Coinbase Global, Inc (NASDAQ: COIN) strengthened its European top ranks to help lead its regional expansion plans.

Cormac Dinan, a general manager at Crypto.com, joined Coinbase as country director for Ireland.

Michael Schroeder, former chief compliance and risk officer at Bittrex, will join the crypto exchange as director of controls for Germany.

Also Read: Is Coinbase In Trouble? CEO Brian Armstrong Clears The Air

Coinbase also promoted Elke Karskens as the new country director in the U.K. and Patrick Elyas as director of market expansion in Europe, the Middle East, and Africa.

In October, Coinbase appointed Daniel Seifert, a senior executive from German financial technology company Solarisbank AG, as regional managing director for EMEA.

Coinbase’s expansion plans in the region come as cryptocurrency exchanges face a crisis of confidence following the swift collapse of Sam Bankman-Fried’s FTX.com, Bloomberg reports.

Shaken by FTX’s swift demise, users have rushed to yank out their cryptocurrencies from exchanges.

Price Action: COIN shares traded lower by 3.32% at $42.81 in the premarket on the last check Monday.

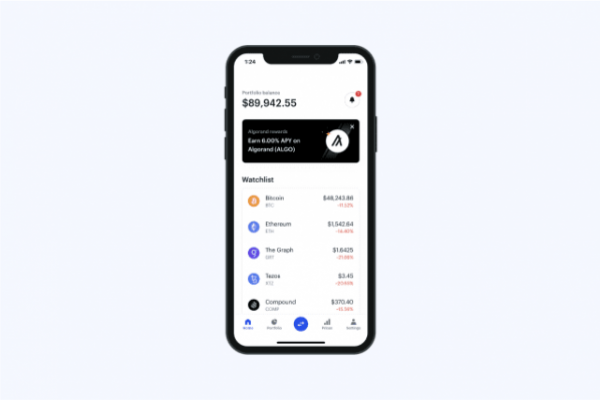

Photo Via Company

See more from Benzinga

Pinduoduo Shares Pop As Q3 Earnings Breezes Past Expectations

Black Friday Surprise: Walmart Beats Amazon In Online Searches For Deals

Don’t miss real-time alerts on your stocks – join Benzinga Pro for free! Try the tool that will help you invest smarter, faster, and better.

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Related Quotes

Cryptocurrency exchange Coinbase has made four new appointments to its European team to help further its expansion plans across the continent.

The "three stocks to avoid" in my column that I thought were going to lose to the market last week — Best Buy (NYSE: BBY), Luckin Coffee (OTC: LKNC.Y), and Apple (NASDAQ: AAPL) — rose 13%, slipped 2%, and fell 12%, respectively, averaging out to a modest 0.3% dip. Interest rates are rising, and that will make life harder for Big Lots.

Community members voted Monday to freeze 17 assets in the Ethereum liquidity pool in order to lower risk within the protocol ahead of upgrading the network to its v3 version.

CNBC After FTX Collapse, 'Crypto Is Dead' And Coinbase' A Waste Of Time:' Mizuho Analyst Dan Dolev, a Mizuho Americas analyst, believes that crypto may be finished after the recent troubles at FTX (FTT/USD), a bankrupt crypto exchange. Dolev said in an interview with CNBC that he thinks "crypto is dead" and "investing in Coinbase (NASDAQ: COIN) is just a waste of time." Wall Street Journal Did AOC Prompt A Justice Department Investigation Over A Taylor Swift Concert? The U.S. Justice Department

Investors looking for a guiding hand to steer them safely through the current hazardous stock market landscape could do worse than listen to what billionaire Ken Fisher has to say. The Fisher Investments founder famously started his independent money management firm with $250 in 1979, a company that is now a $197-plus billion going concern, while Fisher’s own net worth stands north of $5 billion. So, for those getting restless from 2022’s unrelenting bear, Fisher has some very simple advice: "Th

With a yield of 9.62%, the recently expired Series I bond was understandably popular. With interest rates rising, bond funds are down this year and banks continue to offer miserly rates on deposit accounts. So it's no wonder that a … Continue reading → The post It Pays to Procrastinate: The New 6.89% I bonds Will Beat the Old 9.62% Bonds in Just 4 Years appeared first on SmartAsset Blog.

