Kameleon007/iStock Unreleased via Getty Images

Kameleon007/iStock Unreleased via Getty Images

Since I began covering crypto on Seeking Alpha, I don’t think I’ve made it any mystery that I believe meme coins are terrible investments. In an industry that is filled with scams, grifts, and needless tokens, meme coins stand out as particularly poor instruments for investment capital. I even started a marketplace service because I want to help crypto-interested Seeking Alpha readers ‘put the dog money down’ and separate the complete junk from the crypto assets that have staying power. Despite only covering it publicly one time, Dogecoin (DOGE-USD) has been one of my least favorite cryptos of this cycle.

When I last wrote about Dogecoin I highlighted the centralization issue, the fact that it was created as a joke, the lack of a supply cap, the expensive transactions compared to peers, and the low usage among other payment-focused crypto coins. Each of those problems is still evident today. But now we have what I view as more bearish developments that are specific to Dogecoin. This is in addition to a macro environment that still suggests risk-off is the correct approach to portfolio allocation for the time being.

Elon Musk’s history with Dogecoin has been well documented. The coin has moved in response to his actions and tweets to such a large degree that Musk has actually been sued for his influence over the coin’s price action. This by itself should lead any serious crypto advocate to question the investment merits of a coin that can be moved as much as 20% overnight based on one man’s tweets.

Much of the recent excitement that has manifested in Dogecoin price rallies over the last few weeks is from Musk’s plans for integrating payments into Twitter natively. Musk publicly shared slides from a Twitter 2.0 deck that highlighted future initiatives for the company. Among other things, the deck made mention to payments within the application itself. This led to widespread speculation that Dogecoin would be getting some sort of utility within the social media platform.

I have serious doubts about any Dogecoin implementation within Twitter natively. Earlier this month we had an apparent leak pertaining to a forthcoming digital asset that was shared by a user on the platform who found a logo for “Twitter Coin” in the monetization section of the app’s settings. This came after seemingly more concrete evidence of a plan for native Twitter payments with news of a Twitter paperwork filing with the US Treasury last month.

The problem for Dogecoin bulls is neither of these is an actual indication that Musk will integrate Dogecoin specifically into the platform. Actually, it looks to be quite the opposite. It appears as though “Twitter Coin” may just be an in-app currency that is redeemable for dollars and nothing more. Twitter previously had integrated with Bitcoin’s (BTC-USD) lightning network for in-app tips but that feature has been discontinued due to inactivity. It turns out after, over a year of integration, the feature amounted to just $8,500 in total tipping volume. For a platform with a 9-figure user base, that’s not exactly a ringing endorsement for the crypto-tipping appetite from Twitter’s user base even if Dogecoin is somehow integrated.

Dogecoin was created as a joke. It held a top 10 crypto market cap position earlier in its existence and then dropped out of the top 10 for roughly 5 years. If you were a participant in the Wall Street Bets/Meme stock narrative trades during the COVID lockdowns, Dogecoin may have been a natural fit. In many ways, DOGE is a perfect illustration of the financial nihilism movement that can be seen throughout Gen Z.

This is because Dogecoin is largely a dunk on money itself. Vincent Ventures supplied terrific coverage of this phenomenon in April of 2021 shortly before DOGE peaked:

Behind dogecoin is a rebelliously nihilistic and perhaps dangerous idea that meme money is no more real than actual currency. It may be a joke, but it’s a powerful one.

The problem for any joke is when it gets played out and I think that’s what has happened to DOGE since the crypto market peaked in late 2021. When the government is printing stimmy checks and the bars aren’t open, the nihilists have a macro setup that is conducive to throwing money at jokes and memes. Now we are in a very different macro environment where interest rates are rising and the money printing is said to be over. The liquidity that helped drive crypto asset purchases to the moon is gone. There is no money left for jokes with high inflation and worsening economic conditions. In my view, any marginal crypto buyer from here will be allocating to serious ideas that aren’t dependent on one man for utility.

