Experience what our solutions have to offer with free access to highlights of our data, insights and analysis.

From start-ups to market leaders, access critical company intelligence on a global scale

From industry deep dives to global trends, access authoritative research from our experts

Uncover your next opportunity with trusted data & insights that cut across industries

Access our Webinars, Podcasts, Videos, Free Reports

Discover the disruptive forces shaping tomorrow’s world, today

Explore our diverse collection of unique datasets and find the advantage you need

Get clarity into the latest emerging themes with our reports

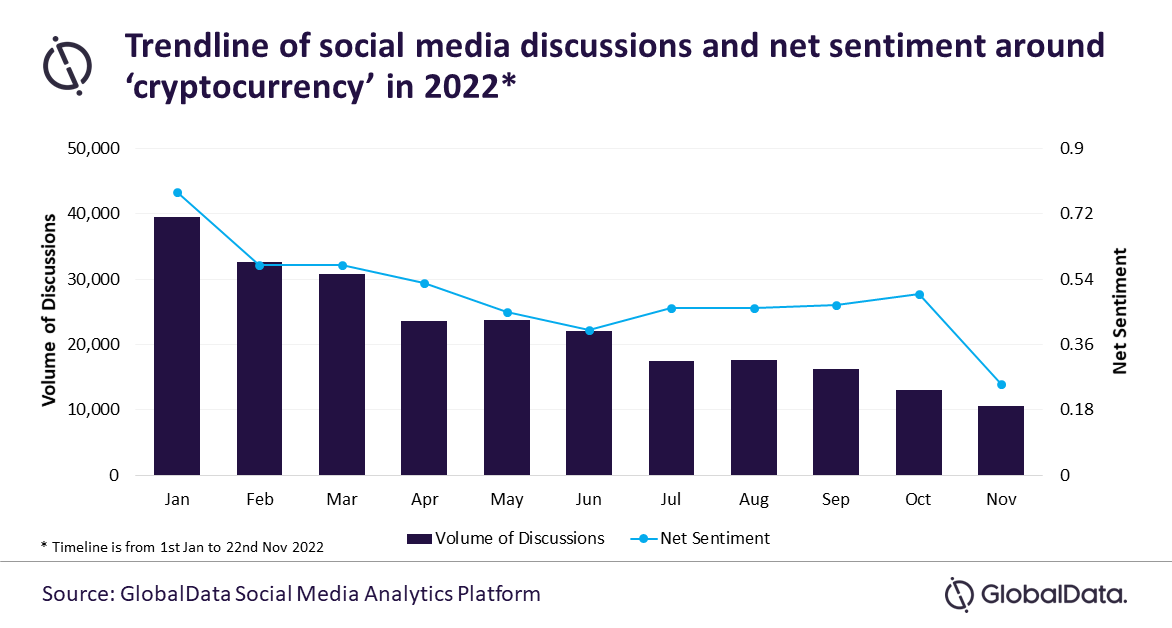

Since the beginning of 2022, the cryptocurrency market has been impacted by macro factors such as increasing inflation, which led investors to a massive sell-off and stay away from riskier assets. In a recent incident, FTX, one of the world’s biggest crypto exchanges, has filed for Chapter 11 bankruptcy protection in the US. Against this backdrop, social media sentiment around ‘cryptocurrency’ has plunged by almost 70% and touched the year’s lowest in November 2022, reveals the Social Media Analytics Platform of GlobalData, a leading data and analytics company.

Reportedly, scams and frauds related to cryptocurrency have skyrocketed over the year across the top exchanges. Subsequently, social media discussions around ‘cryptocurrency’ also fell by 76% from January to November.

Smitarani Tripathy, Social Media Analyst at GlobalData, comments: “Social media net sentiments have fallen by 70% in 2022, from January to November, as the multi-trillion dollar crypto bubble, including top trading cryptos such as Bitcoin and Ethereum, is imploding. Most of the Twitter influencers expect the crypto market to continue the downward trend and a few expect it to even collapse completely.”

Below are a few popular influencer opinions captured by the GlobalData’s Social Media Analytics Platform:

“Also… cryptocurrencies are “going to die. There’s a limited amount of real money left… and as that money gets pulled out there will be less and less…speculative activity. No one’s coming in with fresh capital, and Ponzi schemes without new suckers disappear.”

“A year ago #Bitcoin hit $69,000. One of the main reason for the spectacular rally was all the leverage that funded unprecedented #crypto advertising and speculative buying. The #FTX bankruptcy proves the entire rally was a fraud. It will never be repeated. Bitcoin mania is over.”

“A person I have known for more than ten years, who I consider trustworthy, is convinced the cryptocurrency economy will shortly experience a systemic risk. I don’t know anything concrete, but if I were exposed, I would be concerned.”

“For this, and other reasons, #ethereum is going to 0. Centralized #cryptocurrency that is also a likely illegal security & subject to a infinite rugpull train is not the future of decentralized finance. Apparently few understand.”

“No, not crypto technology, which is largely a means of doing things centralized databases can do better. Virtually every cryptocurrency scheme is a fraud. It all should be banned.”

“#Cryptocurrency is exciting to follow because it’s constantly opening up possibilities: the possibility that your money will be stolen in a cyberattack, that tax authorities will seize your assets, the possibility of losing everything in a crash or to some masquerader…”

*As on 22 November 2022

If you are a member of the press or media and require any further information, please get in touch, as we’re very happy to help.

If you are a member of the press or media and require any further information, please get in touch, as we’re very happy to help.

[email protected]

EMEA: +44 207 832 4399

APAC: +91 40 6616 6809

Author

Administraroot