Hopefully, the recent implosion of cryptocurrency exchange FTX, and the backlash against crypto investors like Sam Bankman-Fried, will prompt the city of Miami to reconsider its economic priorities. FTX, whose 1.2. million users used the exchange to purchase cryptocurrency tokens such as Bitcoin, recently filed for bankruptcy. Amidst the demise of FTX, Bitcoin has plunged along with the entire crypto market. Though certainly concerning for investors, the FTX imbroglio could offer a respite for the environment by discouraging an ongoing crypto craze. Bitcoin transactions consume a lot of energy – the lion’s share of which comes from fossil fuels – since so-called “mining rigs” are comprised of powerful computers working in tandem to solve complex mathematical problems.

Bitcoin is so damaging to the environment, in fact, that experts estimate the digital token now consumes more energy than the whole of Argentina, a nation of 45 million people. Indeed, the carbon footprint of a sole Bitcoin transaction is equivalent to almost two million Visa transactions, and 135,229 hours watching YouTube. Unfortunately, billionaires such as Bankman-Fried have been seemingly impervious to such environmental realities. Other moguls such as Elon Musk, meanwhile, have pledged to fight climate change. However, the Tesla boss has had an odd on-and-off relationship with Bitcoin, not to mention the tech CEO’s own Boring Company which conducts business in the digital currency Dogecoin.

‘Miami Crypto Vice’

In recent years, crypto investors have taken their ambitions to a new level by swarming to the beach. Encouraged by Bitcoin-friendly mayor Francis Suarez, Miami has spearheaded a veritable crypto revolution featuring startups and venture capital. Attracted by the sun, low-tax environment and lax virus restrictions during COVID, investors hope South Florida will become “Miami Crypto Vice.” City streets are lined with ads for tokens that restaurants and clubs are starting to accept, and murals promoting NFTs, or non-fungible tokens, dot the landscape. “BitBasel,” a crypto-art and NFT tech hub for artists and developers, is flourishing in trendy Wynwood. In downtown Miami, meanwhile, luxury residences on sale for $600,000 allow investors “to utilize volatile crypto assets to purchase more stable real estate property.”

Bitcoin A.T.M.s are popping up, crypto fusion catering and even “Bitcoin Brunches” are booming, and born-again followers cheer the rise of Bitcoin dictators in Central America. The suburb of Miami Lakes allows residents to pay all municipal fees in crypto. The Miami Beach Convention Center, meanwhile, holds an annual Bitcoin Conference, and the Inter Miami soccer team wears pink shirts emblazoned with XBTO, a crypto exchange. As if that were not enough, potential real estate investors can get a virtual sneak peek of their purchases by putting on futuristic VR headsets which “welcome users to the metaverse.”

Nuclear crypto?

Before his empire imploded, Bankman-Fried hoped to turn Miami into a hub for global cryptocurrency. Indeed, the investor purchased the naming rights to American Airlines Arena, home to the Miami Heat basketball team. Local officials approved a partnership with the crypto mogul, which would have turned the stadium into an “FTX arena.” As recently as September, mayor Suarez effusively praised FTX when the firm announced plans to move its U.S. headquarters from Chicago to Miami. Going into public relations overdrive, Suarez remarked that environmental concerns over cryptocurrency mining had been misconstrued. Such concerns, he argued, “come from the fact that a lot of the mining was being done in coal-producing countries.” Investors such as Bankman-Fried, the mayor added, could count on supposed clean energy options, most especially nuclear power.

But in order to tap such energy, Suarez would need the cooperation of nearby Turkey Point nuclear power plant, which is owned by Florida Power & Light (FPL). During talks, Suarez and FPL discussed whether mining facilities should be located near Turkey Point, even though the plant isn’t technically located in Suarez’s jurisdiction, but rather south of Miami on the shores of Biscayne Bay. Relying on Turkey Point to supply crypto investors, however, may not be wise. Indeed, the plant has faced stiff opposition from environmentalists, who charge FPL is responsible for dangerous leaks of hypersaline water.

Advocates worry such wastewater contains radioactive isotopes, which in turn pose a risk to drinking water stored in the Biscayne aquifer. Activists seek closure of the aging plant, which in any case is threatened by climate change itself. In fact, rising seas and hurricanes pose a risk to the plant as well as its cooling system. Worryingly, the Atlantic Ocean is projected to rise by more than two feet along South Florida’s coast by mid-century, and in tandem with such changes, the height of hurricane storm surges will also increase, in addition to flooding and damage. If anything, the “staggering scale of wreckage” linked to Hurricane Ian has only served to heighten such fears.

