***For All Things Wyoming, Sign-Up For Our Daily Newsletter***

By Renée Jean, Business and Tourism Reporter

[email protected]

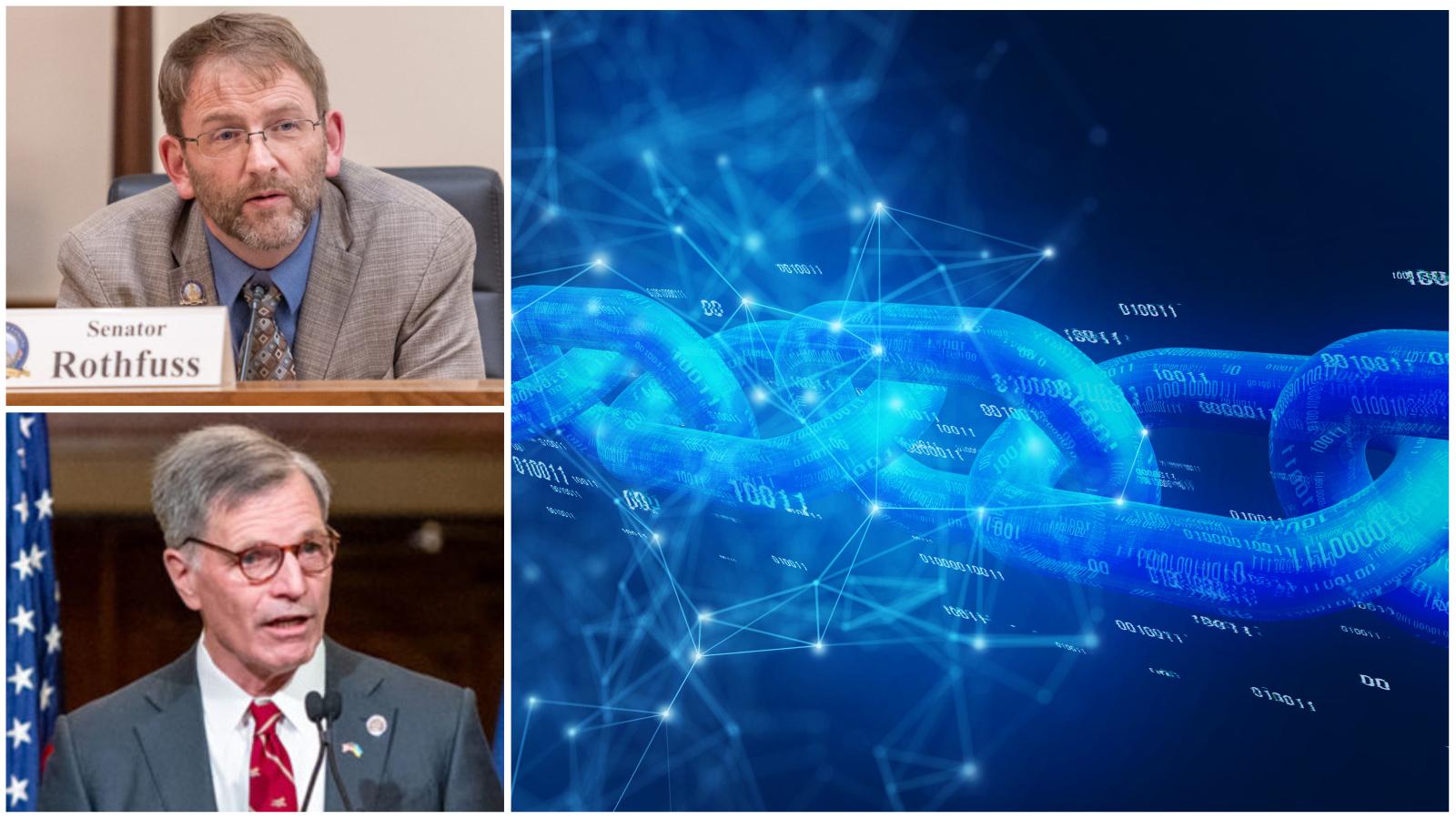

Lawmakers on the Select Committee on Blockchain have revised a bill vetoed by Gov. Mark Gordon last year that would create a Wyoming stable token.

