By Isaiah Poritz

Attorneys for an artist alleged to have sold fake Bored Ape Yatch Club nonfungible tokens could face a $1,500 sanction for “repeated violations” of a Los Angeles federal court’s standing order, US District Judge John F. Walter said Thursday.

Citing those transgressions, Walter also struck conceptual artist Ryder Ripp’s Anti-Strategic Lawsuit Against Public Participation motion and motion to dismiss Yuga Labs Inc.’s trademark infringement lawsuit.

PODCAST: Seth Green’s Stolen ‘Bored Ape’ NFT Saga Ends Without Case Law

The judge’s order said the defendants will have until Sept. 6 to explain in writing why “lead counsel should not be sanctioned.” Louis W. Tompros of Wilmer Cutler Pickering Hale & Dorr LLP, who represents Ripps, said in a statement to Bloomberg Law that he will respond to the order by the court’s deadline.

Ripps’ motions, filed on Aug. 31, violated paragraph 3(b) of the court’s standing order, which governs the time and format for filing motions, according to Walter, of the US District Court for the Central District of California.

Ripps previously filed the motions on Aug. 15, but the judge struck them four days later, citing violations of paragraph 5(b) of the standing order, which requires a joint statement to be filed after both parties meet for a pre-filing conference.

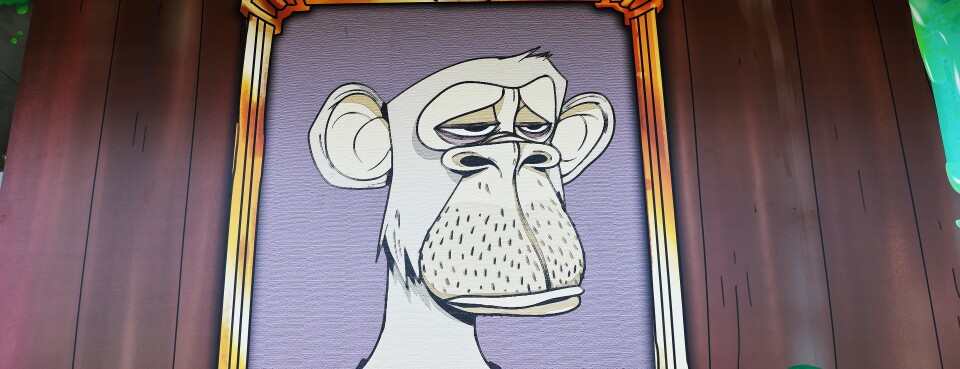

The anti-SLAPP motions argued that Yuga Labs, which created the highly successful Bored Ape NFTs, brought the lawsuit to “silence an artist who used his craft” to criticize the NFT makers. Ripps argued that his version of the NFTs have exposed “neo-Nazi culture” and “coded dog whistles” embedded in the Bored Apes.

The motions also said Ripps was shielded from infringement liability by the Rogers v. Grimaldi trademark test, which can allow artists to use outside trademarks in their work without permission.

The Bored Ape NFTs, which depict digital profile images of apes, have generated more that $2.4 billion in total sales, according to the blockchain data tracker Crytoslam.

Yuga Labs’ lawsuit, filed in late June, alleged that Ripps and Jeremy Cahen scammed consumers into purchasing fake Bored Ape NFTs “by misusing Yuga Labs’ trademarks.” The two allegedly created an “Ape Market” NFT marketplace which requires members to purchase the counterfeit Bored Ape NFTs for access.

Fenwick & West LLP represents Yuga Labs. Wilmer Cutler Pickering Hale & Dorr LLP represent Ripps and Cahen.

The case is Yuga Labs Inc. v. Ripps, C.D. Cal., No. 2:22-cv-04355, 9/1/22.

To contact the reporter on this story: Isaiah Poritz in Washington at iporitz@bloombergindustry.com

To contact the editors responsible for this story: Adam M. Taylor at ataylor@bloombergindustry.com; Jay-Anne B. Casuga at jcasuga@bloomberglaw.com

To read more articles log in.

Learn more about a Bloomberg Law subscription

Author

Administraroot