(Bloomberg) — Cash-strapped Bitcoin miners are reducing loans and scaling back their operations as the crypto-mining industry continues to weather a plunge in the digital asset’s price.

Most Read from Bloomberg

US Safety Agency to Consider Ban on Gas Stoves Amid Health Fears

Rental Housing Is Suddenly Headed Toward a Hard Landing

Microsoft Considers $10 Billion Investment in ChatGPT Creator

Goldman to Cut About 3,200 Jobs This Week After Cost Review

Stocks Give Up Rally Above Key Mark After Fedspeak: Markets Wrap

During the historic bull run in late 2021, miners raised billions of dollars in debt financing to fund their expanding operations. But since the crash early last year, publicly traded miners are refinancing and selling coin reserves as well as equity to repay loans and cover operational costs.

“Miners are trying to deleverage to avoid margin calls or an imminent liquidity crunch if Bitcoin drops below a certain price point,” Wolfie Zhao, an analyst at crypto-consulting firm BlocksBridge, said.

Miners like Marathon Digital Holdings Inc. have raised hundreds of millions of dollars in loans backed by the coin from crypto-friendly banks such as Silvergate Capital Corp., which has been reeling from the crypto industry meltdown.

Core Scientific Inc., the largest Bitcoin miner by computing power, was the first major public mining company to declare bankruptcy in December, citing falling Bitcoin prices and soaring energy costs for its cash-flow issues. The Austin, Texas-based company is trying to work out a plan to repay its creditors.

Last month, Marathon eliminated its $30 million revolver debt, increasing its unrestricted cash to over $100 million, according to BlocksBridge.

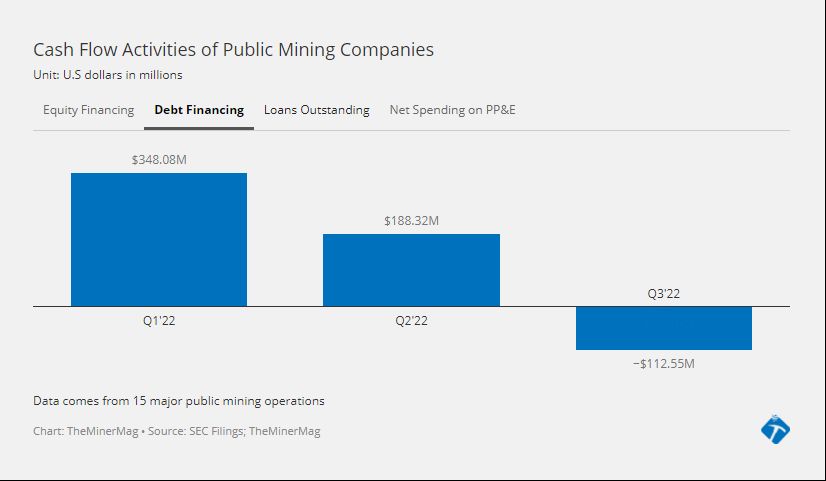

Money raised from debt financing by 15 major public mining companies has been shrinking since the first quarter of 2022, and for the first time in the third quarter it contracted $112.6 million, according to data compiled by BlocksBridge. That’s compared to a total of $348 million and $188 million in the first and second quarters, respectively, said BlocksBridge. Overall, net spending on mining infrastructure fell 77% to $180 million in the third quarter, compared to the prior quarter, the firm’s latest data revealed.

Any sudden drop in the price of Bitcoin can lead to a major liquidity crunch. Bitcoin rose as much as over $45,000 in March 2022 but fell a month later to $29,000 as cryptocurrency Terra Luna crashed, wiping out about $40 billion in the crypto market. The Federal Reserve’s tightening monetary policy and implosions of big digital-asset firms such as hedge fund Three Arrows Capital and crypto exchange FTX have also weighed on the token’s price throughout last year. Bitcoin tumbled by about 65% in 2022.