Stablecoins or tokens attempt to create a cryptocurrency that has a stable price — something that has so far proven elusive. By backing its token with actual assets, Wyoming hopes to avoid the problems that have plagued other efforts. If successful, it would be the first state with a cryptocurrency coin of its own.

Gordon said at the time the bill had many “good ideas,” but that he was concerned about the state’s reputation if the effort should fail. He also disagreed with oversight being put in a single agency or department. He believes it should be a concerted effort of the executive branch.

Gordon had recommended further study of the matter during the interim, to see if all these issues could be addressed.

Revised Bill Puts Token Under Executive Branch

Sen. Chris Rothfuss, D- Laramie, told lawmakers on the Senate Minerals, Business and Economic Development Committee on Wednesday that the revised “Wyoming Stable Token Act,” Senate File 127, would establish a commission to oversee the program, which would include the governor or his designee, as well as the auditor and treasurer, or their designees.

Those three would then select four subject matter experts to serve on the commission as well, making it a seven-member body, similar in structure to other Wyoming Commissions, like the Wyoming Energy Authority.

“This is the aspect that is really intended to help satisfy some of the concerns that were raised by the governor,” Rothfuss said.

Competing With The Free Market?

But Betsy Anderson, deputy chief of staff and general counsel for Gordon, told lawmakers there are lingering concerns with the bill, despite all the otherwise good interim work.

“The committee did address several of the concerns that he had,” Anderson said. “So we really appreciate that. But, at this point, I think again, because of the veto, I think you deserve to understand where he stands on this.”

There are two remaining concerns, Anderson said. The first is whether Wyoming is setting itself up to compete with the private sector.

“I don’t think we ever think government should be competing with the private sector,” she said.

The other, more nebulous issue is the reputational damage, if the state’s stable token fails.

“The state has made great strides in the virtual currency world, in the blockchain world,” Anderson said. “And specifically, the speedy banks that we have set up.”

Failure of the state’s stable token would reflect poorly not just on the stable token itself, but on everything the state has done in the virtual currency world, Anderson said.

“That would make it difficult for us to continue to make advances,” she said.

Anderson also pointed out that Wyoming’s Special Purpose Depository Institutions, or SPDIs, are still in regulatory limbo.

Custodia Bank, one of the state’s first SPDIs, has filed suit over the Securities and Exchange Commission’s slow-walk of their application to open a master account, which banks require to hold their reserves at the Fed.

It’s been almost three years now without a resolution of that issue.

None of Wyoming’s SPDI’s can be fully functional without a master account.

Practical Issues Are Another Concern

Anderson also questioned the practicality of a Dec. 31 deadline for issuing the first Wyoming stable token.

“You’re looking at hiring an executive director, which I don’t think would start the day after this bill is effective,” she said.

There would be drafting of rules, which would take some time, and there will be a need for accountants, marketing specialists, and some sort of technical platform to sell the token on, she said.

“You’re going to have to have somebody to build the actual token,” she said. “You’re going to have to have auditors, independent auditors, and you’re going to have to have IT security, because you can’t be hacked.”

Then there are all the know-your-customer rules and money laundering regulations.

“I don’t see us having that staff (by Dec. 31),” she said. “I believe that’s a lot of contract work that’s going to have to be put in place before you issue this.”

Anderson said the governor’s office would prefer to see a list of criteria that need to be met before the stable token is issued, rather than an arbitrary deadline.

“The governor addresses that in the veto letter, that he’d rather be right than first, and do this well,” she said.

Anderson also had questions about setting up a commission with a majority of non-state officials.

Stop Moving the Goalposts

Sen. Rothfuss described the new concerns as “moving the goalposts.”

“We waited a year to rewrite the bill to get it to the point where it would satisfy those interests about the organizational capacity,” Rothfuss said. “And now the problem is the organizational capacities can take too long to put together? I’m happy to go back to the original bill. It was better in my opinion anyway.”

If all the Legislature has to do to win the governor’s approval and avoid a second veto is move the date to a new deadline such as March 25, Rothfuss said he’s all for that.

“But if it’s just, ‘And here are the 10 other things we hate, but thanks for moving it to March 25,’ I don’t know that we need to do that,” he said.

As far as the setup of the commission, Rothfuss said the four additional members could be private sector or from within the government, whatever is the pleasure of the governor, auditor, and treasurer or their designees.

