Sold a beachside paradise with A-list models including Kendall Jenner, millennials swarmed to the Bahamas in 2017 for the ill-fated Fyre Festival.

We all know what happened next: Wrecked local businesses, dilapidated cheese sandwiches and deceived customers who formed a class-action lawsuit against organizers who used their money to bankroll decadent lifestyles. At the core of the media circus was the role of influencer marketing. Having failed to properly vet the new concept or disclose financial relationships to Fyre, celebrities poneyed up after government agencies came knocking. Jenner, for instance, was forced to pay $90,000 out of pocket for her role in promoting the festival.

Nemo Yang is the Founder and CEO of Oxygen, the Web3 marketing platform.

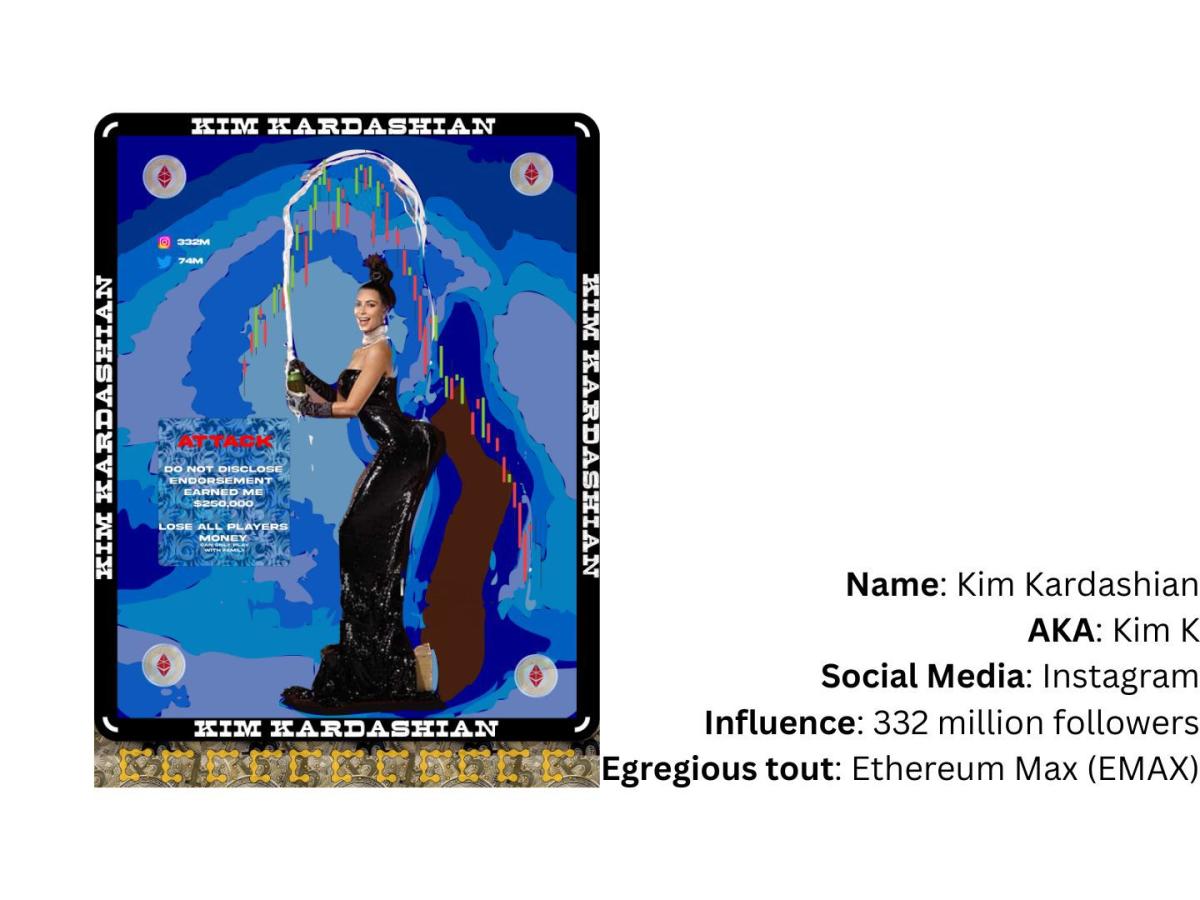

From the tropical environment to the dynastic celebrity families involved, Fyre Festival mirrors the FTX meltdown and other prominent crypto scandals that have blown up these past few months. Despite the lack of regulatory clarity surrounding crypto, much less the compliance scrutiny that traditional financial institutions face, Tom Brady gave FTX his seal of approval as Sam Bankman-Fried’s team proceeded to lose billions of dollars while racking up $55,000 bar tabs at Jimmy Buffet’s Margaritaville in the Bahamas. Kendall Jenner’s half-sister, Kim Kardashian, likewise found herself in the crosshairs of regulators and had to pay a $1.26 million fine for promoting ethereumMax – essentially, a pump-and-dump scheme. In a further twist of irony, the land in Great Exuma where Billy McFarland held Fyre is now being sold as non-fungible token (NFT) parcels, marketed towards crypto heads by the same developers behind Miami Beach’s Setai hotel.

Celebrities, and their managers who present advertising opportunities, owe a responsibility to fans and followers to properly vet products and services, and to actually understand what they’re promoting. While most builders in Web3 understand the risks of investing in cryptocurrency projects and have some lay of the land regarding DeFi architecture, it’s unlikely that Kim Kardashian’s 228 million Instagram followers are well-versed in topics like portfolio allocation. They are sheep being led to the slaughter by someone who has never even ventured an opinion on Ethereum.

Celebrities, unfortunately, are only part of the problem with the current state of crypto marketing. An industry of Web3 YouTubers, Twitch streamers and TikTok stars emerged during the coronavirus pandemic. While most of these creators posted videos in good faith and wanted to share their passion for crypto and blockchain, there are, unfortunately, others who profited off retail, failing to disclose when they were paid to shill or when they took profits.

Read more: Jocelyn Yang – Read ’em and Weep: Five Crypto Influencers Who Dealt Their Followers a Bad Hand

