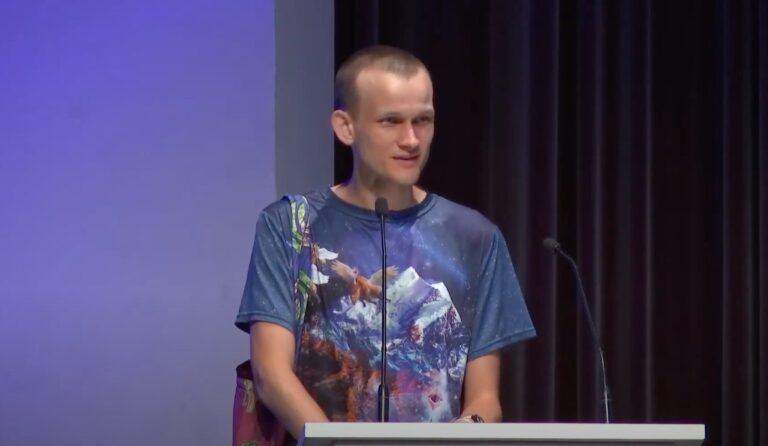

Recently, Russian-Canadian computer scientist Vitalik Buterin, who is best known as the father of Ethereum, named what he believes are three of the biggest opportunities in crypto at the present time.

Earlier this week, during an interview on episode #149 of the Bankless podcast, Buterin said:

“If you can make a wallet that a billion people will use – that’s a huge opportunity… If you can make a stablecoin that can actually survive anything up to, and including, a U.S. dollar hyperinflation… that’s a huge opportunity as well if you can create something that will feel like a lifeline for everyone going through that situation… If you can get signed in with Ethereum to work and if you can unseat Facebook and Google and Twitter as the login overlords of the internet, that itself is a huge opportunity, right?“

On 5 December 2022, Buterin shared his thoughts on Ethereum’s diverse ecosystem in a blog post titled “What in the Ethereum application ecosystem excites me”.

Buterin wrote:

“… my excitement about Ethereum is now no longer based in the potential for undiscovered unknowns, but rather in a few specific categories of applications that are proving themselves already, and are only getting stronger…”

He then went on talk about the five application categories that he was most interested in.

“As a side effect of the Merge, transactions get included significantly more quickly and the chain has become more stable, making it safer to accept transactions after fewer confirmations. Scaling technology such as optimistic and ZK rollups is proceeding quickly. Social recovery and multisig wallets are becoming more practical with account abstraction. These trends will take years to play out as the technology develops, but progress is already being made...

“I see the stablecoin design space as basically being split into three different categories: centralized stablecoins, DAO-governed real-world-asset backed stablecoins and governance-minimized crypto-backed stablecoins… From the user’s perspective, the three types are arranged on a tradeoff spectrum between efficiency and resilience.“

“Decentralized finance is, in my view, a category that started off honorable but limited, turned into somewhat of an overcapitalized monster that relied on unsustainable forms of yield farming, and is now in the early stages of setting down into a stable medium, improving security and refocusing on a few applications that are particularly valuable.“

“The Sign In With Ethereum (SIWE) standard allows users to log into (traditional) websites in much the same way that you can use Google or Facebook accounts to log into websites today. This is actually useful: it allows you to interact with a site without giving Google or Facebook access to your private information or the ability to take over or lock you out of your account…

“ENS lets users have usernames: I have vitalik.eth. Proof of Humanity and other proof-of-personhood systems let users prove that they are unique humans, which is useful in many applications including airdrops and governance.“

“Most generally, a DAO is a smart contract that is meant to represent a structure of ownership or control over some asset or process. But this structure could be anything, from the lowly multisig to highly sophisticated multi-chamber governance mechanisms like those proposed for the Optimism Collective…

“A particular subtlety is that the word “decentralized” is sometimes used to refer to both: a governance structure is decentralized if its decisions depend on decisions taken from a large group of participants, and an implementation of a governance structure is decentralized if it is built on a decentralized structure like a blockchain and is not dependent on any single nation-state legal system.“

“There are many applications that are not entirely on-chain, but that take advantage of both blockchains and other systems to improve their trust models… Voting is an excellent example. High assurances of censorship resistance, auditability and privacy are all required, and systems like MACI effectively combine blockchains, ZK-SNARKs and a limited centralized (or M-of-N) layer for scalability and coercion resistance to achieve all of these guarantees.“

To make sure you receive a FREE weekly newsletter that features highlights from our most popular stories, click here.

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

Author

Administraroot