Good morning, and welcome to Protocol Fintech. This Thursday: Sorare’s fantasy bet, Coinbase’s bankruptcy warning, and the end of Facebook Pay.

It’s a staggering amount of value that’s been vaporized in the crypto meltdown: The total valuation of coins tracked by CoinMarketCap has dropped from $3 trillion at the market’s November peak to under $1.3 trillion. Doesn’t matter if you’re an ostensible utility token like Polygon’s matic or a meta joke like shiba inu coin — almost all of the big cryptos are down. Traders don’t seem to be discriminating, which is as much a signal as any one token’s losses.

The game-play’s the thing

The crypto market is in a massive downturn, and NFTs aren’t immune to the meltdown, with even Bored Ape Yacht Club NFTs selling for fractions of their previous prices.

Despite that, a new genre of NFTs is taking hold, which fuses together fantasy sports and collectibles. The challenge for this emerging market is how to make the games attractive for gamers, and not dependent on investor speculation. If it works, it could establish a sector of the NFT market that’s resistant to market swings.

Fantasy sports plus NFTs are a compelling combination. And the growth of NFT fantasy sports is important for blockchain tech more broadly, as an example of a use for crypto beyond just investment and speculation.

- Startup Sorare, which raised $680 million at a $4.3 billion valuation last year, has built a popular NFT-based fantasy soccer game that is being widely played internationally with 350 million monthly active users. Now it’s taking that model to the U.S. through a deal with MLB and the MLB Players Association to create an NFT-based fantasy baseball game.

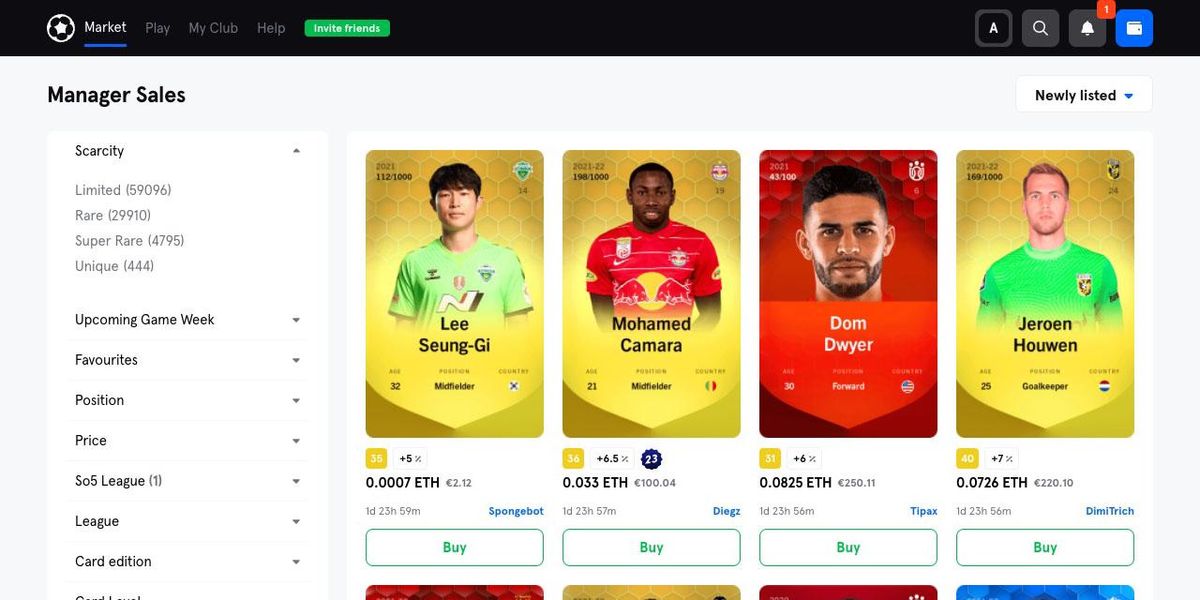

- Sorare’s soccer game has users acquire “cards” of real-life players and receive points when the player does something, such as score a goal. Users can play in tournaments against other managers for prizes such as rarer cards or ether. There’s also a free version, which doesn’t require buying anything.

- The cards are NFTs, which consumers own. And the NFTs can be bought, sold or traded. That also means that if a certain player is performing very well, that NFT might rise in price on the marketplace.

- Sorare did $325 million in NFT card sales in 2021, compared to $8 million in 2020, said Ryan Spoon, COO at Sorare and a former BetMGM and ESPN executive. Sorare has a range of different types of games within its soccer game, such as games with only rookie cards, or geographic leagues or underdog games for lower-level players. There are also more advanced games for users with rarer cards.

