(Bloomberg) — Analysts and investors are struggling to call a bottom in crypto stocks in the wake of a brutal month that ended with the head of BlackRock Inc. saying most digital-asset firms won’t survive.

Most Read from Bloomberg

China’s Covid Pivot Accelerates as Cities Ease Testing Rules

OPEC+ Pauses as Russia Sanctions and China Covid Rules Roil Crude Markets

OPEC+ Latest: Group Agrees to Keep Oil Production Unchanged

Elon Musk Says Apple Is ‘Fully’ Advertising on Twitter Again

This Stock Strategist Says We’ll See 5% Inflation for the Next Decade

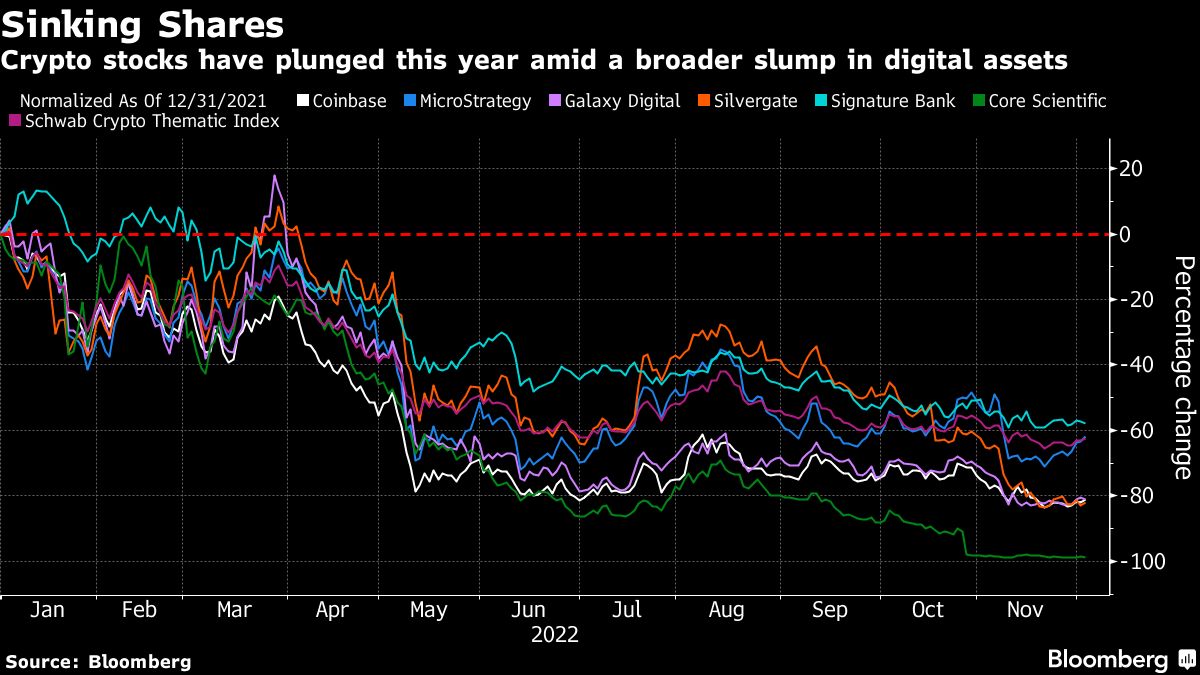

Cryptocurrency firms including Coinbase Global Inc., Galaxy Digital Holdings Ltd. and MicroStrategy Inc. all plunged more than 25% last month. The declines added to the pain of a dismal year amid a deep and extended plunge in Bitcoin and other digital tokens. While that trio of firms rallied this week, they’ve still wiped out roughly $52 billion of shareholder value in 2022.

Already reeling from the so-called crypto winter, investors were dealt a major blow with the high-profile collapse of Sam Bankman-Fried’s FTX exchange in early November, which sent Bitcoin tumbling. To top it off, BlackRock Chief Executive Larry Fink said this week that he expects most crypto companies will fold after FTX’s demise. A Schwab index tracking crypto-linked stocks is coming off its worst month since June, and is down 63% this year.

