Viorika/iStock via Getty Images

Viorika/iStock via Getty Images

“I’ve had a bad month. This hasn’t been any fun for me.”

So said Sam Bankman-Fried, recent and thoroughly disgraced CEO of cryptocurrency platform FTX. The remarks, as well as those below, were delivered at the New York Times Dealbook Summit on November 30.

A few words come to mind at that, including unprofessional, unacceptable and, frankly, pretty pathetic. Childish, too.

Some familiar with the (digital) appearance might point out that “SBF,” as he likes to be called, continued with:

“But that’s not what matters here. What matters here is the millions of customers. What matters here is the stakeholders in FTX. And what matters is trying to help them out.”

However, I remain unimpressed.

It still sounds like he was trying to generate sympathy – pity, really – for a mess of his own making. At best, he was completely inept at his job and never should have pursued the position to begin with.

Certainly, that’s the position he’s trying to take. Yahoo Finance quotes him as saying at the Summit that he “didn’t try to commit fraud.”

Apparently, it just happened. Oops!

Unprofessional. Unacceptable. Pathetic and childish. There’s just no excuse.

At worst, he’s a criminal. A stupid, stupid criminal who lost a whole lot of people a whole lot of money.

I know we’ve been living in a tech-heavy, cryptocurrency-crazy era for years now. But those “newfangled” offerings don’t mean the basic tenets of reality are out of date.

Everyone is ultimately responsible for their own actions. So, yes, I could say something about Tom Brady, Gisele Bündchen, Kevin O’Leary, and other huge names who promoted FTX and therefore SBF.

They were ultimately helping a con artist sell the Brooklyn Bridge.

I could also say something about the people who bought into their brouhaha with the promise of intense profit potential in short order. They were ultimately accepting the idea that the Brooklyn Bridge could be obtained so easily.

Now, before you accuse me of being uncharitable, remember that I was in a comparable boat once upon a time. It feels like a lifetime ago that I was doing something other than writing about real estate investment trusts (“REITs”). But it wasn’t.

As late as 2008 – not even 15 years ago – I owned a physical real estate empire. I handled it foolishly, and I suffered the consequences when the housing bubble burst.

I lost almost everything and had to reevaluate almost everything as a result.

So when it comes to making bad choices, I’ve been there and done that. That makes me even more qualified to comment on the subject.

Since losing it all, I’ve made it my professional mission to warn people away from risky business. That’s why I’ve written so many times before about investing in “real” assets instead of concepts like cryptocurrency that were, frankly, not nearly concrete enough.

Perhaps crypto can move past this to become something worth holding again. But I don’t think that moment is here just yet.

As the aforementioned Kevin O’Leary, co-star of the hit show Shark Tank, said, the fallout from this fiasco is still playing out. As for his personal investment in it, he told Insider that he’s “writing that all down to zero.”

Zip. Zilch. Nada.

“It’s not clear what can be recovered. There’s a lot of allegations flying around. But frankly, I’ve seen this movie before. It’s a difficult situation, there’s no question about it. There’ll be a mountain of litigation.”

The article goes on to note how:

“On Tuesday, The Wall Street Journal reported that Bankman-Fried is trying to raise money to pay back clients, while FTX warned that it could have more than 1 million creditors.”

So like O’Leary basically said, good luck with that.

Again, I maintain he should have known better. He’s an extremely sharp, extremely critical, extremely successful man.

Just like I should have known better in my previous business dealings. But we do what we do for the reasons we do it…

And time eventually tells us whether we’ll be successful or not. Sometimes that happens in a matter of seconds – or less. Sometimes it’s a matter of decades or even centuries.

In the case of crypto, as I said before, it could very well recover from here. I do understand the appeal of trying to buy in now while chaos abounds and prices are depressed.

But in case I haven’t been clear up to this point… I wouldn’t advise it.

That doesn’t mean I think you should ignore the crypto phenomenon altogether. I just have a more “real” way of investing in it.

Real and diversified.

By that, I mean data center REITs like the ones covered below. They’re a great way to invest in digital trends in an intelligent, sustainable way.