Baseball is a natural first major U.S. sport for Sorare. It has stat-heavy games and a longstanding fantasy audience.

- Sorare’s already in the U.S. market with its MLS deal. Sorare’s MLB game will have overall similarities to its soccer game in terms of NFTs, but will have some features unique to baseball, such as pitcher match-ups.

- Sorare is hoping to expand to more sports after baseball, Spoon said. Meanwhile, the company hopes to cross-pollinate its games and users so that, for example, fans of baseball in the U.S. could become fans of soccer through Sorare.

WIth its push into more sports, Sorare is increasingly competing with Dapper Labs, which has popular NFT collectibles products for the NBA, NFL and UFC. One challenge Dapper has faced is ensuring its games are fun for fans and not just a place for speculators to flip NFTs. Developing compelling game-play is a challenge that’s arguably trickier than developing blockchain infrastructure. But the alternative is to throw yourself at the mercy of a merciless market.

— Tomio Geron (email | twitter)

A version of this story first appeared on Protocol.com. Read it here.

A MESSAGE FROM FOURSQUARE

Data-visualization platforms make complex information and insights easier to understand and ultimately react to. You’ll see companies that adopt data visualization are empowered and can spot emerging trends and speed reaction time.

On the money

On Protocol: A new SEC filing by Coinbase warned that users could lose their crypto assets if the exchange went bankrupt. Coinbase CEO Brian Armstrong reassured users that they aren’t at risk of bankruptcy and the warning was required by a recent SEC advisory.

The European Commission is reportedly considering hard curbs on stablecoins. The European Commission and Parliament are at odds, with the commission favoring a curb on the widespread use of stablecoins and Parliament favoring regulatory oversight instead.

Also on Protocol: Meta is officially rebranding Facebook Pay as Meta Pay, since Facebook Pay hasn’t made sense for a while now. The change also reflects Meta’s struggles to figure out how its financial division fits with the rest of the company.

Distributed Ledger is partnering with Mobile for a bitcoin mining project. The Alabama city will host the bitcoin mining project at the GulfQuest National Maritime Museum, aiming to create a new “sustainable” revenue source for the city. The three power plants closest to Mobile are powered by coal and natural gas.

Overheard

Federal Reserve Gov. Christopher Waller says the central bank is going to take inflation seriously this time, promising to raise interest rates to fight it. “We know what happened for the Fed not taking the job seriously on inflation in the 1970s, and we ain’t gonna let that happen,” he said at a panel discussion.

The popular Azuki NFT collection’s floor price crashed on Monday. Why? NFT Twitter freaked out after the collection’s founder revealed his involvement in projects that had been abandoned. “Azuki is built on learnings from creating Phunks & other projects. This taught me to lead, not follow,” the Azuki founder, known as Zagabond, tweeted.

SEC Chair Gary Gensler doesn’t think that it’s a coincidence that the three major stablecoins are all linked to major exchanges. “Each one of the three big ones were founded by the trading platforms to facilitate trading on those platforms and potentially avoid AML and KYC,” he said in an interview with Bloomberg.

Moves and hires

Petal appointed Ali Heron as chief technology officer. Heron was most recently head of Engineering at the credit startup, and a senior vice president at Two Sigma Investments before joining Petal.

CFTC Commissioner Kristin Johnson hired Bruce Fekrat as chief counsel. Fekrat was previously an executive director and associate general counsel at CME Group, where he was lead regulatory counsel on a number of issues, including digital assets.

Aida Álvarez joined Bill.com’s board of directors. Álvarez was formerly the head of the U.S. Small Business Administration during the Clinton administration.

Bill.com also appointed Michael DeAngelo as chief people officer. DeAngelo was previously chief people officer at Pinterest, and was head of People for various teams at Google prior to that.

Coinbase launched its Summer 2022 Community Ambassador Program. The ambassadors will work remotely as part-time contractors. The program is largely aimed at university students interested in crypto.

DriveWealth appointed Terry Angelos as global chief executive officer. Angelos was most recently SVP and global head of Fintech and Crypto at Visa

A MESSAGE FROM FOURSQUARE

In order to be successful in Flatiron, a restaurant will need to draw a weekday lunch crowd with healthy offerings and a work-friendly setting for professionals; to stand out among nearly double the restaurants in SoHo, a new restaurant should lean into arts and culture with a design-forward setting.

The crypto market is in a massive downturn, and NFTs aren’t immune to the meltdown, with even Bored Ape Yacht Club NFTs selling for fractions of their previous prices.