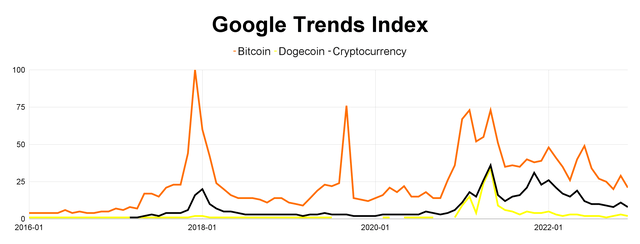

Worldwide Search Interest Index (Google Trends)

Worldwide Search Interest Index (Google Trends)

In the chart above, we can see the Google (GOOG) Trends search interest for Bitcoin, Cryptocurrency broadly, and Dogecoin. In May 2021, search interest in Dogecoin actually surpassed that of Cryptocurrency for a brief period, nearly touching 40. In the last 12 months, DOGE hasn’t sniffed its prior trends index highs. If we look to averages over various lengths of time, we can see DOGE benefited from a small interest bounce in late October when Musk closed the Twitter deal:

Source: Google Trends, Worldwide Averages

But for the most part, interest in Dogecoin is fading, and we can even see that starting to manifest in some of the wallet address data. The chart below shows the DOGE balance held on Robinhood (HOOD) in blue:

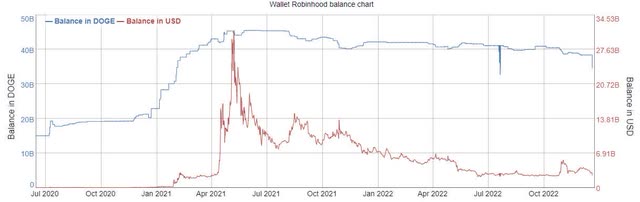

DOGE on Robinhood (BitInfoCharts)

DOGE on Robinhood (BitInfoCharts)

There is no question Dogecoin benefitted as a FOMO-driven meme-coin in early 2021. That FOMO had 45 billion DOGE held on Robinhood during the peak of the Dogecoin madness. It took over a year for DOGE on Robinhood to fall from 45 billion to 40 billion. It has taken less than two months to go from 40 billion DOGE on Robinhood to under 35 billion DOGE as of submission. Since Robinhood traders still hold over 26% of the total coin supply, I believe the selling is only getting started.

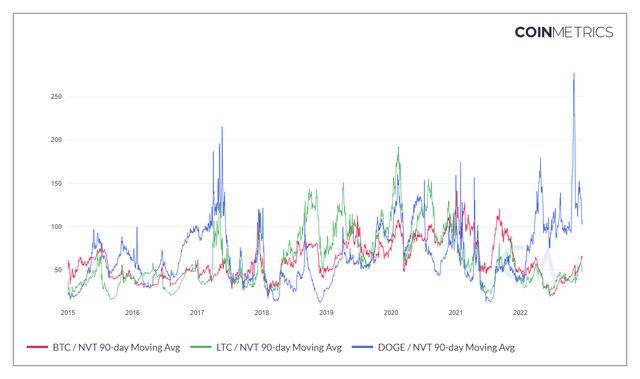

For the sake of assigning a real valuation to a coin that exists as a joke, I think we want to compare Dogecoin to both Litecoin (LTC-USD) and Bitcoin. Bitcoin and Litecoin are viable comps because like DOGE, they also command a top 20 crypto market cap and are proof-of-work payments-focused crypto coins. They are close siblings. When valuing these types of payments-focused cryptos, the Network Value to Transactions Ratio, or NVT ratio, is a great way to assess when a coin is cheap or expensive. The ratio is calculated by dividing market cap by the dollar-denominated transaction volume on chain.