Rothfuss answered the question about competing with private industry with a question of his own.

“Would the governor, on behalf of the state, or the treasurer, on behalf of the state, be willing to accept any of the digital assets that currently exist as a means of tax payment or as any value-bearing asset?” he said. “I would hope the answer is no, because I wouldn’t accept any of them on behalf of the state of Wyoming. If the state of Wyoming is going to engage in this, we have to have something that is a credible dollar back.”

The state’s risk of lost opportunity far exceeds any risk to its reputation, Rothfuss suggested.

“There are plenty of other states that have equivalent credit card laws with the state of South Dakota,” he said. “But South Dakota is the entity that got there first in changing their laws, and that is why 50 percent of credit card companies have their headquarters there.”

Bulk Of Bill Remains The Same

All of the key concepts from the original bill remain in the new version, Rothfuss said.

Wyoming’s stable token would not be its own currency — that would run afoul of federal regulations. It would instead be a digital representation of a single U.S. dollar, held in trust by the state and invested only in short-term treasury bills.

Rothfuss believes this construct will avoid the volatility that has caused other cryptocurrencies to fail.

Terra Luna, for example, promised that its mathematical algorithm would keep its coin stable. But its math failed, and, with no real assets backing the coin, it collapsed, despite all marketing promises to the contrary.

Then there are situations like FTX, where regulators say customer funds were diverted to a privately held crypto hedge fund. From there, the money became venture capital for high-risk investments, or was used to make lavish real estate purchases and large political donations.

When investors became spooked and tried to withdraw their money all at once, there was no liquidity. Those assets had been leveraged or spent and were unavailable.

That made FTX a multi-billion dollar house of cards that tumbled spectacularly, when it was unable to pay out $6 billion in withdrawals over three days.

Treasuries Would Earn Interest, Ensure Stability

Proponents say Wyoming’s stable token would avoid all those scenarios by backing each token with one U.S. dollar invested in the lowest risk investment vehicle around, short-term U.S. treasuries.

“We realized that is the only way there would be confidence in a digital asset from a state standpoint,” Rothfuss said. “If it were literally backed by dollars, and we held those dollars in a way that was not putting them at risk.”

U.S. treasuries do provide a small interest payment over time. Those earnings would be paid into the account until the fund reaches 102 percent of deposits, providing an additional buffer and liquidity to the fund for withdrawals.

Once that level is achieved, earnings would go toward the administration account, to pay for operation of the commission, as well as repay the General Fund for the $500,000 startup cost for the token.

After that, earnings would then be paid equally on a quarterly basis to the Common School Permanent Fund Reserve Account, the School Foundation Program Account and the permanent Wyoming Mineral Trust Fund Reserve Account.

Sudden Redemption Not Sudden Death

The bill also spells out what would happen in the event someone wanted to suddenly redeem a large amount of Wyoming stable tokens, before there’s enough liquidity on hand to make the payment.

In that case, the individual would either have to wait, or take a discount. This is similar to what happens when cashing in a CD before its maturity date. There’s an interest penalty for early withdrawals.

The bill also covers the highly unlikely situation where interest rates for U.S. Treasury bills are actually negative.

“That’s never happened,” Rothfuss said. “But that’s condition No. 1 when we might not pay a full $1.”

In that case, the value of the Wyoming stable token would be the liquidated value of the U.S. Treasury bill redeemed to pay the demand for the Wyoming stable token.

These are important caveats to ensure Wyoming is not on the hook for more than what’s actually available in the account.

“We’re only going to pledge the contents of that trust account,” Rothfuss said.

Where The Bill Stands

A few minor housekeeping amendments were added to Senate File 127, as well as one that requires the four subject matter experts serving on the Stable Token Commission to be free from conflicts of interest.

The committee advanced the bill to the Senate Floor with a unanimous “do-pass” recommendation.

***For All Things Wyoming, Sign-Up For Our Daily Newsletter***

Sen. Lynn Hutchings said she sponsored the anti-CRT bill because factions through the nation are spreading

While some Wyoming legislators push to codify the Indian Child Welfare Act on a state level

A bill dedicating $5.25 million to help Arizona and Texas build a border wall and transport

All rights reserved.

Sen. Lynn Hutchings said she sponsored the anti-CRT bill because

While some Wyoming legislators push to codify the Indian Child

Author

Administraroot