Connecting decision makers to a dynamic network of information, people and ideas, Bloomberg quickly and accurately delivers business and financial information, news and insight around the world

Americas+1 212 318 2000

EMEA+44 20 7330 7500

Asia Pacific+65 6212 1000

Connecting decision makers to a dynamic network of information, people and ideas, Bloomberg quickly and accurately delivers business and financial information, news and insight around the world

Americas+1 212 318 2000

EMEA+44 20 7330 7500

Asia Pacific+65 6212 1000

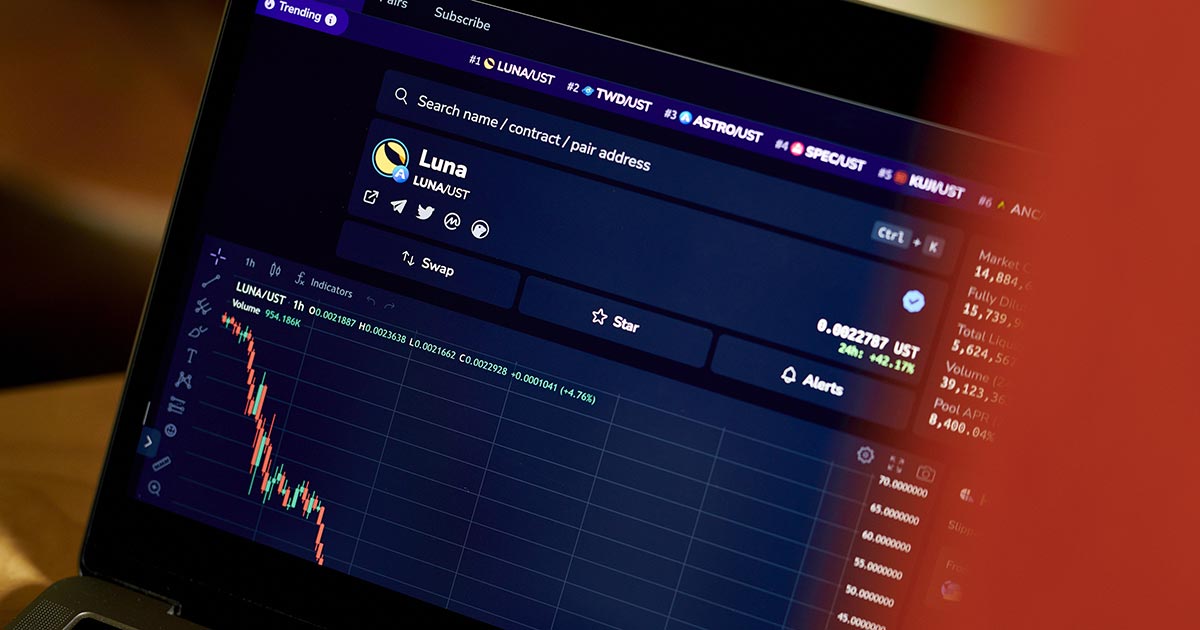

If you put $1 under your mattress, you know you’ll get $1 back when you go looking for it. When you deposit $1 with a bank, you can be pretty sure you’ll get it back even if they do more with it than lock it in a vault, thanks to regulations developed over centuries. A branch of cryptocurrencies called stablecoins has been trying to replicate that kind of dependability in totally new ways. Some have used the equivalent of a digital vault to back up their promises. Others have tried solutions that are far more complex. The biggest of those, TerraUSD, also known as UST, and its sister token Luna have melted down in spectacular fashion, sending their prices to near zero and their market values plunging to a shadow of the combined $60 billion they once commanded. Its plunge has raised concerns that go beyond its narrow slice of the stablecoin world.

