Global Cryptocurrency Exchange Platform Market

Dublin, Nov. 23, 2022 (GLOBE NEWSWIRE) — The “Cryptocurrency Exchange Platform Market Size, Share & Trends Analysis Report by End-use (Commercial, Personal), by Cryptocurrency Type (Bitcoin, Ethereum), by Region (EU, APAC, North America), and Segment Forecasts, 2022-2030” report has been added to ResearchAndMarkets.com’s offering.

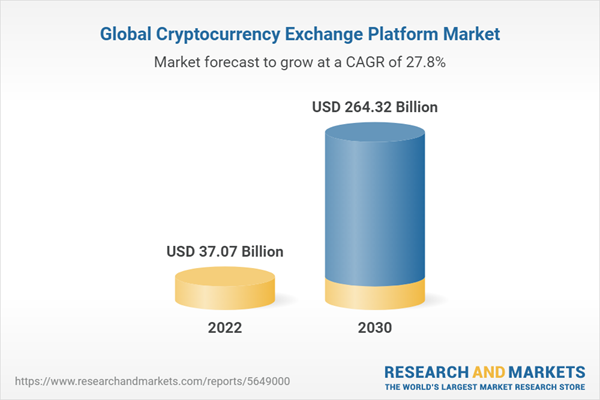

The global cryptocurrency exchange platform market size is expected to reach USD 264.32 billion by 2030, growing at a CAGR of 27.8% from 2022 to 2030, according to this study conducted.

The rising awareness about cryptocurrencies and their advantages, such as flexibility and security, is driving the industry’s growth. The strong emphasis on secure and decentralized networks owing to the emergence of blockchain technology also bodes well with the market growth. Several market players have invested in research and development activities to introduce advanced innovative exchange platforms.

For instance, in July 2022, Billium, an exchange based in Dubai, announced the launch of a new-age platform to carry out decentralized transactions more effectively and efficiently. It is integrated with a copy trading function named ‘Billium Copy Trading’, which will allow novice users to follow the trades of the professionals.

The growing popularity of cryptocurrencies led several financial services companies to collaborate with cryptocurrency exchanges to enhance their service offerings. For instance, in March 2021, Visa, Inc. announced to settle transactions in U.S. Dollar Coin (USDC) on Ethereum with cryptocurrency partners.

In March 2021, Visa, Inc. accepted its first settlement in USDC from its crypto wallet partner Crypto.com. Such developments are expected to propel industry growth over the forecast period.

The outbreak of the COVID-19 pandemic is expected to play a decisive role in driving the industry over the forecast period. Investors worldwide have shifted their interest toward cryptocurrencies as the cryptocurrency segment is decentralized. In addition, as it is not governed by any central authority, it eliminates the political influence during troubled times, such as the pandemic.

Report Attribute

Details

No. of Pages

130

Forecast Period

2022 – 2030

Estimated Market Value (USD) in 2022

$37.07 Billion

Forecasted Market Value (USD) by 2030

$264.32 Billion

Compound Annual Growth Rate

27.8%

Regions Covered

Global

Cryptocurrency Exchange Platform Market Report Highlights

The Ethereum segment is expected to witness a significant CAGR over the forecast period owing to its dominance in the Decentralized Finance (Defi) space

Moreover, the growing number of Non-Fungible Token (NFT) projects is expected to increase the demand for Ethereum exchanges

The personal end-use segment is expected to witness the fastest CAGR over the forecast period

The growth is due to the rising awareness about cryptocurrencies in developing countries, such as Nigeria and the Philippines, and the growing emphasis on digital currencies in developed countries, such as the U.S., Canada, Japan, and others

Asia Pacific is expected to witness the fastest CAGR over the forecast period due to technological advancements and rising awareness about blockchain technology

People in the region are inclined toward cryptocurrency investment as an alternative to traditional investment options, thereby increasing the need for cryptocurrency exchange platforms

Key Topics Covered:

Chapter 1 Methodology and Scope

Chapter 2 Executive Summary

Chapter 3 Cryptocurrency Exchange Platform Industry Outlook

3.1 Market Segmentation and Scope

3.2 Market Size and Growth Prospects

3.3 Cryptocurrency Exchange Platform Market – Value Chain Analysis

3.4 Cryptocurrency Exchange Platform Market – Market Dynamics

3.4.1 Market driver analysis

3.4.1.1 Growing Popularity of mobile-based trading platforms

3.4.1.2 Rising awareness of blockchain technology

3.4.2 Market challenge analysis

3.4.2.1 Absence of uniform standards for cryptocurrency exchanges

3.5 Penetration and Growth Prospect Mapping

3.6 Cryptocurrency Exchange Platform Market – Porter’s Five Forces Analysis

3.7 Cryptocurrency Exchange Platform Market – PESTEL Analysis

Chapter 4 Investment Landscape Analysis

4.1 Investor Strategies

4.2 Investor Vision & Goal Analysis

4.3 Funding Raised By Cryptocurrency Exchange Platform Providers

Chapter 5 Cryptocurrency Exchange Platform Cryptocurrency Type Outlook

5.1 Cryptocurrency Exchange Platform Market Share By Cryptocurrency Type, 2021

5.2 Bitcoin

5.2.1 Bitcoin cryptocurrency exchange platform market, 2017 – 2030

5.3 Ethereum

5.3.1 Ethereum cryptocurrency exchange platform market, 2017 – 2030

5.4 Cardano

5.4.1 Cardano cryptocurrency exchange platform market, 2017 – 2030

5.5 Solana

5.5.1 Solana cryptocurrency exchange platform market, 2017 – 2030

5.6 Others

5.6.1 Others cryptocurrency exchange platform market, 2017 – 2030

Chapter 6 Cryptocurrency Exchange Platform End-use Outlook

6.1 Cryptocurrency Exchange Platform Market Share By End-use, 2021

6.2 Commercial

6.2.1 Commercial cryptocurrency exchange platform market, 2017 – 2030

6.2.1.1 Banks cryptocurrency exchange platform Market, 2017 – 2030

6.2.1.2 Fintech companies cryptocurrency exchange platform Market, 2017 – 2030

6.2.1.3 Credit unions cryptocurrency exchange platform Market, 2017 – 2030

6.2.1.4 Others cryptocurrency exchange platform Market, 2017 – 2030

6.3 Personal

6.3.1 Personal cryptocurrency exchange platform market, 2017 – 2030

Chapter 7 Cryptocurrency Exchange Platform Regional Outlook

Chapter 8 Competitive Analysis

8.1 Recent Developments & Impact Analysis, By Key Market Participants

8.2 Company Categorization

8.3 Vendor Landscape

8.3.1 Key company market share analysis, 2021

8.4 Company Analysis Tools

8.4.1 Company market position analysis

8.4.2 Competitive dashboard analysis

Chapter 9 Competitive Landscape

9.1 BlockFi International Ltd.

9.1.1 Company overview

9.1.2 Financial performance

9.1.3 Product benchmarking

9.1.4 Strategic initiatives

9.2 Coinmama

9.2.1 Company overview

9.2.2 Financial performance

9.2.3 Product benchmarking

9.2.4 Strategic initiatives

9.3 eToro

9.3.1 Company overview

9.3.2 Financial performance

9.3.3 Product benchmarking

9.3.4 Strategic initiatives

9.4 Coinbase

9.4.1 Company overview

9.4.2 Financial performance

9.4.3 Product benchmarking

9.4.4 Strategic initiatives

9.5 Binance

9.5.1 Company overview

9.5.2 Financial performance

9.5.3 Product benchmarking

9.5.4 Strategic initiatives

9.6 Kraken

9.6.1 Company overview

9.6.2 Financial performance

9.6.3 Product benchmarking

9.6.4 Strategic initiatives

9.7 Bitstamp

9.7.1 Company overview

9.7.2 Financial performance

9.7.3 Product benchmarking

9.7.4 Strategic initiatives

9.8 Coincheck, Inc.

9.8.1 Company overview

9.8.2 Financial performance

9.8.3 Product benchmarking

9.8.4 Strategic initiatives

9.9 FTX Trading Ltd.

9.9.1 Company overview

9.9.2 Financial performance

9.9.3 Product benchmarking

9.9.4 Strategic initiatives

9.10 AirSwap

9.10.1 Company overview

9.10.2 Financial performance

9.10.3 Product benchmarking

9.10.4 Strategic initiatives

For more information about this report visit https://www.researchandmarkets.com/r/5bi7rc

Attachment

Global Cryptocurrency Exchange Platform Market

BlockFi user and investment adviser Steve Snowden shared his experience losing $2,500 after crypto lender BlockFi paused services due to "significant exposure" to FTX.

Bitcoin fell Monday on fears Grayscale Bitcoin Trust could be hit by Digital Currency Group's liquidity crunch as Genesis warns of bankruptcy

Be greedy (and lazy) when others are fearful.