Despite that, a new genre of NFTs is taking hold, which fuses together fantasy sports and collectibles. The challenge for this emerging market is how to make the games attractive for gamers, and not dependent on investor speculation. If it works, it could establish a sector of the NFT market that’s resistant to market swings.

Fantasy sports plus NFTs are a compelling combination. And the growth of NFT fantasy sports is important for blockchain tech more broadly, as an example of a use for crypto beyond just investment and speculation.

Baseball is a natural first major U.S. sport for Sorare. It has stat-heavy games and a longstanding fantasy audience.

WIth its push into more sports, Sorare is increasingly competing with Dapper Labs, which has popular NFT collectibles products for the NBA, NFL and UFC. One challenge Dapper has faced is ensuring its games are fun for fans and not just a place for speculators to flip NFTs. Developing compelling game-play is a challenge that’s arguably trickier than developing blockchain infrastructure. But the alternative is to throw yourself at the mercy of a merciless market.

— Tomio Geron (email | twitter)

A version of this story first appeared on Protocol.com. Read it here.

Data-visualization platforms make complex information and insights easier to understand and ultimately react to. You’ll see companies that adopt data visualization are empowered and can spot emerging trends and speed reaction time.

Learn more

On Protocol: A new SEC filing by Coinbase warned that users could lose their crypto assets if the exchange went bankrupt. Coinbase CEO Brian Armstrong reassured users that they aren’t at risk of bankruptcy and the warning was required by a recent SEC advisory.

The European Commission is reportedly considering hard curbs on stablecoins. The European Commission and Parliament are at odds, with the commission favoring a curb on the widespread use of stablecoins and Parliament favoring regulatory oversight instead.

Also on Protocol: Meta is officially rebranding Facebook Pay as Meta Pay, since Facebook Pay hasn’t made sense for a while now. The change also reflects Meta’s struggles to figure out how its financial division fits with the rest of the company.

Distributed Ledger is partnering with Mobile for a bitcoin mining project. The Alabama city will host the bitcoin mining project at the GulfQuest National Maritime Museum, aiming to create a new “sustainable” revenue source for the city. The three power plants closest to Mobile are powered by coal and natural gas.

Federal Reserve Gov. Christopher Waller says the central bank is going to take inflation seriously this time, promising to raise interest rates to fight it. “We know what happened for the Fed not taking the job seriously on inflation in the 1970s, and we ain’t gonna let that happen,” he said at a panel discussion.

The popular Azuki NFT collection’s floor price crashed on Monday. Why? NFT Twitter freaked out after the collection’s founder revealed his involvement in projects that had been abandoned. “Azuki is built on learnings from creating Phunks & other projects. This taught me to lead, not follow,” the Azuki founder, known as Zagabond, tweeted.

SEC Chair Gary Gensler doesn’t think that it’s a coincidence that the three major stablecoins are all linked to major exchanges. “Each one of the three big ones were founded by the trading platforms to facilitate trading on those platforms and potentially avoid AML and KYC,” he said in an interview with Bloomberg.

Petal appointed Ali Heron as chief technology officer. Heron was most recently head of Engineering at the credit startup, and a senior vice president at Two Sigma Investments before joining Petal.

CFTC Commissioner Kristin Johnson hired Bruce Fekrat as chief counsel. Fekrat was previously an executive director and associate general counsel at CME Group, where he was lead regulatory counsel on a number of issues, including digital assets.

Aida Álvarez joined Bill.com’s board of directors. Álvarez was formerly the head of the U.S. Small Business Administration during the Clinton administration.

Bill.com also appointed Michael DeAngelo as chief people officer. DeAngelo was previously chief people officer at Pinterest, and was head of People for various teams at Google prior to that.

Coinbase launched its Summer 2022 Community Ambassador Program. The ambassadors will work remotely as part-time contractors. The program is largely aimed at university students interested in crypto.

DriveWealth appointed Terry Angelos as global chief executive officer. Angelos was most recently SVP and global head of Fintech and Crypto at Visa

In order to be successful in Flatiron, a restaurant will need to draw a weekday lunch crowd with healthy offerings and a work-friendly setting for professionals; to stand out among nearly double the restaurants in SoHo, a new restaurant should lean into arts and culture with a design-forward setting.

Learn more

Thanks for reading — see you tomorrow!

Get access to the Protocol | Fintech newsletter, research, news alerts and events.

Your information will be used in accordance with our Privacy Policy

Thank you for signing up. Please check your inbox to verify your email.

Sorry, something went wrong. Please try again.

A login link has been emailed to you – please check your inbox.

To give you the best possible experience, this site uses cookies. If you continue browsing. you accept our use of cookies. You can review our privacy policy to find out more about the cookies we use.