Mark Cuban should have expected it.

Since crypto lender Voyager Digital filed for Chapter 11 bankruptcy, criticism of the billionaire and owner of the NBA Dallas Mavericks team has been raining down on social media.

These critics accuse him of promoting the platform and therefore hold him responsible for the losses they say they suffered as we wrote on July 8. These reproaches now result in a class action lawsuit against the successful entrepreneur.

These angry individual investors claim that Cuban and the Dallas Mavericks tricked them into investing in Voyager Digital, which went bankrupt and cost them some $5 billion in total, according to the complaint. The complaint is based on another complaint filed already in December against Voyager Digital.

The "deceptive" Voyager Platform "was an unregulated and unsustainable fraud, similar to other Ponzi schemes," claim the plaintiffs. "It was specifically alleged in detail in that complaint how defendants Mark Cuban and Stephen Ehrlich were key players who personally reached out to investors, individually and through the Dallas Mavericks, to induce them to invest in the deceptive Voyager platform."

Ehrlich is Voyager Digital's Chief Executive Officer.

"Cuban and Ehrlich, as will be explained, went to great lengths to use their experience as investors to dupe millions of Americans into investing — in many cases, their life savings — into the deceptive Voyager platform and purchasing Voyager earn program accounts (“EPAs”), which are unregistered securities," the plaintiffs add.

"As a result, over 3.5 million Americans have now all but lost over $5 billion in cryptocurrency assets."

Plaintiffs, who say they want Cuban and Ehrlich to pay them back, primarily use the Shark Tank star's statements when signing a partnership between the Dallas Mavericks and Voyager Digital against him.

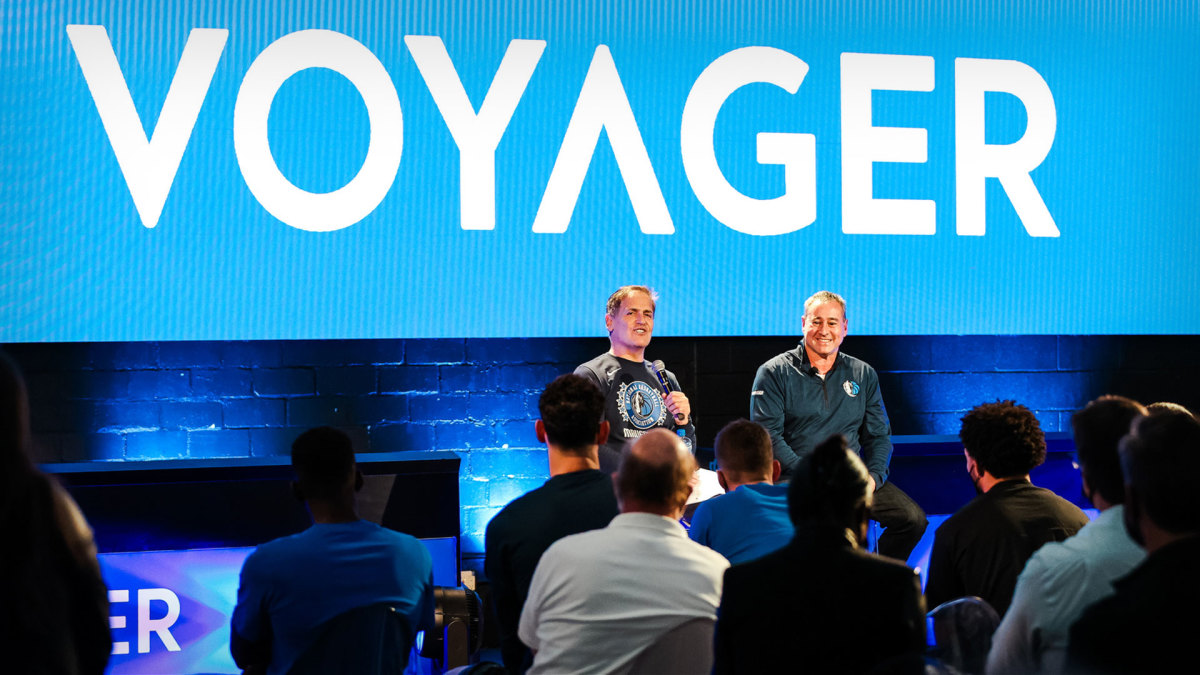

The Dallas Mavericks and Voyager Digital signed a five-year contract on Oct. 28, with the mission to promote cryptocurrencies by making coins more accessible through educational and digital programs.

As part of the partnership, Voyager promised Dallas Mavericks' fans a $100 reward to trade crypto on Voyager for a limited time if they deposited $100 and traded just $10. The offer had met with great success, so much so that Voyager had been obliged to set up a waiting list.

"There’s untapped potential in the future of digital currencies and it’s an attractive investment for novice investors who might only have $100 to start," Cuban said at the time during a press conference with Ehrlich. "That’s where Voyager enters the picture. In other words, it’s a way to earn high returns while also getting skin in the game and the Voyager platform makes the process easy and simplified for fans of all ages."

It is not certain that the complaint will lead to a trial because a judge must already certify that the 12 people put forward in the complaint are representative of the 3.5 million Americans who would have been impacted by the setbacks of Voyager Digital.

Voyager Digital filed for bankruptcy in July, becoming one of the casualties of the confidence crisis that wiped out more than $2 trillion from the cryptocurrency market since its November all-time highs. It is difficult to know if his customers will recover their money.

Voyager is a cryptocurrency trading platform. The firm also offers loans and staking services, which are a kind of rewards for holding certain coins. It was its lending business that got it into trouble: Voyager appears to have loaned its clients' funds to crypto hedge fund Three Arrows Capital, also known as 3AC.

However, this hedge fund defaulted in June on a loan of $667 million granted to it by Voyager. Three Arrows Capital was forced by a court, in the British Virgin Islands, to enter into liquidation. Faced with this disaster, Voyager suspended deposits, withdrawals and loyalty rewards on its platform.

A Twitter request for comment from the Dallas Mavericks has so far gone unanswered.

"In stocks and crypto, you will see companies that were sustained by cheap, easy money — but didn’t have valid business prospects —will disappear,” Cuban said in an interview in June with Fortune. "Like [Warren] Buffett says, 'When the tide goes out, you get to see who is swimming naked."

The plaintiffs included this last statement in their complaint.

Author

Administraroot