To create a Web3 free of bad actors promoting pump-and-dump schemes, the incentive structures need to change for crypto marketing. While the U.S. Federal Trade Commission already requires individuals to disclose payments for promotions, Web3 is full of unproven startups, value propositions and teams requiring even greater accountability. Promoters in this space need to explain why they chose to align themselves with certain brands. Unlike skincare products or merchandise, cryptocurrencies directly impact financial markets and carry the risks for derivatives trading and contagion into other institutions. With all transactions visible on a public ledger, blockchain tech is built with transparency in mind. Those who tout the technology’s virtues should abide by this essential principle from both a legal and moral standpoint, and the industry needs to hold them accountable.

Crypto influencers, marketers and PR professionals need to spend more time digging into blockchain’s foundational architecture and uncovering their own ideology toward crypto and decentralization as a guiding force for selecting projects to endorse. Only by educating themselves first can they educate others. This statement should be obvious, but in the wake of the failed FTX and Celsius Network, the industry needs to adopt a “no tolerance” policy for promoters who blatantly hype brands without understanding or respecting the core technology.

As a first step, companies and influencers should begin measuring their social media reach for campaigns as a way to quantify their potential impact on financial markets and large population swaths. Oxygen has made it our mission to bring transparency to Web2 and Web3 growth marketing by using data analytics to understand creators and brands online, as well as relevant on-chain activity, to verify their legitimacy. We’ve also seen our partners in the industry such as CreatorDAO, a financing and technology platform assisting creators, play an active role in educating influencers on the best advertising practices to protect their audiences. By being transparent with who they are targeting, and how they are doing so, marketing teams will take an important step in embracing accountability.

Crypto marketing in 2023 will inevitably be defined by establishing new regulatory frameworks, but will also require embracing a new culture and attitudes. Those responsible for promoting crypto companies to the general public should be able to, at a minimum, articulate how their concept fits into the overall blockchain ecosystem – from protocol-level to consensus.

Those in positions of authority in Web3 (VCs, founders, etc.) can highlight individuals who promote companies from a place of good faith, acknowledge when they are wrong, and who get excited by the ideologies behind code – rather than the interchangeable brand associations of centralized vested interest groups.

Vauld has received bids from two digital asset fund managers to take over the beleaguered lender after talks with Nexo broke down.

