Get the best experience and stay connected to your community with our Spectrum News app. Learn More

Continue in Browser

Get hyperlocal forecasts, radar and weather alerts.

Please enter a valid zipcode.

Save

Earlier this month, those who were invested in the world of cryptocurrency watched online as the Terra ecosystem spiraled into nothing.

What You Need To Know

Cryptocurrency Terra crashed into practically nothing earlier this month

Terra is split into UST and LUNA, which are made to stabilize each other

Millions of investors and developers lost money in the downfall of Terra

The crypto industry lost about $200 billion in one day, making it the biggest crypto crash in history

Anthony Rosa, a software engineer who owns a security auditing company called Moultrie Audits, watched it happen.

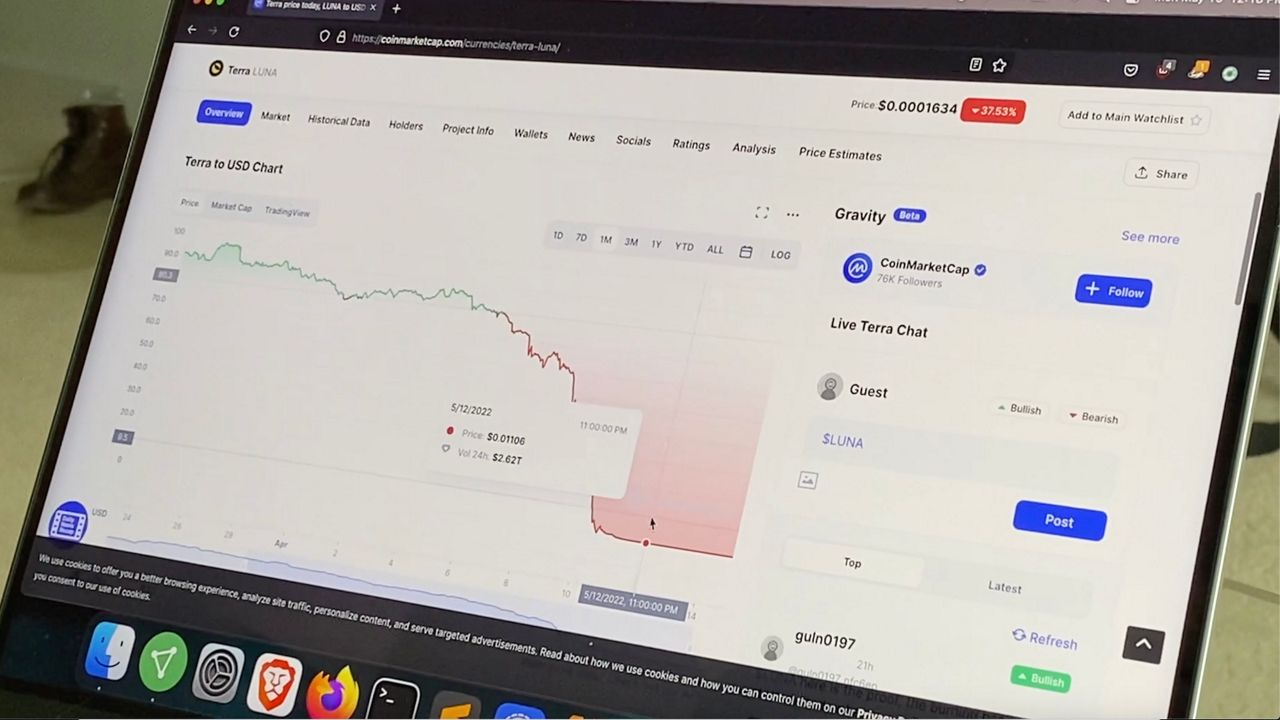

“It was essentially hovering around $100 a bit over a month ago,” Rosa said. “It was around $85 before it started a down-only plummet in a matter of a couple days to essentially zero. And now it’s at 0.001634, so if you put a million dollars in, you would not have much money left. Maybe a dollar or a few pennies.”

Rosa said the crash was predicted by a lot of people.

The Terra ecosystem is split into two parts: Terra USD — known as UST — and Terra LUNA.

UST is a stable coin, so it’s supposed to have a one-to-one ratio with the dollar and not supposed to go up and down in price.

LUNA was made to stabilize UST. That means if you have equal amounts of UST and LUNA, but you want more UST, then you burn LUNA to rid it from circulation and get UST instead.

If you want more LUNA, then you can burn UST and get LUNA tokens in exchange.

The problem occurred when someone took more than a billion dollars of UST out of the the Terra ecosystem without exchanging it for LUNA.

Terra tried to keep up by making more and more LUNA, but that made it’s value decrease, ultimately resulting in a death spiral.

“It doesn’t make a difference if it was maliciously intended or not,” Rosa said. “Because if that attack could occur, then it’s going to at some point or if that trade could occur it was going to at some point. So the way that their algorithmic stable coin was designed does not work.”

So how does this affect investors?

“Well, I just lost all my money,” Rosa said. “I lost millions of dollars in terms of the company’s value. And personal money, I lost most of it. Day-to-day life, nothing’s changed.”

Rosa says the crypto industry lost about $200 billion in one day — making it the biggest crypto crash in history. Millions of people lost money, and some of them lost everything they owned.

“It’s not like anything was hidden,” Rosa said. “Everybody was aware of what the risks were in this system. And we took the risk, and we got obliterated. They got obliterated.”

But Rosa says he’s not invested in the crypto industry for the money. His goal is to help build up a system that gives power to the people, instead of the government. Now, he’s ready to rebuild his company and move forward.

“You have to make decisions that an average person doesn’t make if you don’t want to live the life of an average person,” Rosa said. “So there is extreme risk for doing things like this. But what do you value? Do you value having stability in life and trying to have a 401(k) and get to a million dollars by the time you’re 60? Or are you willing to risk poverty in the hopes that you’ll become a millionaire in your twenties and move on?”

Rosa says in the long run, it’s a good thing when markets go up, collapse and build back. It makes the system even stronger.

“I understand that it’s brutal to lose a lot of money,” Rosa said. “But at the end of the day, you need to take personal responsibility for your finances and your decisions in life, dust off the dirt, get back up and move forward.”

Rosa says a lot of these cryptocurrency systems are based on trust. At this point, he doesn’t think Terra will be able to build itself back up because people lost trust in the system.

The rest of the crypto market took a hit because of all this as well. Although many currencies are at a low, Rosa thinks most of them will return to normal in the coming months.

Author

Administraroot