Will stablecoins transform banking? register to find out

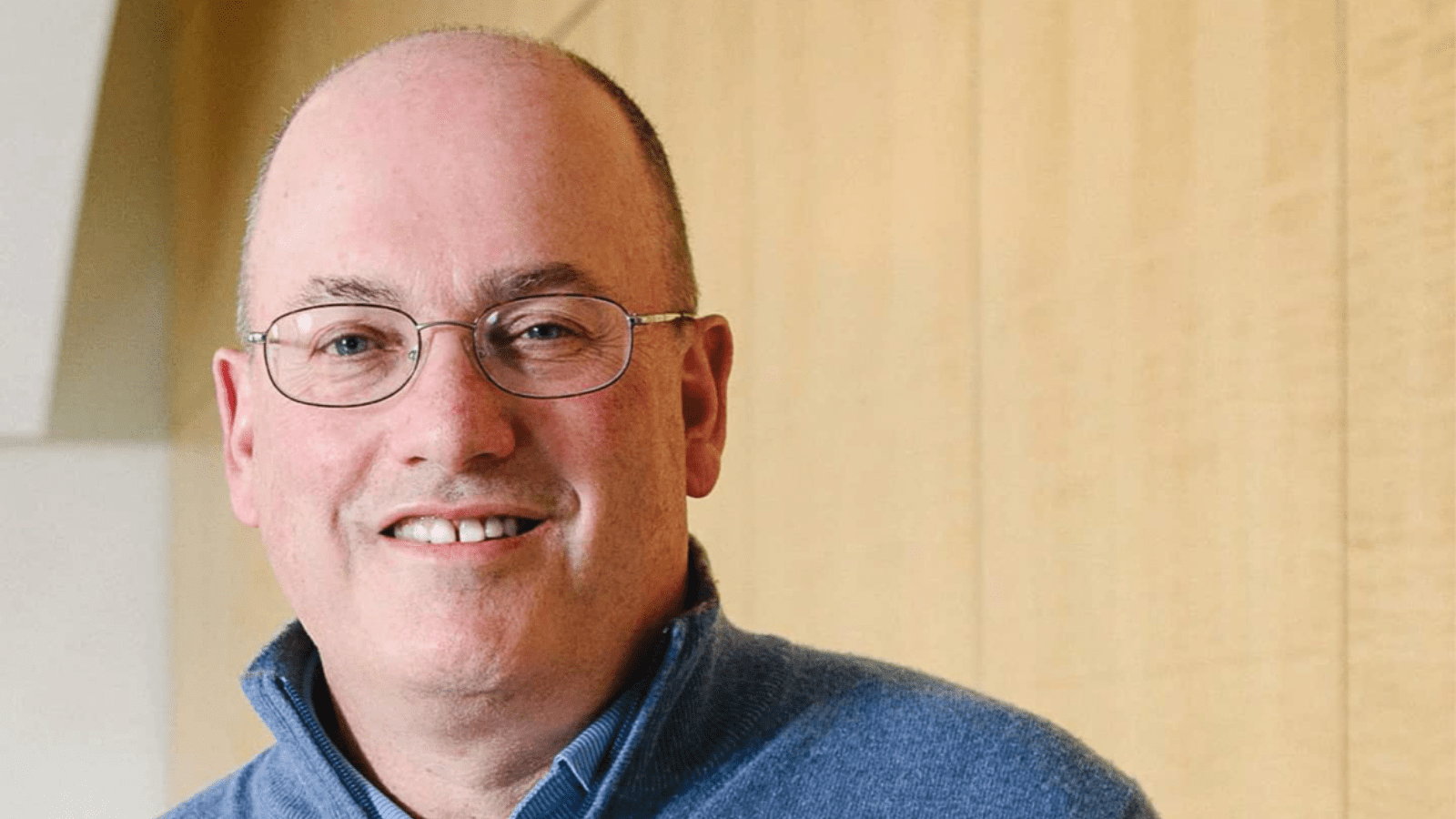

Blockworks exclusive: Steve Cohen’s hedge fund heavyweight is looking to hire at least two senior crypto-focused professionals

The staffing of Point72 Asset Management’s burgeoning cryptocurrency operations is starting to take shape as the multi-strategy hedge fund firm deepens its push into digital assets, according to two sources familiar with the matter.

