Virtual implosion

The virtual investment promises were compelling: High return, no inflation risk, complete safety, absolute privacy, and immediately transferable to anywhere. Moreover, there was no interference – no regulations, taxes, fees, red tape. Clearly, this virtual investment would be the top choice in the modern age. Nothing could go wrong with the latest innovation: Cryptocurrency.

It turns out there was a “hidden” weakness. New buyers were required to reward previous buyers, thereby attracting more new buyers – just like in Charles Ponzi’s scheme (and the countless others that occurred before and after his). Should sellers outnumber buyers, the cycle reverses.

It appears that day has come. The heavy hitters who are less enamored with being part of a modern movement appear to be selling. Those vacating “investors” likely include a mix of privacy seekers like dictators, oligarchs, organized crime figures, and ransomware attackers.

Making matters worse are the leveraged funds of funds that compound returns only if prices rise. Otherwise, they go bust as investors bail.

Finally, there are the offshoots. Their implosions give the same message as dying canaries in a mine: “Get out!” NFTs (non-fungible tokens) are a good example, but nothing says the party is over like stablecoins.

From Investopedia.com: (Underlining is mine)

“Stablecoins are cryptocurrencies the value of which is pegged, or tied, to that of another currency, commodity or financial instrument. Stablecoins aim to provide an alternative to the high volatility of the most popular cryptocurrencies including Bitcoin, which has made such investments less suitable for wide use in transactions.”

What? Cryptocurrencies aren’t the best? Well, remember that when people say “volatility,” they mean risk, and that means losses. Importantly, the short-lived popularity for the U.S. dollar stablecoins was based on being linked to the U.S. Government’s currency – the very thing cryptocurrency supporters viewed as an inferior and outdated mode of payment and an unreliable store of value.

People flocked to cryptocurrencies (CCs) to get in on the latest financial craze – and make big bucks (sorry – big CC gains). But then they learned that the value of CCs (as measured by the U.S. Government’s currency!) could decline. The cure? Tie the CC to the US$. Say, what? Why not just toss the CC and use the US$? Well, when those misnamed stablecoins dropped in US$ value, the answer was clear: “Get out!”

And so here we are, as The Wall Street Journal‘s front page article just reported: “Crypto Meltdown Worsens…”

Following Bitcoin’s success were new virtual currencies, with each following a different valuation path. “Get in on the ground floor” became the strategy for making the big bucks (oops, again – CCs). The growth then took off, creating a roulette wheel of virtual currencies to bet on. The disparate returns highlighted the fact that none of these CCs was “best.” At that point the cryptocurrency movement had devolved into a guessing game of where buyers would flock next. (And then when to get out before the rout).

Many financial innovations and theories have been created over the years. However, most are gone now, having crashed into the reality wall of common sense when sellers began to outnumber buyers.

Will cryptocurrencies disappear? Maybe, sometime. However, there are a lot of people and organizations fiddling around with blockchain strategies. Add to that the desire to make big bucks (i.e., real money), and there likely will be many attempts to create new, improved virtual-somethings that produce heady returns – for the creators, at least.

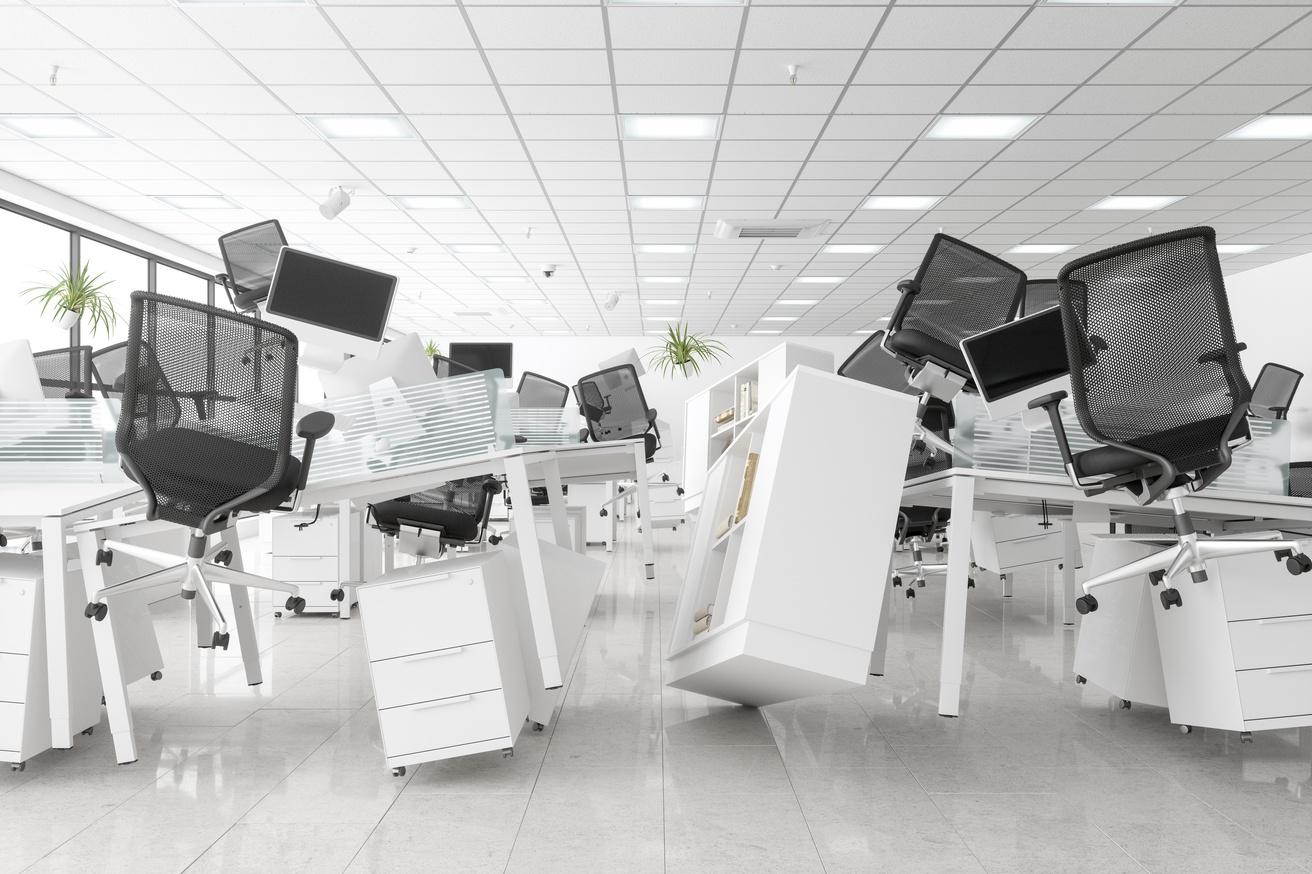

Financial innovators hard at work

Author

Administraroot