Bloomberg: Balance of Power focuses on the politics and policies being shaped by the agenda of President Biden’s administration.

Bloomberg: Balance of Power focuses on the politics and policies being shaped by the agenda of President Biden’s administration.

If the only thing you know about sports is who wins and who loses, you are missing the highest stakes action of all. The business owners that power this multibillion dollar industry are changing, and a new era of the business of sports is underway. From media and technology to finance and real estate, leagues and teams across the globe have matured into far more than just back page entertainment. And the decisions they make have huge consequences, not just for the bottom line, but for communities, cities, even entire countries.

CVS Names New Leaders for Pharmacy Services, Consumer Products

Economists Laugh Off South America’s Common Currency Idea

Euro-Area Consumer Confidence Rises to Highest in Nearly a Year

Fed and Bank of Canada Have Reason to Pause Hikes, BMO’s Joyce Says

Israeli Economy in Danger, Central Bank Panelist Says After Resignation

Ritchie Woos IAA Deal Opponents With More Cash, Special Dividend

Bigger Is Better in India’s Nascent Electric Car Market

Microsoft Invests $10 Billion in ChatGPT Maker OpenAI

Elon Musk to Resume Testimony in Defense of His Tweets at Tesla Trial

Spotify Will Cut About 6% of Jobs in Latest Tech Layoffs

UK Urges EU Not to Harm British Firms in US Clean Power Fight

Erdogan to Forgive Debt of Turks in Pre-Election Voter Giveaway

How to Save for Retirement by Paying Down Your Student Loans

Who Pays for Your Rewards? Indebted Cardholders, Paper Finds

Emirates Airline to Raise Service to Australia on Higher Demand

What It Was Like to Attend Beyoncé’s Explosive Concert in Dubai

Activist Investors Move on Salesforce. Is Big Tech Safe?

Big Tech Helps Big Oil Spread Subtle Climate Denialism

AI Is Improving Faster Than Most Humans Realize

Wind Turbines Taller Than the Statue of Liberty Are Falling Over

The Coyotes Working the US Side of the Border Are Often Highly Vulnerable, Too

How Microbes Can Help Solve the World’s Fertilizer Problems

Railroads Offer Paid Sick Days, Schedule Changes to Retain Employees

Welsh Rugby Union Accused of ‘Toxic Culture’ of Sexism by Ex-Employees

France Needs to Study Impact of Global Warming on Nuclear Plants, Watchdog Says

Argentine Meatpacking Heir Wants to Embed Crops With Animal DNA

NYC, Goldman Sachs Launch Effort to Give Struggling Small Businesses a Lift

Milan Luxury Real Estate Booms as Bankers Leave London for Italy

London’s Historic Smithfield Market Meets a New Chapter

Binance Says Signature Sets Transaction Minimum Amid Pullback

Meme, Crypto Revival to Hit a Wall as Recession Risk Looms: Q&A

Bitcoin Reaches Highest Since August Amid Second Weekend Surge

Money laundering, fraud and tax evasion — real or virtual — are risks that won’t go away on their own

Lionel Laurent

Subscriber Benefit

Subscribe

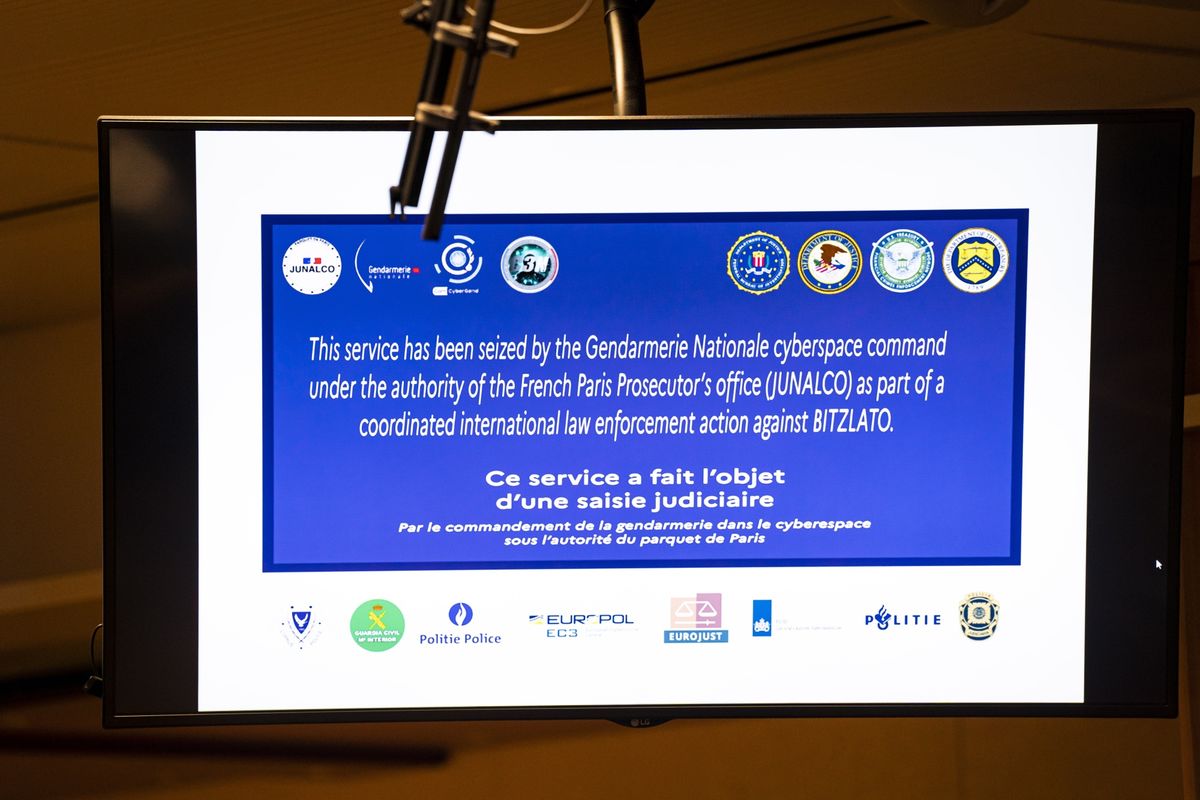

There was much mirth online when the US Justice Department announced the arrest of crypto exchange Bitzlato’s founder last week. Unpronounceable, unknown and unlike any of the far bigger fish (like Binance) getting headlines, Bitzlato looked like a small-fry, a nothingburger. The fact that Bitcoin resumed its march past $21,000 seemed to confirm it.

But this ignores the bigger picture. In the first few weeks of 2023, watchdogs have done a lot. On Jan. 3, a joint statement by US bank regulators warned the industry of crypto risks creeping into the banking system. Then came a $100 million settlement with Coinbase Global Inc. over weak internal controls, a lawsuit against the Winklevoss twins’ Gemini and broker Genesis for allegedly selling unregistered securities, and a $45 million settlement with lending platform Nexo (which has ceased US operations). Subpoenas are flying.

Author

Administraroot