The firm — which is run by founder Steve Cohen and trades a wide variety of traditional financial assets, including equities, commodities and debt — is looking to hire a couple of senior blockchain-focused professionals, including a head of crypto technology who would report to the Mark Brubaker, the firm’s chief technology officer.

Brubaker, sources said, has been conducting interviews with potential candidates in recent weeks, with some introductions coming by the way of a third-party recruiting outfit focused on crypto.

The second role would be more of a head of digital asset operations, which would encompass coordinating efforts between middle- and back-office teams that support portfolio managers and analysts. Additional junior and mid-level hires are in the works.

The plan for Point72’s crypto dealings — which ought to build upon Cohen’s relatively early venture capital-style investments in the space via his family office and the firm’s venture arm — is to start with quantitative trades and build out a business model from there.

“There are high-level, serious people [at Point72] that are getting in on crypto now,” one source said. “They’re finally taking it seriously. It’s early, but this looks like the early innings of a big push. And it’s finally clear that Steve [Cohen] has signed off on it.”

Prominent hedge funds have by and large stayed on the crypto sidelines. Before the recent market crash, top financiers were worried about regulation; they’re now also worried about whether digital assets will continue to free-fall in what’s been a tough time to enter quickly gyrating markets.

There’s also the not-insignificant matter of sizable institutional limited partners, especially conservative-leaning sovereign wealth funds, wary of the firm and others they invest with pushing into crypto too fast — especially when it’s unclear, arguably, whether digital assets have a large enough market cap to justify the big tickets Point72 and its rivals need to generate meaningful alpha from those trades.

To kick things off, the firm last month installed Jump Trading veteran Elie Galam as head of crypto for the quant division, Cubist Systematic Strategies, Bloomberg reported. Galam and at least two supporting portfolio managers have been tasked with doing due diligence on trading fairly liquid, high-market-cap spot cryptocurrencies — plus related derivatives.

The firm had already been trading digital asset-backed ETFs and similar institutional products, including Grayscale Investments’ Ethereum Trust (ETHE) and Bitcoin Trust (GBTC). The Cubist unit is also trading certain crypto derivatives already.

The firm is not, however, trading spot digital assets.

Cubist more broadly, meanwhile, is undergoing a bit of an overhaul. The unit is adding a centralized quant platform — which Galam will be a part of. Here’s how it works: Each trader contributes algorithms, or supporting article intelligence or machine learning applications, to a master quantitative strategy. It’s a setup favored by the likes of DE Shaw and Renaissance Technologies.

The division will continue its traditional practice, too, of divvying up “pods” of portfolio managers and supporting analysts who hone their own independent strategies that feed into the firm’s flagship fund.

Sources were granted anonymity to discuss sensitive business dealings. A spokesperson for Point72 declined to comment.

Get the day’s top crypto nws and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.

DATE

Tuesday & Wednesday, September 13 & 14, 2022

LOCATION

The Glasshouse, 660 12th Avenue, NY, NY 10019

Blockworks exclusive: The venture fund startup was incubated by Three Arrows, a then-favorable arrangement that has since soured

“Hedge funds betting on wider contagion and market capitulation could be licking their wounds,” Bitfinex analysts told Blockworks

It will be several months — not including time spent on litigation — before Voyager begins repaying its creditors

Floor prices in The Sandbox, Decentraland and Otherdeed for Otherside are all hovering above 2 ETH

The economy added 372,000 jobs in June, but the unemployment rate was 3.6% — unchanged from May

Author

Administraroot