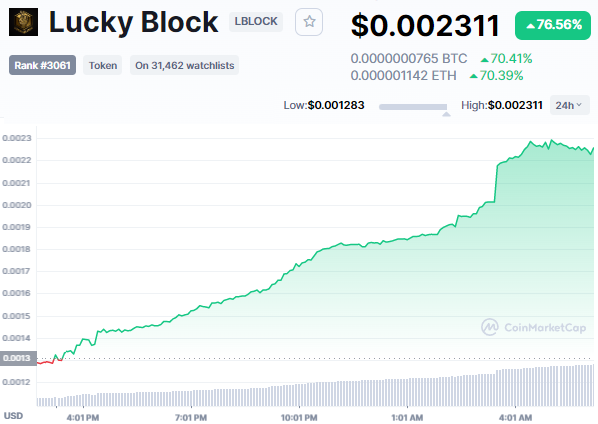

Crypto games platform Lucky Block and its native token LBLOCK are on the biggest crypto gainers list today, with a 75 – 80% percentage gain in the past 24 hours.

Its current 24 hour low was approximately $0.0012 on Pancakeswap and LBank exchange, followed by a move to the upside to the current high of $0.0023 (a 90% intraday move).

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

Lucky Block is expected to demonstrate its use case and utility later this month, launching a decentralized crypto games and competitions platform, including jackpot prizepools.

Holders of the native coin LBLOCK or one of the project’s NFTs receive free tickets to those draws, as an incentive to buy and hold, leading to a large percentage gain in the run-up to the end of May launch.

Nasdaq featured LBLOCK as a bullish ‘high upside bet’ and Yahoo Finance covered its charity drive.

Many altcoins, which act as a beta asset to Bitcoin are reacting well to BTC moving back above $30,000 and closing a daily candle above it.

The current May 20th daily open is over $30,200, resulting in a potential mini ‘altcoin season’ ahead of the weekend when the stock market will also be closed.

Biggest crypto gainers today feed via Coinmarketcap

The Lucky Block (LBLOCK) 24 hour volume has risen to over $1.3 million, one of the biggest percentage gainers today in terms of buying volume.

Some coins on the biggest crypto gainers and losers list can display high percentage gains only as a result of low liquidity on the crypto exchanges they’re listed.

Bitcoin is +3.2% on the day, and Ethereum leading it slightly +3.3% in the green – ETH leading BTC can also indicate a potential alt season.

Among the blue chip crypto gainers Ripple (XRP) is also +4.8% and Dogecoin +2.7% – on May 12th Elon Musk tweeted DOGE has potential as a currency.

Another of the notable biggest crypto gainers today among low cap cryptos is 0x (ZRX) which is +20% on the day. Like LBLOCK it had a strong move to the upside in February 2022 followed by a correction.

LBLOCK was among the biggest percentage gainers in crypto in February with an over 900% move from the $0.001 area to its current all time high over $0.009. It retested those prior support levels earlier in May to put in a bounce.

Many crypto assets are reaching oversold levels as sentiment was low following the Terra (LUNA) crash – overdue for a relief rally and a new macro uptrend. The total crypto market cap has now retraced for six months and ten days following Bitcoin’s $69,000 ATH set November 10th, 2021.

The brief wick to $25,000 on some derivatives exchanges on May 12th – Binance hit $26,700 against USDT – may have been the capitulation candle to mark the bottom before the next crypto bull run.

Some of the biggest stock gainers today have also put in double digit percentage gains, bouncing after yesterday’s crash – including Upwork Inc +12%, and tech stocks such as SoftwareONE + 15%.

With few trading days remaining in the month the ‘sell in May and go away’ effect may be coming to a close for the stock market. Wall Street seeing the worst sell off since 2020 as the Dow Jones dropped 1,100 points yesterday may also have been capitulation before the start of a new bull cycle.

Even if further downside is to come in 2022 amid inflation and recession fears, nothing goes down in a straight line so there will be opportunities to buy the dip, and some low cap coins can almost double in valuation in a day as LBLOCK showed.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

This article was written for Business 2 Community by Matt Williams.

Learn how to publish your content on B2C

Hailing from Northampton UK, Matt has a keen interest in stocks and crypto, and ways to earn passive income online to achieve financial freedom.… View full profile ›

Join over 100,000 of your peers and receive our weekly newsletter which features the top trends, news and expert analysis to help keep you ahead of the curve

by Mary Lister

by Michael Abetz

by Ayo Oyedotun

by James Scherer

by Hassan Mansoor

by Jonathan Furman

by Daniel Hopper

by Brian Morris

document.getElementById( “ak_js_1” ).setAttribute( “value”, ( new Date() ).getTime() );

Thanks for adding to the conversation!

Our comments are moderated. Your comment may not appear immediately.

Note that the content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This website is free for you to use but we may receive commission from the companies we feature on this site.