![]() Ekta Mourya

Ekta Mourya

FXStreet

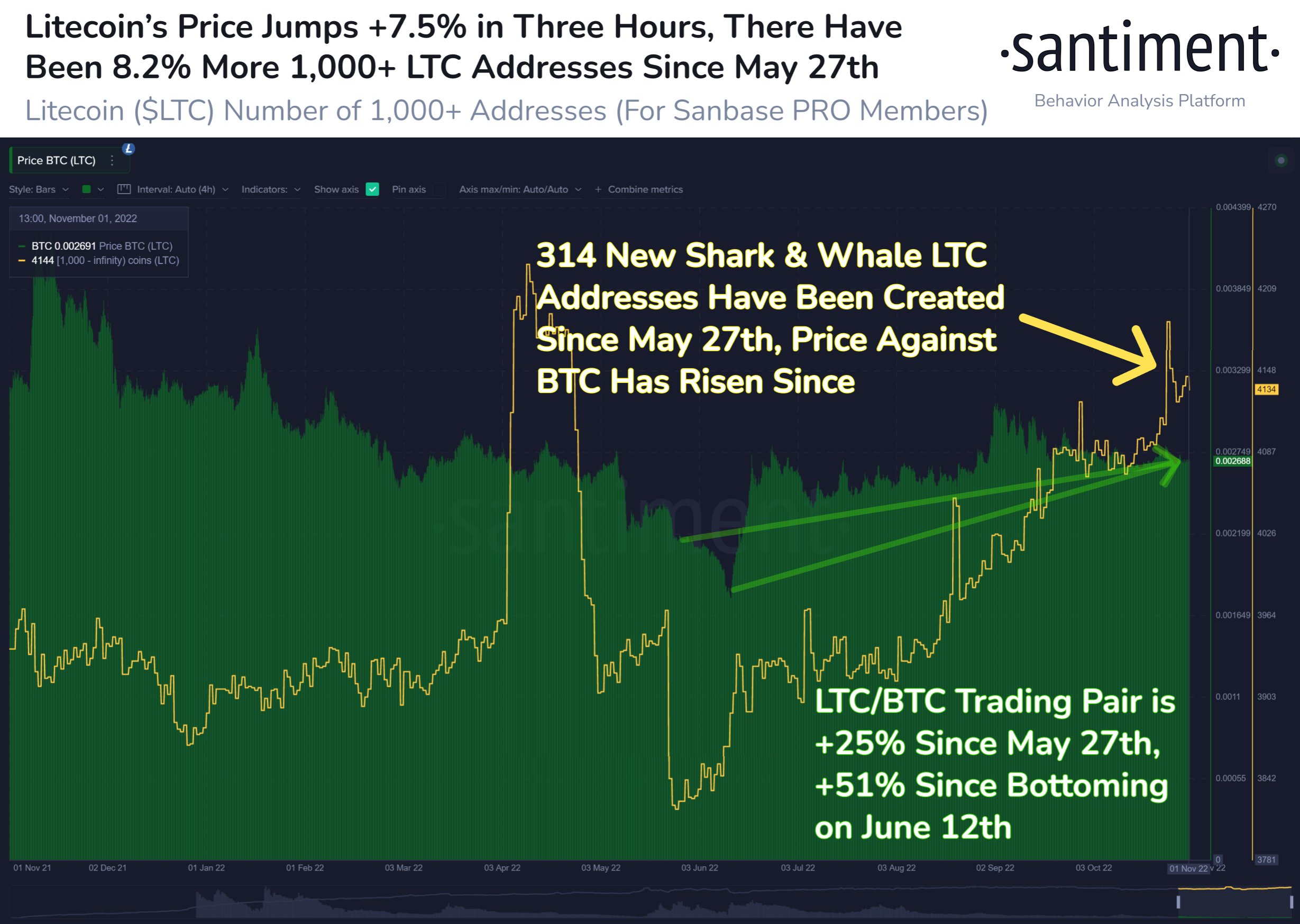

Moneygram, a global peer-to-peer payments company announced that users in nearly all US states and the District of Columbia can buy, sell and hold Litecoin and other cryptos. Based on data from a crypto intelligence platform, Litecoin recently decoupled from altcoins and posted a massive rally against Bitcoin.

Also read: XRP Price: NFTs arrive on XRP Ledger Mainnet, what to expect

Santiment, a leading crypto intelligence platform noted that Litecoin price is rallying after temporary decoupling from the cryptocurrency market. The decentralized peer-to-peer cryptocurrency has witnessed a rise in the number of addresses holding 1,000 or more LTC.

LTC/BTC price chart and Litecoin address growth

Litecoin has added 314 new shark and whale addresses; these wallets hold large volumes of LTC and contribute to a spike in on-chain activity.

Since mid-June 2022, Litecoin’s price against Bitcoin increased 51%. LTC/BTC pair has therefore yielded holders upwards of 50% gains in the ongoing bear market. Several key factors have contributed to Litecoin’s price rally. MoneyGram, a global leader in digital payments, announced on November 1 that users in nearly all US states and the District of Columbia can buy, sell and hold Litecoin.

MoneyGram announces the launch of a new service enabling consumers to buy, sell and hold cryptocurrency via The MoneyGram App. This feature gives customers in nearly all U.S. states the ability to trade and store BTC, ETH and LTC.

Read more: https://t.co/13TzRJlSPc pic.twitter.com/FixCCJc0Jc

The announcement applies to cryptocurrencies like Bitcoin and Ethereum as well. The payments giant now supports the purchase and sale of these cryptocurrencies via MoneyGram mobile app.

Analysts evaluated the LTC/USDT price chart and presented a bullish outlook. The recent activity in Litecoin price has been noted after months of consolidation at the $55 level. Litecoin price is now past the key resistance level at $60, which has acted as a barrier to a break out on several occasions.

Interestingly, the Relative Strength Index has risen considerably from 39 a few days ago to 68, close to the oversold region. This movement indicates a strong positive momentum and complements the price rally. LTC could continue its climb till RSI hits 70 and crosses over into the overbought territory.

LTC/USDT price chart

Khashayar Abbasi, crypto analyst argues that Litecoin’s 200-day MA sits directly above the current price at $60.66. This is the most significant resistance level for the altcoin and above this there is a possibility for a substantial rally towards $125.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

XRP price shows a tight-range formation after the Fed decided on a 75 basis points hike on November 2. This decision triggered a spike in volatility, but Ripple has managed to hold above a stable support barrier. The remittance token is likely to provide an accumulation opportunity for patient holders.

Banks and governments around the world are considering blockchain technology as the next step in technological advancements. Singapore incorporated this technology with DeFi into testing cross-country institutional digital asset trading.

Binance is the biggest cryptocurrency exchange and also operates the fourth biggest cryptocurrency in the world. However, the company does not plan on stopping there as Binance’s CEO indicates the company’s intention of possibly acquiring banks.

Solana price is declining in a free-fall fashion following the recent Fed meeting. Key levels have been defined to gauge a potential landing zone for the centralized smart-contract token. Solana price shows concern during the first week of November.

Bitcoin price is reacting well to the bullish developments that have been taking place over the last month or so. A recent breakout could be the start of a prolonged move up when looked at via the lens of Bitcoin’s historical performance in Q4s stretching over the last decade.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and omissions may occur. Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, clients or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.