Bitcoin Bunker, sinking coastlines

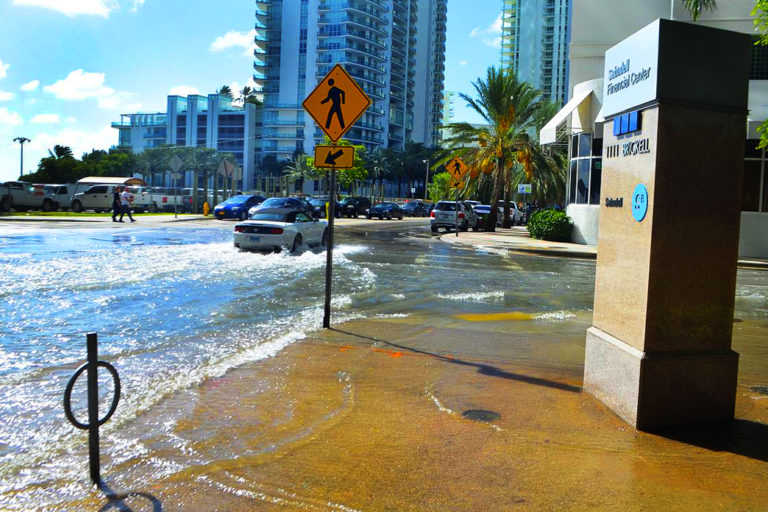

Hopefully, the demise of FTX will derail such vainglorious fantasies. But even without Sam Bankman-Fried playing an outsized role, crypto investors have contributed to global warming and Florida’s sinking coastline through energy-wasting crypto transactions. What is more, such investors have ironically participated in a real estate boom which is at the mercy of rising sea levels and climate change, from restaurants to spas to shops to nightclubs and hotels. “Miami and cryptocurrency truly are a match made in hell,” notes Miami New Times. “While the city is sinking beneath sea level with the rest of South Florida, digital currencies are also taking a nosedive into the drink.”

Rising sea levels threaten lucrative beachfront homes in Miami Beach and neighboring Indian Creek. Drain outlets are below high-tide level during surges, which leads to saltwater entering the drainage system, not to mention flooded roads. Unlike other coastal cities, Miami lies on a bed of silt which acts like a sponge, so seawater encroaches on freshwater aquifers. Because of these particularities, seawalls will do nothing to address the situation, and some politicians are openly advocating a “managed retreat.” Others have pushed for “resilience” and “green infrastructure” including dune restoration, sea grasses, coral reefs and mangroves. Looking to the past might make sense, since Miami Beach used to be a swamp, and mangroves were once plentiful. Startups, meanwhile, are pushing the notion of floating homes, but with a hefty price tag of $5.5 million, few will be able to embrace high-tech solutions.

In yet another ironic wrinkle, it would seem the wealthy could care less if one of their secondary beachfront residences winds up flooding, since condos are viewed as tradable commodities. “Billionaire Bunker” is an exclusive enclave located on Indian Creek Island near Miami Beach, and plays home to a rolodex of high-profile figures including Jared Kushner and Ivanka Trump, singer Julio Iglesias and investor Carl Icahn. Football quarterback Tom Brady, who has promoted FTX, also lives on the property. Though the island is exposed to flooding from climate change, that hasn’t stopped the crypto crowd from wanting to make a killing: one local mansion sells for an eye-watering $59 million, and purchasers may pay in Bitcoin. The “tropical modern playhouse” comes with a “prep kitchen,” gym, media room, four-car garage, dockage for yachts and “lush landscaping.” Ideally, real estate brokers believe the mansion might be suitable for a tech bachelor sporting an “extended entourage.”

It remains to be seen whether the fall of Bankman-Fried will lead local officials to rethink their messianic faith in crypto. While Suarez was previously bullish on crypto, the Miami mayor has been fairly quiet about the FTX implosion as of late. The demise of Bankman-Fried has hit Miami-Dade County and the Miami Heat “right in the arena,” however. Indeed, officials now want the bankrupt exchange company’s logo removed for its sports arena and have asked a federal judge to end FTX’s lucrative naming rights deal. Meanwhile, crypto investors have sued Bankman-Fried as well as “Bitcoin Bunker” quarterback Brady, claiming that FTX engaged in deceptive practices.

There are signs an environmental backlash against crypto may also be in the works. Recently, governor Kathy Hochul of New York signed the country’s first moratorium on crypto mining, which will temporarily halt new issuance and renewal of permits for two years. The bill applies to new fossil-fuel crypto plants relying on extensive amounts of energy to supply computers. The pause constitutes a victory for environmentalists, who argued that crypto undermined the state’s aspiration to reduce emissions. In recent years, there has been a proliferation of upstate crypto plants, which have repurposed aging aluminum mills and coal operations while spewing smoke into the air.

It is doubtful, however, whether such environmental consciousness can gain much traction in Florida, which has now become a deep red state, politically, in contrast to New York. While some Miami investors lament FTX’s fall, which has been “brutal” for crypto, others believe the city “has gained much from its association with crypto and stands to lose little from the current collapse of the industry.” In the long-run, there are hopes Miami’s links to crypto will transform the town from “just a tourism and hospitality enclave into a new and emerging global tech haven,” becoming the “next Silicon Valley of Web3.” It seems that even in the wake of deadly storms, eroding coastlines and climate change, Florida may not learn its lesson while continuing to pursue grandiose delusions of folly.

Nikolas Kozloff is the author of No Rain in the Amazon: How South America’s Climate Change Affects the Entire Planet, as well as scores of articles about the environment.

Related listening from Mongabay’s podcast: Author Brett Scott discusses the many pitfalls of cryptocurrencies for conservation and journalist Judith Lewis Mernit shares her reporting on the Bitcoin mining surge in Texas that spiked energy prices, listen here:

Related reading here at Mongabay:

Climate damage from Bitcoin mining grew more than 125 times worse in just five years

View targeted feeds![]() Twitter

Twitter![]() Instagram

Instagram![]() LinkedIn

LinkedIn![]() YouTube

YouTube

![]() Mastodon

Mastodon![]() RSS / XML

RSS / XML![]() Android mobile app

Android mobile app![]() Apple News

Apple News![]()

Mongabay is a U.S.-based non-profit conservation and environmental science news platform. Our EIN or tax ID is 45-3714703.![]()

© 2022 Copyright Conservation news

you're currently offline