“Questions about whether crypto has a future have become prevalent after a year during which many tokens lost more than 70% of their value and the collapse of FTX has exacerbated a crisis of confidence that had started in the spring,” said Mark Palmer, an analyst at BTIG LLC.

Few, if any, companies connected to the sector have been spared during the selloff, with even banks like Silvergate Capital Corp. and Signature Bank taking hits. Mining stocks have been among the worst performers, with Marathon Digital Holdings Inc. and Hut 8 Mining Corp. both seeing their share prices cut roughly in half in November.

FTX’s sudden downfall sparked fears of contagion across the industry, which ultimately became a reality this week when crypto lender BlockFi Inc. also filed for bankruptcy.

“We expect the crypto space to continue to be toxic for investors in the near-term and expect overall chain activity to be relatively quiet among users as we continue to wait out potential contagion effects as a result of the bankruptcy of FTX,” Chase White, an analyst at Compass Point, wrote in a note to clients.

Silvergate now finds itself playing damage control. The company, whose shares tumbled by a record 52% in November, said several weeks ago that its exposure to FTX represented less than 10% of its digital-asset deposits. This week, it said exposure to BlockFi was less than $20 million.

It’s been a similar situation for Coinbase. Chief Executive Officer Brian Armstrong took to Twitter multiple times in recent weeks in an attempt to reassure investors that the cryptocurrency exchange remains on solid footing. So far, it seems to have done little to sway traders and analysts.

Coinbase closed at a record low on Nov. 21 and has been downgraded by analysts at firms including Bank of America Corp. and Daiwa Securities, leaving it with its lowest number of buy ratings since August 2021, data compiled by Bloomberg show. Coinbase shares just snapped a four-week slide, but they’re still down about 80% this year, erasing about $44 billion in value.

Cryptocurrency mining stocks have fared even worse as soaring energy costs add to the challenge of sinking cryptocurrency values. Core Scientific Inc. has seen its share price crumble nearly 99% this year. In its third-quarter earnings release, the company said losses for the nine months through September had reached $1.7 billion and it’s also said it might have to file for bankruptcy if it can’t find additional funding.

The slump in crypto-mining stocks is problematic for a group that was already struggling to pay back $4 billion in loans tied to mining-equipment.

Read more: Fink Says Most Crypto Firms Will Die Off Following FTX Implosion

To be sure, Fink, whose firm had invested roughly $24 million in FTX, said he still sees potential in the technology underlying crypto, including instant settlement of securities.

And some money managers see an opportunity in the beaten-down stocks. Cathie Wood’s Ark Investment Management added crypto investments in the weeks following FTX’s bankruptcy, including in Coinbase, Silvergate and the Grayscale Bitcoin Trust. Wood also told Bloomberg TV that she stands by her forecast that Bitcoin — which traded at roughly $17,000 on Friday afternoon in New York — will hit $1 million by 2030.

Most Read from Bloomberg Businessweek

11 Hours With Sam Bankman-Fried: Inside the Bahamian Penthouse After FTX’s Fall

TikTok’s Viral Challenges Keep Luring Young Kids to Their Deaths

Can Duolingo Actually Teach You Spanish?

Ryanair, EasyJet Scale Back in Germany Over Airport Fees

Forget Zoom Calls, Remote Work Startups Want to Build a Virtual Office

©2022 Bloomberg L.P.

Related Quotes

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to…

Imminent recession next year leads major banks to take necessary steps to maintain profitability. The development leads to bearish investor sentiments, with bank stocks ending in the red.

The stock market traded lower as corporate earnings weren't enough to allay investors concerns about interest-rate hikes.

Wake up and smell the diesel.