Without data centers, there is no cryptocurrency. But, fortunately for us, without cryptocurrency, data centers have thousands and thousands of reasons to live on.

Digital Realty Trust, Inc. (DLR) is the first data center REIT we’ll look at today. It’s made the news fairly often as of late.

Problem is… It’s made the news for the wrong reasons.

I’m not blaming Digital Realty for that. It didn’t exactly court prominent short-seller Jim Chanos’ attention, after all. Yet, it still happened anyway.

Over the summer, Chanos announced a large short position he has open against the REIT.

Shares were already under pressure by that point. But that really heated up after the report came out.

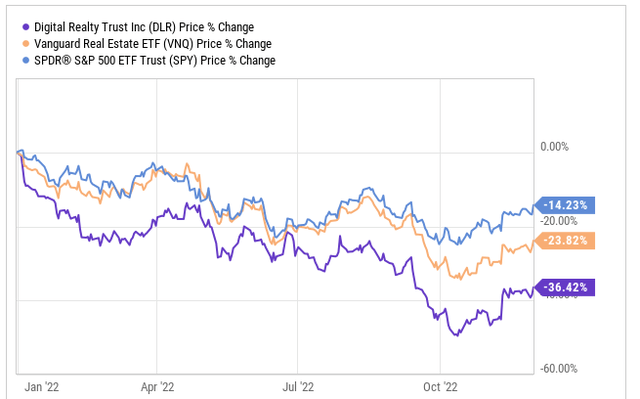

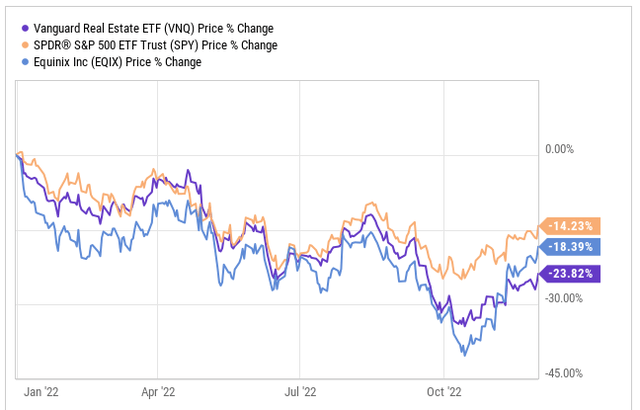

That’s how DLR came to be down over 35% year-to-date, underperforming both the S&P 500 – as measured by SPDR S&P 500 ETF Trust (SPY) – and the broader REIT index, as measured by Vanguard Real Estate Index Fund (VNQ).

YCharts

YCharts

Chanos’ argument is that large tech and cloud providers like Google (GOOG, GOOGL) and Meta Platforms (META) are building their own data center facilities. In which case, they won’t need the likes of DLR anymore.

Okay. That’s one argument. But here’s another…

Yes, those companies have the cash available to build out infrastructure. Yet that doesn’t mean they all want to. And there are plenty of other businesses that don’t have the option at all.

Leasing from DLR or the other data center REITs we’re covering today undoubtedly adds short-term and even long-term financial flexibility for companies.

That’s why we’re perfectly fine writing about them in a positive light today.

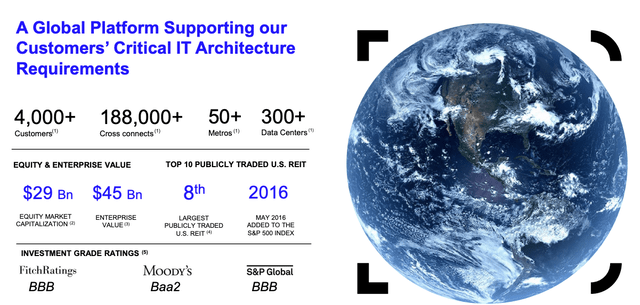

Looking at DLR specifically, it’s quite the catch size-wise, with a market cap of $31.6 billion. It’s also the largest global provider of cloud and carrier-neutral data center and interconnection solutions around.

Make no mistake of it: Digital Realty Trust has over 4,000 customers. So there’s a lot more to its story than a few big tech companies that Chanos wants to focus on.

