![]() Ekta Mourya

Ekta Mourya

FXStreet

Litecoin transaction count explodes on the world’s largest crypto payment processor BitPay. The altcoin outperformed other cryptocurrencies in the aftermath of FTX exchange collapse and ranks second to BTC in transaction count according to BitPay statistics.

Also read: Bitcoin dominance stagnates after FTX bankruptcy as investors pull out of BTC

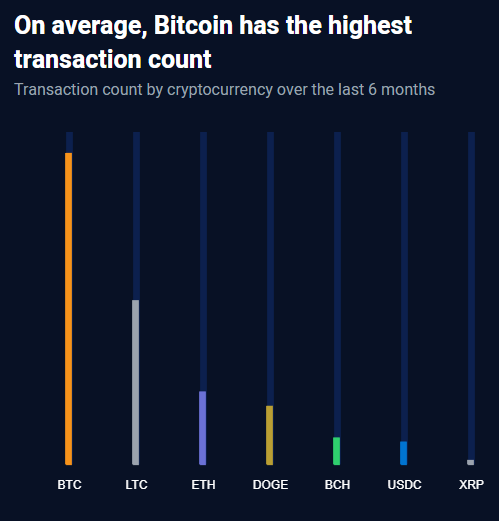

Litecoin, the 13th largest crypto by market capitalization witnessed a massive spike in its transaction count on payment processor BitPay. One of the world’s largest crypto payments processors, BitPay released its statistics for the last six months.

Based on data from the crypto payment provider, Litecoin ranks second to Bitcoin in transaction count.

Transaction count for last six months on BitPay

Litecoin ranks first among all other cryptocurrencies sans Bitcoin, Ethereum (ETH), Dogecoin (DOGE), Bitcoin Cash (BCH), USD Coin (USDC) and XRP. Litecoin’s increasing popularity is coupled by higher accumulation of the altcoin by large wallet investors in the network.

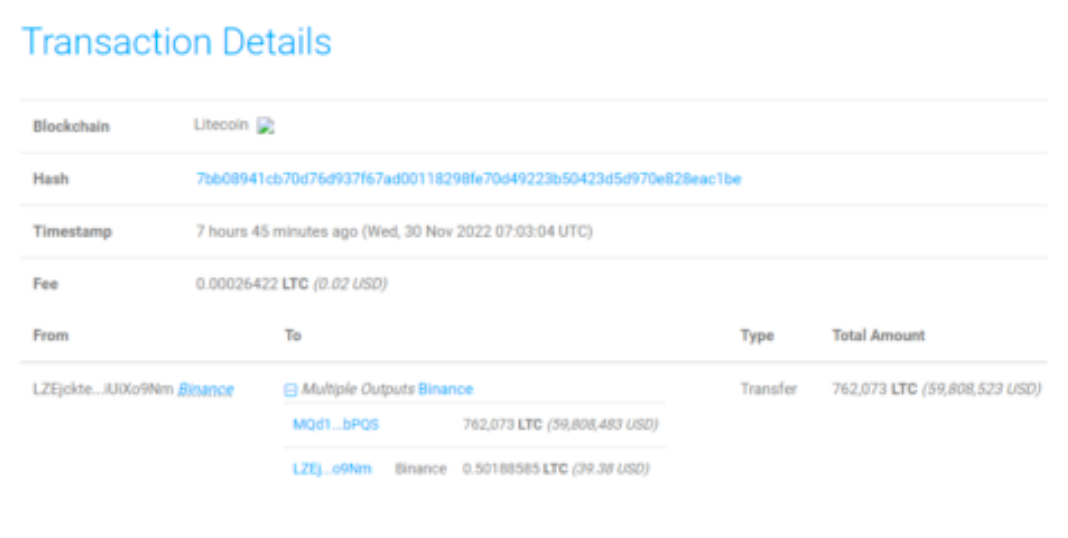

As per data from a large wallet tracker service Whale Alert, there were two large LTC transfers recently. The first accounted for $5.8 million in LTC and the second was worth $59.8 million. Find details of the second transaction below:

$59.8 million in Litecoin transferred by whale

Both transfers have the same sending and receiving addresses, implying that the same large wallet investor made both transfers. Exchange outflows are considered bullish for assets. Litecoin’s exchange outflow is therefore a bullish indicator for the asset.

Litecoin yielded 11.5% gains over the past month, outperforming other altcoins post the FTX exchange collapse. Based on the chart below, the 200-day Exponential Moving Average (EMA) at $68.89 and 50-day EMA at $67.44 are acting as support for altcoin.

Litecoin price is likely to face resistance at $85.03 in its uptrend and the target for the altcoin is $101.50.

LTC/USDT price chart

A decline below support at $68.89 could invalidate the bullish thesis for altcoin.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Ethereum price spiked up by 6% on December 8 after a brief consolidation. Ethereum (ETH) price shows a strong comeback as it follows in Bitcoin’s footsteps. This uptick coincides with ETH developers announcing the Shanghai hard fork release in March 2023.

Bitcoin has been the face of the crypto market and the Proof of Work (PoW) consensus method. But at the same time, it has also been the face of excessive energy consumption, sparking debates about curbing the impact of digital assets.

Ethereum is seemingly in a development streak ever since the network first experienced its biggest upgrade this year. The Merge, initiated the transition of the network from PoW to PoS, is set to be pushed further with “Shanghai”.

Dogecoin price has been outperforming the Shiba Inu price, but circumstances are subject to change. If market conditions persist, SHIB could gain market control and rally while DOGE heads for lower targets. Dogecoin price pulled off an astonishing uptrend rally during the fall.

A massive bullish move is coming. In the last two articles, we have taken a look at why this is possible from a technical and on-chain perspective. In this weekly forecast, we will take a look at Bitcoin’s monthly performance for the last decade and determine if this bullish outlook is possible.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and omissions may occur. Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, clients or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.