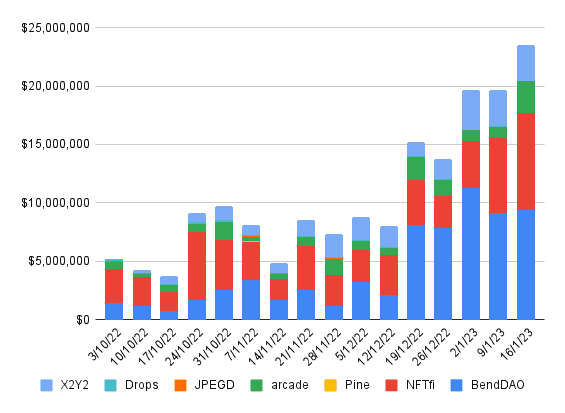

The NFT lending ecosystem has experienced significant growth in recent months, with weekly borrow volume rising from $5.2 million to $23.4 million since October 2022. This trend is driven by a number of platforms that are now offering lending services for NFTs, the most notable of which include BendDAO, NFTfi, X2Y2, and Arcade.

Since October 2022, the NFT lending ecosystem has grown from a total of $5.2M weekly borrow volume to $23.4M.

Over the past week, BendDAO saw 40% of the total volume, NFTfi with 35%, X2Y2 with 12.9%, and Arcade with 11.5%.@DuneAnalytics dashboard by @ahkek4, @impossiblefi. pic.twitter.com/YNWg5EPNQs

BendDAO has been particularly successful in this area, with the platform accounting for 40% of the total volume in the NFT lending ecosystem over the past week. This is thanks in large part to its large holdings of NFTs, including over 423 MAYC and 94 Doodles NFTs.

NFTfi, another major player in the NFT lending ecosystem, has also seen significant growth in recent weeks, accounting for 35% of the total volume. X2Y2 and Arcade also saw notable growth, with 12.9% and 11.5% of the total volume respectively.

Recently, 154 Bored Ape Yacht Club NFTs were deposited to BendDAO as collateral, further strengthening the platform’s NFT holdings.

These trends are a clear indication of the growing importance of NFTs in the lending market, and the increasing demand for ways to borrow and lend these unique digital assets. As the ecosystem continues to evolve, it is likely that we will see even more platforms and services emerge to meet this growing demand.

Follow our On-Chain NFTs section to get daily NFT insights you won’t get anywhere else.

Justin Kan’s Web3 Gaming Platform, Fractal Launches on Polygon

Industry’s Latest: Ethereum Dominates Trading, Optimism Emerges as New Hub, BendDAO Leads in Holdings

UNEP Launches Metaverse Simulator Game for Environment Protection Studies

Ethereum NFT Market Shifts Trading Patterns, Remains Strong

Bored Ape Kennel Club Experienced 1.7K ETH In 2-Day Volume

Lazio Fan Token Saw Over $302M In 24H Sales