In fact, as CEO A. William Stein pointed out in his rebuttal to that thesis, demand has increased from even big tech.

DLR Investor Presentation

DLR Investor Presentation

But let’s say Chanos is correct. Let’s say those large clients begin to lower their exposure over the years as they build out their own facilities.

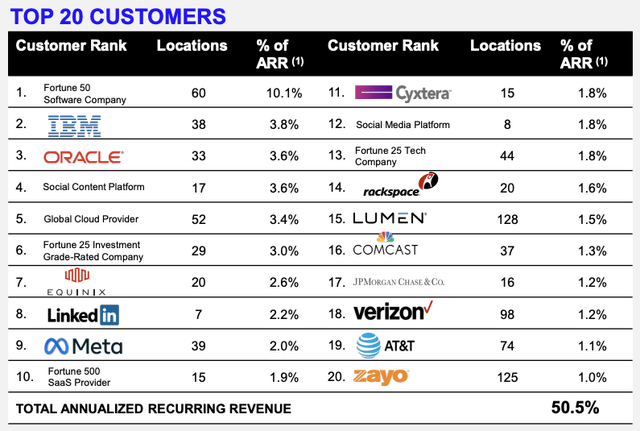

In that case, here’s the company’s list of top tenants.

DLR Investor Presentation

DLR Investor Presentation

DLR clearly has diversification on its side.

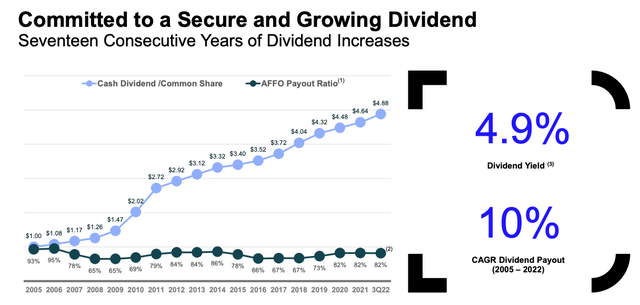

The REIT continues to generate strong cash flows from that crowd, helping fund its dividend – with its current 4.5% yield – which it’s increased for 17 years and counting. Not quite a dividend aristocrat there, but it sure seems to be aiming at that.

DLR Investor Presentation

DLR Investor Presentation

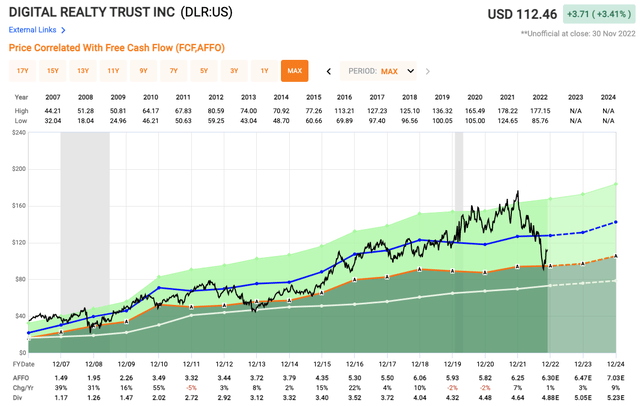

Shares of DLR currently trade with an adjusted funds from operations (AFFO) multiple of 17.4x. Over the past five years, that figure has averaged about 20.2x, suggesting that shares are undervalued.

That means now could be a great time to make Digital Realty Trust part of your portfolio today.

FAST Graphs

FAST Graphs

iREIT on Alpha rates it a Strong Buy.

Our second data center REIT happens to be the largest in terms of market cap. Equinix, Inc. (EQIX) stands out at $63.9 billion in that regard, nearly double the size of DLR.

We discussed the DLR short position a second ago, which includes all the data center REITs in a way. So its particular situation has had some negative effect on share prices.

That’s why CEO Charles Meyers snapped back at Chanos, calling his theory “an underdeveloped understanding of the data center market and the relative position of various players.”

But again, damage has been done. On the year, shares are down over 18%, underperforming the S&P 500. Though that does outperform the broader REIT index.

YCharts

YCharts

So what do we make of that assortment of information?

