Denys Serhiichuk

U.Today

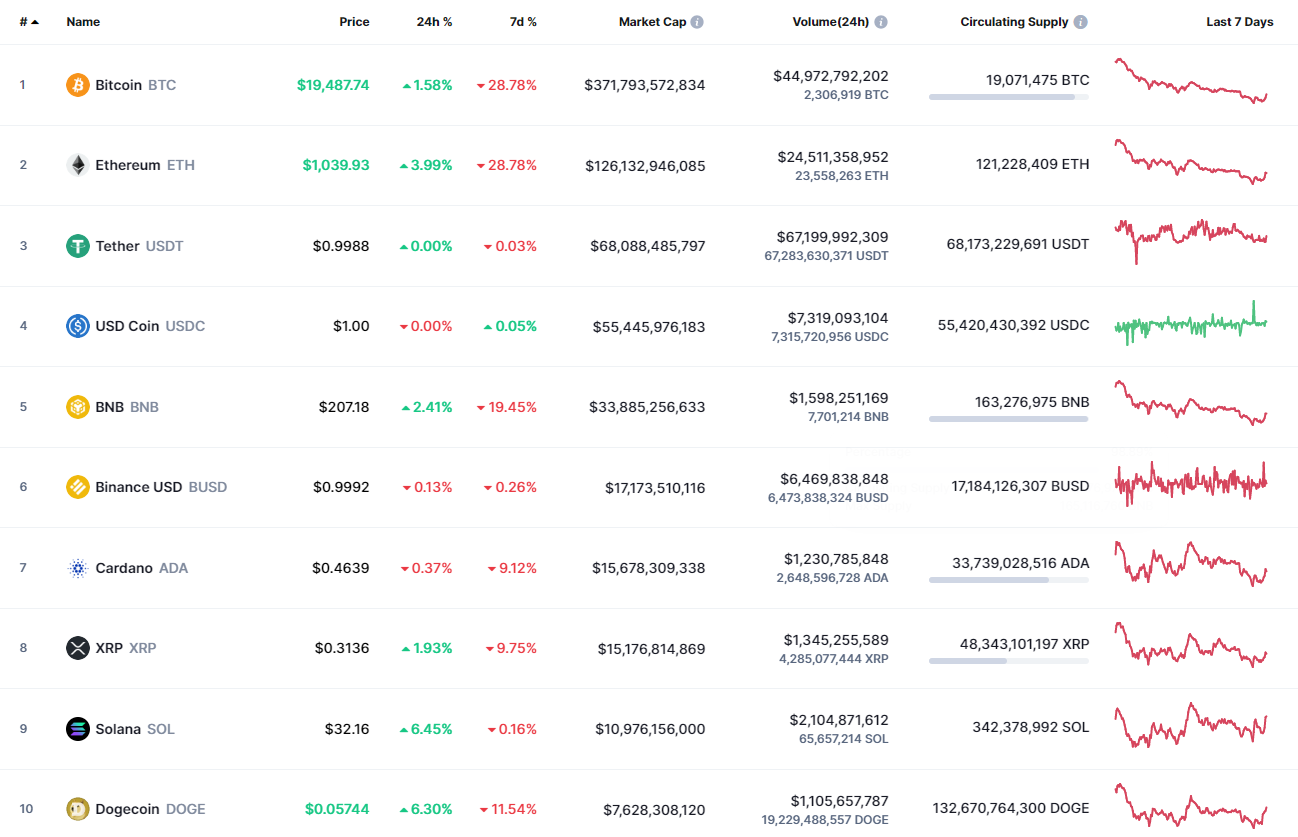

The cryptocurrency market is slightly recovering after a prolonged drop, and most of the coins are in the green zone.

Top coins by CoinMarketCap

Despite today's rise, the rate of Bitcoin (BTC) has gone down by 28.80% over the last seven days.

BTC/USD chart by TradingView

On the weekly chart, Bitcoin (BTC) is about to make a false breakout of the $19,490 mark. At the moment, one should pay close attention to the daily closure. If buyers can keep the initiative and the price holds near the $19,500 mark, there are chances to see a further correction to the $20,000 zone next week.

Bitcoin is trading at $19,468 at press time.

Ethereum (ETH) has risen more than Bitcoin (BTC) since yesterday, as the price change has accounted for 4.44%.

ETH/USD chart by TradingView

Ethereum (ETH) has also bounced off the $900 mark against the increased volume. Thus, the rate has come back above the crucial $1,000 mark. If the situation does not change by the end of the day, one can expect the continued growth to the $1,150-$1,200 area within the next few days.

Ethereum is trading at $1,033 at press time.

XRP is falling the least in terms of the weekly analysis as the drop has constituted 9.80%.

XRP/USD chart by TradingView

Despite this, the situation is less clear compared to Ethereum (ETH) and Bitcoin (BTC). Currenly, bulls need to hold the initiative they have gained, keeping the rate above the $0.30 level. If they manage to do that, a rise is possible to $0.35 shortly.

XRP is trading at $0.3132 at press time.

Any financial and market information given on U.Today is written for informational purposes only. Conduct your own research by contacting financial experts before making any investment decisions.

Bitcoin price has shown incredible elasticity after it snapped back after dipping below a stable support level. This quick but small recovery has caused some altcoins – not Ethereum and Ripple – to bounce massively. Synthetic (SNX) price has rallied 121% over the last day or so.

Cardano price has been hovering above a stable but intermediate support level since May 13. This range tightening suggests that a breakout move is around the corner. While the technicals remain range bound, there seems to be tensions around the Vasil hard fork and rumors that it could be delayed.

In the latest twist-and-turn of the SEC vs. Ripple case, the US Securities and Exchange Commission has hit back at Ripple, objecting to the payment giants attempts to redact certain information it deems ‘sensitive and confidential’.

Polygon (MATIC) price is set to fall to a historically important low projected at $0.269. In the aftermath of the seismic shock which sent Bitcoin tanking massively over the weekend, MATIC price could be next to suffer from the spillover effect.

Bitcoin price has gone through turbulent times over the last few months. From reaching a new all-time high to hitting yearly lows and revisiting levels since 2020, the crypto markets have been extremely volatile.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Author

Administraroot