What happened Shares of Anavex Life Sciences (NASDAQ: AVXL), a clinical-stage biotech that specializes in therapies to treat neurodegenerative and neurodevelopmental diseases, fell by 23.5% on Monday.

Financial services are one of the world's largest industries, worth trillions of dollars. Financial technology companies like SoFi Technologies (NASDAQ: SOFI) are trying to do things differently and, as a result, are nipping at the heels of traditional banks. Here is why SoFi's stock could shine like a diamond in 2023.

Shares of leading semiconductor companies Taiwan Semiconductor Manufacturing (NYSE: TSM), Intel (NASDAQ: INTC), and Qualcomm (NASDAQ: QCOM) all fell today, declining 2.9%, 2.6%, and 3.6%, respectively, as of 3:37 p.m. ET. First, widespread protests in China over COVID-19 restrictions erupted this past weekend, putting pressure on any stock with exposure to China or products made there. Second, a report from a leading tech industry research company predicted a bigger decline in overall semiconductor revenue next year than it had forecast just four months ago.

Dow Jones futures were higher ahead of Tuesday's open after the Dow Jones Industrial Average sold off nearly 500 points Monday.

In this article, we will discuss the best dividend stocks according to hedge funds with over 5% yield. You can skip our detailed analysis of dividend stocks and their performance over the years, and go directly to read 5 Best 5% Dividend Stocks To Buy According To Hedge Funds. The current stock market situation has […]

(Bloomberg) — A gauge of global equities advanced, led by a rebound in Chinese stocks as nationwide unrest over Covid curbs eased. The dollar and Treasuries fell amid improved sentiment for risk taking.Most Read from BloombergApple to Lose 6 Million iPhone Pros From Tumult at China PlantNext Covid-19 Strain May be More Dangerous, Lab Study ShowsThere’s a Job-Market Riddle at the Heart of the Next RecessionStocks Hit by Fedspeak as China Woes Boost Havens: Markets WrapShares rallied in Hong Kong

The abrupt and rapid collapse of the FTX cryptocurrency exchange has caused a shock in the crypto space. The fall, in a few days, of a company valued at $32 billion in February, ended up casting suspicion on the entire young industry of financial services, based on the Blockchain technology. Retail investors have fled, while institutional investors, linked to FTX and its sister company Alameda Research, are still determining their losses from their exposure to Sam Bankman-Fried's empire.

(Bloomberg) — The inversion of the US Treasury yield curve is flashing that long-term interest rates have peaked, stocks have bottomed out and the Federal Reserve’s policy tightening is approaching its limit, according to Ed Yardeni of Yardeni Research Inc.Most Read from BloombergApple to Lose 6 Million iPhone Pros From Tumult at China PlantNext Covid-19 Strain May be More Dangerous, Lab Study ShowsThere’s a Job-Market Riddle at the Heart of the Next RecessionStocks Hit by Fedspeak as China Woe

Deutsche Bank researchers are the latest analysts to put a 25% decline in equities on the map, and they expect the U.S. to go into a recession by mid-2023.

National Grid has narrowly avoided activating its emergency blackout plan for the first time this winter as low wind speeds and nuclear outages push supply closer to the danger zone.

Several headwinds that pummeled the stock market in 2022 have turned into tailwinds, setting the stage for a rally in U.S. equities heading into year-end, according to Tom Lee of Fundstrat Global Advisors.

In this article, we discuss the top 10 stock picks from Louis Navellier. If you want to see more stocks in this selection, check out Louis Navellier’s Top 5 Stock Picks for Q4 2022. Louis Navellier, the author of a BusinessWeek best-seller, “The Little Book That Makes You Rich”, is the founder and chairman of […]

The tech investor’s Valar Ventures had a 19% stake in the crypto lender, according to documents filed with the bankruptcy court.

The FTX bankruptcy has hurt many stocks in the crypto space, creating buying opportunities for those who are brave enough.

Author

Administraroot