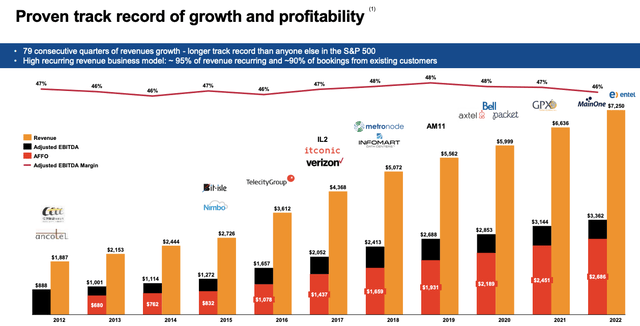

For one thing, we should remember that Equinix has an impressive track record, generating 20 consecutive years of revenue growth. And its recently released Q3 earnings report showed further year-over-year revenue growth of 10%.

It seems obvious the company appears to be in a good place to continue this streak.

EQIX Investor Presentation

EQIX Investor Presentation

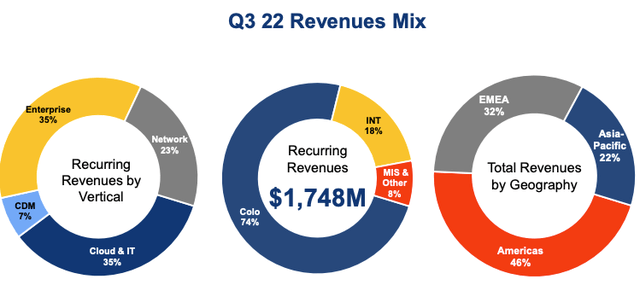

Equinix is a global REIT. Just 46% of its revenues are earned in the United States. Another 32% comes from Europe, the Middle East, and Africa (EMEA). And the remaining 22% is generated in Asia-Pacific (APAC).

EQIX Investor Presentation

EQIX Investor Presentation

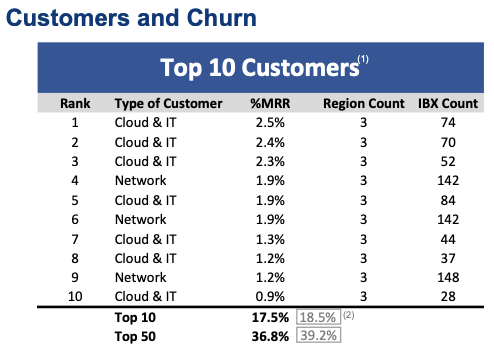

Here’s a look at Equinix’s top 10 customers for further indication of its diversification. You’ll notice it doesn’t list any actual company names. All the same, it seems clear it has no huge exposure to any single customer.

So there’s no great risk even if a client did build its own facilities and ditch Equinix completely.

EQIX Investor Presentation

EQIX Investor Presentation

The REIT pays out a $12.40 annual dividend, which equates to a 1.85% yield. That may be much lower than DLR’s, but EQIX has been able to grow its dividend at a much faster pace.

We’d even go so far as to call it something of a dividend growth REIT.

Over the past five years, it’s grown that payout at an average annual rate of about 10%.

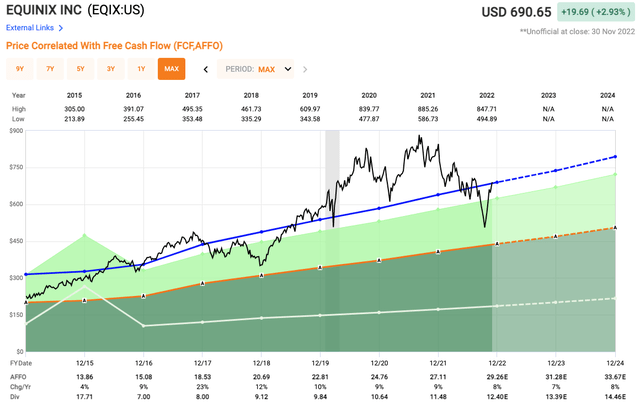

Turning to valuation, shares have bounced back in a strong way off their October lows. They’re trading with an AFFO multiple of 23x – which is right in-line with its five-year average.

