KanawatTH

KanawatTH

Riot Platforms (NASDAQ:RIOT), formerly Riot Blockchain, is one of the premier Bitcoin mining companies from a profitability perspective (I have covered this firm multiple times in the past, and you can filter for the entire history of my coverage here, complete with crypto cheatsheets and industry commentary).

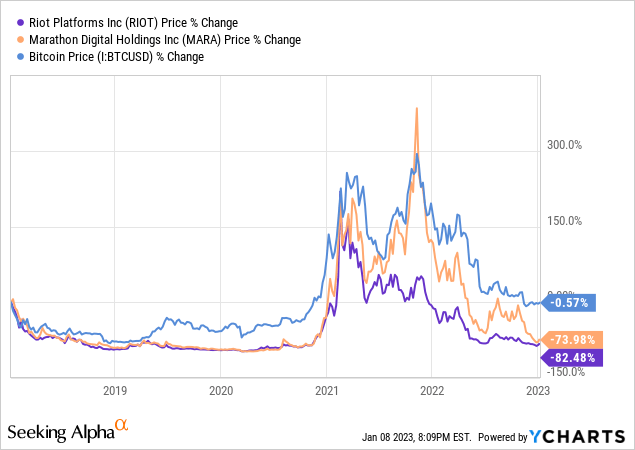

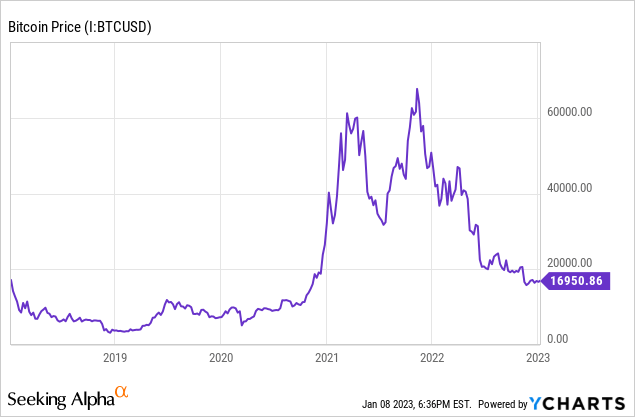

It has been a tough year for Riot shareholders. The sharp crypto selloff has battered the stock, and there is no sign of a bottom in sight. Despite the significant PR and legislative commentary in the past, crypto mining companies can still be viewed as small companies in that they usually produce one product, and for Riot, that product is Bitcoin. With the complexity and shiny object syndrome surrounding Bitcoin, at times, it is easy to forget that Bitcoin miners operate in the same way fundamentally as rare earth miners in that they stockpile tokens at low prices and distribute them at advantageous prices. Due to this dynamic, the price action for miners is greatly determined by the price of the crypto token they mine, which explains what has been happening with Riot. The stock has fallen off a cliff despite clear signs of progress internally.

In December 2022, Riot produced 659 bitcoins, an increase of 26% from the previous month and 55% higher than its December 2021 production.

Author estimates adapted from Seeking Alpha

Author estimates adapted from Seeking Alpha

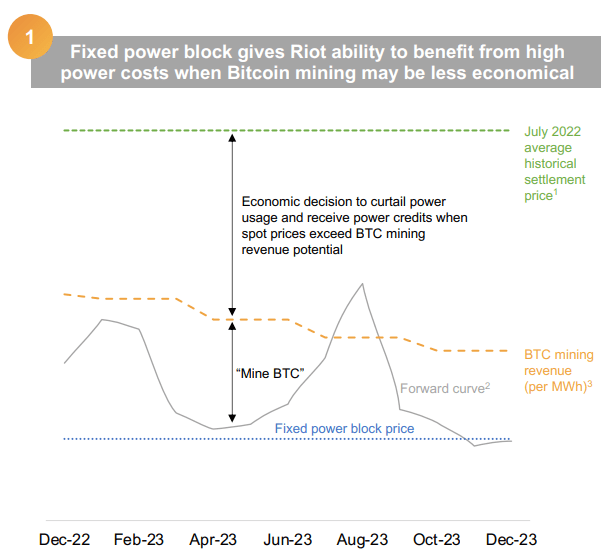

The company earned $4.9 million in power credits during the month, which is equivalent to approximately 290 bitcoins using the December 2022 weighted average daily closing price of $16,967. The company has been strategically executing its power strategy to drive lower power costs. A summary of the strategy can be found below:

Riot Platforms

Riot Platforms

Riot sold 600 bitcoins in December, generating net proceeds of around $10.2 million, and held approximately 6,952 bitcoins as of December 31, 2022. Forced sales or sales at disadvantageous prices are often red flags for Bitcoin mining companies like Riot, but in the context of a crypto bear market, it is understandable to see some liquidation at this point. Investors should be well aware of the risks for mining companies in this environment by now, so it is unlikely that further sales will be met by any sensational price action.