CEO Barry Silbert of Digital Currency Group, a finance veteran who built a crypto conglomerate, now is fighting to keep its lending firm out of bankruptcy.

Get the most out of your home essentials with these Amazon deals on streaming devices, kitchen appliances, tax software and more.

The collapse of crypto exchange FTX has led to a greater focus on using regulated custodians, and the custody revenue opportunity could grow to $8 billion by 2033 from less than $300 million today, Bernstein said in a research report on Tuesday. “Crypto custody is the foundational enabler for institutional adoption,” analysts Gautam Chhugani and Manas Agrawal wrote, adding that “unlike legacy custody, crypto custody is all about securing the private key,” which makes it a more of a technological endeavor. The Bernstein analysts said post-FTX they expect a jump in “crypto custody penetration” with existing investors and a sharp growth in custody services in the medium term driven by increased institutional participation in digital-asset markets.

Developers are mainly focusing on alternative ecosystems to Bitcoin and Ethereum, helping them grow faster, the VC firm said in a report.

The founders of Three Arrows Capital are seeking to launch an exchange where creditors to insolvent digital-assets firms, including their own, would be able to buy and sell claims.

CRYPTO UPDATE Most of the largest cryptocurrencies were up during morning trading on Tuesday, with Polkadot (DOTUSD) seeing the biggest change, rallying 2.67% to $6.00. Six additional currencies posted raises Tuesday.

CWB Financial Group (TSX: CWB) (CWB) will release our first quarter 2023 results on March 2, 2023 via newswire at approximately 7:00 a.m. Eastern Time (ET) and CWB Management will host a conference call with analysts on the same day at 10:00 a.m ET. A copy of the news release, supplemental financial results and conference call presentation will be available in the Investor Relations section of our website at www.cwb.com/investor-relations/quarterly-reports.

Nexo has sued the Cayman Islands Monetary Authority to overturn its rejection of Nexo's application to register as a virtual asset services provider.

The British Columbia Ferry Services Board is pleased to announce the appointment of Nicolas Jimenez as President and Chief Executive Officer of BC Ferries, effective March 6, 2023.

Hong Kong’s new digital asset-friendly policies could set the city up as the home for secondary NFT marketplaces from China as trading of ‘digital collectibles’ remains a gray area on the mainland.

The crypto-climate coalition is trying to come up with interoperability principles and business cases.

Founders of Three Arrows Capital, a crypto hedge fund whose bankruptcy in June resulted in potentially billions of losses for investors and creditors, are seeking to raise up to $25 million for their new business.

Guaranty Bancshares Inc. (GNTY) delivered earnings and revenue surprises of 19.32% and 2.11%, respectively, for the quarter ended December 2022. Do the numbers hold clues to what lies ahead for the stock?

In this article we are going to estimate the intrinsic value of MINISO Group Holding Limited ( NYSE:MNSO ) by…

How much cash do you have in your portfolio? While conventional wisdom suggests limiting the size of your cash position, a recent study from Dalbar calls for holding enough cash and cash equivalents to cover five years' worth of expenses. … Continue reading → The post Why Your Portfolio's Asset Allocation May Be Off appeared first on SmartAsset Blog.

Couple accused of kidnapping man at gunpoint in Daytona Beach

NetEase, Inc (NASDAQ: NTES) ditched an offer from U.S. games publisher Activision Blizzard, Inc (NASDAQ: ATVI) to extend their China licensing agreement by six months. The denial signals the exit of global titles like World of Warcraft from the top gaming market, Bloomberg reports. Blizzard's content and online services will be unavailable in China from January 23 under the existing agreement. Blizzard and NetEase failed to reach a new licensing agreement in 2022 that would have prolonged their

Silvergate Capital Corp reported a net loss of $1 billion in the fourth quarter, after reporting earlier this month that investors spooked by the collapse of crypto exchange FTX pulled out more than $8 billion in deposits in the last three months of 2022. Shares of the bank were last up more than 10% as the bank attempted to reassure investors that it remained committed to serving the digital asset industry. "We are in the process of evaluating our product portfolio and customer relationships with a focus on profitability," said Silvergate Chief Executive Alan Lane on a conference call with analysts on Tuesday.

Yahoo Finance Live’s Jared Blikre breaks down how crypto stocks are trading.

Author

Administraroot