Helping you make informed decisions on investing, money, equities and personal finance. Seasoned investors or newbie traders, our financial education corner has something for all.

Catch the latest updates from Australia’s premier stock exchange & market indices.

Can Tether cryptocurrency be mined?

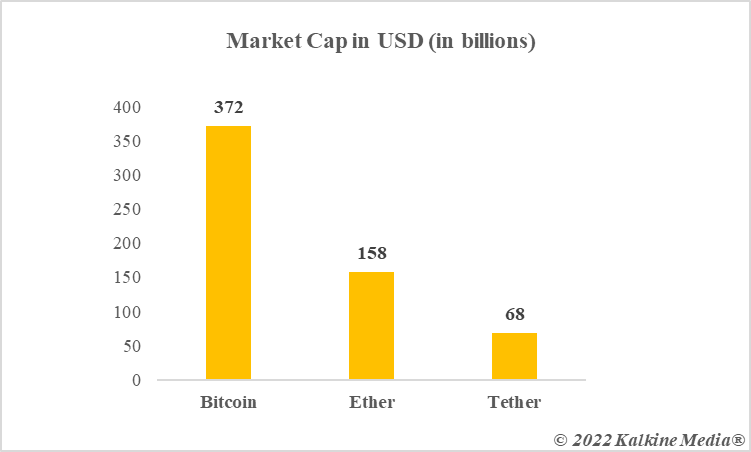

Bitcoin, launched in 2009, is generally considered the first cryptocurrency. The whitepaper by its creator/s Satoshi Nakamoto focuses largely on Bitcoin’s use as ‘electronic cash’, with no interference from intermediaries like banks. Later entrants, including Ether and Tether, are also classified as cryptocurrencies. However, these can be very different from Bitcoin with respect to the release of new tokens and the intended utility.

Ether or ETH is about the payment of the gas fee within Ethereum’s ecosystem, which allows developers to create new decentralised and distributed ledger-based applications. Tether, on the other hand, is not a typical cryptocurrency, but it is a stablecoin. This makes it different with respect to the launch of new Tether tokens. On Bitcoin and Ethereum’s blockchains, new BTC and ETH tokens, are mined. Mining is a specialised process that involves hashing through the use of sophisticated computing. Today, let us explore the subject of the release of new Tether tokens and if mining has any role to play in it.

Tether, as mentioned earlier, is a stablecoin, which by definition, means a coin with a stable value at all times. Tether is pegged to the most dominant fiat currency in the world — the US dollar. One Tether token, often called USDT, must always be valued at US$1, otherwise, the entire scheme of things would not make any sense. Typical cryptocurrency tokens like BTC (Bitcoin), however, are exposed to value appreciation or depreciation, largely depending on demand and supply forces. For Tether to maintain stability in its per token price, mining is out of the picture.

A Tether token is not the outcome of any computational work on a blockchain but of reserves maintained by those handling the stablecoin’s operations. For example, for every 10 Tether tokens issued in the market, first there should be US$10 maintained through holdings like currency reserves and corporate bonds. Every single USDT must be backed by reserves, otherwise there is a chance of disruption in USDT-to-fiat-currency conversion. Adequate reserves are at the heart of the release of Tether tokens, unlike in BTC’s case where the total supply is capped at 21 million BTC tokens and the value is subject to variations.

Data provided by CoinMarketCap.com

Tether operates on multiple blockchains, including those of Ethereum and Polygon. ETH, which exists only on Ethereum, can be mined by partaking in the transaction validation process. This is not possible in the case of Tether’s USDT tokens, simply because Tether has no independent blockchain like Bitcoin and Ethereum, which means there is no place to become a node operator and carry out the sophisticated mining process.

Tether tokens are claimed to be a product of reserves maintained to back them. Does Tether have adequate reserves to back the presently circulating tokens — over US$68 billion as of writing — is a separate subject of discussion. Mining is not possible because neither a standalone blockchain exists, nor the intended utility of Tether is the same as that of typical cryptocurrencies like Bitcoin.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.

Ankit is a law graduate. He holds an interest in public policy, corporate ethics, development economics, macro-economic policies, and sustainable development….

Shaghil Bilali is a research editor with 15 years of experience in different verticals across media. He has worked with some of the leading media organisations in India. Before joining Kalkine Media, he was with Microsoft News' Canada overnight opera…

Copyright © 2022 Kalkine Media Pty Ltd. All Rights Reserved.

ACN:629 651 672 ABN:84 629 651 672

Welcome to Kalkine Media Pty Ltd. website. Your website access and usage is governed by the applicable Terms of Use & Privacy Policy.

Welcome to Kalkine Media LLC website. Your website access and usage is governed by the applicable Terms and Conditions & Privacy Policy.

Welcome to Kalkine Media New Zealand Limited website. Your website access and usage is governed by the applicable Terms and Conditions & Privacy Policy.

Welcome to Kalkine Media Incorporated website. Your website access and usage is governed by the applicable Terms and Conditions & Privacy Policy.

Welcome to Kalkine Media Limited website. Your website access and usage is governed by the applicable Terms of Use & Privacy Policy.