Some miners like Riot Platforms Inc. and Bitfarms started selling their coin reserves last year to boost liquidity. Marathon, which tends to hold on to its mined coins, still has 12,232 in Bitcoin on its balance sheet. About 36% of the reserve is restricted, secured against its remaining loans as of Dec. 31, according to BlocksBridge.

Core Scientific and Riot sold equity to raise money amid the slump. Argo Blockchain proposed issuing shares last year, though the offering didn’t take place.

(Updates the final paragraph to note that Argo proposed issuing shares last year, though the offering didn’t take place.)

Most Read from Bloomberg Businessweek

America’s Aggressive Chip Strategy Forces China Into a Corner

Poland’s Election Provides a Path Out of EU Isolation

The Great American EV Battery Revolution Might Finally Be Here

Death of Easy Money Creates Financial Upheaval Around the Globe

Who Owns the Content AI Creates?

©2023 Bloomberg L.P.

Despite looming economic headwinds across the globe, it was another banner year for British luxury automaker Rolls-Royce Motorcars. The 118-year old brand, who’s cars start at around $340,000, reported global deliveries climbed 8% to a record 6,021 vehicles. Rolls-Royce said bespoke commissions reached record levels as well, with its order book of future orders reaching far into its 2023 production run.

The first interactive show on Thursday will feature a 1:1 Ethereum NFT auctioned in collaboration with Daniel Ellsberg.

The former chairman of Bithumb Holdings was recently acquitted of fraud charges.

(Bloomberg) — Russia's oil exports made a small gain last week, but not by enough to prevent what appears for now to be a downtrend in the nation's shipments to a diminished group of buyers.Most Read from BloombergUS Safety Agency to Consider Ban on Gas Stoves Amid Health FearsRental Housing Is Suddenly Headed Toward a Hard LandingMicrosoft Considers $10 Billion Investment in ChatGPT CreatorGoldman to Cut About 3,200 Jobs This Week After Cost ReviewStocks Give Up Rally Above Key Mark After Feds

The Bureau of Labor Statistics on Thursday will report the consumer price index for December. Economists are predicting no change in the index.

The Financial Markets Authority joins the country’s central bank and Senate in seeking to anticipate new EU laws.

The community who purchased Martin Shrkeli’s Wu-Tang Clan album in July of 2021 pivots to hosting its own sales, starting with a NFT by Edward Snowden, Daniel Ellsberg and the Freedom of the Press Foundation.

CRYPTO UPDATE All of the largest cryptocurrencies were up during morning trading on Monday, with Cardano (ADAUSD) seeing the biggest change, jumping 10.25% to 32 cents. Dogecoin (DOGEUSD) rallied 7.74% to 8 cents, while Litecoin (LTCUSD) increased 7.

The Easy Company has raised $14.2 million in a seed round and launched its “social” crypto wallet to help onboard more mainstream audiences, it shared exclusively with TechCrunch. Today, its beta wallet is available to the public on iOS and Android after completing a 30-day private testing phase, Mike Dougherty, co-founder and CEO of Easy, said to TechCrunch. The funding round included Lobby Capital, Relay Ventures, 6th Man Ventures, Tapestry VC, Upside and Scribble Ventures, as well as angel investors from traditional social media and web3 groups like former heads of Instagram, Novi product and engineering and former executives from Airbnb, Twitter, Uber, OpenTable and Eventbrite, among others.

Wyre users are now only able to withdraw 90% of their funds, with the firm adding that it's "exploring strategic options" amid the bear market.

