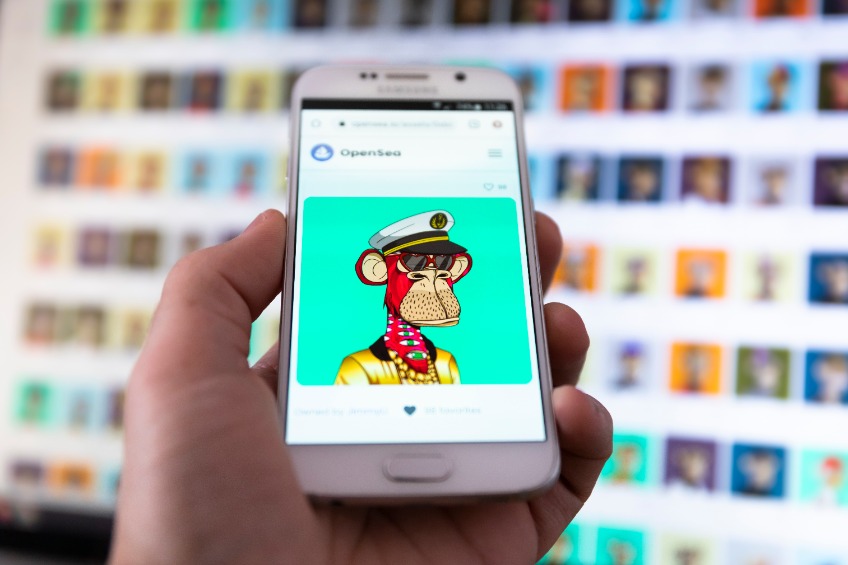

NFTs were the most discussed topic in the crypto world in 2021. The keyword found increasing popularity in every single corner of the world, particularly because NFTs have vast potential and can be integrated with almost all industries, from entertainment to sports and arts.

Over the past year, the term NFT was the most discussed topic on crypto, according to research by Huobi. The research revealed that, overall, five crypto terms of NFT, cryptocurrency, DeFi, GameFi, and BTC were the most popular keywords in the crypto world.

The keyword “NFT” was “surprisingly popular,” according to Huobi, finding popularity worldwide. The report cited NFTs’ vast potential as the reason for this unparalleled popularity, which gives this innovation the ability to integrate and add value to various industries. The report said:

“NFT can be well integrated with various industries, such as sports, arts, entertainment, and cultural creations, expanding the application scenarios on a larger scale. In addition, with the unique community culture and wealth effect of each NFT, NFT has gone viral worldwide.”

Notably, unlike NFT, other popular crypto-related terms do not enjoy worldwide popularity. For instance, cryptocurrency, DeFi, and BTC keywords are most frequently searched in South America, South Africa, and the Middle East. Huobi said:

“This is largely due to the underdeveloped financial infrastructure and payment systems in these regions, as well as the suffering from high inflation rate, which makes cryptocurrency a perfect alternative for payments and store of value.”

Join our Telegram group and never miss a breaking digital asset story.

The market for NFTs saw explosive growth last year. In total, the NFT market saw inflows of $44.2 billion in 2021. By comparison, the total trading volume of NFTs reached $250 million in 2020.

However, amid the broader crypto market downturn, NFTs have also seen a steep drop in demand. As reported, NFT sales stood at $3.4 billion in the third quarter of the year, down from $8.4 billion in the second quarter. Furthermore, compared to Q3 2021, NFT sales in Q3 2022 were down 68.2%.

The steep drop comes as investors avert from NFTs, cryptocurrencies, and other riskier investments amid record-high inflation and aggressive interest rate hikes by global central banks. Furthermore, the price of NFTs has dropped significantly, delivering huge losses to investors who jumped on the craze last year.

For instance, one of Justin Bieber’s Bored Apes that he acquired for $1.3 million in ETH this January is now worth around $70,000. Similarly, other celebs, including Snoop Dogg, Logan Paul, Gary Vee, and Steve Aoki, are down millions on their NFT investments.

It is worth noting that some innovative NFT projects have been able to buck the trend recently and make huge waves in the industry despite the bear market.

Last month, the NFT project Art Gobblers generated over $50 million worth of secondary sales after free mint. And before that, Reddit NFT collections surpassed $8.6 million in transactions, while Renga NFTs posted a higher trading volume than the combined volume of CryptoPunks and Bored Ape Yacht Club (BAYC).

Do you think the market for NFTs will pick up again along with the broader crypto market? Let us know in the comments below.

General Disclaimer: The Tokenist is an independent media publication. All information shared on The Tokenist, including its associated social media channels, is provided for informational purposes only. Nothing shared by The Tokenist should be considered investment advice. The Tokenist does not provide investment advice. While we do our best to ensure accuracy, The Tokenist makes no guarantee that all information contained on the site will be accurate. If you have any questions whatsoever, consult a licensed financial advisor.

Advertising Disclosure: Some offers on this page may promote affiliates, which means The Tokenist earns a commission if you purchase products or services through the links provided. All opinions expressed here are the author’s and not of any other entity. The content at The Tokenist has not been endorsed by any entity mentioned at the site. For additional information, please review our full advertising disclosure.

Author

Administraroot