While there are several NFT marketplaces to choose from when buying your digital assets, it is inefficient to constantly switch between them when trading. Another problem in the fragmented market is having to pay gas fees more than once when buying from different marketplaces.

NFT aggregators allow people to buy multiple NFTs from various platforms in bulk, thereby saving on gas fees and being efficient. Beyond that, aggregators are also experimenting with novel models for NFT trading, namely AMM marketplace, pledging and NFT tokenization.

Will they become the go-to places to buy NFTs?

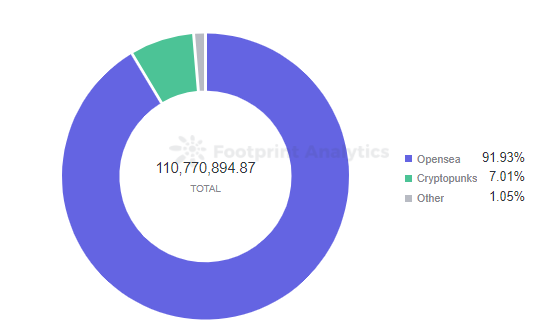

From 2016 to 2018, the first NFT trading marketplaces—OpenSea, MakersPlace, and SuperRare—emerged. Since then, OpenSea has occupied more than 90% of the market share, despite its unstable trading system, hacking attacks, and even scandals such as the theft of user NFT assets.

Footprint Analytics – Trading Volume by Marketplace – 2021

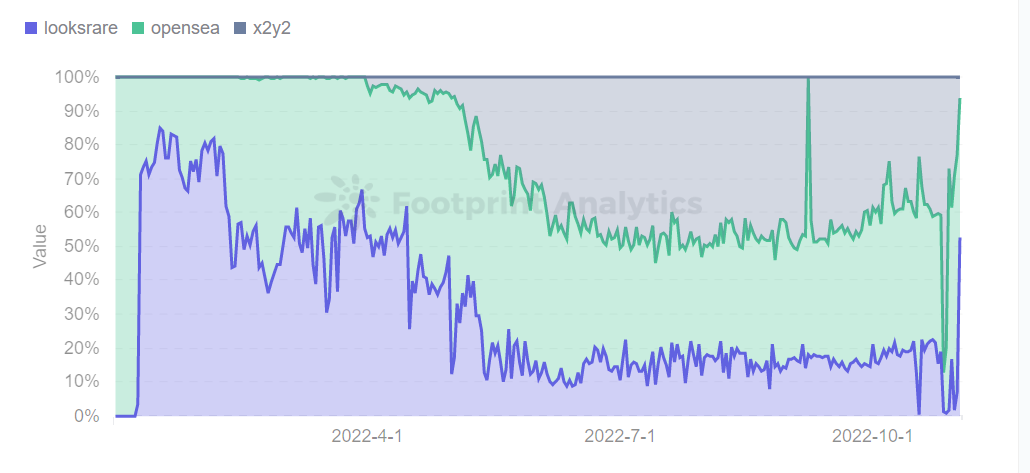

At the beginning of 2022, X2Y2 and LooksRare both started to challenge OpenSea with decentralization, lower fees, and platform revenue sharing. This began to divide the NFT market.

Footprint Analytics – Market Share of OpenSea & LooksRare & X2Y2 Volume

However, these platforms were slow to address problems with batch buying, which is where NFT aggregation platforms gained a foothold.