1. What’s a stablecoin?

A cryptocurrency designed to hold a steady value, in sharp contrast to the extreme price volatility seen for Bitcoin and other tokens. Stablecoins are meant to be useful, not to make their owners rich by soaring in value. They do that in two ways: by allowing crypto owners to conduct transactions without having to take volatility into account, and by offering them a safe haven for their holdings, protected from wild swings in the crypto market without having to convert their holdings into traditional money. The most popular stablecoin, Tether, can be exchanged for more than 4,000 other cryptocurrencies on centralized exchanges, according to crypto data firm Kaiko, making it one of crypto’s most traded tokens.

2. How do they hold their value?

They’re typically pegged to another currency: both Tether and UST were designed to be pegged to the US dollar. They maintain that peg in one of three ways. Tether and many other of the biggest cryptocurrencies maintain a reserve of cash or cash-equivalent assets whose value in theory matches the total value of the stablecoin in circulation. That is, when a user pays Tether $1 for a token, that money is supposed to be held in Tether’s bank accounts. Others, like MakerDAO’s DAI, maintain a reserve of cryptocurrencies rather than traditional money, but “overcollateralize”—hold reserves larger than the face value of their stablecoins to compensate for their volatility. TerraUSD, however, took the third route, operating as an algorithmic stablecoin.

3. What’s an algorithmic stablecoin?

It’s a currency backed by automated operations meant to maintain a stablecoin’s value by increasing or decreasing its supply. The idea was to create a fully decentralized currency not ultimately backed by a centralized issuer of assets like the US government. Algorithmic stablecoins are designed around the fact that stablecoins, like other cryptocurrencies, operate on blockchains—digital public ledgers operated by a community rather than a bank or government. Blockchains can contain so-called smart contracts—code that operates automatically in specified circumstances. The algorithms can be programmed to automatically create more units of a stablecoin or destroy existing units in response to swings in its supply and demand. When the stablecoin trades above its pegged value, more tokens are created and the price comes down. When the stablecoin trades below the peg, more tokens are taken out of the circulation and the price comes up. A sister token with a volatile price is usually involved.

4. What was TerraUSD’s model?

TerraUSD was linked to a sister token, Luna, whose price was set by the market. Because 1 UST was defined as being equal to $1 worth of Luna, that meant that while the amount of Luna handed over in a swap for UST would vary, a holder of $1 in UST would always get $1 in value back. That created arbitrage incentives for traders that were designed to keep the value of UST at or close to $1.

1 UST is always considered to be equal to $1

UST

(Stablecoin)

Luna

(Floating rate)

$20

When 1 UST is less than $1

UST

(Stablecoin)

Luna

(Floating rate)

$20

When 1 UST is less than $1

UST

(Stablecoin)

Luna

(Floating rate)

$20

When 1 UST is greater than $1

UST

(Stablecoin)

Luna

(Floating rate)

$20

When 1 UST is less than $1

UST

(Stablecoin)

Luna

(Floating rate)

$20

When 1 UST is less than $1

UST

(Stablecoin)

Luna

(Floating rate)

$20

When 1 UST is less than $1

UST

(Stablecoin)

Luna

(Floating rate)

$40

When 1 UST is less than $1

UST

(Stablecoin)

Luna

(Floating rate)

$40

When 1 UST is less than $1

UST

(Stablecoin)

Luna

(Floating rate)

$40

One ● UST can always be exchanged for a floating quantity of ● Luna with a market value of $1. Whenever either of them is exchanged, the currency is taken out of the circulation by the smart contracts programmed to maintain the system.

When the market value of one UST is greater than $1, there is an incentive to trade $1 worth of Luna for one UST, which is worth more than one dollar, making an instant profit. This puts more UST into circulation, driving down ↓ the price of UST.

Vice versa, when the market value of one UST is less than $1 there is an incentive to trade one UST, which now is worth less than $1, for $1 worth of Luna, making an instant profit. This takes some UST out of circulation, driving up ↑ the price of UST.