FAST Graphs

FAST Graphs

That seems fair to us, which is why we rate it a Buy.

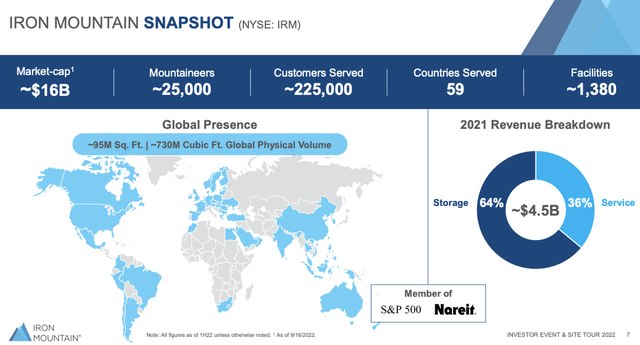

Today’s final REIT is Iron Mountain Incorporated (IRM), a tried-and-true company. Yet it manages to be one of the newest companies on the data center landlord list.

Iron Mountain was founded in 1951 and has long-since become the global leader for storage and information management services. It’s trusted by more than 225,000 organizations around the world in that regard.

The REIT’s real estate network consists of more than 95 million square feet across 1,380+ facilities in over 50 countries. These store and protect billions of valued assets, including critical business information, highly sensitive data, and cultural and historical artifacts.

IRM Investor Presentation

IRM Investor Presentation

Iron Mountain existed as a regular operating company for quite a while. Yet it knows how to take advantage of and grow with the times. So in January 2014, it became a REIT.

And now it’s changing again to incorporate data centers into its services.

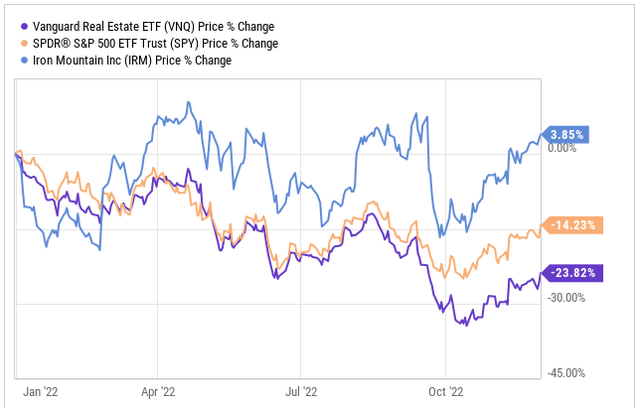

In 2021, shares of IRM rallied over 75%, far outpacing SPY’s 27% and VNQ’s 36%. This year has seen even more outperformance, with 4% growth instead of the negative progress around it.

Shares did dip in October, admittedly. But like EQIX, they have bounced back in a strong way since then.

YCharts

YCharts

So what are shareholders seeing these days that looks so good?

On the one hand, it’s the same-old, same-old company, to its credit. IRM’s storage segment still accounts for about 60% of total revenue, down from 64% in 2021.

It’s a very reliable source for those customers, as evidenced by its 98% retention rate.

However, the majority of investor focus as of late has been on its push into the data center space. Iron Mountain has been expanding into that sphere at a fast pace.

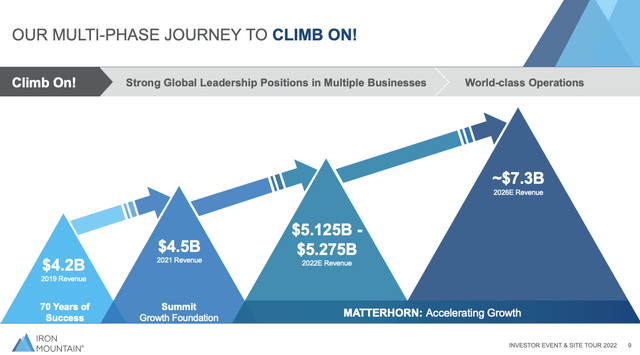

During its recent Investor Day, management laid out a new plan titled Project Matterhorn, which will focus on:

All while driving revenue up to about $7.3 billion by 2026, if all goes as planned.

