Published

on

By

While the price of non-fungible tokens (NFTs) representing digital art has dropped precipitously back to earth after skyrocketing last year, a panel of experts believes the future is still bright for the innovative technology.

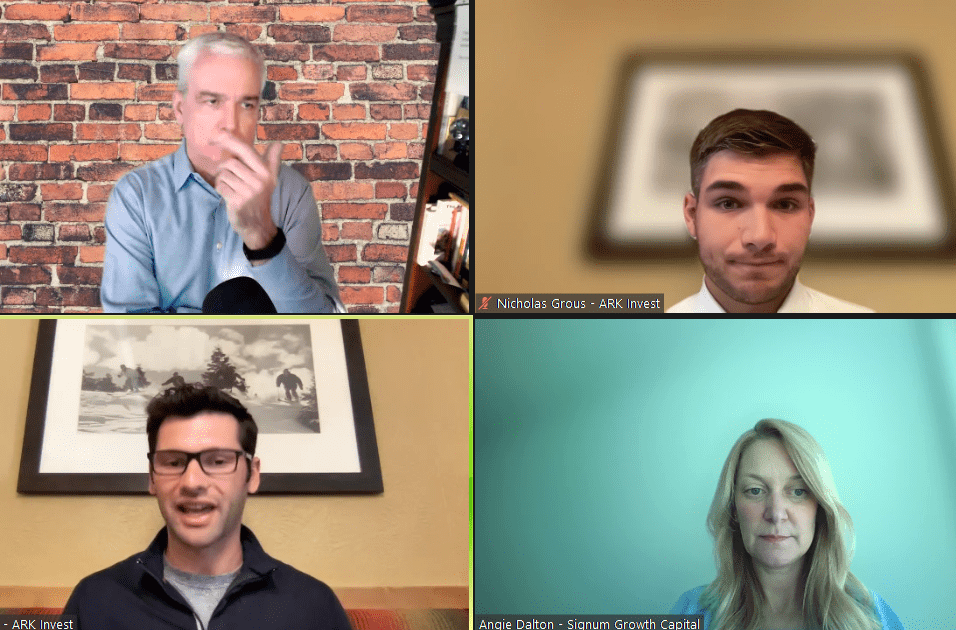

Ken Evans, managing director for the Tampa Bay Innovation Center, moderated a virtual TECH Talk Tuesday on what the future holds for NFTs. Joining Evans on the panel was Angela Dalton, founder and CEO of Brooklyn-based Signum Growth Capital, and Nicholas Grous and Frank Downing, analysts for St. Petersburg-based ARK Invest.

Evans began the discussion by asking when the panel believes they will see widespread adoption of NFT technology among enterprise corporations. Downing said he agrees with information technology research and consultancy company Gartner’s recent assertation that inflated expectations of NFTs have reached a peak.

“There’s been a broad crypto bull market for the past two years, and we’ve seen a lot of innovation and a lot of investment and a lot of ideas, and we need a lot of follow-through on those,” said Downing. “So, there’s a lot of attention on the space, and that’s really good, and I think there’s going to be a lot of building that happens.

“But there’s also a lot of froth out there in the market.”

Downing compared the current NFT market to the initial coin offering boom and bust of 2017-18. He said startups realized launching a token was a successful method for fundraising, and money flowed into the space before adequate product development.

While there are some initial use-cases for NFTs, such as with digital art and gaming, he said the industry is learning as it goes without a playbook to follow.

“I think as the broader markets have been selling off crypto, especially in the NFT space, we’ll see some consolidation, and some of that froth will die out,” said Downing. “It’s hard to put an exact time frame on it, but in the two to three-year time period, you’ll see … these big ideas that are being talked about now come to fruition.”

Grous called NFTs an interesting mix of investment and consumption not typically seen in the digital realm. The technology provides proof of digital ownership, and people have made – and lost – significant amounts of money using it as an investment tool.

In a May 11 article, CNET noted how the highly-publicized Bored Ape Yacht Club NFT collection lost roughly half its value since April. However, its digital art is still selling for hundreds of thousands of dollars, and streaming giant Netflix’s shares also halved over the same period. As of press time, shares of Amazon are down 25% over the last month.

When it comes to long-term utility, Grous called digital art just the tip of the NFT iceberg. He compared the technology to the initial launch of Apple’s App Store, which “caused a massive shift” in the way people consumed and interacted online.

“If you had asked someone at the time what the App Store is going to enable,” said Grous. “I don’t think anyone could have told you there would have been Uber and Lyft and all these multibillion-dollar companies that would arise because of just this simple shift from desktop to mobile. I think that’s where we are in the NFT space, where we’ve just basically launched this ‘App Store,’ this ability to create utility around digital ownership.”

“In 5-10 years, we’re going to have this massive boom in applications and utility that are going to arise from this simple idea around digital ownership.”

Dalton said that while she thinks the speculation is a hype cycle, the technology is just beginning to prove itself through digital art. She thinks of the metaverse as a neighborhood, with games like Fortnight serving as streets that the public will walk down to catch a movie or interact with friends. In a virtual community, added Dalton, everything around you looks like art.

Dalton also used established technology as a reference point. She explained that in Web2, the current iteration of the internet, invisible protocols allow people to move freely between one website to another. In Web3, which developers are in the process of building, she said communities are solving specific problems utilizing blockchains, but interoperability between blockchains is still in its infancy.

“Yes, it (NFTs) got really hyped up, but it’s limited by the fact that we don’t even have interoperability yet in these NFT platforms,” said Dalton. “We’ve seen some really positive indications that we’re moving that forward.

“So, I think the next wave will be much more interesting to the hundreds of millions and not just a few people who are speculating.”

To reach mass-market adoption, Grous said transacting with digital tokens must match the simplicity of e-commerce. He said purchases must process within fractions of a second, without the “scariness” involved in owning digital wallet keys and the potential loss of assets.

He added that consumers would appreciate developers recreating some of the Web2 infrastructures into the decentralized Web3 platform due to the familiarity. Grous noted that is a common debate at ARK during brainstorming sessions, and he believes more centralization will lead to widespread adoption of the emerging technologies.

“That’s something we need to be very careful with over time and building because with centralization comes convenience, but also points of failure,” said Grous. “So it’s a double-edged sword in that way.”

Your email address will not be published.

By posting a comment, I have read, understand and agree to the Posting Guidelines.

document.getElementById( “ak_js_1” ).setAttribute( “value”, ( new Date() ).getTime() );

Get the latest right to your phone

Transit agency to link downtown St. Pete to Tampa airport

Judge dismisses Pinellas election lawsuit, Seel to retire

The Catalyst interview: Actor Patrick Wilson

The Catalyst honors its name by aggregating & curating the sparks that propel the St Pete engine. It is a modern news platform, powered by community sourced content and augmented with directed coverage. Bring your news, your perspective and your spark to the St Pete Catalyst and take your seat at the table.

Email us: spark@stpetecatalyst.com

Privacy Policy | Copyright © 2020 The St Petersburg Group

Enter the details of the person you want to share this article with.