5. What else was involved?

The primary challenge for all new cryptocurrencies is to create reasons for people to buy them. Demand can be driven by the prospect of huge gains if the token catches on, or can be primed by providing a reward to currency holders. In the case of TerraUSD, the main attraction involved Anchor, a lending project based on Terra blockchain that promised interest rates as high as 20% for UST deposits, an offer that led to UST’s explosive growth. As Terra grew bigger, an organization called Luna Foundation Guard (LFG) was launched by Terra’s main developer, Do Kwon, to accumulate reserves to give UST another kind of backing. Kwon told Bloomberg News in March 2022 that having a third-party asset to meet “short-term” demand in redemption of UST would be “valuable” for Terra’s algorithmic stablecoin system. The forex reserve initially only contained Bitcoin and LFG promised to buy as much as $10 billion worth of Bitcoin. About $100 million worth of Avalanche, another cryptocurrency, was later added to the reserve in April. It was a step that did little to placate Terra’s many critics.

6. What did the critics say?

Some called UST a new form of Ponzi scheme. Others more politely said that Terra’s business model had a vulnerability at its heart: that UST’s peg to Luna without a peg to anything else would only work if people believed that they would keep their value, and that they would only keep their value if more and more people bought them. Since the main attraction was the high returns for depositing UST on Anchor—which in turn was being subsidized by investors in Terra—that didn’t seem like a sustainable enterprise. Between the end of April and the collapse of Luna, Anchor burned nearly $100 million worth of UST in its reserve to keep up with the demand for high yields. To the critics, LFG’s creation of a crypto reserve was a doomed attempt to use some of the Ponzi-like earnings of UST to create a more conventional backing for the currency. If demand for either UST or Luna fell, they said, the value of both could evaporate in what’s known as a “death spiral.”

7. What happened?

A death spiral. It’s not clear what set off the initial slump in demand for UST, though Anchor had dropped its yields from 20% to 18% on May 2. A few days later, a large amount of UST was withdrawn from the decentralized exchange Curve Finance. Kwon said on Twitter that his firm Terraform Labs had withdrawn $150 million UST from Curve to prepare for a new “liquidity pool” that would go live on the exchange, but at roughly the same time, an unknown user exchanged roughly $84 million worth of UST for a currency known as USD Coin through Curve. Those large moves, following on the heels of the interest rate cut, led more UST depositors to withdraw their stablecoins from Anchor, a flood of transactions that knocked UST off of its $1 peg. In the crypto equivalent of a bank run, that led more UST holders to try to get their money out. But since one of the main ways to exit from UST was through Luna, which was already falling in value due to investors’ loss of confidence as well as an overall down market, that only worsened the situation. The UST-Luna exchange mechanism meant that the massive UST withdrawals led to a vast expansion in the supply of Luna, driving down its value even further.

8. What did Terra do?

According to tweets from LFG’s official Twitter account, it spent almost all of its Bitcoin reserves in an attempt to save UST’s peg by different trading strategies including selling Bitcoin for UST. As of May 16, its reserve had dropped from more than 80,000 Bitcoin to just 313. That day, Kwon gave up on saving the stablecoin but proposed preserving the Terra blockchain as a new entity that would only use Luna tokens.

9. What does this mean for stablecoins?

Regulators had already been concerned about stablecoins as a source of risk in the financial system because of their use in leveraged transactions and because of the way they are used to interact with traditional financial institutions. In a report issued May 9, the US Federal Reserve said stablecoins were “vulnerable to runs” and lacked transparency about their assets. US Treasury Secretary Janet Yellen said recently that Terra’s meltdown underscores the urgent need for guardrails and said it would be “highly appropriate” for lawmakers to enact legislation as soon as this year.

The Reference Shelf

- A Bloomberg News profile of Do Kwon, described by his followers the “King of the Lunatics.”

- A Bloomberg News article described the beginning of the end for UST.

- A Bloomberg Opinion column by Matt Levine analyzed the meltdown.

- Two economists at VoxEU analyze algorithmic stablecoins.