Footprint Analytics – NFT Aggregator List Based on 90 Days

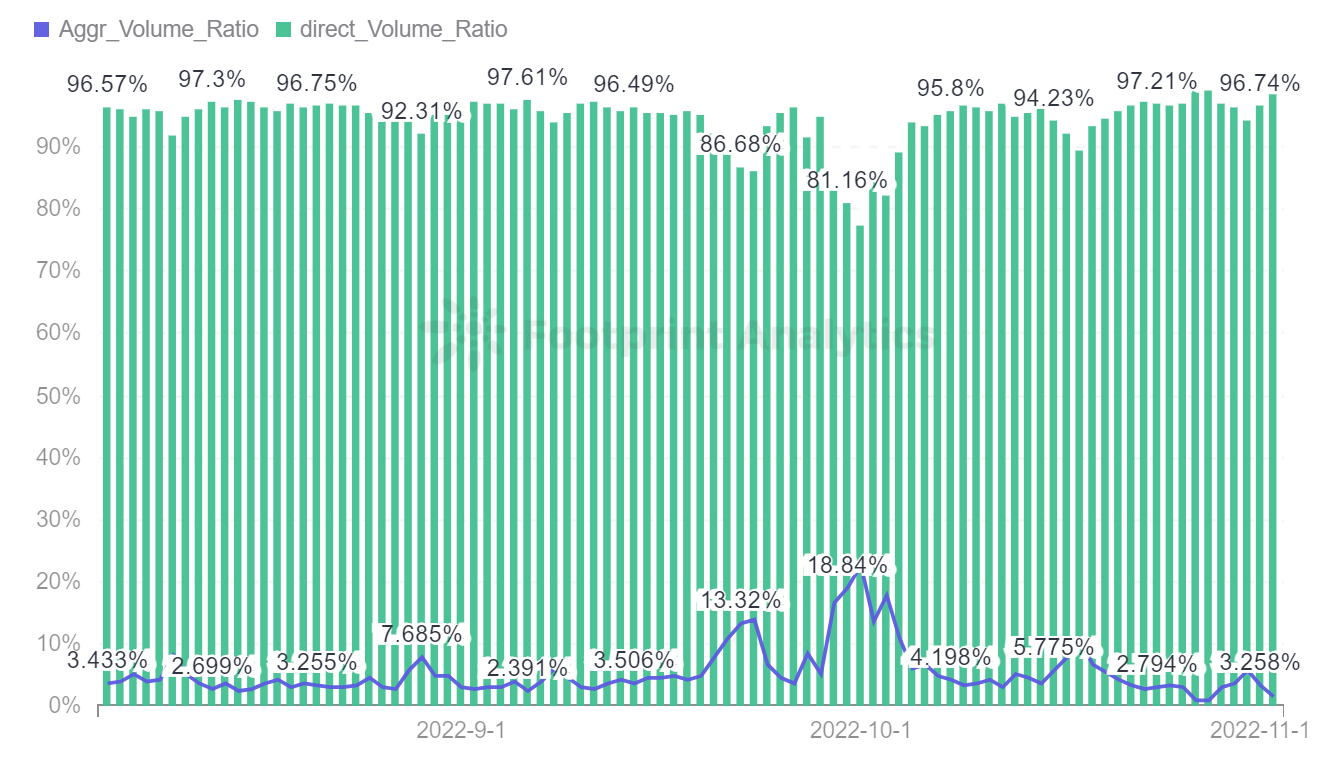

According to Footprint Analytics, the proportion of transactions on Ethereum-based aggregated trading platforms (13 platforms) gradually increased from August to October, reaching a maximum of more than 18%, and then resumed normal transactions. This indicates a trend in which the NFT market is gradually entering into aggregated transactions.

Footprint Analytics – Aggregator Daily Ratio

However, many developers are beginning to seek value innovation, chasing advantages such as greater convenience and faster efficiency. There are clear boundaries between existing markets, and which types of services users need are created.

In turn, OpenSea has upgraded its product and acquired competitors.

There is the promise of a comprehensive marketplace improvement through various features, low fees and time cost of searching for NFTs. For example, Element aggregates layouts from all the most popular blockchains (Ethereum, BNB Chain, Polygon, Avalanche and Solana) to enable cross-chain transactions and expand the user base.

The emergence and development of various aggregated trading markets, for users to reduce the tedious operation of a transaction, allowing users to batch listing and purchase operations, reducing transaction costs and the time cost of searching NFT.

OpenSea has had a near-monopoly on NFT trading for several years. Even as other marketplaces launched with competitive features, it has been the go-to platform for buying and selling NFTs. However, NFT aggregators have emerged with unique models and solutions to problems in the industry.

This piece is contributed by Footprint Analytics community.

The Footprint Community is a place where data and crypto enthusiasts worldwide help each other understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the fledgling world of blockchain. Here you’ll find active, diverse voices supporting each other and driving the community forward.

Footprint Website: https://www.footprint.network

Discord: https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_Data

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.

Previous Article

Next Article

Coin Rivet 2022 © | All rights reserved

Privacy Policy | Cookie Policy | Cookie Preferences

Author

Administraroot