San Francisco and Silicon Valley are leading the call for new transparency and stable assets

(Olivia Wise/The Examiner)

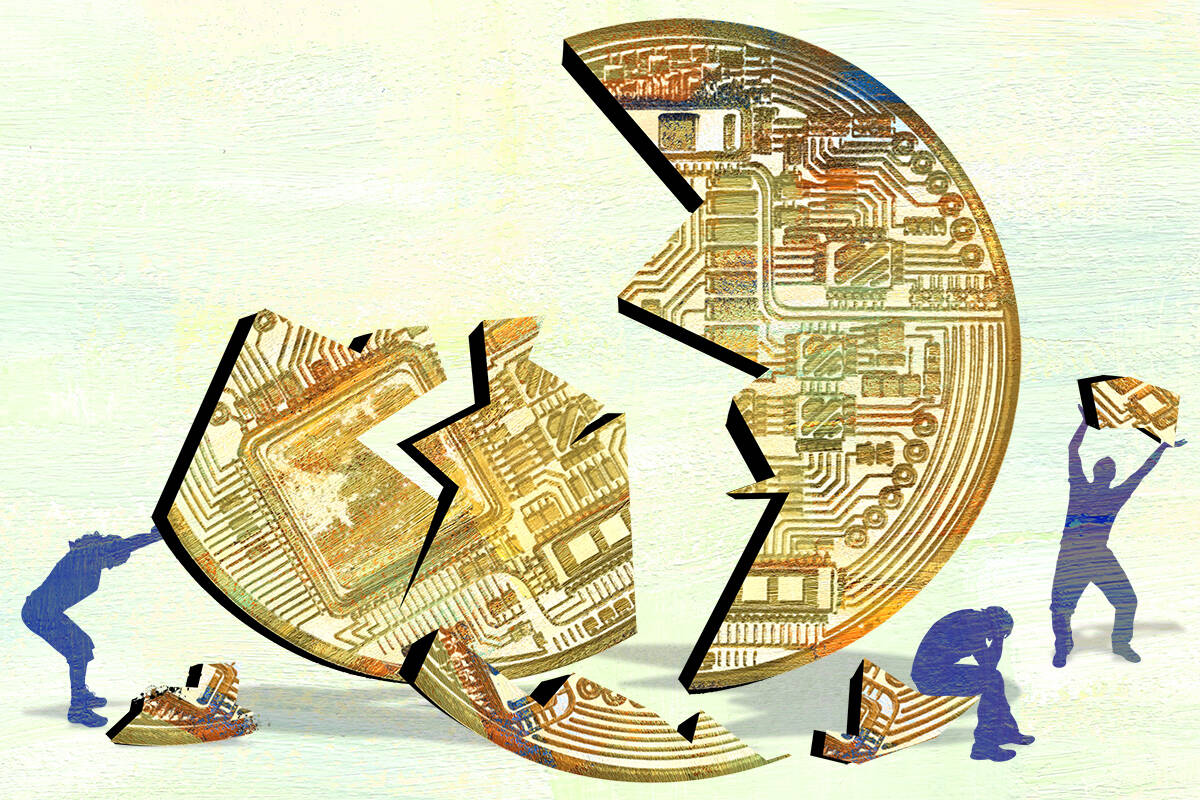

Confidence in the cryptocurrency industry has been fractured more than ever during the current crypto crash, in which investors have lost around $800 billion in fewer than two months. The industry is trying to piece its reputation back together with the glue of “transparency,” a buzzword that is currently everywhere.

The CEO of San Francisco crypto company Ripple is calling for transparency in Davos, Switzerland, where the World Economic Forum is debating the future of digital assets. The Stellar Development Foundation, a San Francisco nonprofit with a long history of addressing challenging issues in crypto, is also calling for transparency. So is a company with a new cryptocurrency coin and old ties to the Bay Area.

What are they trying to clear up?

Legislators and consumer advocates have warned for years that the industry does not warn consumers of the risks of quickly losing large investments or encountering rampant fraud schemes, even as the buzzy assets are hyped in Super Bowl ads and other high-profile promotions, some in the Bay Area.

In January, Golden State Warriors star Klay Thompson tweeted he was “excited to take part of my paycheck in bitcoin thanks to Cash App! I’m with bitcoin because I believe it’s the future of money.” The tweet was a promotion for the banking app Cash App in which Thompson and fellow Warriors star Andre Iguodala gave out $1 million in bitcoin.

But giving away bitcoin on Twitter may be over, experts say.