IRM Investor Presentation

IRM Investor Presentation

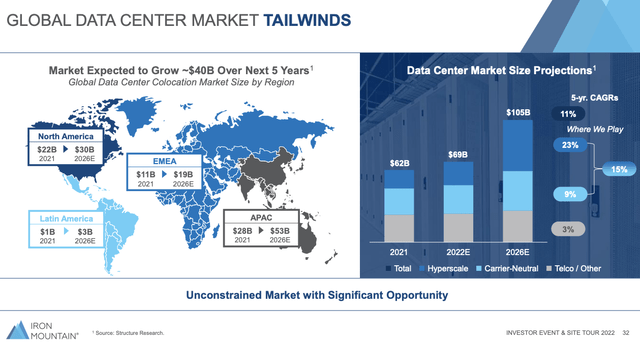

Much of that growth will come from data centers, a larger market that’s expected to expand from $62 billion in 2021 to over $100 billion in 2026.

IRM Investor Presentation

IRM Investor Presentation

IRM is fully committed to getting a piece of that pie, building out necessary infrastructure along impressive timelines.

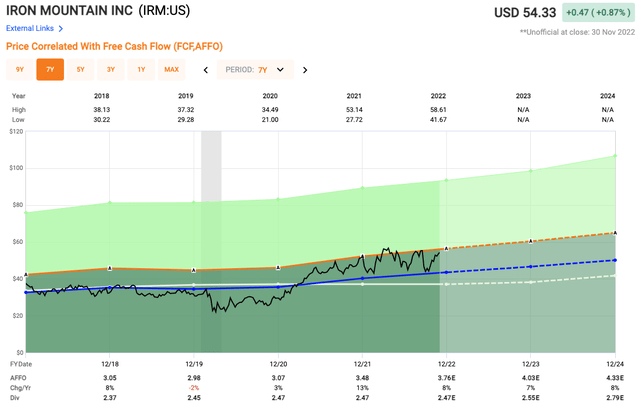

Shares – with their 4.6% dividend yield – trade at a forward p/AFFO of 13.5x, which is above its five-year average of 11.6x. But that higher multiple makes sense considering its increased growth as of late.

FAST Graphs

FAST Graphs

iREIT see shares as being fairly valued at current levels. But we wouldn’t object to seeing another retest of the stock’s October lows.

That would be a very intriguing spot to buy in.

According to DATACENTERS.com,

“Bitcoin is a computation heavy activity with the need for ever more electricity and computing power. This puts on strain on data center resources and the space and power they have to allocate to other clients.

As a result, data centers have had to become better equipped at accommodating and cooling this type of equipment.

Bitcoin requires highly specialized equipment. In order to run a successful mining operation, you need to have high performance hardware that’s capable of solving computational algorithms at high speeds while remaining efficient and accurate.

Not an easy task at all. The demand for the hardware necessary to mine bitcoin is constantly increasing, making this infrastructure hard to come by.”

As I told a classroom of students today at Clemson University, I would much rather own data center REITs that invest in crypto.

Because without this mission-critical infrastructure that specialize in cryptocurrency hosting, bitcoin mining would be virtually impossible.

Simply put, the cloud is extremely relevant, and many businesses rely on data centers to survive. I am allocating more capital to the (data center) sector recognizing that hosting providers are accommodating bitcoin miners in record numbers (a catalyst).

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, Builders, Asset Managers, and we added Prop Tech SPACs to the lineup.

We recently added an all-new Ratings Tracker called iREIT Buy Zone to help members screen for value. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.

This article was written by

Brad Thomas is the CEO of Wide Moat Research (“WMR”), a subscription-based publisher of financial information, serving over 6,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) The Intelligent REIT Investor (newsletter), (2) The Intelligent Dividend Investor (newsletter), (3) iREIT on Alpha (Seeking Alpha), and (4) The Dividend Kings (Seeking Alpha). Thomas is also the editor of The Forbes Real Estate Investor and the Property Chronicle North America.

Thomas has also been featured in Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox. He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, and 2019 (based on page views) and has over 102,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley).

Disclosure: I/we have a beneficial long position in the shares of DLR, IRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.