(Bloomberg) — Switzerland’s government will not receive a payout from the Swiss National Bank for 2022, as the central bank projects the biggest loss in its 116-year history.Most Read from BloombergGoldman to Cut About 3,200 Jobs This Week After Cost ReviewUS Safety Agency to Consider Ban on Gas Stoves Amid Health FearsCommodity Ship Heads for Inspection After Suez Canal MishapStocks Rally as Fed Wagers Encourage Dollar Bears: Markets WrapMega Bonuses of 50 Months’ Salary Handed Out by Shipping

(Bloomberg) — UK job recruiters said demand for permanent staff slipped for a third month in December, contracting at the sharpest pace since pandemic lockdowns were in place in early 2021.Most Read from BloombergUS Safety Agency to Consider Ban on Gas Stoves Amid Health FearsRental Housing Is Suddenly Headed Toward a Hard LandingGoldman to Cut About 3,200 Jobs This Week After Cost ReviewStocks Give Up Rally Above Key Mark After Fedspeak: Markets WrapCommodity Ship Heads for Inspection After Su

(Bloomberg) — China’s credit expanded at a slower-than-expected pace in December as Covid disruptions and a turbulent bond market weighed on borrowing activity.Most Read from BloombergUS Safety Agency to Consider Ban on Gas Stoves Amid Health FearsRental Housing Is Suddenly Headed Toward a Hard LandingMicrosoft Considers $10 Billion Investment in ChatGPT CreatorGoldman to Cut About 3,200 Jobs This Week After Cost ReviewStocks Give Up Rally Above Key Mark After Fedspeak: Markets WrapAggregate fi

The National Federation of Independent Business (NFIB) said its Small Business Optimism Index fell 2.1 points to 89.8 last month – the lowest since June – amid a decline in the share of owners who expected better business conditions over the next six months. The net share of owners expecting better business conditions over the next six months fell to -51% last month from -43% in November. Thirty-two percent of owners reported that inflation was their single most important problem, unchanged from November and 5 points lower than July's reading, which was the highest since the fourth quarter of 1979.

(Bloomberg) — Brazil’s football association condemned the widespread use of its iconic yellow jersey by supporters of former President Jair Bolsonaro in the insurrection that took the country’s capital by storm on Sunday. Most Read from BloombergUS Safety Agency to Consider Ban on Gas Stoves Amid Health FearsRental Housing Is Suddenly Headed Toward a Hard LandingMicrosoft Considers $10 Billion Investment in ChatGPT CreatorGoldman to Cut About 3,200 Jobs This Week After Cost ReviewStocks Give Up

Newly-named Metalpha has its work cut out for it, hedging an uncertain market for institutional clients.

Romania's 25 basis point rate hike on Tuesday may signal an end to Central Europe's aggressive 18-month campaign of monetary tightening but persistently tight local labour markets and other obstacles still litter the path towards lower inflation. The relatively modest move consolidated a view among economists that the region, which was at the forefront of a global tide of policy tightening to arrest a once-in-a-generation surge in prices, is turning the page on rate rises. The Romanian central bank said slower economic growth and cheaper energy would help bring inflation down to single digits this year from over 16% now, earlier than previously forecast.

Canadian bitcoin miner Hive Blockchain (HIVE) earned $3.15 million, or the equivalent of about 184 bitcoin, by curtailing its power use in December, whereas it mined 213.8 BTC for the month. "The Hash" panel discusses why miners cut back their power use at times of high demand to cope with market headwinds. Plus, insights on the Buzzminers designed with Intel's (INTC) Blocksale chips.

(Bloomberg) — Canada’s banking regulator will consider new constraints on firms’ mortgage lending in an attempt to protect the financial system, potentially adding more headwinds for the housing market.Most Read from BloombergUS Safety Agency to Consider Ban on Gas Stoves Amid Health FearsRental Housing Is Suddenly Headed Toward a Hard LandingGoldman to Cut About 3,200 Jobs This Week After Cost ReviewStocks Give Up Rally Above Key Mark After Fedspeak: Markets WrapCommodity Ship Heads for Inspec

(Bloomberg) — The major US banks will set the stage for a new year fraught with economic fears and a new earnings season when they deliver fourth-quarter results starting Friday. As recession has increasingly become a question of “when” not “if”, investors will focus on the financial institutions’ outlooks, particularly the level of bad loan provisions they set aside as they brace for worsening economic conditions in the US. Consensus estimates show investment banking may continue to suffer bef

Author

Administraroot