NFTs are tools to prove identity and ownership of both digital and physical assets.

Photo: Unsplash

Non-fungible tokens (NFTs) represent a multibillion dollar market. Globally, NFT transactions totaled more than $17 billion in 2021, marking a 21,350% increase from ~$82.5 million in 2020.

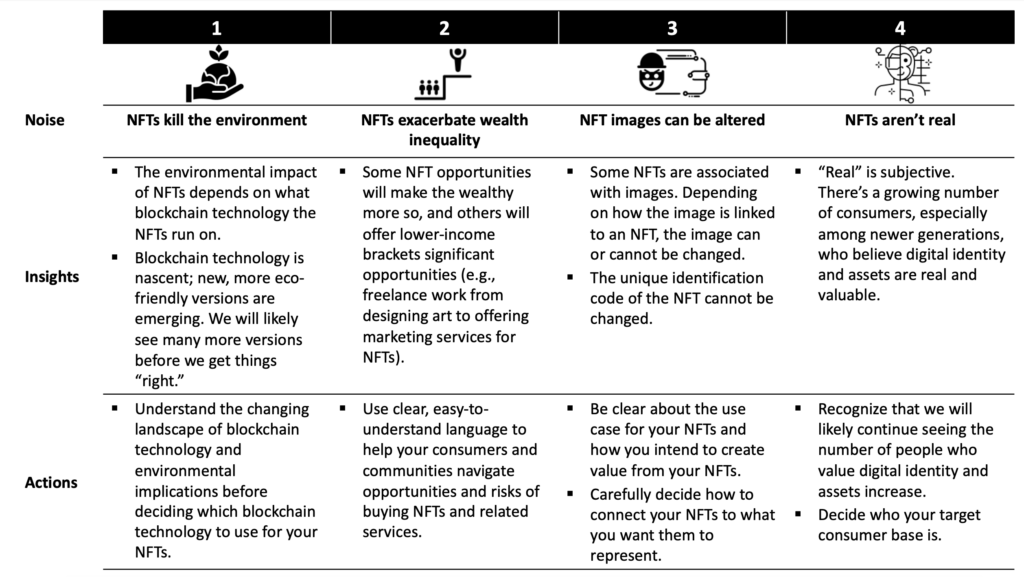

To capitalize on this new and fast-growing market, it is important to untangle the opportunities from the noise. There is a lot of confusion about what NFTs are, both among critics who lambast NFTs and among fans who cannot get enough of multi-million-dollar NFT art.

NFTs are non-interchangeable units of data stored on a blockchain (e.g., Ethereum) and enable ownership of digital assets. Blockchain technology is a digital record-keeping system that can make data immutable — it cannot be modified or deleted once recorded. Each NFT has a unique identification code that is immutable and can have only one owner at a time.

Simply put, NFTs are tools to prove identity and ownership of both digital and physical assets.

NFT art like Bored Ape Yacht Club (BAYC) and CryptoPunks has popularized the use of NFTs. But art is just one possible NFT use case. There are many other NFT use cases that we are only starting to explore (see Figure 1).

NFTs can be associated with JPEGs, but they do not have to be. In NFT art, the image is not what makes an NFT — rather, it is the underlying identification technology.

Barcodes can offer a helpful comparison to understand NFTs. Barcodes are tools to help identify and buy/sell goods. The barcode is separate from the product it is tagged to. Similarly, an NFT is separate from the thing it is coded to represent. A key difference is that barcodes can be changed or copied/pasted, whereas NFTs cannot. As a result, NFTs make it harder to fake identity and commit fraud.

When critics decry NFTs, they are often referring to NFT art, perhaps because of memorable headlines like Beeple’s NFT art, which sold for $69.3 million.

Companies entering the NFT market for various use cases should hear out these NFT art critiques. Behind the noise, there are deeper insights to glean about a newly emerging landscape of consumers and commercial opportunities.

Emerging Uses for NFTs

This is an ongoing debate. Today, most NFTs run on the Ethereum blockchain, which currently uses energy roughly equivalent to the consumption of a medium-sized country. Ethereum plans to reduce energy usage by ~99.95%. There are also new blockchain technologies emerging with a focus on reducing carbon footprint. It may take multiple versions to see material improvements — just as it has taken many decades of effort to see eco-friendly improvements to automobiles.

Some critics believe the NFT marketplace is a “turf war between the wealthy and the ultra-wealthy” and scam-like. This is a narrow view of NFTs, still in their nascent phase (the first NFT dates back to only 2014). In fact, NFT-related opportunities are already offering lower-income brackets significant opportunities. For example, NFTs can be a significant source of income by offering spinoff freelancer services, from designing art to offering marketing services for NFTs (e.g., on Fiverr, an online marketplace for freelance services). Recent Fiverr survey results show that more than three in five freelancers in the U.S. are profiting from offering NFT-related services, and more than one in two believe they can earn an additional $2,600-$5,200 per month by monetizing skills related to blockchain technology.

Some NFTs are associated with images. As explained above, the image is not what makes an NFT. Depending on how the image is linked to an NFT, the image can or cannot be changed. But the unique identification code of the NFT — what authenticates identity and proves ownership — cannot be changed. If the intended NFT use case is to represent and derive value from images (e.g., NFT art), there are newly emerging technologies focused on making images associated with NFTs non-alterable as well. As with all emerging technologies, we will continue making improvements in versions 2.0, 3.0, and beyond.

4 NFT Critiques and Actions for Companies Entering the NFT Space

This critique reflects a deeper discomfort with how we make sense of reality when our digital and physical worlds are merging. “Real” is subjective. There is a growing tension between those who cling to the physical world and those for whom “real” already exists in the digital world. This discomfort also has generational undertones. One in three of Gen Z believe their online identity is their most authentic self, compared to one in five of millennials and one in 10 of Gen X. Over the last holiday season, many Gen Z and millennials gave NFTs as gifts to friends and family. As tech companies race to build the Metaverse, our physical and digital worlds will continue blending at an even more accelerated pace.

Dismissing NFTs and blockchain technologies based on their current, nascent states is like dismissing all cars and related technologies because the first iterations of automobiles were not environmentally friendly, were only affordable for the wealthy, were technologically clunky, and seemed out of place in a world that was used to horses and buggies.

Companies looking to enter the NFT space need to understand both the challenges and opportunities associated with NFTs. It is incumbent on all of us to be intentional and thoughtful about how we want to use NFTs and shape versions 2.0 and beyond.

Jaymin Kim is a Director at Marsh McLennan and drives global commercial strategy with a focus on cyber, technology and digital. In her role, Jaymin advises Fortune 100 companies on the emerging Metaverse and related fields including NFTs, blockchain technology, and decision-making structures. Previously, Jaymin led Innovation at a fintech startup in Toronto and led Capital Advisory Services at an innovation hub that supports over 1,400 Canadian startup companies.