Warren Buffett — the Oracle of Omaha — is widely regarded as one of the greatest investors of all time. Berkshire Hathaway Inc. (NYSE: BRK-A) has returned tens of thousands of percent over the years and consistently outperforms the market. Buffett purchased the company for just $8.3 million in 1965, and it’s now valued at nearly $700 billion, roughly a 10 million percent return. But one of Buffett’s top all-time picks and longest-held positions is one you might not expect. Berkshire Hathaway fir

Concerns surrounding the growth of big tech do not apply to George Soros. The Federal Reserve's decision to aggressively raise interest rates to fight inflation, which is at a 40-year high, threatens to push the economy into a recession, many analysts say. This inflation, which is particularly impacting consumers, is a huge problem for the technology sector, because tech products and services are the first to suffer from spending cuts.

Among the telecoms is Verizon Communications (NYSE: VZ), the second-largest provider behind AT&T. The stock sports an attractive 6.89% dividend yield, which also places it in red-flag territory. Often, when a stock's dividend yield rises higher than 5%, it's seen as a warning sign that the company won't be able to pay its dividend obligations sustainably. Should Verizon shareholders be concerned?

Tough times are coming. But you can still make money.

What time does the stock market close the day before Thanksgiving? Is the stock market open on Black Friday?

The Nasdaq Composite (NASDAQINDEX: ^IXIC) rose almost 1%, and while gains for the S&P 500 (SNPINDEX: ^GSPC) and Dow Jones Industrial Average (DJINDICES: ^DJI) were more measured, there was still palpable optimism among investors going into the Thanksgiving break. One trend that has picked up lately has been interest from companies looking to make strategic moves in the merger and acquisition (M&A) market. On Wednesday, both Coupa Software (NASDAQ: COUP) and Manchester United (NYSE: MANU) experienced sizable gains on reports that the companies might be putting themselves up for sale or have attracted interest from a potential acquirer.

FTX collapsed. These players held the keys.

Yahoo Finance Live examines AMC shares after Amazon's invests in in-person movie releases for its content.

The legendary investor continues to amass shares of the electric vehicle maker despite the stock market slump.

FTX lawyers say a substantial amount of assets are missing or stolen in latest bankruptcy proceedings; Cathie Wood still sees Bitcoin at $1 million

Some Twitter employees who chose to stay at the company as it transformed to "Twitter 2.0" are being shown the door.

(Bloomberg) — In the wake of the spectacular meltdown of Sam Bankman-Fried’s crypto empire, many investors are looking for early warning signs that may have foretold the contagion that was about to unfold. One possibility? Coinbase Global Inc.’s junk bonds.Most Read from BloombergElizabeth Holmes Judge Proposes Texas Prison, Family VisitsMost Fed Officials Seek to Slow Pace of Interest-Rate Hikes SoonTrump Had Losses of $900 Million in Two Years, Jury ToldFrom Tom Brady to Shaq, FTX’s Celebrity

Market conditions these days are best described as ‘unsettled.’ Inflation was lower in the October print, but remains stubbornly high, while the Fed’s reactive interest rate policy is pushing up the price of capital, but has not yet constricted retail or other purchasing activity – or inflation. Other headwinds include continued bottlenecks in global supply chains, made worse by recurring COVID lockdown policies in China, and the ongoing Russian war in Ukraine. So, should investors stick to a de

In 2017, business magnate Warren Buffett did something that’s somewhat unusual for him. He poured hundreds of millions of dollars into a real estate investment. Buffett has been dismissive of real estate investing in the past. He’s called it a “lousy investment” in part because real estate can be expensive to maintain. Real estate also often requires “sweat equity” or the physical effort needed to upgrade properties or simply keep them from falling into disrepair. Yet in 2017, Berkshire Hathaway

Shares of Brazilian fintech PagSeguro Digital (NYSE: PAGS) were plummeting on Wednesday, declining about 18% as of 1:28 p.m. ET. The company, which is a payments processor for small and medium-sized merchants in Brazil, as well as a digital bank for Brazilian merchants and consumers alike, reported third-quarter earnings today. In the third quarter, PagSeguro's revenue rose 45% to just over 4 billion reals, which seems like a strong result, given all of the economic headwinds in Brazil and across the world.

The FDA just approved its most expensive drug ever — a hemophilia gene therapy from Carlisle and UniQure — and QURE stock popped Wednesday.

Intel Corp. (Nasdaq: INTC) said in a filing this week it would alter the CEO Pat Gelsinger's stock awards, changing the metrics for him to earn stock awards. The changes "increase the stock price performance hurdles for certain awards" and "provide even greater alignment with stockholders by lengthening the period during which stock price performance hurdles must be maintained." According to Intel's SEC filing Tuesday, Gelsinger's amended compensation raises the threshold for Gelsinger's performance-based awards.