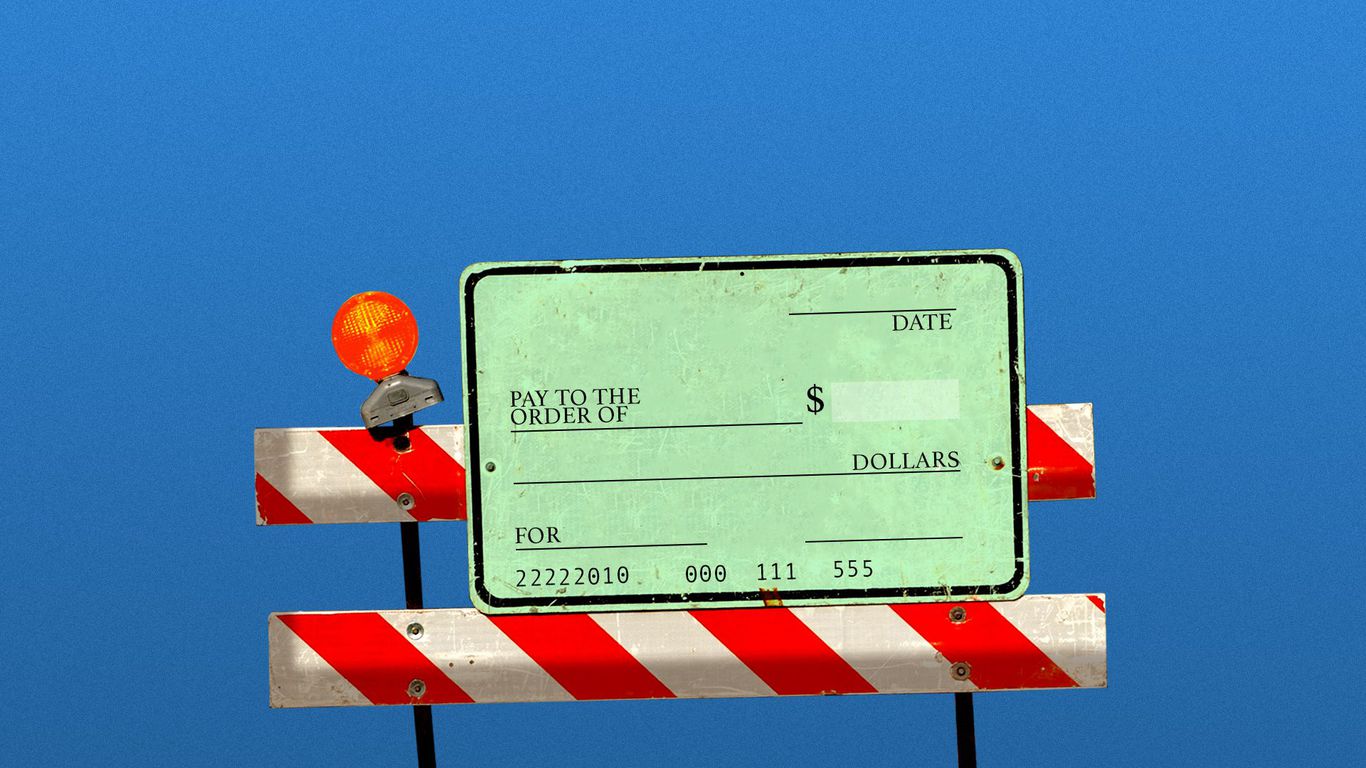

There appears to be one route to public markets that will slow down crypto: merging with SPACs or special purpose acquisition companies.

Why it matters: The extra time being seen in regulatory reviews for crypto SPAC deals coincides with heightened regulatory scrutiny for those go-public vehicles, as well as for the crypto sector at large.

By the numbers: A review of closed SPAC deals from April 2021 to April 2022 shows that the three in the crypto sector took more than 7 months to close, compared to an overall average of 5.6 months for all SPAC deals during that period.

Driving the news: Bullish on Tuesday submitted its sixth amended filing since its November 1 proxy, which still contains no record or vote date. The appearance of those dates in filings signals that the deal is getting closer to the finish line.

Separately, media company Forbes just scrapped its plans to go public with a SPAC. Recall that the deal came with a $200 million investment from crypto exchange Binance.

Details: Bullish is a subsidiary Block.one, the blockchain company behind the infamous EOS ICO and protocol.

Flashback: When Bullish announced its SPAC deal with Far Peak Acquisition Corp. in July 2021, it was just a blueprint of an exchange with a star-studded cast of Wall Street's who's who.

Our thought bubble: The deals that make it through the SEC might say something about the regulator's level of comfort with a specific type of crypto company. Example, the controversial payment-for-order-flow practice under review.

Author

Administraroot