![]() Tony M.

Tony M.

FXStreet

Bitcoin price shows bearish technicals, but optimism for the end of the year Santa-rally persists. Nearly 100 years of stock market data suggest risk assets have a high chance of performing well.

Bitcoin price is putting up a fight after experiencing a 10% selloff last week. On December 14, the peer-to-peer digital currency displayed optimistic signals. The bulls had climbed back to the $18,000 level, and moving averages provided cushion during turbulent times in the market.

Within 24 hours, what had first appeared to be just another profit-taking consolidation, quickly morphed into a seller’s frenzy. Bitcoin pierced through the 8-day exponential and 21-day simple moving averages and continued treading south into the mid-$16,000 zone.

Bitcoin price currently auctions at $16,933, a 4% rise from the Monday morning low at $16,256. Although the countertrend spike is a positive gesture, in the grand scheme, the BTC price could be setting up for additional selloffs in the coming days. The recently breached moving averages confirm this bias as they are set to collide while the BTC price auctions are below.

A classical crossing of moving averages will likely entice bears to add to their positions. If the market is genuinely bearish, a breach of the Monday low at $16,256 could induce a downswing to challenge the yearly low at 15,476 for a 7% decline. If a double bottom does not form near the yearly low, then a $14,000 BTC will be imminent.

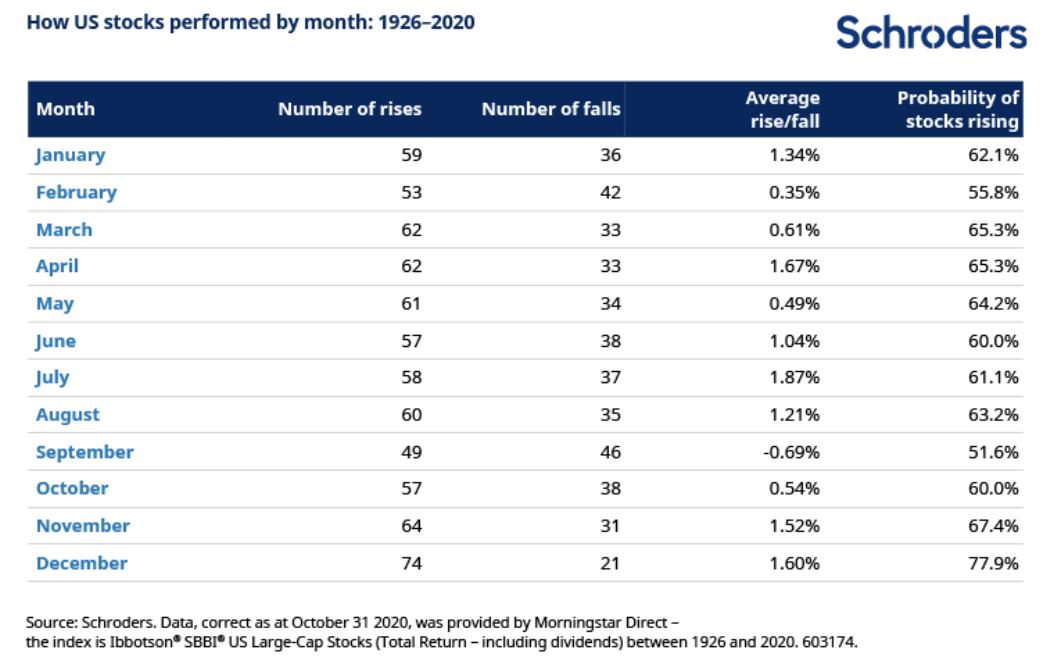

The bearish technicals may be challenging for traders to accept, as many in the space anticipate a Santa rally. In recent days, Schroders, a global asset and wealth management firm, made the case that risk assets have nearly an 80% chance of closing in December with positive returns.

The wealth management firm collected data on US large-cap stocks since 1926 and found that December was the best-performing month. According to Schroeders, large-cap stocks have a 77.9% chance of closing December in a net positive. The firm calculates these metrics by dividing all percentage gains vs. percentage losses within a month. Investors should remember that Bitcoin has seen over a 90% correlation to the stock market this year. One could argue that the peer-to-peer digital currency will continue to mirror the stock market’s price fluctuations until the end of the year.

Bitcoin price is currently down 2% from December’s opening price of $17,167. It is worth noting that Schroders identified positive returns with a minimum of 1.5% above the previous month. Thus, the Bitcoin price would need to rise by 3.5% and sustain price action near $17,550 by January 1 to align with Schroder’s 100-year stock market data. The earliest signs of a Santa rally would be a bullish hurdle-and-flip of the colliding moving averages into support. The indicators are currently positioned near the monthly open at $17,150.

.

BTC/USDT 8-Hour Chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Charles Hoskinson, an American entrepreneur and co-founder of blockchain engineering company Input Output Global, urged the Cardano community to share their take on the new improvement proposal. Similar to Ethereum Improvement Proposals, ETH’s competitor Cardano is gearing up for the launch of Cardano Improvement Proposal 1694 that paves way for the Voltaire phase of ADA’s development.

The FTX collapse will go down as one of the biggest downfalls in the history of crypto. The now-bankrupt exchange’s founder, Sam Bankman-Fried, is bringing the saga to a close with his most recent decision as acquaintances protect themselves by severing ties with the former.

Binance is making headlines every other week in the crypto space, be it the parent company exchange or its American extension. Binance US arm’s CEO, Brian Shroder, stated the exchange still has hundreds of millions in current assets.

Etheruem price rose by 4% following last week's 10% decline. Ethereum price will be challenging to forecast as the bulls and bears spar over minute price fluctuations. Currently, the technicals lean bearish, but traders should be aware of the alternative scenario.

Bitcoin (BTC) price is traversing a channel that is sloping to the upside. Despite the consolidation, BTC is slowly climbing higher like clockwork. The recent Federal Open Market Committee (FOMC) Meeting on December 15 caused BTC to spike beyond the confines of the channel, but things are back to normal.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and omissions may occur. Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, clients or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.