pixelparticle/iStock via Getty Images

pixelparticle/iStock via Getty Images

Quant (QNT-USD) was founded in 2015 by Gilbert Verdian with the vision of creating a fully interoperable blockchain environment. A lot of blockchains cannot operate with each other, which stands in the way of innovation. Quant is essentially a blockchain Operating System. The software connects different blockchain networks through its Overledger OS.

In theory, this technology has the potential to create a completely integrated blockchain ecosystem. The lack of interoperability between blockchains has been one of the major obstacles to the fast adoption of crypto, NFTs, the metaverse and all imaginable systems and applications that can be built in Web3.

Quant will also facilitate the transfer of value among different Distributed Layer Technologies (DLTs). With the technology Quant is building, organizations will be able to orchestrate transactions between different authorized DLTs.

Quant aims to become the go-to protocol of Web3 just like TCP/IP became the protocol standard for inter-networking on the Internet. TCP/IP stands for Transmission Control Protocol/Internet Protocol; the invention of TCP/IP allowed siloed sections of the Internet to communicate with each other, no matter the location or operating systems used.

Quant aims to connect different blockchain networks regardless of their consensus mechanism or distributed ledger. Blockchains at the moment are almost completely isolated from each other and find it difficult to interact. To interact with two blockchains at the same time, developers must understand how both blockchains work, and develop an application accordingly.

Bridges to move tokens from one blockchain to another have been created by blockchain companies to facilitate this inter-chain interaction; bridges create wrapped tokens to replicate a token on another blockchain by locking the real token in a contract, exchange, or atomic swap. However, bridges are difficult to create, extremely complex and often vulnerable to devastating hacks.

Quant’s solution to the blockchain interoperability problem focuses solely on the information inside a blockchain transaction and doesn’t care about the channel the transaction originated from. Quant uses Application Programming Interfaces (APIs) to create the parameters that allow blockchains to exchange data with each other without having to know everything about the channel the data originated from or the sender of the data.

The Quant network achieves this chain-agnostic data transfer method by using different layers in the data transfer process.

The Transaction Layer: When transactions are initiated, this layer stores and queues them. This layer also performs the cross-consensus and transaction validation operations.

The Messaging Layer: This layer takes care of the data transfer of smart contract data, metadata and transaction data. The messaging layer extracts the main information needed to process and send data. At this layer, Metadata is used to interpret and translate messages for each blockchain to understand.

The Filtering and Ordering Layer: This layer checks if sent data and messages meet the requirement of the recipient channel. For example, a Multi-Chain Decentralized Application (MAPP) may accept only a minimum number of coins. If coins are below that minimum, the transaction will be declined. The Filtering layer does the job of checking beforehand if certain requirements are met.

The flagship system developed by Quant Network, called Overledger Operating System (OS), allows developers to build MApps. MApps are decentralized applications that store data and transact on multiple blockchains or systems at once. According to Quant, Overledger is not another blockchain; Overledger sits on top of blockchains and provides a meta-gateway.

The great thing about MApps is that they can be built using different blockchains. Quant will allow developers to easily be able to write code that interacts with all the blockchains in a cohesive way.

Deploying Overledger for an organisation is very simple, it only takes 3 lines of code to connect to the API. Overledger also acts as a “node provider”, like Infura or Quicknode. Overledger offers access to all nodes, DLTs and databases created and managed by other users.

Of course, QNT is the native token of QUANT, and it is necessary to carry out transactions.

Quant Network has secured interesting partnerships, including a partnership with US software giant Oracle. In 2019, Quant Network was accepted into the Oracle Start-up Ecosystem.

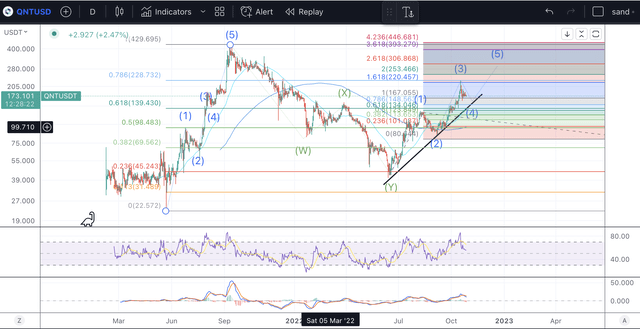

The chart on QNT has given us some clear indications that the token may have bottomed already, but a large pull-back is still in the cards.

QNT Price Analysis (Author’s work)

QNT Price Analysis (Author’s work)

We can see that QNT completed a five-wave move-up in September, which took it all the way to $429. Since then, we have retraced all the way down to the 76.4% retracement, where we may have bottomed in June.

Since then, we have formed a clear five-wave structure, and it looks like we are now in wave 4. Using trend-based fib extensions, we can see that wave 3 reached the 1.618 targets, and I’d expect the final wave 5 to take us all the way towards $253.

Bear in mind, this would signify the end of an initial large degree wave I up, which means we should get a retracement in wave II that can take us back towards the $70 level. This would be the ideal entry in terms of risk/reward.

Quant is a solid and ambitious project, but its MApps will not likely take over DApps. Some developers would cite latency concerns as MApps first need to communicate with Quant’s Overledger before data is routed by the filtering layer to the specific blockchain in the transaction; meanwhile, DApps work directly on-chain with no intermediary.

Quant requires identity checks before a user can access its mainnet. This has been largely criticized by the crypto community.

Overledger APIs are also not yet full-fledged; only options like “Create and Sign a transaction,” “Search Addresses”, and “Subscribe to Address Changes” are currently available. Having ended its ICO in 2018, Quant has under-delivered in four years, which is a lot of time to develop a quality, full-fledged product.

Some of Quant’s partnerships are also stuck in the mud. Its 2020 announced partnership with Sia has not yielded any results in terms of products of active collaboration. Most of Quant’s other partnerships are similarly “stagnant.”

Quant has done a good job of marketing its brand, even without a real, working solution to the interoperability challenges it claims to solve.

QNT has very attractive tokenomics. Its total supply is 14,612,493 QNT of which more than 80% are in circulation, and no further minting of QNT will occur. With almost all the existing supply in circulation, there is no inflation risk. Quant is highly hyped. It has enjoyed a good price rally as a result of the hype. Generally, in crypto, good hype equals good token price. Enjoy the Quant hype while it lasts!

This is just one of many exciting cryptocurrencies you can buy right now!

Join Technically Crypto to stay ahead of the latest news and trends in the crypto space. Learn the ins and outs of blockchain technology and how you can profit from it. Here’s what you will get with your subscription:

Here’s what you will get with your subscription:

– Access to our Crypto Portfolio.

– On-chain analysis of Bitcoin and Ethereum.

– Deep dive reports on Altcoins.

– Technical Analysis of major cryptocurrencies.

– News updates.

Crypto is changing the future, don’t just watch it, be a part of it!

This article was written by

The Value Trend is now The Digital Trend.

We believe the greatest opportunities of the next decade will be in innovative technologies and cryptocurrencies, so this is where we focus our analysis.

We felt a brand update would help our readers better understand our work.

The world is turning digital and so should your portfolio!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in QNT-USD over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.