![]() Ekta Mourya

Ekta Mourya

FXStreet

Bitcoin price trend remained undecided as the asset sustained above $19,000 through the release of CPI data and US FOMC minutes. Analysts focus on total altcoin market capitalization, to identify a breakout in crypto within the next week.

Also read: Shiba Inu holders get bullish as Shiba Eternity rating climbs on Play Store

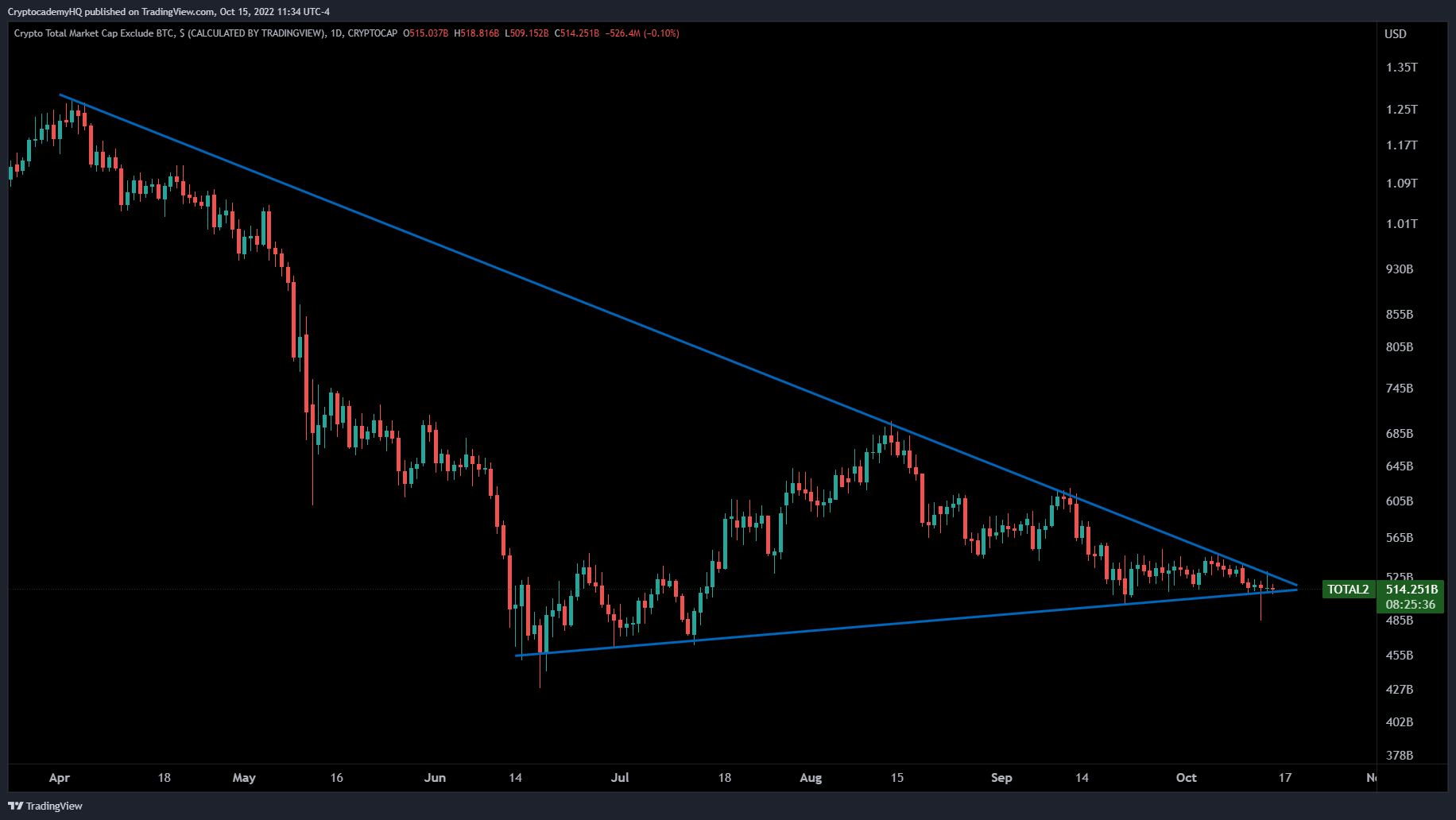

Justin Bennett, an internationally recognized Forex trader and crypto analyst evaluated the total altcoin market capitalization and predicted a breakout in cryptocurrencies by mid-week. The analyst noted that altcoin market capitalization is coiling inside a four-month terminal pattern after a recovery on Thursday.

Bennett expects an explosive break from cryptocurrencies in either direction, by October 19, Wednesday at the earliest. Bennett has accurately timed breakouts in Bitcoin, Ethereum and altcoins in the top thirty in the past. This prediction of a breakout therefore implies either Bitcoin could witness a spike in dominance or lose its key support at $19,000 and witness a decline.

Total altcoin market capitalization

According to Bennett, the quiet period for cryptocurrencies is about to end, and traders need to prepare for volatility in the week ahead. Bennett addressed his setup and recommendation in a recent tweet. The analyst was quoted as saying:

Some of you apparently think I'm far more bullish than I am. I'm not a permabull or permabear. I'm a trader, so I respect the charts. Period. Bitcoin can break higher, lower, or continue to go sideways. There will be opportunities regardless.

TechDev_52, a crypto analyst and trader spotted a 14-18 month BTC corrective wave that continues to develop. The analyst has identified the wave and believes Bitcoin price is ready for a correction in the short-term and reveals a bearish outlook.

BTC price ready for correction

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Bitcoin price shows a continuation of the bear flag setup with no signs of invalidation yet. A daily close above $19,516 will be the first sign of a bullish resurgence. If buyers manage to flip the $20,737 barrier into a support level, it will invalidate the bearish outlook.

Shiba Inu ecosystem’s collectable card game, Shiba Eternity, received a 4.9 out of 5 rating from users. This puts the game in the list of top games on the play store. Analysts retain their bullish outlook on Shiba Inu.

Within days of Judge Analisa Torres’ approval of request, Tapjets a private jet charter company filed its amicus curiae brief supporting Ripple’s summary judgment motion against US regulator SEC.

Analysts on crypto Twitter are looking for the next 1000x altcoin and evaluating hordes of DeFi tokens and altcoins. Based on their bullish potential, analysts have picked Quant (QNT), Ethereum Name Service (ENS) and Maker (MKR).

Bitcoin price triggered a bullish reversal after October 13 CPI that is reminiscent of the July 13 events. The transaction data shows that a flip of $22,000 will open the path for BTC to head up to $27,000.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and omissions may occur. Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, clients or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.