At age 51, Anne Schieber was broke and disillusioned. She had worked for the IRS for 23 years and was regarded as one of the agency’s top auditors. But she never got promoted and never earned more than $3,150 in a year. With half her life already behind her, her retirement prospects looked bleak. But Schieber had learned a powerful secret from years of studying the tax returns of America’s richest residents. Over the next 50 years, it earned her a 449,000% return — making Schieber one of the mos

Investors searching for that feeling telling you market sentiment is shifting to a more positive outlook have been brought down to earth again. Following 2022’s market behavior to a tee, the recent rally has run into a brick wall. To wit, the S&P 500 notched 5 consecutive negative sessions over the last week with investors mulling over the prospect of a recession. Indeed, financial experts have been sounding the warning bells on the precarious state of the global economy. One of the doomsayers h

The battery innovator is making progress on its lithium-metal batteries, but it still has a couple of years to go before it could start booking meaningful revenue.

ARK ETF Founder Cathie Wood joins Yahoo Finance Live for a wide-ranging interview on the state of the crypto market, Elon Musk, Fed policy, Teladoc, and more.

Yahoo Finance's Jared Blikre highlights which stocks are making moves at the end of the trading session on Thursday.

(Bloomberg) — While Elon Musk is busy overhauling newly acquired Twitter Inc., Tesla Inc. is facing increasingly urgent issues and testing the faith of some of its chief executive’s biggest fans.Most Read from BloombergTesla's Troubles Are Piling Up While Elon Musk Is Distracted With TwitterPutin Calls Russian Nukes Deterrent Factor, Says War Risk RisingWNBA Star Griner Freed in One-for-One Swap for Arms DealerElon Musk’s Bankers Consider Tesla Margin Loans to Cut Risky Twitter DebtPeru’s Presi

Analysts muse whether Verizon needs to do a transformative merger amid a rough stretch for its consumer wireless business.

JJK Research Associates Janet Joseph Kloppenburg joins Yahoo Finance Live to discuss Lululemon's latest earnings report, the designer brand's operating margins and forward outlook, and the brand's pricing after the Black Friday shopping event.

DocuSign (DOCU) delivered earnings and revenue surprises of 39.02% and 3.10%, respectively, for the quarter ended October 2022. Do the numbers hold clues to what lies ahead for the stock?

"Hyperscale spending continues strong, enterprise consumption continues strong and broadband deployment across North America, Europe and even parts of Asia continues their multiyear trend of growth," said CEO Hock Tan.

Carvana, which is best known for its "car vending machine" towers, challenged traditional used car dealerships with an e-commerce platform that enabled customers to easily secure financing, buy vehicles, and sell them online. Upstart challenged traditional credit reporting agencies by analyzing non-traditional data like a person's education, GPA, standardized test scores, and work history to help banks, credit unions, and auto dealerships approve loans. Carvana hit an all-time high of $370.10 last August, while Upstart closed at a record high of $390 last October.

After falling for much of the week, the major stock market indexes were gaining ground early Thursday as investors digested the latest unemployment numbers. Last week's initial jobless claims suggest the Federal Reserve's campaign to combat inflation may finally be bearing fruit. Investors used that positive development as an excuse to buy up their favorite beaten-down tech stocks.

The electric vehicle maker saw net loss widen to 1.65 billion yuan ($237.55 million) compared with a net loss of 21.5 million yuan a year ago for the third quarter ended Sept.30. Most auto makers have been hit by rising material costs and a global chip shortage, but Li Auto said that it was expecting higher deliveries and production scale up as global supply chain issues ease. Rivals Xpeng Inc and Nio Inc also reported wider losses owing to soaring inflation.

In this article, we will discuss the 15 best electric car stocks to buy now. If you want to explore similar stocks, you can also take a look at 5 Best Electric Car Stocks To Buy Now. The Electric Car Industry: An Analysis Electric car stocks are increasingly becoming a popular investment option as the […]

Novavax (NVAX) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

Shares of Summit Therapeutics (NASDAQ: SMMT) were skyrocketing 371.8% higher this week as of the market close on Thursday, according to data provided by S&P Global Market Intelligence. This huge gain came after the company announced on Tuesday that it's licensing bispecific antibody ivonescimab from Chinese drugmaker Akeso. Akeso will retain the rights to market the therapy throughout the rest of the world, including China.

Author

Administraroot