In the current crash, a key part of the industry broke, triggering huge losses. Stablecoins were assumed to be crypto’s safe bet because their value is supposed to be aligned with real-world currency. They don’t provide the explosive investment potential of other cryptocurrency, but provide a solid medium of exchange for many virtual needs, like long-distance money transfers to people without bank accountants, routine financial transactions, or trading goods and services online. They were supposed to be inviolable.

But Do Kwon, a “crypto bro” with a severe case of hubris, oversaw the plummet of the stablecoins terra and luna, which were not backed by real-world assets, but tied to one another via algorithms that were supposed to address market fluctuations.

Kwon, a Stanford grad, once dismissed economist Fraces Coppola on Twitter by declaring, “I don’t debate the poor on Twitter, and sorry I don’t have any change on me for her at the moment.”

He should have listened.

Luna’s price fell from $97 on April 25 to $.00016 now. That disaster only made up $40 billion of the recent losses — so 5%. But the impact was seismic. The industry told the world it could never happen with stablecoins.

“An event as significant as terra and luna is a really big challenge. We know that it sets us back,” says Denelle Dixon, CEO of the Stellar Development Foundation. A lawyer for Yahoo in 2007 when the company faced Congressional scrutiny for mishandling data, Dixon is no stranger to Silicon Valley’s struggles to safeguard new innovation.

“We felt like there was a tremendous amount of momentum in terms of working with governments and traditional companies and bringing them into crypto. But these things set you back,” Dixon says, when it comes to “the brand attached to crypto generally.”

Dixon and others believe transparency about the assets backing up stablecoins is an important first step to rebuilding cryptocurrency.

Denelle Dixon, CEO of Stellar Development Foundation, and others say transparency about assets backing up stablecoin is an important first step to rebuilding cryptocurrency. (Craig Lee/The Examiner)

Transparency for stablecoins is crucial to “make sure the people participating feel, buy and have access to whatever financial information they need to feel comfortable that it is in fact dollar-backed,” Brad Garlinghouse, CEO of Ripple, told Fox Business on May 24. Ripple is a San Francisco company that helps financial institutions with cryptocurrency transactions.

Garlinghouse, whose company has had its own struggles with the Securities Exchange Commission, spoke from the World Economic Forum, where crypto was a key topic. The head of the International Monetary Fund begged investors not to abandon crypto while noting stablecoins that aren’t fully backed up run the risk of “blowing up in your face.” Christine Lagarde, the president of the European Central Bank, echoed that thought, saying, “Coin issuers should have to back up their coins with as many dollars as they have coins. That needs to be checked, supervised, regulated,” according to Fortune.

Regulation is coming, including legislation addressing stablecoins specifically. The Biden Administration cited stablecoins as a key concern in a Treasury report in November. In early May, California Gov. Gavin Newsom also released an executive order calling for crypto regulation.

Veterans of the federal government who have Bay Area ties are lining up behind a new cryptocurrency they say provides that transparency. They include former U.S. Treasury Secretary Rosie Rios, who was previously an Oakland economic development official and consultant to San Francisco. Rios says Silicon Valley must help rebuild trust in the industry.

“For anyone investing in crypto, it’s important to consider its utility and the role that your particular investment is playing both in Silicon Valley and beyond,” Rios says. “If California wants to continue to be the leader in technology and innovation, we should find ways to encourage crypto’s functionality and role in the global economy.”

Rios believes that must happen with stablecoins that are actually backed by real-world assets rather than coins “just trading as a floating asset.”

Rios is a director at Unicorn Hunters, the company building unicoin, a cryptocurrency that will be backed by an investment fund, so holders of the coin could receive dividends from the investments.

Moe Vela, another director of the company, was director of administration for President Obama, where he worked closely with Biden. Vela also worked with Vice President Al Gore in the Clinton White House.

“The lack of transparency has caused an unparalleled and incomparable volatility in the investment process,” Vela says. “I cannot stress how important it is that there has to be a distinction between non-asset backed crypto, the traditional crypto that’s collapsing now, and asset-backed crypto.”

Regulation of stablecoins and other assets may change crypto in the Bay Area and around the world. Promotions urging the public to plunge in may be over. Transparency and stablecoin’s time may have come. Just months ago, celebrities were urging consumers to plunge in. Some of those promotions have not aged well.

If Thompson, the Warriors star, had taken his entire paycheck for the season in bitcoin during his Twitter promotion at the beginning of the year, he would have lost $19 million, or about half his salary.

Asked for a comment, the Warriors declined, noting “As you know, markets can go up and can go down.”

jelder@sfexaminer.com

High employee turnover often worsens living conditions in San Francisco’s residential hotels. As a result, extremely low-income residents can get…

Conservation techniques alone are not going to solve the water crisis, experts say

‘We will not be pushed back into the closet’

Author

Administraroot