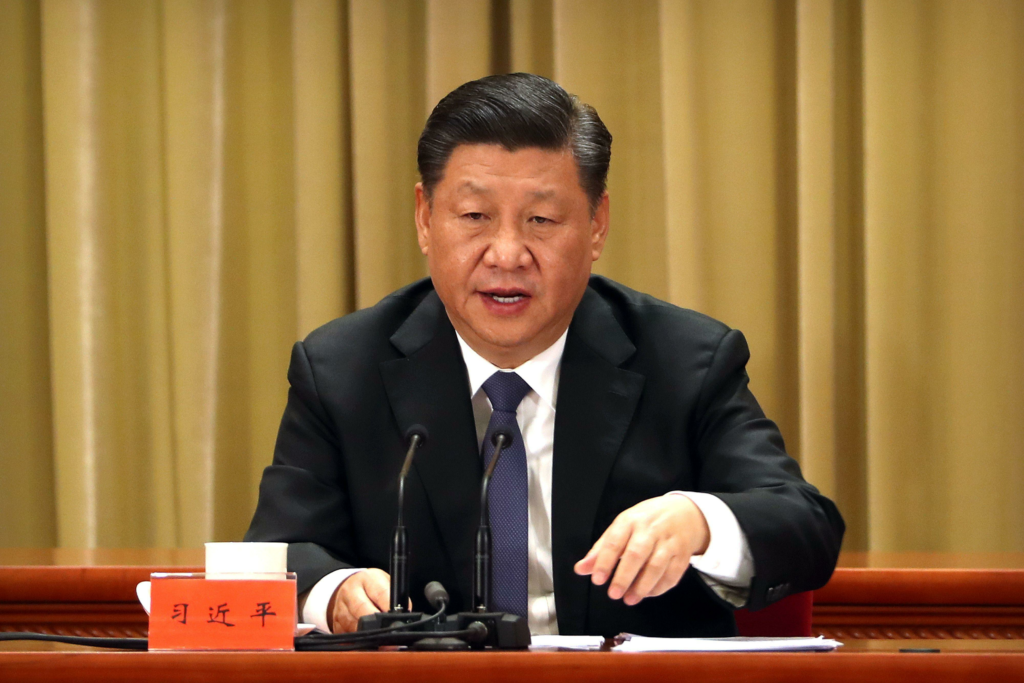

China president Xi Jinping has previously said the country should “seize the opportunity” offered by … [+]

“Bitcoin is nothing more than a string of digital codes, and its returns mainly come from buying low and selling high,” the Economic Daily newspaper wrote, it was reported by the South China Morning Post. “In the future, once investors’ confidence collapses or when sovereign countries declare bitcoin illegal, it will return to its original value, which is utterly worthless.”

Last year, a comprehensive crackdown on bitcoin and cryptocurrencies in China sent the bitcoin price into free fall after the CCP ordered all bitcoin miners—who use powerful computers to secure the bitcoin network and validate transactions in return for fresh bitcoins—to shut down.

In September, China’s central bank declared all bitcoin and cryptocurrency transactions illegal, promising to take action against anyone facilitating crypto transactions and warning offshore exchanges away from China.

Sign up now for CryptoCodex—A free, daily newsletter for the crypto-curious

The bitcoin price has been bouncing around the closely-watched $20,000 per bitcoin level after … [+]

The bitcoin price went on to rebound as miners set up shop in the U.S. and other countries around the world only to begin to slide again late last year as the Federal Reserve said it would begin hiking interest rates in an attempt to drive down surging inflation.

The U.S. and other governments around the world have stepped up efforts to regulate and rein in the volatile bitcoin and crypto market in recent months—with the Economic Daily blaming a lack of regulation for creating a market “full of manipulation and pseudo-technology concepts.”

In November last year, Berkshire vice chairman and Warren Buffett’s right-hand man Charlie Munger praised China president Xi Jinping for banning bitcoin.

“He was smart enough to ban bitcoin in China, and with all our presumed advantages of civilization, we are a lot dumber than the communist leader in China,” Munger said.

Author

Administraroot