Moving on to the fleet, Riot deployed an additional 16,128 S-19-series miners, bringing its hash rate capacity to a new all-time high of 9.7 EH/s. However, some of the company’s operations at its Rockdale facility sustained damage from severe winter weather in Texas, which impacted around 2.5 EH/s of its total hash rate capacity. Riot expects to have a total of 89,708 miners deployed with a hash rate capacity of around 9.9 EH/s, with shipments of an additional 5,130 S19-series miners expected to be received in January 2023. It is interesting that Riot continues to invest heavily in its fleet. At this point, the companies are selling tokens at a loss, and many miners have mining costs that hover around the ten thousand dollar mark. It is essential to note that spreading fixed costs like administration and real estate among many miners will aid margins, but this is hugely capital intensive, and the companies must balance this benefit against the risks of illiquidity should Bitcoin prices remain depressed for an extended period.

In the recent third-quarter earnings call, Riot announced that the company had a total revenue of $46.3 million, compared to $64.8 million in the same period in 2021. The decrease was primarily due to lower Bitcoin production resulting from the company’s power strategy and a 49% decrease in the market price of Bitcoin. This is a trend we are seeing with some of the bigger miners.

The company earned $13.1 million in power curtailment credits in the third quarter of 2022, compared to $2.5 million in the same period in 2021. It produced 1,042 Bitcoin in the third quarter of 2022, compared to 1,292 in the same period in 2021. The company’s mining revenue in the third quarter of 2022 was $22.1 million, compared to $53.6 million in the same period in 2021. Its data center hosting revenue was $8.4 million in the third quarter of 2022, compared to $11.2 million in the same period in 2021.

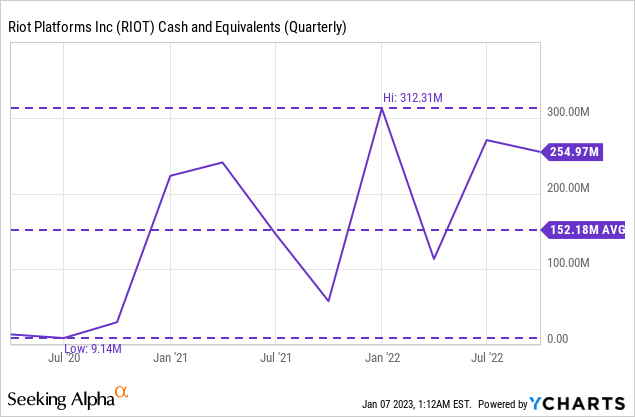

The company had $369.8 million in working capital and $255.0 million in cash on hand as of September 30, 2022, and it produced 6,766 Bitcoin in that period. Investors will want to pay keen attention to the cash balance in the future as these depressed Bitcoin prices and elevated cost of production begin to take agreed to effect on the company’s balance sheet. We can see that the recent sales along with prior dilution have greatly improved the company’s liquidity position.

Riot has always done relatively well with managing its cash balance and liquidity position. This has led to some analysts branding it the top pick of the Bitcoin mining space. It is important to note that despite the superior capital controls, Bitcoin mining companies are fundamentally the same business, and they cannot sustain long-term depressed prices. The company had a net loss of $14.9 million in the third quarter of 2022, compared to a net loss of $47.3 million in the same period in 2021.

So earnings suggest Riot is actually showing some clear signs of progress despite the massive crypto meltdown, and much of this is attributable to their operational prowess. We have seen production disruptions seriously impact goals for other companies, but Riot has always seemed to be happy to continue to build out its fleet despite the massive industry-wide decline in profitability. Many analysts have painted a picture of doom and gloom because of the losses and harsh headlines, but Riot is a bit different. Riot is what you call a low-cost miner; that is, they are able to manage their direct costs of Bitcoin production better than many other firms. In the early Bitcoin mining explosion, many producers had their direct costs hovering around the $10k mark, and they could quickly sell their tokens on the market for 3 to 5 times that on the open market to fund other business expenses. Since then, the cost of energy has gone through the roof, and many miners have become more adept at managing those non-direct costs since they have limited control over energy rates. This is where Riot sets itself apart from the rest. Despite the rise in energy costs, Riot has managed to improve its direct mining costs from $15,250/BTC to just $11,346/BTC.

At the time of the writing of this article, Bitcoin was hovering at a price of ~$17,000. This means the company still has room to contribute to non-direct costs at current prices. It is important to emphasize that this is by no means a comfortable situation for investors or shareholders.

As difficulty rates continue to increase, we will see direct costs naturally go up (discussed in greater detail here), holding all other things constant. Also, for profitability to have a shot at happening at this level, the company would need to significantly increase the size of its fleet, which would likely require more cash than Riot can reasonably access. They also need to hope that their competitors avoid doing the same or that Bitcoin’s network hashrate falls off a cliff.

I have been a long-time fan of buying the wash on mining companies and waiting for the eventual Bitcoin rally to unload, but this time feels different. The industry has been hit by a wave of defaults, and legislators could use Bitcoin miners as a scapegoat for investor losses. I see Riot as one of the best companies in the industry, but that industry is struggling right now. I am a long-term Bitcoin bull, but I do have concerns regarding whether some mining firms will make it to the other side of this slowdown. The risk of more losses or dilution will likely remain high for the extended future, but I continue to remain bullish on Riot. I rate the stock as a speculative buy.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of RIOT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.