90 Day Average NVT (CoinMetrics)

90 Day Average NVT (CoinMetrics)

In the past, the NVT for DOGE has been in-line with Bitcoin and Litecoin; at times it’s even been the cheapest. You can see in the divergence in NVT ratio since the crypto market topped in November 2021. The current 90 Day average NVT ratio for Dogecoin is now 107, well ahead of Bitcoin and Litecoin which are at 65 and 49. Dogecoin’s highest NVT ratio ever was recorded within the last few weeks. While DOGE’s NVT has come back down since, when we compare current levels to the NVT lows we see Dogecoin is still trading at a massive 8.2 multiple against the low. This is well ahead of LTC and BTC.

Source: CoinMetrics, as of 12/18/22

So not only is Dogecoin still trading at an extremely elevated NVT ratio, but it’s doing so when the two other proof-of-work ‘OG’ cryptos are trading closer to NVT lows rather than NVT highs. This is telling us that Dogecoin is particularly overvalued both compared to its own history and to its peers. The ratio could certainly move lower if there are more transactions that start happening on the blockchain, but I don’t think that’s very likely. Despite the appearance of a dedicated following behind the coin, DOGE is not a widely held or used cryptocurrency.

Source: Messari, as of 12/19/22

There are less people holding Dogecoin than holding Litecoin and those who do hold Dogecoin use it less than they use Bitcoin, which has a much higher mean transaction fee. This means Dogecoin simply isn’t serving a purpose as a micropayments currency and has less real adoption for larger payments than Litecoin which has a lower market cap and a lower NVT. Dogecoin’s valuation is held together by an idea. And it’s looking increasingly like the prospects for that idea are dwindling.

Memes are actually very powerful. I would never recommend shorting something like Dogecoin because there is no reason it should have a market cap of $10 billion, but it does. There is no reason it should have a market cap of $2 billion, but it is well beyond that. The biggest risk to the bearish Dogecoin view is if it rises with all boats. If the fed pivots and liquidity returns to the risk markets, Dogecoin could theoretically rise. But even after this deep crypto selloff, I would argue that the coin should still fall considerably from current levels even when risk-on inevitably returns.

Dogecoin is an important cryptocurrency for many of the wrong reasons. It was never meant to be taken seriously but it road a massive wave from a fraction of a penny in January of 2021 to over 73 cents just a few months later. In the time since, it has sold off more than 90% but it still could have much lower to go. The coin surged because of Robinhood buyers who now appear to be selling.

DOGE has maintained some level of intrigue because of Elon Musk’s affinity for the project but after spending billions on Twitter, Musk likely has much bigger concerns at this point than pushing forward a cryptocurrency that is probably only popular because the logo is cute. Like him or not, I don’t think it’s unfair to say Musk has taken some ill-advised steps in his brief time running Twitter. The company must worry more about appeasing the users and customers of the Twitter platform than the whimsical wishes of a small digital trinket community.

Given Twitter’s recent decision to discontinue Bitcoin Lightning Network tipping, I think it’s far more likely the Twitter team simply uses an internal ledger for fiat-based tipping rather than trying again with a PoW blockchain that isn’t exactly cheap to transact on. Crypto Winter isn’t over until Dogecoin is back under a penny. I’m sorry, Robinhood kids, but DOGE must die.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Decode the digital asset space with BlockChain Reaction. Block out the noise in the cryptocurrency market and pick the best tokens that will change the way the world works. Some of the great features you’ll get out of this service include:

Decode the digital asset space with BlockChain Reaction. Block out the noise in the cryptocurrency market and pick the best tokens that will change the way the world works. Some of the great features you’ll get out of this service include:

Digital assets and the companies that are building the future of the digital asset space are the investment opportunity of this generation. Don’t buy dog money and memes that won’t matter down the line.

Sign up today and position your portfolio for the future!

This article was written by

5 years as a media research analyst. Mainly covering crypto, metal, and media equities. Operator of Heretic Speculator newsletter where I share additional thoughts on finance with more of a social backdrop.

Disclosure: I/we have a beneficial long position in the shares of LTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I’m not an investment advisor. I share what I do and why I do it for informational purposes only.